November 22, 2023

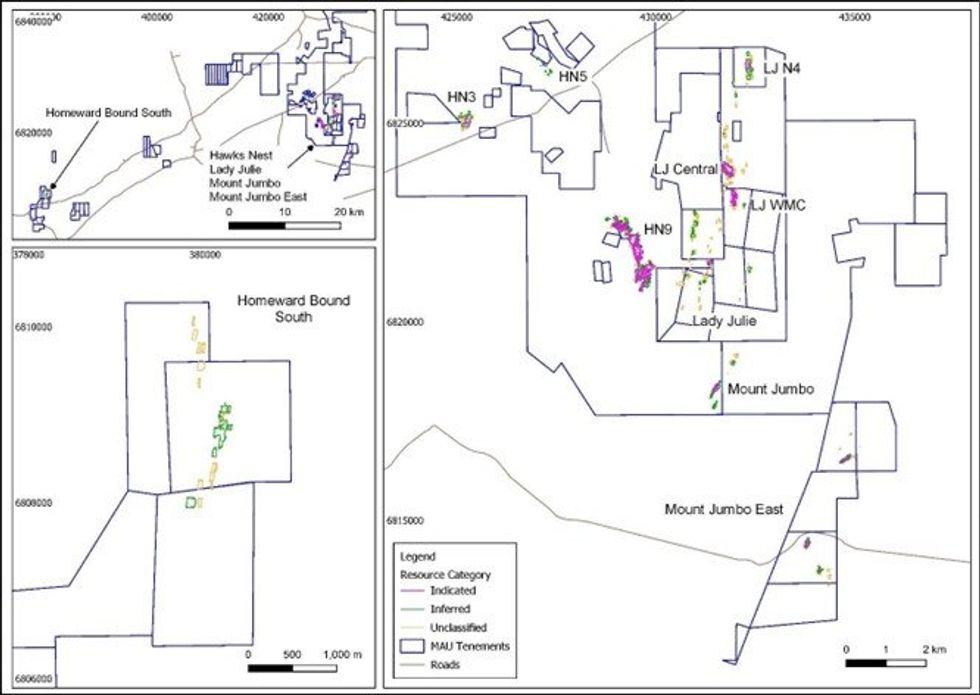

Magnetic Resources NL (Magnetic or the Company) is pleased to announce an Updated Mineral Resource Estimates from its deposits in the Laverton and Homeward Bound area. The main deposits include Hawks Nest 9 (HN9), Lady Julie Central (LJC), Lady Julie North 4 (LJN4), Mount Jumbo and Homeward Bound South, which are all located in an area with well-endowed regional infrastructure including three processing plants within 35kms.

HIGHLIGHTS

- This update incorporates recent drilling results at Lady Julie North 4 (LJN4) and Lady Julie Central (LJC) since the last resource report in February 2023 (“Expands Mineral Resources estimate ASX release 3 February 2023”).

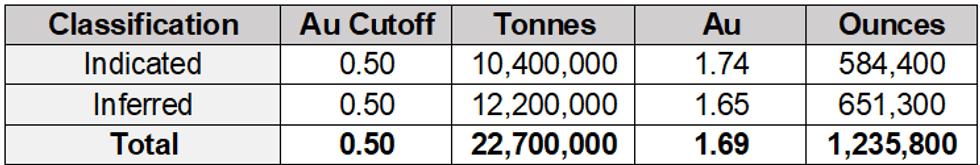

- Updated combined Mineral Resources estimate for the whole project area of:

- 22.7Mt @ 1.69g/t Au totaling 1.24Moz of gold at 0.5g/t cutoff.

- Increase of 107% of the total ounces over the 3 February 2023 ASX Release.

- Significantly, the contained gold in LJN4 has risen from 204,000oz to 852,000oz Au (a 317% increase).

- LJN4 is now by far the largest resource in the project area – and it remains open at depth; exploration continues for similar deposits along the extensive 12km Chatterbox shear.

- Key deposits are close to each other and form part of one mining field.

- Three processing plants are nearby, within 10km - 35km away providing scope for toll processing. Given the scale of the resource upgrade, consideration is now also being given to a dedicated processing plant.

- Ongoing extension drilling continues and is expected to result in further resource increases.

The update follows extensive infill and down-dip drilling mainly at LJN4 and some at LJC.

The verification and reporting of Mineral Resources on behalf of the Company was completed by its JORC Competent Person, Mr M Edwards of Blue Cap Mining. The Mineral Resources Estimate has been prepared and reported in accordance with the 2012 Edition of the JORC Code.

Total Mineral Resources reported for the Laverton and Homeward Bound South projects is now 22.7Mt @ 1.69g/t Au at 0.5g/t cut-off totaling 1,236,000oz of gold (See Table 1 below). The cutoff grade is considered appropriate for a large-scale open pit operation.

Managing Director George Sakalidis commented:

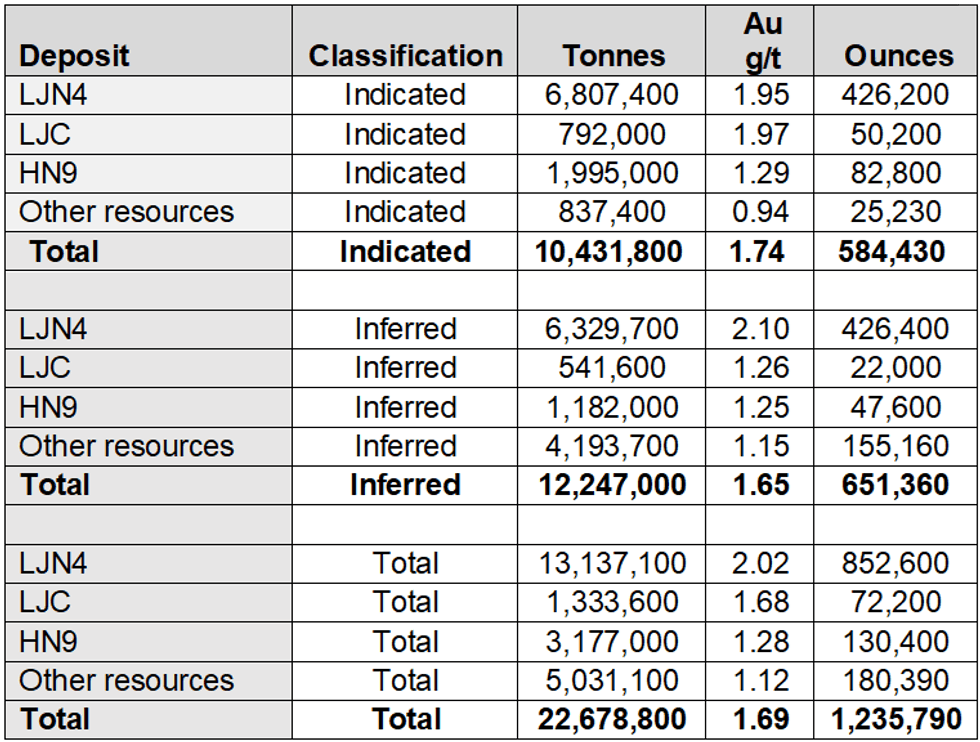

“The Lady Julie North 4 Resource has been the prime drilling focus as reported in periodic releases to the ASX. It has multiple stacked lodes with a number of thick intersections that have not been closed off at depth. The initial deeper drilling started on the 25 January 2023 and has expanded in subsequent months to a 95-hole RC program for 16,356m. Drilling is continuing, with holes in excess of 400m depth, which is expected to increase the current resource at LJN4 of 13.1Mt at 2.02g/t for 852,000oz at a 0.5g/t cut off (Table 2).

This LJN4 deposit sits within a regional structure called the Chatterbox Shear Zone that extends over a 12km length within the Magnetic tenements. This shear extends southwards of LJN4 and has had initial AC and RC drilling completed and some anomalous intersections that will be followed up with some shallow RC drilling for the purpose of finding further gold deposits.

Drilling in the last 6 months included diamond drill holes for geotechnical evaluation of proposed pits, and for hydrology analysis. Project environmental, heritage and technical background studies are close to completion – optimisation and pit design has commenced on LJC and the expanded LJN4 – the aim is to prepare and submit a Mining Proposal in early 2024. Other strategic opportunities are also being investigated”.

The Table below summarises the updated Total Mineral Resource at a 0.5g/t Au cutoff (Table 1), with Table 2 providing details of the major resources. Details for the smaller resources which have not changed can be found in the 3 February 2023 ASX release.

The key deposits that have been drilled in the last six months are LJC and LJN4, which are shown in Table 2 and are further summarised below:

LJC Resource

The LJC (Indicated and Inferred) Resource of 1.33Mt at 1.68g/t Au for 72,200oz is 350m by 200m in plan (Figure 2). 59% of the resource falls in the Indicated category. There are some thicker intersections including a number of intersections that start from surface (Figure 3 a, b and c). The long section (Figure 4) shows a thickened, near surface zone which gently plunges to the south-east forming two distinct zones.

Click here for the full ASX Release

This article includes content from Magnetic Resources NL, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

MAU:AU

The Conversation (0)

13 December 2023

Magnetic Resources NL

An Exciting Gold Development Play in Western Australia

An Exciting Gold Development Play in Western Australia Keep Reading...

3h

Investor Presentation

Aurum Resources (AUE:AU) has announced Investor PresentationDownload the PDF here. Keep Reading...

19h

Armory Mining To Conduct a Series of Airborne Geophysics Surveys at the Ammo Gold-Antimony Project

(TheNewswire) Vancouver, B.C. TheNewswire - February 9, 2026 Armory Mining Corp. (CSE: ARMY) (OTC: RMRYF) (FRA: 2JS) (the "Company" or "Armory") a resource exploration company focused on the discovery and development of minerals critical to the energy, security and defense sectors, is pleased to... Keep Reading...

06 February

Editor's Picks: Is Gold and Silver's Price Correction Over?

It's been a wild couple of weeks for gold and silver. After surging to record highs at the end of January, prices for both precious metals saw significant corrections, creating turmoil for market participants.This week brought some relief, with gold bouncing back from its low point and even... Keep Reading...

06 February

Blackrock Silver to Present at the Precious Metals and Critical Minerals Virtual Investor Conference on February 10th 2026

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce that Andrew Pollard, President & Chief Executive Officer of the Company, will present live at the Precious Metals & Critical Minerals Virtual Investor Conference hosted... Keep Reading...

05 February

Experts: Gold's Fundamentals Intact, Price Could Hit US$7,000 in 2026

Gold took center stage at this year's Vancouver Resource Investment Conference (VRIC), coming to the fore in a slew of discussions as the price surged past US$5,000 per ounce. Held from January 25 to 26, the conference brought together diverse experts, with a focus point being the "Gold... Keep Reading...

05 February

Barrick Advances North American Gold Spinoff After Record 2025 Results

Toronto-based company Barrick Mining (TSX:ABX,NYSE:B) said it will move ahead with plans to spin off its North American gold assets after a strong finish to 2025.The company's board has authorized preparations for an initial public offering (IPO) of a new entity that would house its premier... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00