August 13, 2024

Labyrinth Resources Limited (‘the Company’ or ‘Labyrinth’) advises that it is seeking shareholder approval at the upcoming Extraordinary General Meeting of Shareholders (‘EGM’) to be held on Friday, 13 September 2024, to consolidate the issued capital of the Company.

Labyrinth is proposing to consolidate:

a) every 10 Shares into 1 Share;

b) every 10 Options into 1 Option; and

c) every 10 Performance Rights into 1 Performance Right, (‘Consolidation’).

As the Consolidation applies equally to all security holders, it will have no material effect on the percentage shareholding interest of each individual shareholder.

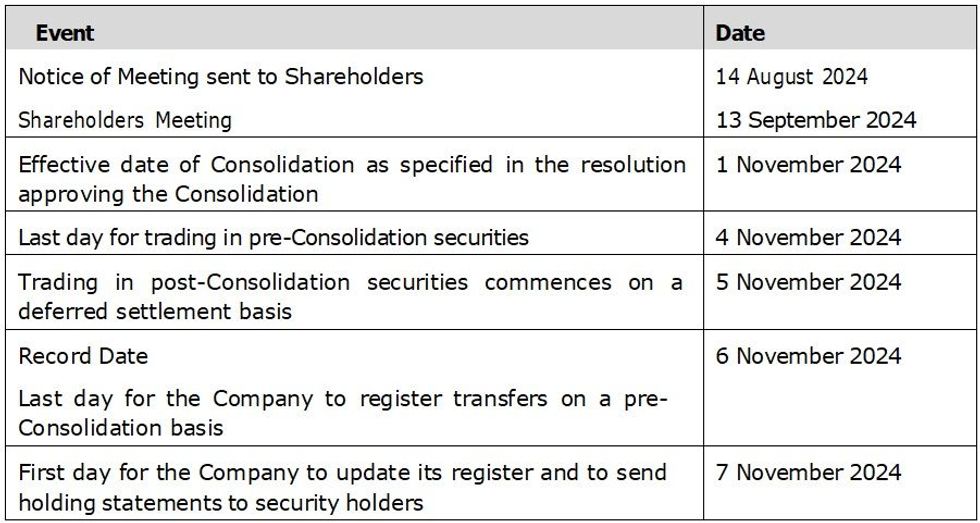

The indicative timetable for the Consolidation is as follows:

The above dates are indicative only and subject to change.

For further details in respect of the proposed Consolidation, refer to the Company’s Notice of EGM lodged with the Company’s ASX platform on 14 August 2024.

Click here for the full ASX Release

This article includes content from Labyrinth Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

LRL:AU

The Conversation (0)

31 August 2023

Labyrinth Resources

Developing underexplored gold assets in the prolific Canadian Abitibi Gold Belt and the Yilgarn Craton of Western Australia.

Developing underexplored gold assets in the prolific Canadian Abitibi Gold Belt and the Yilgarn Craton of Western Australia. Keep Reading...

18h

Aurum Hits High-Grade Gold at Napie, Cote d'Ivoire

Aurum Resources (AUE:AU) has announced Aurum Hits High-Grade Gold at Napie, Cote d'IvoireDownload the PDF here. Keep Reading...

19h

Precious Metals Price Update: Gold, Silver, PGMs Fall on Escalating US-Iran War

Precious metals prices are down on potential for economic fallout from escalating US-Iran War.Volatility has returned to the precious metals market this past week. All eyes are on the breakout of a full-scale war across the Middle East prompted by a coordinated assault on Iran by the United... Keep Reading...

04 March

SSR Mining to Sell Çöpler Gold Mine Stake in US$1.5 Billion Deal

SSR Mining (NASDAQ:SSRM,TSX:SSRM,OTCPL:SSRGF) has agreed to sell its majority stake in the Çöpler gold mine in Turkey for US$1.5 billion in cash, shifting the company’s portfolio towards the Americas as the yellow metal continues to surge amid rising geopolitical tensions.The Denver-based miner... Keep Reading...

04 March

Blackrock Silver Announces the Appointment of Bernard Poznanski and Susan Mathieu to the Board of Directors

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce the appointment of Bernard Poznanski and Susan Mathieu as independent directors to the Board of Directors of the Company (the "Board of Directors").In conjunction with... Keep Reading...

03 March

Fortune Bay: Exploration Underway, Fully Funded Program at the Goldfields Project in Saskatchewan

While Saskatchewan has long been recognized for uranium, its geology and historical exploration also make it a promising place for gold. Canadian company Fortune Bay (TSXV:FOR,OTCQB:FTBYF) seeks to maximize this potential with its flagship Goldfields project. Fortune Bay’s 100 percent owned... Keep Reading...

03 March

RUA GOLD Files 43-101 Technical Reports for the Reefton and Glamorgan Projects in New Zealand

Rua Gold INC. (TSX: RUA,OTC:NZAUF) (NZX: RGI) (OTCQX: NZAUF) ("Rua Gold" or the "Company") is pleased to announce the filing on SEDAR+ of independent Technical Reports for its Reefton Project ("Reefton Technical Report") on the South Island and Glamorgan Project ("Glamorgan Technical Report") on... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00