June 02, 2022

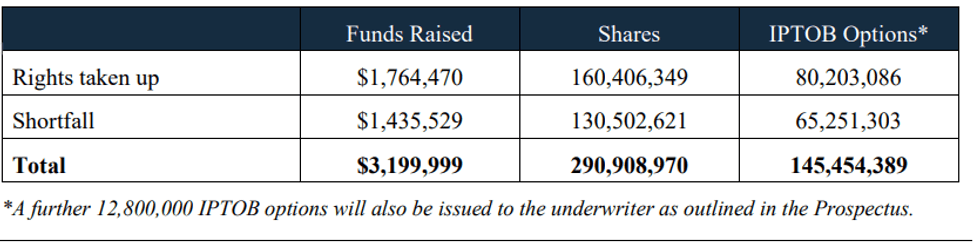

Impact Minerals Limited (ASX:IPT) (Impact Minerals or the Company) is pleased to announce that the Renounceable Rights Issue (Issue) announced on 26 April 2022 has closed raising $3.2 Million (before costs). The Company will issue 290,908,970 new fully paid ordinary shares (Shares) and 158,254,389 new listed options exercisable at $0.02, with an expiry date of 2 June 2024 (Options). The Options will be quoted under the ASX code IPTOB.

Impact’s Managing Director Dr Mike Jones said “We are very pleased to have raised this significant amount from shareholders and new investors in what has been the most volatile market for several years. We are now funded for our exploration programmes on our significant and exciting battery and strategic metals projects here in Western Australia for the next 18 months. We have recently completed drill programmes and soil geochemistry surveys at several of our projects as well as an airborne EM survey over our flagship Arkun project.

We look forward to analysing the results of all of this work and getting on with follow up drilling. We thank everyone for their significant support in this raising and in particular our lead manager Mahe Capital. Given the success of the raising we have decided to now close the issue and will not be placing any further shortfall.”

The net proceeds will enable the Company to complete its early-stage exploration programmes across its battery and strategic project portfolio in Western Australia. At the flagship Arkun Project, a major airborne electromagnetic (EM) survey has just been completed and extensive follow up soil geochemistry and ground geophysical surveys will now be undertaken to define drill targets to be tested in late 2022 and 2023.

The Company would like to thank all its shareholders for their support of the Issue and would like to welcome new investors to the register. It is noted that the Company’s directors also took up their full entitlements, demonstrating a strong commitment to and confidence in the Company’s projects and its future.

The final allocations are set out below:

Mahe Capital Pty Ltd advised Impact Minerals on the Issue and acted as Lead Manager and Underwriter to the capital raising.

The new securities are expected will be issued today Friday, 3 June 2022, in accordance with the updated timetable. The Directors in conjunction with the Underwriter have resolved to close the Issue and will not be seeking to place the balance of the shortfall.

This announcement has been authorised for release by the Managing Director.

If you have any queries concerning the Entitlement Offer, please contact the Company Secretary on +61 (08) 6454 6666.

Dr Mike Jones

Managing Director

Click here for the full ASX Release

This article includes content from Impact Minerals Limited , licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

IPT:AU

The Conversation (0)

22 October 2024

Impact Minerals Limited

Developing the lowest-cost HPA project in Australia

Developing the lowest-cost HPA project in Australia Keep Reading...

27 March 2025

Successful Completion of the Renounceable Rights Issue

Impact Minerals Limited (IPT:AU) has announced Successful Completion of the Renounceable Rights IssueDownload the PDF here. Keep Reading...

19 March 2025

Renounceable Rights Issue Closing Date

Impact Minerals Limited (IPT:AU) has announced Renounceable Rights Issue Closing DateDownload the PDF here. Keep Reading...

13 March 2025

Major drill targets identified at the Caligula Prospect

Impact Minerals Limited (IPT:AU) has announced Major drill targets identified at the Caligula ProspectDownload the PDF here. Keep Reading...

09 March 2025

NFM: Sale of Broken Hill East Project to Impact Minerals

Impact Minerals Limited (IPT:AU) has announced NFM: Sale of Broken Hill East Project to Impact MineralsDownload the PDF here. Keep Reading...

04 March 2025

Update on the Renounceable Rights Issue to raise $5.2M

Impact Minerals Limited (IPT:AU) has announced Update on the Renounceable Rights Issue to raise $5.2MDownload the PDF here. Keep Reading...

30 January

Editor's Picks: Gold and Silver Prices Hit New Highs, Then Drop — What's Next?

Gold and silver are wrapping up a record-setting week once again. Starting with gold, the yellow metal left market participants hanging last week after finishing just shy of US$5,000 per ounce. However, it made up for it in spades this week, breaking through that level and continuing on up to... Keep Reading...

30 January

Lobo Tiggre: Gold, Silver Hit Record Highs, Next "Buy Low" Sector

Did gold and silver just experience a blow-off top, or do they have more room to run? Lobo Tiggre, CEO of IndependentSpeculator.com, shares his thoughts on what's going on with the precious metals, and how investors may want to position.Don't forget to follow us @INN_Resource for real-time... Keep Reading...

30 January

Ross Beaty: Gold, Silver in "Bubble Territory," What Happens Next?

Ross Beaty of Equinox Gold (TSX:EQX,NYSEAMERICAN:EQX) and Pan American Silver (TSX:PAAS,NASDAQ:PAAS) shares his thoughts on gold and silver's record-setting runs. While high prices are exciting, he noted that even US$50 per ounce silver is good for miners. "At the end of the day, there's still... Keep Reading...

30 January

Is it Time to Take Profits? Experts Share Gold and Silver Strategies in Vancouver

Optimism was building at last year’s Vancouver Resource Investment Conference (VRIC), with fresh capital flowing back into the mining sector, lifting project financings and investor portfolios alike.This year's VRIC, which ran from January 25 to 26, saw that optimism tip into outright... Keep Reading...

30 January

Adoption of Omnibus Incentive Plan & Private Placement Update

iMetal Resources Inc. (TSXV: IMR,OTC:IMRFF) (OTCQB: IMRFF) (FSE: A7VA) ("iMetal" or the "Company"). The Company confirms shareholders approved the adoption of a new omnibus incentive plan (the "Plan") at the annual general and special meeting (the "Meeting") of shareholders held on August 7,... Keep Reading...

30 January

Flow Metals Announces Closing of Shares for Debt

Flow Metals Corp. (CSE: FWM) ("Flow Metals" or the "Company") is pleased to announce that, further to its news release dated January 23, 2026, it has closed a debt settlement transaction (the "Debt Settlement") with certain insiders' of the Company pursuant to which the Company settled... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00