December 12, 2023

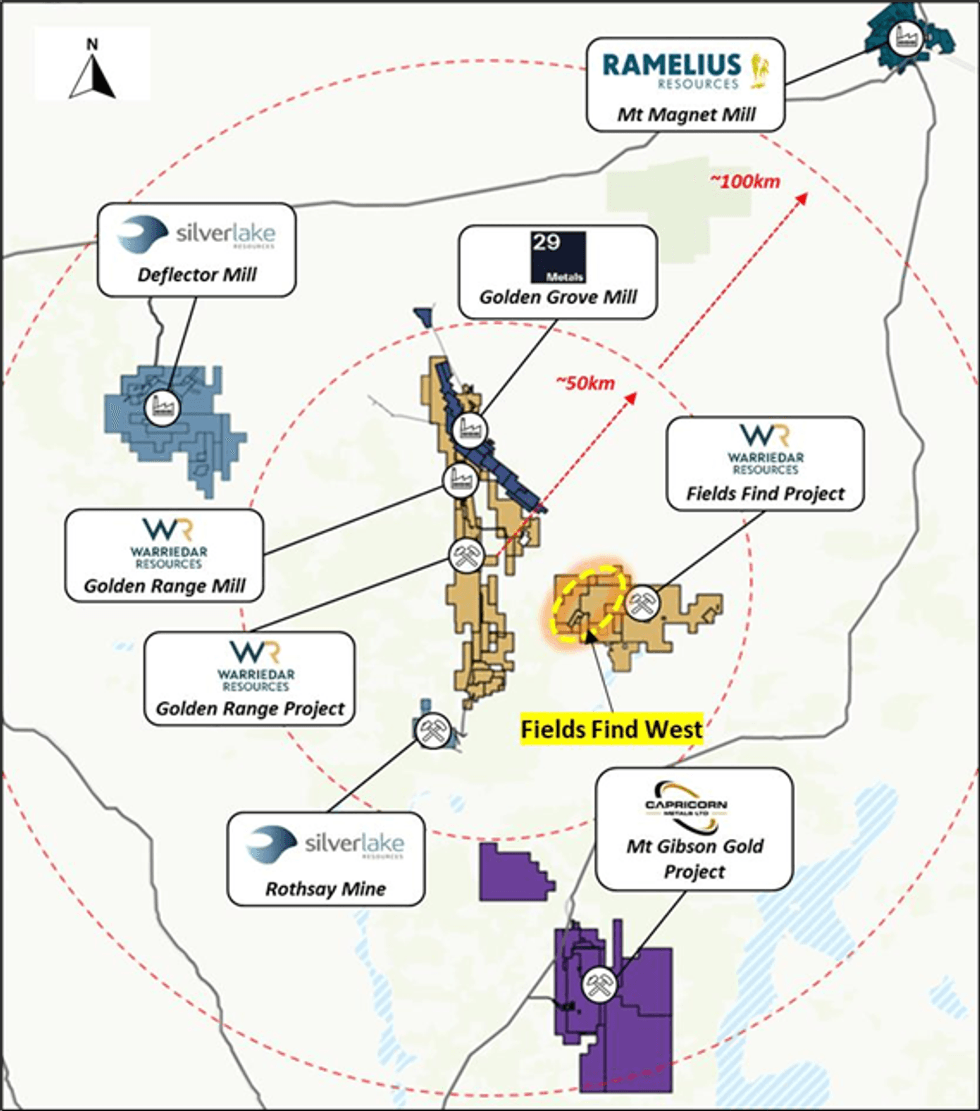

Warriedar Resources Limited (ASX: WA8) (Warriedar or the Company) is pleased to advise that assay results have been received for the greenfields drilling program undertaken at the Mopoke, Falcon, Sandpiper and Warriedar Copper Prospects at its Fields Find Project (Fields Find) in the Murchison region of Western Australia. The drilling is part of Warriedar’s exploration program designed to test the highly prospective Fields Find West area for significant gold and base metal deposits.

HIGHLIGHTS:

- Greenfields drilling at Fields Find West has successfully intercepted significant gold and copper mineralisation including:

- 4m @ 5.00 g/t Au from 92m (Mopoke Prospect)

- 8m @ 1.46 g/t Au from 24m (Sandpiper Prospect)

- 4m @ 1.58 g/t Au from 25m (Sandpiper Prospect)

- 1m @ 1.66% Cu, 0.22 g/t Au, 102 ppm Mo, 16 g/t Ag from 34m (Warriedar Copper Prospect)

- Combined with historic drilling, these results support a multi-phase porphyry intrusive model of robust scale potential.

- Drilling and geophysical data confirm the significant footprint of the porphyry which has been identified within an area ~ 7km long (from Sandpiper in the north to Warriedar Copper in the south). The contact of the porphyry and surrounding greenstone units defines a significant and prospective exploration corridor.

- Soil sampling confirms the high-grade Sandpiper gold mineralisation continues along strike a further 500m to the south. Soil sampling has now defined a gold anomaly that measures ~800m by 350m.

Warriedar Managing Director and CEO, Dr Amanda Buckingham, commented:

“The assays from our initial Fields Find West drilling have demonstrated the wider presence of significant gold mineralisation in the shallow porphyry system previously identified at Fields Find. This is a meaningful development, both in terms of our exploration model for this central corridor at Fields Find West and for overall exploration prospectivity of this area to hold substantial accumulations of gold.

We plan to return to this target zone during H1 CY2024 to test the extent of the mineralised system and its potential to deliver a sizeable deposit(s) of mineable, economic ounces.”

Engage with this announcement at the Warriedar Investor Hub.

This initial drilling focused along the central corridor of Fields Find West, where late monzonite porphyries intrude the greenstone sequence. In total, 17 holes for 4,026 metres were drilled across four prospects – Mopoke, Sandpiper, Falcon and Warriedar Copper (refer Table 1 and Figures 2 & 3). Significant intercepts are reported in Tables 2 & 3.

Click here for the full ASX Release

This article includes content from Warriedar Resources Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

WA8:AU

The Conversation (0)

09 April 2024

Warriedar Resources

Advanced gold and copper exploration in Western Australia and Nevada

Advanced gold and copper exploration in Western Australia and Nevada Keep Reading...

18 November 2024

Targeted Exploration Focus Delivers an Additional 471koz or 99% Increase in Ounces, and a Higher Grade for Ricciardo

Warriedar Resources Limited (ASX: WA8) (Warriedar or the Company) is pleased to report on an updated MRE for its flagship Ricciardo Gold Deposit, part of the broader Golden Range Project located in the Murchison region of Western Australia. HIGHLIGHTS:Updated Mineral Resource Estimate (MRE) for... Keep Reading...

30 September 2024

Continued Delivery of High Grade Antimony Mineralisation at Ricciardo

Warriedar Resources Limited (ASX: WA8) (Warriedar or the Company) provides an update on its initial review of the antimony (Sb) potential at the Ricciardo deposit, located within its Golden Range Project in the Murchison region of Western Australia. HIGHLIGHTS:Review of the antimony (Sb)... Keep Reading...

29 September 2024

Further Strong Extensional Diamond Drill Results from Ricciardo

Warriedar Resources Limited (ASX: WA8) (Warriedar or the Company) provides further assay results from its Golden Range Project, located in the Murchison region of Western Australia. HIGHLIGHTS:All residual assay results received from the recent 2,701m (27 holes) diamond drilling program at... Keep Reading...

26 August 2024

Further Step-Out Gold Success and High-Grade Antimony Discovery

Warriedar Resources Limited (ASX: WA8) (Warriedar or the Company) provides further assay results from its Golden Range Project, located in the Murchison region of Western Australia. The results reported in this release are for a further 6 of the 27 diamond holes drilled in the current program at... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00