June 18, 2024

Assays from first three holes intersect high-grade lithium mineralisation

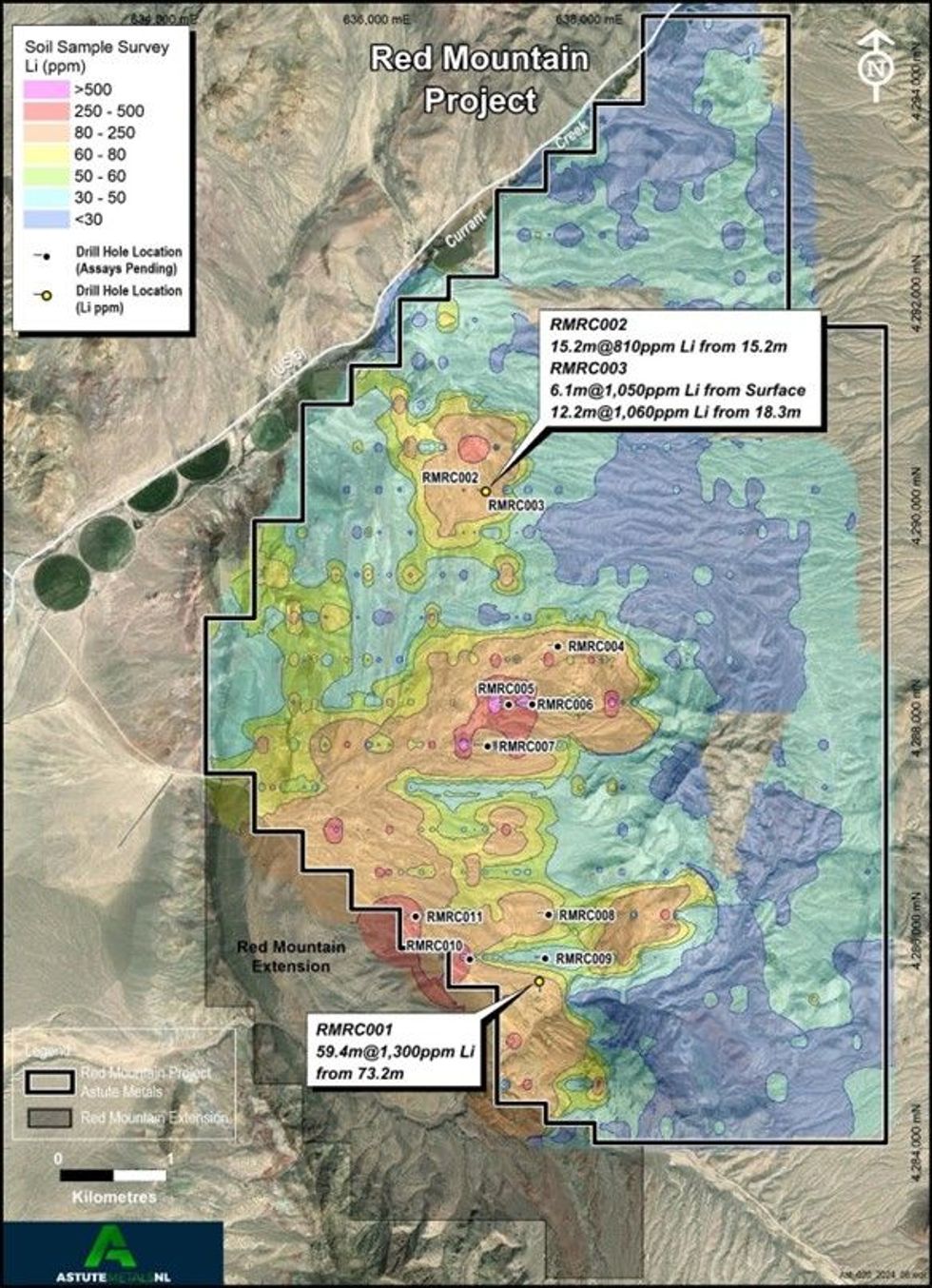

Astute Metals NL (ASX: ASE) (“ASE”, “Astute” or “the Company”) is pleased to advise that assays results from the first three holes of the maiden RC drilling campaign at its 100%-owned Red Mountain Lithium Project in Nevada, USA have returned high-grade mineralisation, indicating the potential discovery of a significant lithium deposit.

The assay results included the following high-grade drill intersections:

- RMRC001 : 59.4m @ 1,300ppm Li / 0.69% Lithium Carbonate Equivalent1 (LCE) from 73.2m

- RMRC002 : 15.2m @ 810ppm Li / 0.43% LCE from 15.2m

- RMRC003 : 6.1m @ 1,050ppm Li / 0.56% LCE from surface, and

- 12.2m @ 1,060ppm Li / 0.56% LCE from 18.3m

A total of 11 holes were drilled for a combined 1,518m as part of the maiden RC drilling campaign, which targeted lithium clay mineralisation in zones of strong soil anomalism and/or rock chip anomalism with a view to understanding the thickness and grade potential of the project (Table 1 and Figure 1).

These initial results have confirmed the anticipated discovery of sub-surface lithium mineralisation at Red Mountain, which has clear potential to emerge as a significant project in the context of North American exploration efforts for battery metals.

Once assays for the remaining drill holes have been received by the Company, results will be collated and interpreted in order to guide the next steps for exploration at the project, which is now expected to include a follow-up drilling campaign in the second half of the calendar year. The remaining assays are expected to be received in two batches in early and late July.

Astute Chairman, Tony Leibowitz, said:

“This is a very exciting start to our drilling campaign at Red Mountain, with all three of our initial drill holes intersecting high-grade lithium mineralisation. The results have been returned over 4.6km of strike, indicating the potential for a major new discovery.

We are now eagerly awaiting the results from the remaining eight holes, which are expected to be received in July, with assays from all holes to be integrated into an updated geological model for Red Mountain with a view of expediting the process to achieving a maiden resource for our Red Mountain Project.”

About Lithium Carbonate Equivalent (LCE)

Unlike spodumene concentrate, which is a feedstock for a value-added battery product, Lithium Carbonate is a principal lithium-ion battery product, which may be used directly in battery production or converted to other battery products such as lithium hydroxide. The Benchmark Mineral Intelligence Lithium Carbonate China Index priced lithium carbonate product at US$13,710/t6 as of 12 June 2024.

Lithium carbonate is the product of many of the most advanced lithium clay projects around the world, including Lithium Americas’ (NYSE: LAC) 16.1Mt LCE Thacker Pass Project3 which is currently under construction. Accordingly, exploration results for Red Mountain have been reported as both the standard parts-per-million (ppm) and as % Lithium Carbonate Equivalent (LCE). A full table of tabulated assay results is provided in Appendix 2.

Click here for the full ASX Release

This article includes content from Astute Metals NL, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

19 February

Top Australian Mining Stocks This Week: Lithium Valley Results Boost Gold Mountain

Welcome to the Investing News Network's weekly round-up of the top-performing mining stocks listed on the ASX, starting with news in Australia's resource sector.Mining giant BHP (ASX:BHP,NYSE:BHP,LSE:BHP) reported strong half-year copper results, saying that its copper operations accounted for... Keep Reading...

17 February

Howard Klein Doubles Down on Strategic Lithium Reserve as Project Vault Takes Shape

Before the Trump administration revealed plans for Project Vault, Howard Klein, co-founder and partner at RK Equity, proposed the idea of a strategic lithium reserve. “The goal of a strategic lithium reserve is to stabilize prices and allow the industry to develop,” he told the Investing News... Keep Reading...

17 February

Sigma Lithium Makes New Lithium Fines Sale, Unlocks US$96 Million Credit Facility

Sigma Lithium (TSXV:SGML,NASDAQ:SGML) has secured another large-scale sale of high-purity lithium fines and activated a production-backed revolving credit facility as it ramps up operations in Brazil.The lithium producer announced it has agreed to sell 150,000 metric tons (MT) of high-purity... Keep Reading...

12 February

Albemarle Lifts Lithium Demand Forecast as Energy Storage Surges

Albemarle (NYSE:ALB) is raising its long-term lithium demand outlook after a breakout year for stationary energy storage, underscoring a shift in the battery materials market that is no longer driven solely by electric vehicles.The US-based lithium major reported fourth quarter 2025 net sales of... Keep Reading...

21 January

Official signing of the Portuguese State Grant

Savannah joins other grant recipient companies at official signing ceremony

Savannah Resources Plc, the developer of the Barroso Lithium Project in Portugal, a 'Strategic Project' under the European Critical Raw Materials Act and Europe's largest spodumene lithium deposit (the 'Project'), was delighted to join with other recipients of State grants yesterday at the... Keep Reading...

21 January

Excellent Results from 2025 Core Drilling Program at McDermitt

Jindalee Lithium Limited (Jindalee, or the Company; ASX: JLL, OTCQX: JNDAF) is pleased to report assay results from the drilling program at the McDermitt Lithium Project completed late 2025. All holes returned strong lithium and magnesium intercepts from shallow depths, including:R92: 36.5m @... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00