January 17, 2025

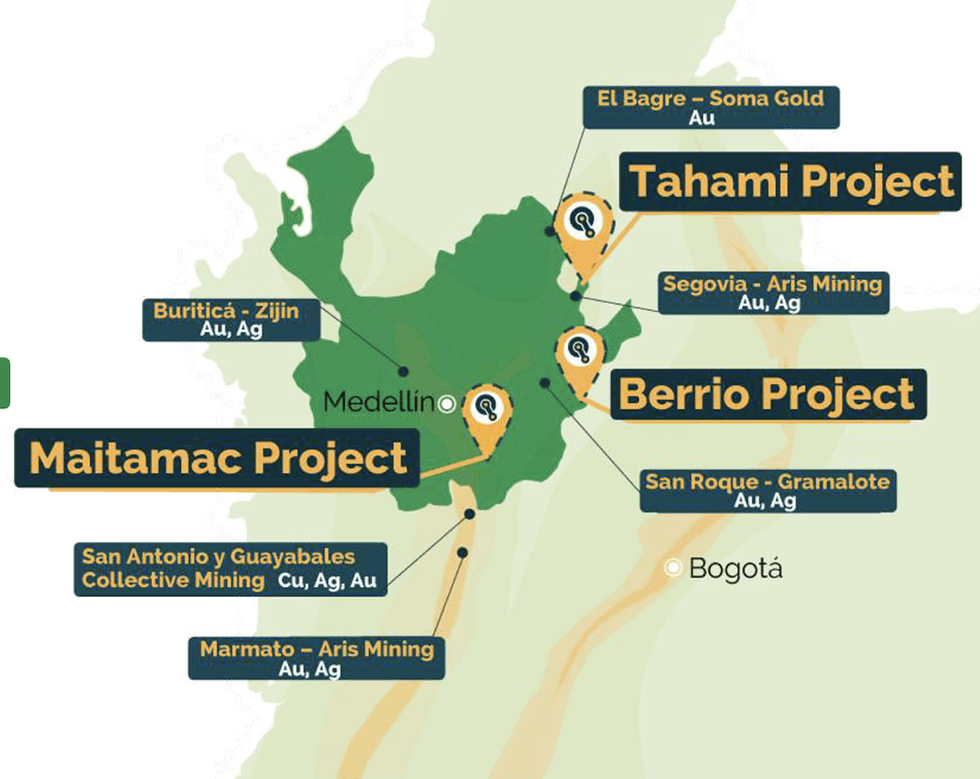

Quimbaya Gold (CSE:QIM)) is a junior gold exploration company exploring high-grade gold projects in Colombia. Quimbaya Gold's portfolio spans 59,057 hectares in highly prospective regions in the Antioquia mining district, the region responsible for about 50 percent of Colombia’s total gold production or around one million ounces (Moz) annually.

Located next to Aris Mining’s (TSX:ARIS) Segovia mine, Quimbaya leverages its proximity to established infrastructure and gold-rich geological formations. With Colombia being one of the most underexplored yet top mining jurisdictions in South America, Quimbaya’s projects are uniquely poised for significant discoveries.

Quimbaya's flagship Tahami project spans 17,087 hectares featuring mesothermal veins with multiple mineralization events underlain by Precambrian metamorphic rocks consolidated within the San Lucas Gneiss unit.

Company Highlights

- Quimbaya Gold controls 59,057 hectares across three distinct projects in Antioquia, Colombia — renowned as the country's top mining department, accounting for over half of Colombia’s gold production.

- The flagship Tahami project is adjacent and on trend to Aris Mining’s Segovia mine, one of the highest-grade gold mines globally. Tahami benefits from its strategic proximity to Segovia and its potential for discovery of high-grade vein gold systems.

- Tight share structure (60 percent insider/family offices/institutions ownership) with a market cap of approximately C$11.45 million, ensuring alignment with shareholder interests.

- Quimbaya has entered into a partnership with Independence Drilling, Colombia’s largest drilling company, which secures an extremely cost-effective 100,000 meters of drilling over five years.

- Quimbaya utilizes software that allows for rapid and cost-effective acquisition of mining claims, giving the company a competitive edge in securing high-value assets.

- The technical team’s proven track record of major discoveries in Colombia positions Quimbaya as a standout explorer in the region.

This Quimbaya Gold profile is part of a paid investor education campaign.*

Click here to connect with Quimbaya Gold (CSE:QIM) to receive an Investor Presentation

QIM:CC

Sign up to get your FREE

Quimbaya Gold Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

29 July 2025

Quimbaya Gold

Unlocking high-grade gold potential in Antioquia, Colombia’s premier mining district

Unlocking high-grade gold potential in Antioquia, Colombia’s premier mining district Keep Reading...

29 May 2023

Quimbaya Gold Inc. Announces Investor Relations Agreement

/NOT FOR DISTRIBUTION TO UNITED STATES NEWS WIRE SERVICES OR FOR DISSEMINATION IN THE UNITED STATES / Quimbaya Gold Inc. (CSE: QIM) ("Quimbaya") is pleased to announce that it has entered into an Investor Relations Agreement (the "Agreement") with Pietro Solari (address: Torre de las Americas... Keep Reading...

6h

SSR Mining to Sell Çöpler Gold Mine Stake in US$1.5 Billion Deal

SSR Mining (NASDAQ:SSRM,TSX:SSRM,OTCPL:SSRGF) has agreed to sell its majority stake in the Çöpler gold mine in Turkey for US$1.5 billion in cash, shifting the company’s portfolio towards the Americas as the yellow metal continues to surge amid rising geopolitical tensions.The Denver-based miner... Keep Reading...

14h

Blackrock Silver Announces the Appointment of Bernard Poznanski and Susan Mathieu to the Board of Directors

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce the appointment of Bernard Poznanski and Susan Mathieu as independent directors to the Board of Directors of the Company (the "Board of Directors").In conjunction with... Keep Reading...

03 March

Fortune Bay: Exploration Underway, Fully Funded Program at the Goldfields Project in Saskatchewan

While Saskatchewan has long been recognized for uranium, its geology and historical exploration also make it a promising place for gold. Canadian company Fortune Bay (TSXV:FOR,OTCQB:FTBYF) seeks to maximize this potential with its flagship Goldfields project. Fortune Bay’s 100 percent owned... Keep Reading...

03 March

RUA GOLD Files 43-101 Technical Reports for the Reefton and Glamorgan Projects in New Zealand

Rua Gold INC. (TSX: RUA,OTC:NZAUF) (NZX: RGI) (OTCQX: NZAUF) ("Rua Gold" or the "Company") is pleased to announce the filing on SEDAR+ of independent Technical Reports for its Reefton Project ("Reefton Technical Report") on the South Island and Glamorgan Project ("Glamorgan Technical Report") on... Keep Reading...

03 March

Blackrock Silver Receives First of Three Key Permits for the Tonopah West Project

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce the issuance by the Nevada Department of Environmental Protection (NDEP), through the Bureau of Air Pollution Control, the Class II Air Quality and Surface Disturbance... Keep Reading...

02 March

Steve Barton: Gold, Silver, Oil — Key Price Levels to Watch Now

Steve Barton, host of In It To Win It, shares key price levels for silver and gold.He also explains his current approach to the oil and copper markets, and outlines an emerging opportunity in nickel as Indonesia loosens its hold on the space. Don't forget to follow us @INN_Resource for real-time... Keep Reading...

Latest News

Sign up to get your FREE

Quimbaya Gold Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00