May 10, 2024

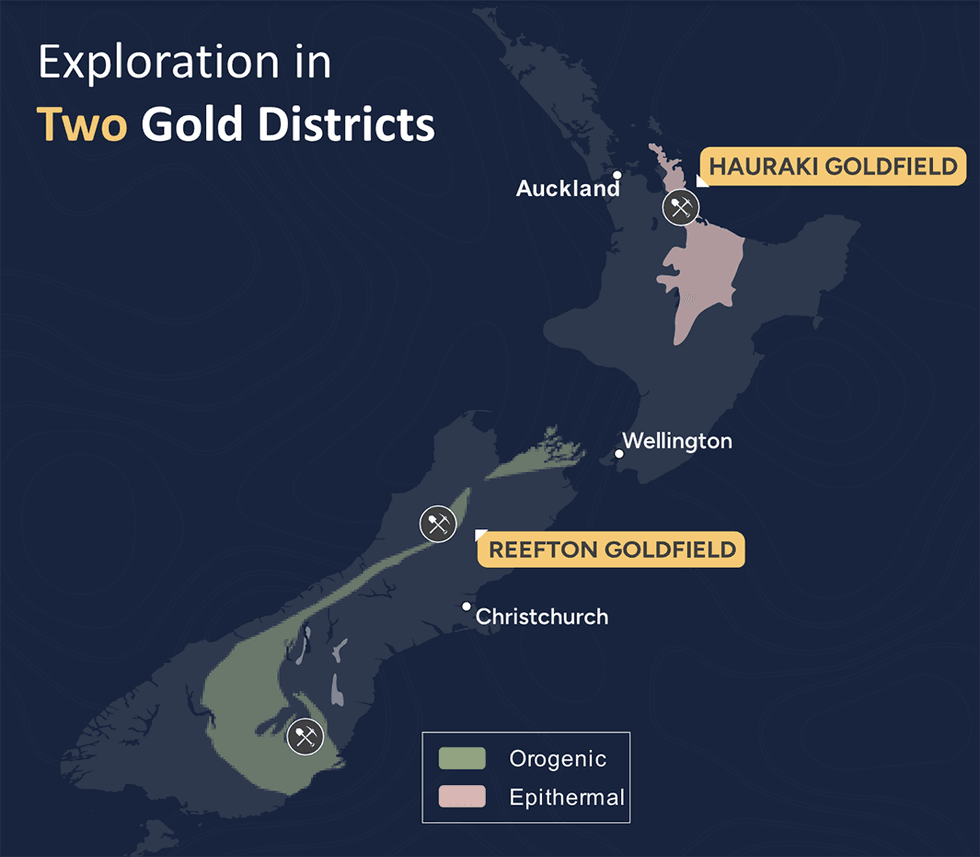

Rua Gold (CSE:RUA,OTC:NZAUF,WKN:A4010V) focuses on the Hauraki Goldfield and Reefton Goldfield - two prolific, historic gold-producing regions in New Zealand boasting previous high-grade gold production. New Zealand is a tier 1 mining jurisdiction with highly prospective geology, and a skilled workforce. The new government of New Zealand has committed to promoting economic growth through mining- and business-friendly policies, such as the Fast Track Approval Bill, which proposes quicker approval timelines for a range of projects, including mining.

New Zealand has a rich history of gold production from orogenic deposits (+9 Moz), epithermal sources (+15 Moz), and alluvial deposits (+22 Moz). The country has low sovereign risk with no corruption, making it an attractive destination for mining investment.

Rua Gold has launched a fully funded exploration program at its properties which includes a 2,500-meter diamond drill program focused on the Pactolus prospect at Reefton Goldfield. Pactolus has returned assays for three of six holes drilled on the system, with hole DD_PAC_035 intersecting 2 meters @ 5.13 grams per ton (g/t) gold. Additional work is required to accurately model this zone's geometry before proceeding with further drilling at this prospect. Consequently, the company anticipates redirecting its focus towards the previously productive areas in Reefton in the near future, which includes the Murray Creek, Crushington, Capleston and Caledonian historic districts. These historic mines collectively produced ~700 koz at 25.2 g/t within a radius of ~20 kms.

Company Highlights

- Rua Gold is a gold exploration company with two highly prospective land packages in New Zealand’s historic gold districts – Hauraki Goldfield and Reefton Goldfield.

- New Zealand is a tier 1 mining jurisdiction boasting highly promising geological formations and a significant history of gold production, with orogenic deposits (+9 Moz), epithermal sources (+15 Moz), and alluvial deposits (+22 Moz).

- The company’s two key assets include the Reefton Goldfield on New Zealand’s South Island and Glamorgan on New Zealand’s North Island.

- The new government is focused on stimulating economic growth, as evidenced by the recent Fast Track Approval Bill, which proposes fast-track approvals for a range of projects, including mining.

- Rua Gold has high-quality orogenic and epithermal gold prospects, boasting historical production grades ranging from 16 to 50 g/t gold.

- Rua Gold is fully permitted and fully financed with significant near-term catalysts. The company has launched an exploration program at its two properties. Drilling is already ongoing at the company’s properties in the Reefton district.

- A seasoned board and management team is at the helm of Rua Gold, with extensive regional knowledge and a proven track record of successful discoveries. With full financing and permits in place, the company is well-positioned to capitalize on growth prospects.

This Rua Gold profile is part of a paid investor education campaign.*

Click here to connect with Rua Gold (CSE:RUA) to receive an Investor Presentation

RUA:CNX

The Conversation (0)

8h

How to Invest in Gold Royalty and Streaming Stocks

Gold royalty companies offer investors exposure to gold and silver with the benefits of diversification, lower risk and a steady income stream. Royalty companies operating in the resource sector will typically agree to provide funding for the exploration or development of a resource in exchange... Keep Reading...

8h

How Would a New BRICS Currency Affect the US Dollar?

The BRICS nations, originally composed of Brazil, Russia, India, China and South Africa, have had many discussions about establishing a new reserve currency backed by a basket of their respective currencies. The creation of a potentially gold-backed currency, known as the "Unit," as a US dollar... Keep Reading...

12h

Toronto to Host Global Mineral Sector for PDAC 2026, March 1 – 4

The Prospectors & Developers Association of Canada (PDAC) will bring together the mineral exploration and mining community in Toronto for its 94th annual Convention, taking place March 1 – 4, 2026, at the Metro Toronto Convention Centre (MTCC).As the World’s Premier Mineral Exploration & Mining... Keep Reading...

15h

THE SIGNAL ARCHITECTURE: 5 Stocks Calibrating the 2026 Infrastructure Cycle

USANewsGroup.com Market Intelligence Brief — WHAT'S HAPPENING: The infrastructure holding the global economy together is being stress-tested in real time: Gold at $5,552 per ounce as central banks loaded another 755 tonnes into reserves [1]The G7 issued formal guidance treating the quantum... Keep Reading...

23 February

Mining’s New Reality: Strategic Nationalism, Gold Records and a Fractured Cost Curve

The era of “smooth globalization” is over, and mining is entering a more fragmented, politically charged phase defined by strategic nationalism, according to speakers at S&P Global’s latest webinar.Jason Holden, who opened the “State of the Market: Mining Q4 2025” session with a macro overview,... Keep Reading...

23 February

Brazilian State Firm Seeks Injunction to Block Equinox Gold-CMOC Asset Sale

A Brazilian state-run mining company is seeking an emergency court injunction to block the sale of one of Equinox Gold's (TSX:EQX,NYSEAMERICAN:EQX) Brazilian assets. Bloomberg reported that Companhia Baiana de Produção Mineral (CBPM) has asked the Bahia State Court of Justice to immediately... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00