April 03, 2024

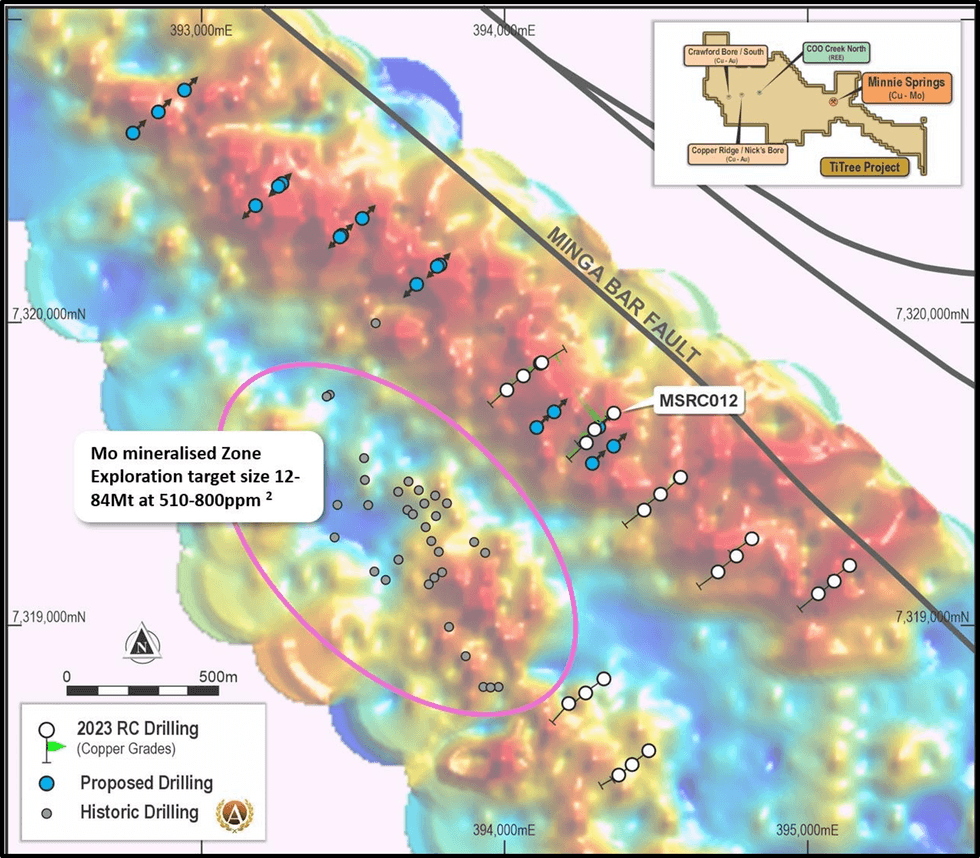

Augustus Minerals (ASX: AUG; “Augustus” or the “Company”) is pleased to advise that a 3,400m reverse circulation (RC) drill program has commenced at the Ti-Tree Project, ~200kms east of Carnarvon in Western Australia. The program is designed to complete the first pass drill coverage of the 3.5km long soil copper anomaly located 300m northeast of the defined molybdenum mineralisation / exploration target estimate (Figure 1).

- 3,400m RC drill program has commenced at the Minnie Springs Cu-Mo-Ag porphyry prospect, with deeper diamond drilling planned for June.

- The drilling will follow-up on the 2023 program where MSRC0121 intersected:

- 18m @ 0.52% CuEq (0.37% Cu and 9.7 g/t Ag) from 94m downhole, and;

- 16m @ 0.69% CuEq (0.38% Cu and 19.4g/t Ag) from 121m downhole

- The drilling will also target the northern 2km of the strong copper-in-soil anomaly that has now had Heritage Clearance.

- A deeper diamond drilling program is planned for June to test the undrilled area between the molybdenum mineralisation and the 3.5km long copper-in-soil trend.

Andrew Ford, GM Exploration

“The 2023 program intersected one of the strongest copper intervals in this region to date. Combined with the extensive surface anomalism and the large nearby Minnie Springs Molybdenum Porphyry, we affirm our belief of the potential of a substantial mineral system at this project. Drilling will be conducted north, south and at depth of MSRC012 to further define extensions of the Minnie Springs copper discovery intersected last year. This program will also give us a first look at the northern half of the 2km long high-level copper anomaly.”

The deeper diamond program scheduled for June will provide drill coverage between the molybdenum mineralised core intrusion and the large copper-in-soil anomaly.

In parallel with the drilling, the extensive soil sampling program that commenced in late February (Figure 2) continues with initial results expected from Moogooree and Howells Gap in the next few weeks.

Click here for the full ASX Release

This article includes content from Augustus Minerals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

AUG:AU

Sign up to get your FREE

Augustus Minerals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

04 July 2023

Augustus Minerals

Vast Land Package for Critical and Precious Metals Exploration in Australia

Vast Land Package for Critical and Precious Metals Exploration in Australia Keep Reading...

28 January

Quarterly Activities/Appendix 5B Cash Flow Report

Augustus Minerals (AUG:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

11 January

Heritage Approval for Drilling at Music Well

Augustus Minerals (AUG:AU) has announced Heritage Approval for Drilling at Music WellDownload the PDF here. Keep Reading...

15 December 2025

CEO Resignation

Augustus Minerals (AUG:AU) has announced CEO ResignationDownload the PDF here. Keep Reading...

18 November 2025

Exploration Update - Soil Sampling Results

Augustus Minerals (AUG:AU) has announced Exploration Update - Soil Sampling ResultsDownload the PDF here. Keep Reading...

16 November 2025

Augustus Secures Vanapa River Tenement Application in PNG

Augustus Minerals (AUG:AU) has announced Augustus Secures Vanapa River Tenement Application in PNGDownload the PDF here. Keep Reading...

Latest News

Sign up to get your FREE

Augustus Minerals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00