May 29, 2024

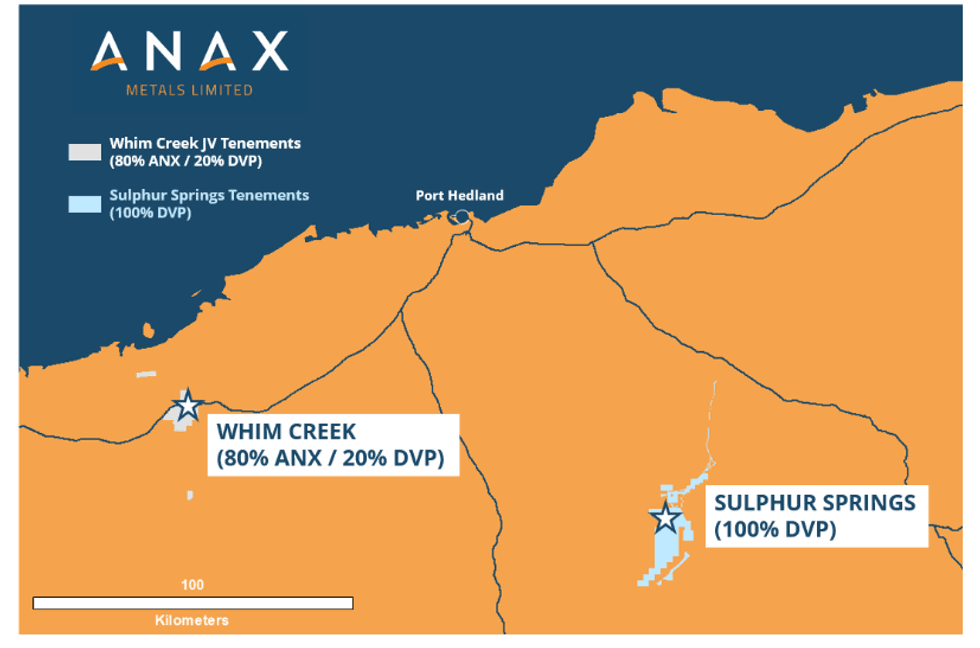

Anax Metals Ltd (ASX: ANX) (Anax) and Develop Global Ltd (ASX: DVP) (Develop) are pleased to provide an update on the progress of the Scoping Study announced in March 2024 investigating options for processing select oxide and transitional ores from Sulphur Springs at Whim Creek.1 The Whim Creek Copper-Zinc Project, located 100 km southwest of Port Hedland, is jointly held by ANX (80%) and DVP (20%). Develop’s 100%-owned Sulphur Springs Zinc-Copper project is located 115 km south-east of Port Hedland and 150 km east-southeast of Whim Creek.

- Bench scale tests on Sulphur Springs oxide and transitional ore demonstrate excellent leaching amenability

- High grade transitional and oxide copper recoveries between 80-95%

- High grade transitional zinc recoveries ranged between 95% and 99%

- Whim Creek bacteria used to enhance the leaching process

- High zinc recoveries could unlock significant value for the joint venture through zinc sulphate production

- Acid production from the leaching process potentially a valuable byproduct

Anax’s Managing Director, Geoff Laing commented: “The Anax team has applied the considerable knowledge and learnings, including from the Whim Creek heap leach programme over the last three years, to deliver outstanding outcomes in this preliminary round of test work. Heap leaching of copper oxide and transitional ores is commonly practiced, and the Sulphur Springs ore has demonstrated excellent amenability to the process conditions we have applied. We are excited to have demonstrated the excellent response of zinc dissolution to the process as this may facilitate the production of zinc sulphate, a key additive to fertilisers.”

Sulphur Springs Project

The Sulphur Springs Project is an advanced pre-development Project with a JORC compliant resource of 13.8 Mt @ 1.1% Cu, 5.7% Zn and 23.5 g/t Ag. 2 In June 2023, DVP announced the results of an updated Definitive Feasibility Study (DFS) for the Sulphur Springs Project, which identified an ore Reserve of 8.8 Mt @ 1.1% Cu and 5.4% Zn that will be processed through a new 1.3 Mtpa concentrator.

ANX and DVP have identified high-grade oxide and transitional ore outside the mineral inventory, reported by DVP in the Sulphur Springs DFS,3 that may be amenable to heap leaching. The Scoping Study is investigating the feasibility of transporting oxide ores from Sulphur Springs to the fully permitted Whim Creek, where ore may be heap leached to produce saleable copper and zinc products.

Sulphur Springs Test Work Samples

Key to the strategy is demonstrating the metallurgical amenability of the Sulphur Springs ores to heap leaching at Whim Creek. Heap leaching of oxide, supergene and transitional ores is common practice within the industry and the refurbished Whim Creek heap infrastructure provides an opportunity for the joint venture partners to enhance the value of both projects.

Click here for the full ASX Release

This article includes content from Anax Metals Ltd, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

ANX:AU

The Conversation (0)

28 July 2025

Quarterly Activities/Appendix 5B Cash Flow Report

Anax Metals Limited (ANX:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

02 July 2025

Anax withdraws from arbitration

Anax Metals Limited (ANX:AU) has announced Anax withdraws from arbitrationDownload the PDF here. Keep Reading...

05 May 2025

ANX secures commitment for funding from cornerstone investor

Anax Metals Limited (ANX:AU) has announced ANX secures commitment for funding from cornerstone investorDownload the PDF here. Keep Reading...

01 May 2025

Trading Halt

Anax Metals Limited (ANX:AU) has announced Trading HaltDownload the PDF here. Keep Reading...

30 April 2025

Quarterly Activities/Appendix 5B Cash Flow Report

Anax Metals Limited (ANX:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00