August 21, 2022

Metal Hawk Limited (ASX: MHK, “Metal Hawk” or the “Company”) is pleased to advise that a new campaign of reverse circulation (RC) drilling has commenced at the Berehaven Project, 20km south-east of Kalgoorlie in Western Australian. Drilling will test multiple new nickel sulphide targets across the project area with a total of 3,000m planned.

- 3,000m campaign of RC drilling has commenced

- Targets include new EM conductors and follow-up drilling of nickel sulphide intercepts at the Torana and Commodore South prospects

The Company identified several late-time conductors from ground moving loop electromagnetic (MLEM) surveys carried out earlier this year across the project area. Drilling to date has focused on exploring along the western Commodore ultramafic trend, with significant nickel sulphide mineralisation identified in RC drilling north and south of the Commodore discovery at the Torana and Commodore South prospects. Whilst the current RC program is continuing to explore along this fertile western ultramafic trend, several holes are also planned to test four MLEM conductors (BVM_09 to BVM_012) further east of Commodore.

Metal Hawk’s Managing Director Will Belbin commented: “We are continuing systematic, rigorous exploration at Berehaven with this next phase of RC drilling. Since the discovery of high-grade nickel at Commodore late last year, the regional work we have carried out on this project has generated several more exciting discovery opportunities for nickel and gold.”

“Considering the proximity to nearby hits of nickel sulphide along strike to the north at the Euston and Blair North prospects, there has been very little exploration carried out in the vicinity of these eastern EM anomalies. Our consulting geophysicists at Newexco have carefully refined and prioritised these drill-ready conductors.”

“We are also going to be drilling more RC holes at Torana, and plans are being prepared for deeper diamond drilling to test the strong off-hole DHEM conductor situated beneath a zone of thick mineralised ultramafic rocks.”

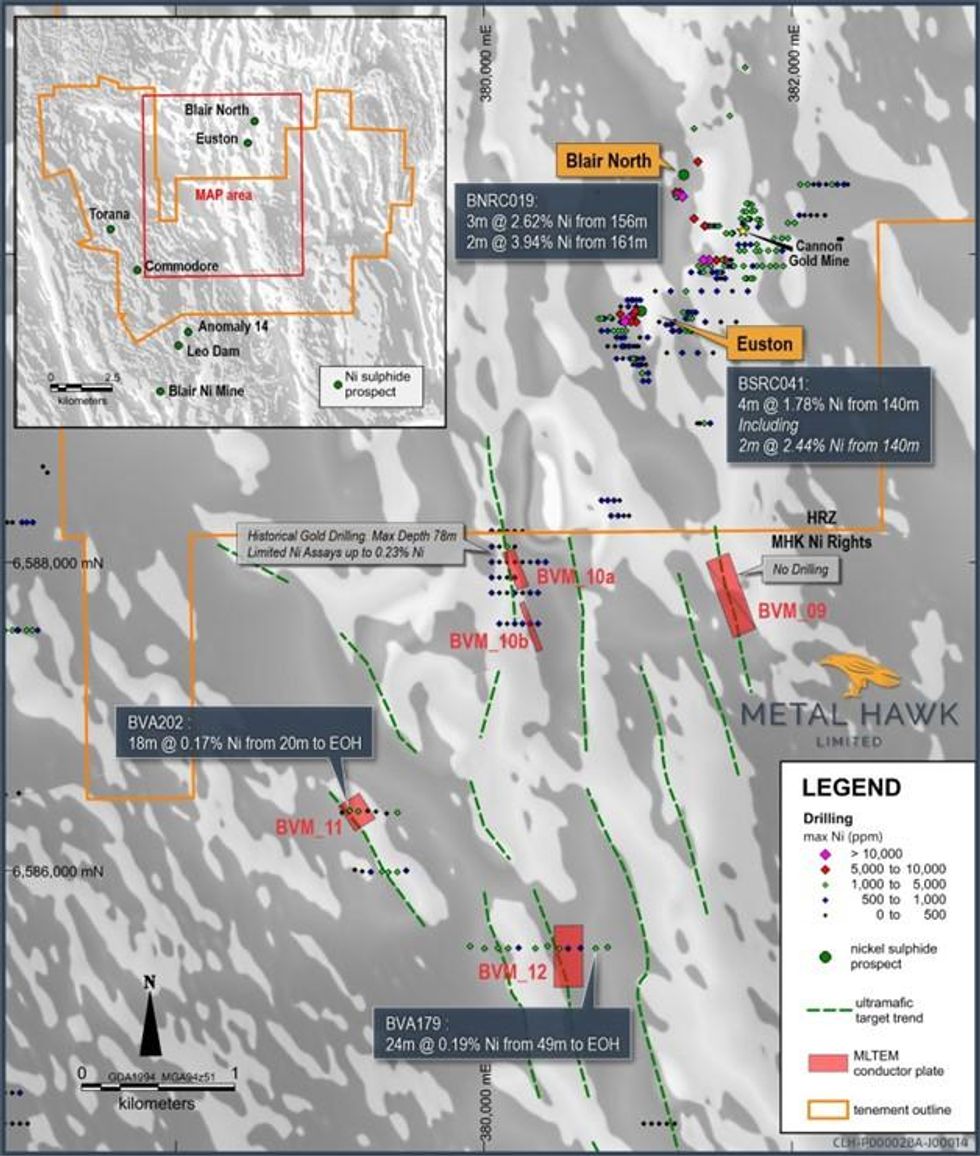

Figure 1. Berehaven Project - EM targets shown in red.

BEREHAVEN REGIONAL

Four (4) late-time bedrock conductors with steep to moderately west-dipping modelled plates, BVM_09 to BVM_12 (Figure 1), are located from 3km to 5km east of the Commodore ultramafic trend, and present as priority untested RC drill targets. The weathering at this central part of the project area is notably shallower than that observed along the Commodore trend, where the effectiveness of surface EM has been limited by the deeply weathered rocks and the transitional nature of the nickel sulphides present.

Several RC holes have been designed to intersect the conductive target zones at between 150m to 220m depth, with follow-up downhole electromagnetic (DHEM) surveys to be carried out in order to detect any conductive responses related to nearby accumulations of massive nickel sulphide mineralisation.

Click here for the full ASX Release

This article includes content from Metal Hawk Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

02 October 2024

Metal Hawk Limited

Gold-focused exploration in Western Australia’s prolific Eastern Goldfields region

Gold-focused exploration in Western Australia’s prolific Eastern Goldfields region Keep Reading...

04 February

FPX Nickel Reports Confirmatory Results from Geotechnical Drilling at the Baptiste Nickel Project

FPX Nickel Corp. (TSX-V: FPX, OTCQX: FPOCF) ("FPX" or the "Company") is pleased to report assay results from select drill holes completed during its 2025 engineering field investigation program at the Baptiste Nickel Project ("Baptiste" or the "Project") in central British Columbia.As previously... Keep Reading...

08 January

Nickel Market Recalibrates After Explosive Trading Week

Nickel prices stabilized on Thursday (January 8) after a turbulent week that saw the market swing sharply higher before retreating as traders reassessed the balance between existing supply risks and a growing overhang of inventory.Three-month nickel on the London Metal Exchange (LME) hovered... Keep Reading...

05 January

Nusa Nickel Corp. Provides 2025 Year-End Corporate Update and 2026 Outlook

Nusa Nickel Corp. is pleased to provide a year-end update highlighting key achievements in 2025 and outlining strategic priorities for 2026 as the Company continues to build a vertically integrated nickel business in Indonesia.2025 Year-End Highlights-Successfully advanced into production during... Keep Reading...

22 December 2025

Nickel Price Forecast: Top Trends for Nickel in 2026

Nickel prices were stagnant in 2025, trading around US$15,000 per metric ton (MT) for much of the year.Weighing heavily on the metal was persistent oversupply from Indonesian operations. Meanwhile, sentiment remained weak amid soft demand growth from the construction and manufacturing sectors,... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00