April 29, 2024

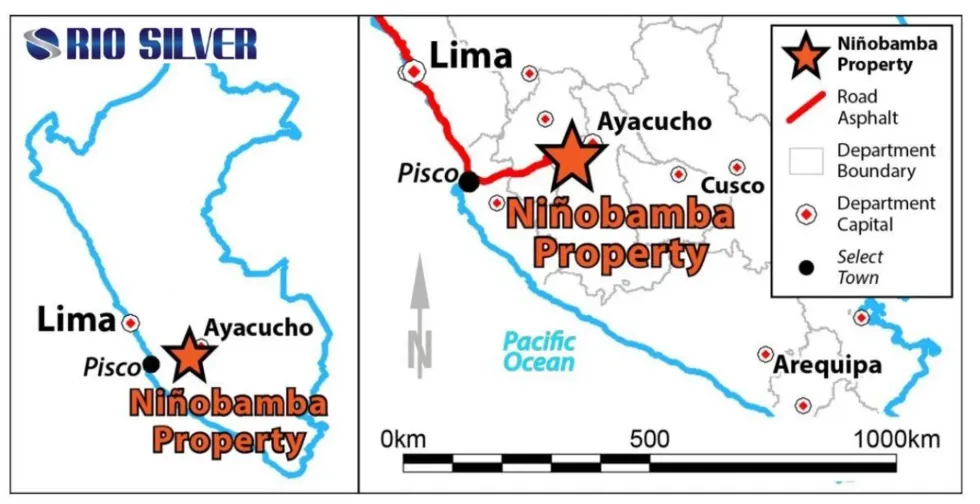

Rio Silver (TSXV:RYO) focuses on the acquisition, exploration and development of precious metals deposits in South America. The company is currently advancing its 100 percent-owned Niñobamba silver-gold project in Peru. The The 3,933-hectare Niñobamba property is a drill-ready project located in the Department of Ayacucho about 330 kilometers southeast of Lima.

To date, Rio Silver and other historical operators have completed US$10 million in exploration expenditure on the Niñobamba property. The company has low overhead expenditure and strong alliances in Peru that are helping it achieve new initiatives for enhanced sustainability.

In 2016, Rio Silver consolidated its property by acquiring the surrounding 2,200 hectares of adjoining land from Newmont Mining and Southern Peru Copper. These included the Jorimina zone, which is located about 6.5 kilometers west of the Niñobamba and is believed to be part of the same high-sulfidation silver-gold system identified in the main Niñobamba zones.

Company Highlights

- Rio Silver owns six mineral concessions covering 4,100 hectares of wholly-owned land in a historic Peruvian mining district.

- The property was historically surrounded by big-name miners (Newmont, Southern Peru Copper) and is now wholly owned by Rio Silver.

- Experienced management team with more than two decades of mining experience in Peru.

- Extensive trenching completed at the Niñobamba zone.

- The management team holds a 29 percent stake in the company.

- US$10 million in exploration expenditure completed to date by Rio and historical operators.

- All the historical data has been collected from previous owners.

- Historical drilling on the Niñobamba property intersected 130 meters of 2.55 oz/t silver and 72.3 meters of 1.19 g/t gold.

- New gold zone identified including 56 meters at 98.9 g/t silver and 21.77 meters at 1.32 g/t gold, 102.46 g/t silver.

This Rio Silver profile is part of a paid investor education campaign.*

Click here to connect with Rio Silver (TSXV:RYO) to receive an Investor Presentation

RYO:CA

Sign up to get your FREE

Rio Silver Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

02 December 2025

Rio Silver

Leveraging 25+ years of mining experience in Peru

Leveraging 25+ years of mining experience in Peru Keep Reading...

15h

Rick Rule: Gold Price During War, Silver Strategy, Oil Stock Game Plan

Rick Rule, proprietor at Rule Investment Media, shares updates on his current strategy in the resource space, mentioning gold, silver, oil and agriculture. He also reminds investors to pay more attention to gold's underlying drivers than to current events.Click here to register for the Rule... Keep Reading...

15h

Lobo Tiggre: Gold, Oil in Times of War, Plus My Shopping List Now

Lobo Tiggre of IndependentSpeculator.com shares his thoughts on how gold, silver and oil could be impacted by the developing situation in the Middle East. He cautioned investors not to chase these commodities if prices run. Don't forget to follow us @INN_Resource for real-time updates!Securities... Keep Reading...

16h

TomaGold: New High-grade Deep Discovery at Berrigan Mine

TomaGold (TSXV:LOT) President, CEO and Director David Grondin said the company is focusing on its flagship Berrigan mine in Chibougamau, Québec, following a large, significant discovery at depth.Berrigan is 4 kilometers northwest of the city of Chibougamau and has existed for about 50 years.... Keep Reading...

16h

Oreterra Metals Fully Financed for Maiden Discovery Drilling at Trek South

Oreterra Metals (TSXV:OTMC) is set to launch its first-ever discovery drill program at the Trek South porphyry copper-gold prospect in BC, Canada, a pivotal moment following a corporate restructuring that culminated in the company emerging under its new name on February 2.Speaking at the... Keep Reading...

04 March

Aurum Hits High-Grade Gold at Napie, Cote d'Ivoire

Aurum Resources (AUE:AU) has announced Aurum Hits High-Grade Gold at Napie, Cote d'IvoireDownload the PDF here. Keep Reading...

Latest News

Sign up to get your FREE

Rio Silver Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00