April 28, 2022

Ionic Rare Earths Limited (ASX: IXR) (IonicRE or the Company) is pleased to provide its Quarterly Report for the period ending 31 March 2022, including exploration activities at its 51% owned Makuutu Rare Earths Project (Makuutu) in Uganda

HIGHLIGHTS

- Fourth Tranche of Phase 4 drilling results received with all 75 holes intersecting rare earth element (REE) mineralised clay above the Mineral Resource Estimate (MRE) cut-off grade

- Fifth Tranche of Phase 4 drilling results received with all 110 holes intersecting rare earth element (REE) mineralised clay above the MRE cut-off grade

- Sixth and final Tranche of Phase 4 drilling results received with all 66 holes intersecting rare earth element (REE) mineralised clay above the MRE cut-off grade

- Completed due diligence and post end of Q1, received UK Government approval and completed acquisition of 100% of Seren Technologies Limited,

- Post end of Q1, completed Capital Raise of $30 million at an issue price of $0.074 per Share to global institutional investors

Makuutu is one of the world’s largest scale ionic adsorption clay (IAC) hosted Rare Earth Element (REE) deposits, located 120 km east of Kampala in Uganda. The Makuutu Mineral Resource Estimate (MRE) (ASX: 3 March 2021) was announced at 315 Million tonnes at 650 ppm Total Rare Earth Oxide (TREO) with a cut-off grade of 200 parts per million (ppm) TREO minus Cerium Oxide (TREO-CeO2). A revised MRE is in preparation to incorporate the outstanding results from the Phase 4 drilling program completed in 2021, of which the remaining three (3) tranches were reported in the quarter.

Phase 4 Drilling Results

Tranche Four

On 6 January 2022, IonicRE reported results for Tranche Four (4) of the 8,220 metre Phase 4 drill program completed in October 2021 at the Makuutu Rare Earths Project (“Makuutu” or “the Project”) in Uganda.

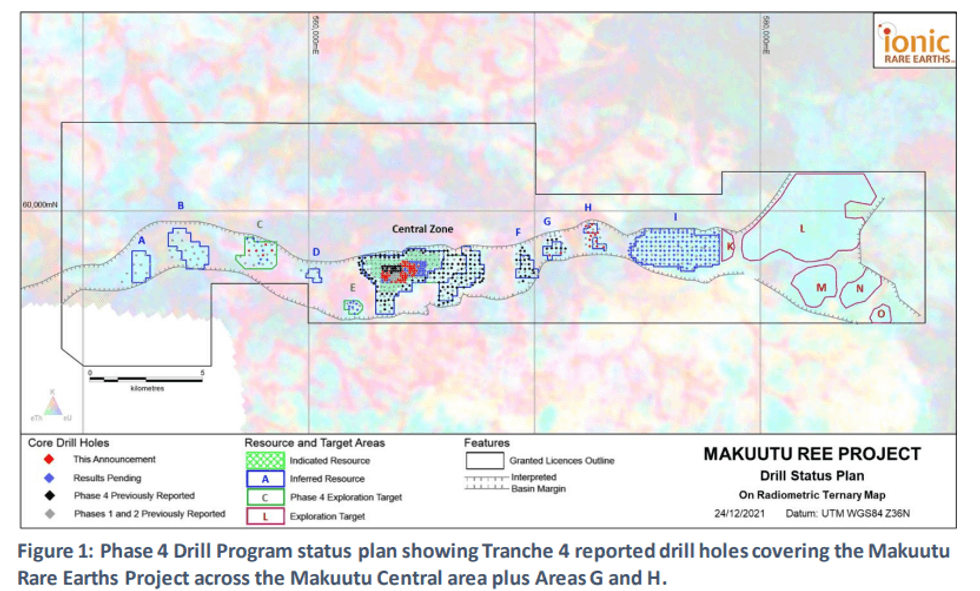

Drill assay results were received for a further 75 drill holes making up the Tranche 4 submission. The results were for holes drilled within the existing inferred and indicated Mineral Resource Estimate (MRE) at the Makuutu Central Zone, resource areas G and H, and to evaluate Exploration Target C, that was excluded from the 2021 MRE due to limited drill hole density. Figure 1 provides an illustration of the drill hole assay results reported in Tranche 4.

All 75 holes reported delivered clay and saprolite mineralisation intersections above the cut-off grade of 200 ppm Total Rare Earth Oxide less CeO2 (TREO-CeO2), consistent with the initial drilling phases (2019 and H1 2020) and the current MRE.

Notable thick, high-grade and near surface intervals reported from the Tranche 4 assay results included:

- RRMDD539 8.9 metres at 1,476 ppm TREO from 4.3 metres

- RRMDD477 13.5 metres at 1,432 ppm TREO from 3.5 metres

- RRMDD518 16.5 metres at 1,424 ppm TREO from 5.4 metres

- RRMDD514 8.7 metres at 1,336 ppm TREO from 12.3 metres

- RRMDD533 9.6 metres at 1,296 ppm TREO from 3.1 metres

- RRMDD520 28.5 metres at 1,250 ppm TREO from 2.9 metres

- RRMDD523 16.4 metres at 1,229 ppm TREO from 4.1 metres

- RRMDD521 18.6 metres at 1,200 ppm TREO from 4.7 metres

- RRMDD534 13.8 metres at 1,185 ppm TREO from 3.0 metres

- RRMDD517 15.1 metres at 1,175 ppm TREO from 5.4 metres

- RRMDD535 15.2 metres at 1,171 ppm TREO from 4.3 metres

- RRMDD513 16.3 metres at 1,126 ppm TREO from 2.9 metres

- RRMDD532 15.3 metres at 1,105 ppm TREO from 4.2 metres

- RRMDD488 22.1 metres at 1,080 ppm TREO from 4.9 metres

- RRMDD467 20.1 metres at 1,077 ppm TREO from 5.8 metres

- RRMDD546 10.3 metres at 1,076 ppm TREO from 3.9 metres

The Phase 4 drill program at Makuutu has produced strong results. The infill drill holes across the Makuutu Central Zone confirmed near surface, thick REE bearing clays, and continues to validate the Makuutu deposit. Thickness of mineralised clay and minimal cover is crucial to minimising the operating cost, and Makuutu continued to deliver with results from this batch reporting approximately 25% of the intercepts within the Makuutu Central Zone exceeding 20m thick, and over 85% greater than 10 metres thick.

The extension holes in Areas G and H we expect will deliver new resource potential at Makuutu, and additionally, the results from area C were again very pleasing in providing greater confidence across this area to convert the considerable existing exploration target of 14 to 27 million tonnes to a resource in the next update

Click here for the full ASX Release

This article includes content from Ionic Rare Earths Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

IXR:AU

The Conversation (0)

14 September 2023

Ionic Rare Earths

Low Capital Operations With the Potential for High Margins

Low Capital Operations With the Potential for High Margins Keep Reading...

17 September 2025

Sulista Exploration Results Confirm a New High-Grade Rare Earth District

Brazilian Rare Earths Limited (ASX: BRE) (OTCQX: BRELY / OTCQX: BRETF) announces exploration results at the Sulista Project, located ~80km southwest of the Monte Alto project. The exploration program delivered outstanding outcomes across multiple targets, upgrading the Sulista Project to a... Keep Reading...

01 July 2025

Rare Earths Extracted from Ema ISR Field Trial

ISR leaching confirms commercial scale viability using low concentration MgS04

Brazilian Critical Minerals Limited (ASX: BCM) (“BCM” or the “Company”) is pleased to announce that it has now successfully leached, extracted and precipitated rare earths from its in-situ recovery (ISR) pilot field trial at the Ema project. HighlightsFirst REEs successfully recovered under... Keep Reading...

26 March 2025

High-Grade Discoveries Enhance Scale of Pelé Project

Brazilian Rare Earths Limited (ASX: BRE) (OTCQX: BRELY / OTCQX: BRETF) is pleased to report the results of exploration drilling at the Pelé Target 1 Project, located in Bahia, Brazil. New discovery of high-grade REE-Nb-Sc-Ta-U mineralisationHigh-grade diamond drill results at Pelé Target 1... Keep Reading...

26 February 2025

Ema Rare Earths Scoping Study Confirms Potential for Ultra Low CAPEX and OPEX Project, Showing Strong Financial Returns at Current Commodity Prices

Brazilian Critical Minerals Ltd (BCM or the Company) (ASX: BCM) advises of completion of a Scoping Study on its 100%-owned EMA Rare Earths Project (Ema Project) in southeastern Amazonas, Brazil. The Scoping Study was completed utilising industry recognised experts in the Australian engineering... Keep Reading...

01 November 2023

E-Tech Resources

Get access to more exclusive Rare Earth Investing Stock profiles here Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00