September 24, 2024

Saga Metals (TSXV:SAGA) is a mineral exploration company focused on acquiring and exploring mineral assets in Canada. The company explores for uranium, lithium, titanium-vanadium and high purity iron ore deposits. Saga Metals has five fully owned exploration assets in top-tier mining jurisdictions in Canada. Its primary projects, Double Mer and Legacy are prospective for uranium and lithium, respectively. Its secondary assets are Radar (titanium-vanadium) and North Wind (iron ore).

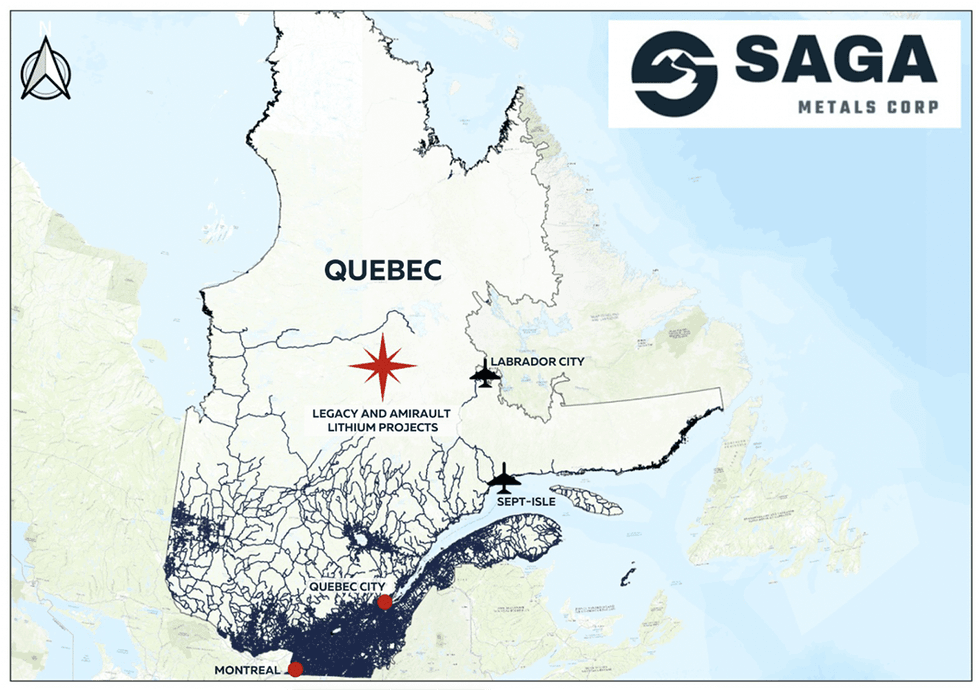

The Legacy lithium project in James Bay, Quebec, is the subject of a C$44 million joint venture option agreement with Rio Tinto Exploration Canada (NYSE:RIO), signed in June 2024. Rio Tinto will act as a project manager for the exploration of Legacy, with the option to acquire an initial 51 percent interest in Legacy over a period of four years. This joint venture allows Saga Metals to focus on its other primary asset, the Double Mer Uranium project, a 25,600-hectare property located 90km Northeast of Goose Bay in Labrador.

Legacy is the subject of a joint option agreement between Saga Metals and Rio Tinto, under which Rio Tinto will act as project manager during the first and second option period. The optioned property contains 663 claims spanning 34,243 hectares hosting 100 km of striking paragneiss.

Company Highlights

- Saga Metals is an exploration company with a diversified portfolio of critical minerals assets in top-tier mining jurisdictions in North America consisting of uranium, lithium, titanium-vanadium and iron ore projects.

- Saga Metals' flagship asset is the Double Mer Uranium Property with an 18km trend verified with high-resolution magnetic survey, uranium count radiometrics, consistent counts-per-second (cps) readings and rock sample assay results of up to 4,280ppm U3O8. With numerous targets validated in the 2024 summer exploration program the company is planning for its maiden drill program this winter.

- The company recently entered a CAD$44M joint venture with Rio Tinto to advance the exploration of the Legacy Lithium project in James Bay, Quebec.

- The Legacy Lithium property is dedicated to expanding North America’s newest lithium district in the prolific James Bay region.

This Saga Metals profile is part of a paid investor education campaign.*

Click here to connect with Saga Metals (TSXV:SAGA) to receive an Investor Presentation

SAGA:CA

Sign up to get your FREE

Saga Metals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

03 September 2025

Saga Metals

Advancing a globally significant, high-grade titanium-vanadium-iron discovery in Labrador with strong growth pipeline in uranium and lithium

Advancing a globally significant, high-grade titanium-vanadium-iron discovery in Labrador with strong growth pipeline in uranium and lithium Keep Reading...

12 February

Deep Space Energy Secures US$1.1 Million to Advance Lunar Power and Satellite Resilience Goals

Latvian startup Deep Space Energy announced it has raised approximately US$1.1 million in a combination of private investment and public funding to advance a radioisotope-based power generator designed to operate on the Moon.The company closed a US$416,500 pre-seed round led by Outlast Fund and... Keep Reading...

05 February

Ranger Uranium Mine Rehabilitation Gets Green Light from Australia

Minister for Resources and Northern Australia Madeleine King has issued a new rehabilitation authority to Energy Resources Australia (ASX:ERA) for the continuation of rehabilitation activities at the Ranger uranium mine in the Northern Territory.“This new authority means that Energy Resources... Keep Reading...

04 February

Uranium Bull Market Isn’t Over, but Volatility Lies Ahead

Uranium’s resurgence has been one of the resource sector's most durable stories of the past five years, but as prices hover near multi-year highs, investors are increasingly asking the same question: How late is it?At the Vancouver Resource Investment Conference (VRIC), panelists Rick Rule, Lobo... Keep Reading...

02 February

Eagle Energy Metals Corp. and Spring Valley Acquisition Corp. II Announce Effectiveness of Registration Statement and Record and Meeting Dates for Extraordinary General Meeting of Shareholders to Approve Proposed Business Combination

Eagle, a next-generation nuclear energy company with rights to the largest open pit-constrained measured and indicated uranium deposit in the United States, and SVII, a special purpose acquisition company, today announced that the SEC has declared effective the Registration Statement, which... Keep Reading...

30 January

Spot Uranium Passes US$100, Extends Year-Long Rally

Uranium prices surged back above US$100 a pound this week, extending a year-long rally that is reshaping the uranium market after more than a decade of underinvestment.Spot price of uranium climbed US$7.75 to US$101 a pound after the Sprott Physical Uranium Trust... Keep Reading...

Latest News

Sign up to get your FREE

Saga Metals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00