Scryb Inc. (CSE: SCYB,OTC:SCYRF) ("Scryb'' or the "Company") has filed financial results for its third quarter ended June 30, 2025 ("Q3 2025"), and also provides commentary on Scryb's largest holding, Cybeats, which filed its second quarter ended June 30, 2025 Interim Financial Statements and Management's Discussion and Analysis ("MD&A").

Scryb's reported results for Q3 2025 reflect the transition to equity accounting for Cybeats following the deconsolidation in November 2024. Balance sheet improvements were driven by portfolio realignment, disciplined expense control, and balance-sheet simplification. Further to the deconsolidation, Scryb is positioned with a cleaner balance sheet and is able to report on Cybeats' performance as an investment going forward. Scryb maintains a 75 million common share position in Cybeats, which is approximately 40% of Cybeats issued and outstanding shares.

Cybeats Technologies Corp.

Over the past quarter Cybeats has secured multiple client expansions, and is broadening its market reach and growth potential by establishing strategic partnerships, including channel and white-label arrangements. With ongoing product enhancements, strong customer retention, and the completion of a $3.2 million financing following quarter-end, Cybeats is well positioned to scale its operations and deliver sustained long-term performance.

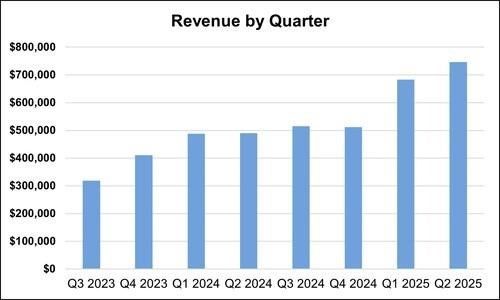

Cybeats also announced it has the strongest pipeline in its history with potential customers in all stages of advancement including POCs, planned POCs and pilots. Below is a graph of revenue growth and Cybeats Financial Highlights for the three months ended June 30, 2025 ("Q2 2025") with comparatives for the three months ended June 30, 2024 ("Q2 2024"):

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/952/264910_08c6d91e14a44ab9_001full.jpg

Cybeats Revenue in Q2 2025 was $744,664 versus $492,331 in Q2 2024, an increase of 51% or $252,333. This growth was due to the addition of new customers and the expansion of our existing customers.

Net loss in Q2 2025 was $(856,431), versus a loss of $(2,261,534) in Q2 2024, an improvement of $1,405,103 or 164%. The reduction in net loss was due to operational efficiencies.

SBOM Studio continues to drive adoption across critical infrastructure and industrial control system sectors, with global leaders like Emerson Electric, Rockwell Automation, Schneider Electric, and Johnson Controls.

Both sets of financial statements discussed in this release are filed on SEDAR+ at www.sedarplus.ca for more information.1

About Scryb Inc.

Scryb invests in and actively supports a growing portfolio of innovative and high-upside ventures across AI, biotech, digital health, and cybersecurity.

Contact:

James Van Staveren, CEO

Phone: 647-847-5543

Email: info@scryb.ai

Forward-looking Information Cautionary Statement

Except for statements of historic fact, this news release contains certain "forward-looking information" within the meaning of applicable securities law. Forward-looking information is frequently characterized by words such as "plan", "expect", "project", "intend", "believe", "anticipate", "estimate" and other similar words, or statements that certain events or conditions "may" or "will" occur. Forward-looking statements are based on the opinions and estimates at the date the statements are made, and are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those anticipated in the forward-looking statements including, but not limited to delays or uncertainties with regulatory approvals, including that of the CSE. There are uncertainties inherent in forward-looking information, including factors beyond the Company's control. There are no assurances that the commercialization plans for the technology described in this news release will come into effect on the terms or time frame described herein. The Company undertakes no obligation to update forward-looking information if circumstances or management's estimates or opinions should change except as required by law. The reader is cautioned not to place undue reliance on forward-looking statements. Additional risk disclosures are available in the Company's filings on https://www.sedarplus.ca/.

_____________________________

1https://www.newswire.ca/news-releases/cybeats-technologies-corp-announces-second-quarter-fiscal-2025-financial-results-851613444.html

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/264910