HIGHLIGHTS

- Prismo Metals has received commitments for a $1.1 million private placement of units at a price of $0.17 per unit.

- Hot Breccia Copper Project (Arizona):

- Permit expected this month.

- Upcoming exploration program to focus on diamond drilling five holes with an expected depth of 1,000 metres each.

- Palos Verdes Silver Project (Mexico):

- Planning to drill approximately 3,600 meters in ten holes to be completed in two phases.

- These holes will be drilled from Vizsla Silver Corp. concessions adjacent to the Palos Verdes concession and will target the Palos Verdes vein at depth.

NOT FOR DISTRIBUTION TO UNITED STATES NEWS WIRE SERVICES OR FOR DISSEMINATION IN THE UNITED STATES

Prismo Metals Inc. ("Prismo" or the "Company") (CSE:PRIZ)(OTCQB:PMOMF) is pleased to announce that it has received commitments for 6,500,000 units of the Company ("Units") at a price of $0.17 per Unit for gross proceeds of $1,105,000 to be issued on a non-brokered private placement basis (the "Private Placement"). The total amount of the Private Placement has been committed to and the Company expects that the Private Placement will be fully subscribed at a closing expected to take place on or around June 18, 2024

Each Unit consists of one common share in the capital of the Company (a "Share") and one-half of one common share purchase warrant of the Company (each whole warrant, a "Warrant"). Each Warrant entitles the holder to purchase one common share in the capital of the Company for a period of twenty-four (24) months from the date of issue at an exercise price of $0.25.

Steve Robertson, President of Prismo Metals commented: "The recent strengthening in commodity prices has resulted in renewed interest from investors in exploration companies like ours. We are pleased to welcome several new incoming shareholders who will be participating in the Private Placement. Our priorities this year remain to start drilling at our Hot Breccia copper project located in the heart of the Arizona copper belt and to test the Palos Verdes vein at depth on our silver project of the same name in Mexico."

Mr. Robertson added: "The anticipated exploration program at Hot Breccia will focus on diamond drilling five holes with an expected depth of 1,000 metres each, for a program total of 5,000 metres. The actual depth of each drill hole will be determined by the stratigraphy encountered. The exploration team would like to ensure the entire Paleozoic carbonate sequence, which are the most prospective host rock for mineralization, is intersected. Arrangements for the start of drilling will be underway once the final Bureau of Land Management ("BLM") permit is fully in place, which is anticipated to occur in the near future."

Regarding the Palos Verdes silver project in Mexico, Craig Gibson, Co-Founder and Chief Exploration Officer said: "Immediately following closing of the Private Placement, we will mobilize our drilling crew at our Palos Verdes for our next phase of drilling. We are planning to drill approximately 3,600 meters in ten holes to be completed in two phases. These holes will be drilled from Vizsla Silver Corp. concessions adjacent to the Palos Verdes concession and will target the Palos Verdes vein at depth. This drill program follows a recommendation presented by the Panuco Joint Technical Committee. The Joint Technical Committee is comprised of Prismo's CXO Dr. Craig Gibson, Vizsla Silver's VP Exploration Dr. Jesus Velador, and Dr. Peter Megaw."

About Hot Breccia

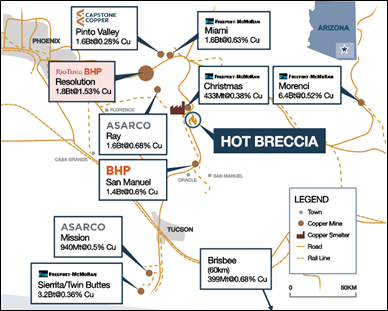

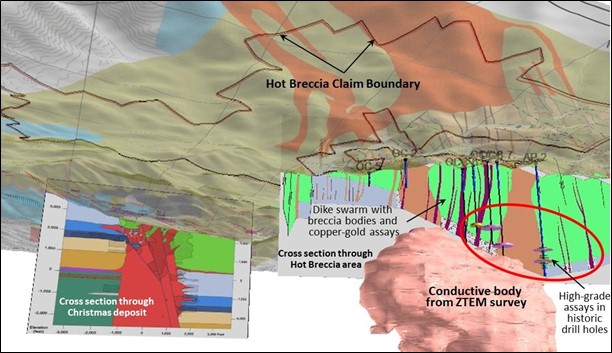

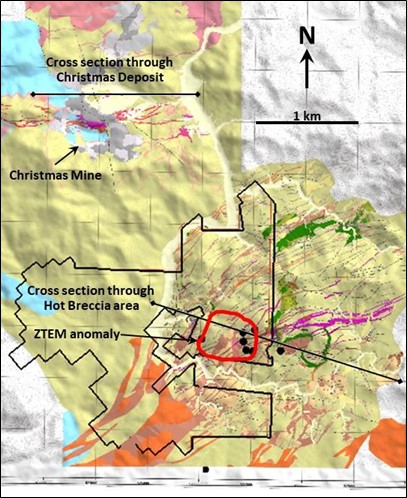

The Hot Breccia property consists of 1,420 hectares 227 contiguous mining claims located in the world class Arizona Copper Belt between several very well-understood world-class copper mines including Morenci, Ray and Resolution (Figure 1). Hot Breccia shows many features in common with these neighboring systems, most prominently a swarm of porphyry dikes and series of breccia pipes containing numerous fragments of well copper-mineralized rocks mixed with fragments of volcanic and sedimentary derived from considerable depth. Prismo ran a ZTEM survey last year that identified a very large conductive anomaly directly beneath the breccia outcrops (Figures 2 and 3).

Sampling at the project has shown the presence of copper and gold mineralization associated with polymictic breccia that has brought fragments of sedimentary rocks and mineralization to the surface from depths believed to be 400-1,000 meters below the surface. Drilling of deep holes, possibly including a twin of an historical hole, is planned.

Gold mineralization ranging from anomalous values of 0.1-0.3 g/t to 28 g/t with local copper has also been encountered at the surface associated with dikes (see News Release of July 11, 2023).

Figure 1: Location of the Hot Breccia copper project in Arizona.

Figure 2. View of the subsurface looking northeasterly showing the conductive body from the ZTEM survey and cross sections of the Christmas deposit and the Hot Breccia area. Historic drill holes are shown with copper assays as disks within the red ellipse; the magenta color indicates > 1% Copper.

Figure 3. Plan view of the surface geology showing the hot breccia land boundary in black and the cross sections from Fig. 2. The surface projection of the conductive body shown in Fig. 2 is roughly outlined in red.

Assay results from historical drill holes are unverified as the core has been destroyed, but information has been gathered from memos, photos and drill logs that contain some, but not all, of the assay results and descriptions.

About Palos Verdes

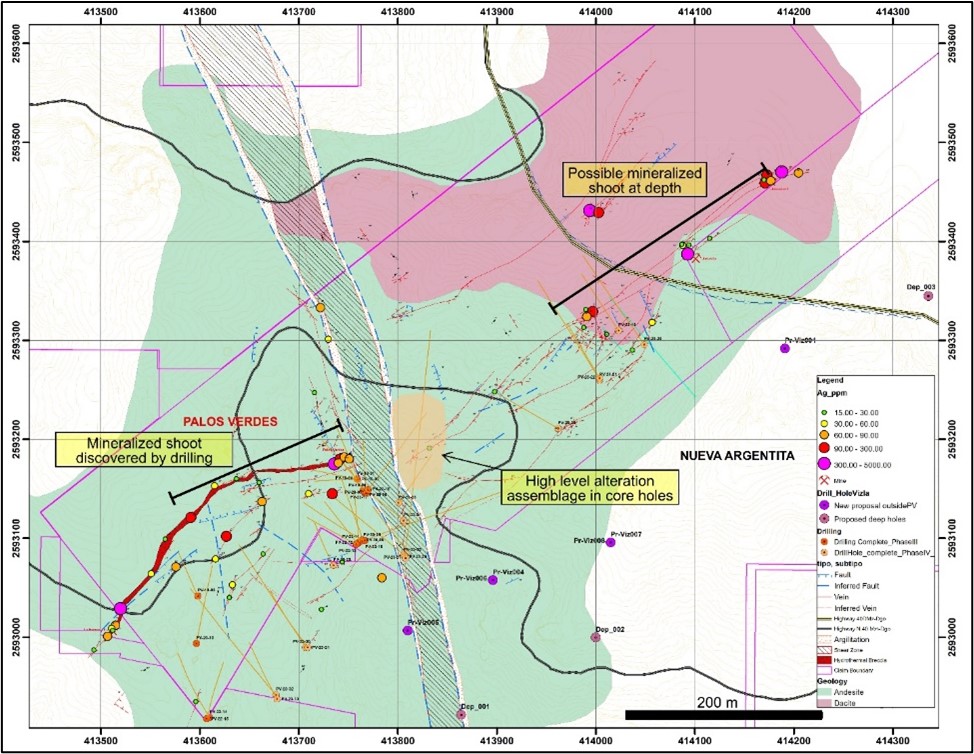

The Palos Verdes project is located in the historic Pánuco-Copala silver-gold district in southern Sinaloa, Mexico, approximately 65 kilometers NE of Mazatlán, Sinaloa, in the Municipality of Concordia. The Palos Verdes concession (claim) covers 700 meters of strike length of the Palos Verdes vein, a member of the north-easterly trending vein family located in the eastern part of the district outside of the area of modern exploration. Shallow drilling (www.prismometals.com ). This mineralization is open in all directions and the currently planned drilling program is designed to follow it along strike and to depth.

A geochemical sampling program conducted in late 2023 focused on narrow and most strongly mineralized portions of the vein was conducted along the exposed strike length of the Palos Verdes vein system. The best sample from that program assayed 930 g/t silver and 10.55 g/t gold with 15.4% zinc and 4.5% lead (2,605 g/t Ag/Eq) over 0.5 meters. Strongly anomalous values of precious metal and indicator elements occur above the mineralized shoot identified during drilling and also along the vein system further to the northeast. This area may indicate the presence of a second blind mineralized shoot that will also be tested by the deep drilling from Vizsla ground.

Table 1. Assay highlights for Palos Verdes sampling program.

| Sample | UTM Coordinates WGS84 | Length | Au | Ag | Cu | Pb | Zn | |

E | N | meters | g/t | g/t | % | % | % | |

126032 | 414,003 | 2,593,429 | 0.5 | 0.833 | 280 | - | - | - |

126035 | 414,173 | 2,593,467 | 1.0 | 0.854 | 174 | - | - | - |

126036 | 414,171 | 2,593,459 | 1.0 | 0.152 | 103 | - | - | - |

126037 | 414,188 | 2,593,470 | 1.0 | 5.96 | 433 | - | - | - |

126038 | 414,205 | 2,593,469 | 1.0 | 0.249 | 75.5 | - | - | - |

126041 | 414,093 | 2,593,387 | 1.0 | 0.969 | 415 | - | - | - |

126068 | 413,520 | 2,593,029 | 0.5 | 0.174 | 103 | - | - | - |

126072 | 413,591 | 2,593,121 | 0.5 | 0.184 | 98.8 | - | - | - |

126077 | 413,627 | 2,593,102 | 0.5 | 1.285 | 326 | - | - | - |

126079 | 413,663 | 2,593,137 | 0.5 | 0.331 | 78.1 | - | - | - |

126083 | 413,722 | 2,593,333 | 0.5 | 0.459 | 65 | - | - | - |

126085 | 413,740 | 2,593,176 | 0.5 | 0.203 | 82.6 | 0.94 | 4.55 | 14.23 |

126086 | 413,736 | 2,593,175 | 0.5 | 10.55 | 930 | 0.78 | 4.50 | 15.40 |

126088 | 413,746 | 2,593,182 | 0.5 | 0.073 | 76.8 | 0.78 | 1.14 | 2.03 |

126089 | 413,744 | 2,593,076 | 0.5 | 0.034 | 24.5 | 0.22 | 2.33 | 3.40 |

126095 | 413,734 | 2,593,145 | 0.5 | 1.19 | 190 | - | - | - |

517878 | 413,751 | 2,593,180 | 0.5 | 0.079 | 61.7 | 0.32 | 0.73 | 11.85 |

517879 | 413,742 | 2,593,180 | 0.5 | 0.182 | 129 | 0.18 | 8.22 | 15.65 |

The Company completed its third drill campaign last year with 2,923 meters drilled in 15 holes with high grade mineralization encountered in several holes. Assays previously reported from this program include the highest-grade intercept recorded at the project in hole PV-23-25 with 102 g/t gold, 3,100 g/t silver and 0.26% zinc over 0.5 meters, or 11,520 g/t silver equivalent (see News Release of July 27, 2023). The last eight drill holes in the program, PV-23-26 to PV-23-33 were drilled to test the limits of the mineralized shoot in the western portion of the vein at depth and to the east of the NW fault.

Holes PV-23-27 and PV-23-29 to PV-23-33 tested the mineralized shoot to define the limits of mineralization and cut variably mineralized vein material (Table 1). The angle of inclination of several holes was very steep at -75 degrees, and drilling from the Vizsla Silver ground will provide more useful information.

Holes PV-23-26 and PV-23-28 explored to the east of the NW fault and did not cut significant mineralization but provided valuable information for the next holes that need to be drilled deeper from the adjoining Vizsla Silver ground.

2023 Palos Verdes Drilling Highlights

PV-23-25:

- This hole intersected 11,520 g/t Ag equivalent over 0.5 meters (3,100 g/t Ag, 102 g/t Au and 0.26% Zn)

- This intercept is part of a wider mineralized interval with 4,311 g/t Ag equivalent over 1.35 meters (1157 g/t Ag, 38 g/t Au and 0.1% Zn)

- A second interval higher in the hole yielded 512 g/t Ag equivalent over 0.3 meter (384 g/t Ag, 1.36 g/t Au and 0.27% Zn)

PV-23-24:

- This hole intercepted 1,234 g/t g/t Ag equivalent over 0.7 meter (60 g/t Ag, 11.9 g/t Au and 3.9% Zn)

- This interval is within a wider 2.6-meter interval with 384 g/t Ag equivalent (32 g/t Ag, 3.3 g/t Au and 1.57% Zn)

- A second interval higher in the hole yielded 302 g/t Ag equivalent over 1.2. meters (95 g/t Ag, 1.84 g/t Au and 1.2% Zn)

PV-23-20:

- This hole intercepted 189 g/t g/t Ag equivalent over 0.9 meters (58 g/t Ag and 1.58 g/t Au) and is the first mineralized intercept in the northeastern portion of the concession

PV-23-32:

- This hole intersected 450.2 g/t Ag equivalent over 0.3 meters (45 g/t Ag, 0.83 g/t Au, 0.43% Pb, and 0.47% Zn) as part of a larger zone of 2.2 meters with 115 g/t Ag equivalent

- A second interval deeper in the hole yielded 391.5 g/t Ag equivalent over 0.4 meters (17 g/t Ag, 3.56% Pb, 6.03%Zn) within a larger interval of 5.55 meters with 103.8 g/t Ag equivalent

PV-23-33:

- This hole intersected 112.7 g/t Ag equivalent over 0.35 meters (37 g/t Ag, 0.489 g/t Au, 0.36% Pb, and 0.56% Zn)

- A second interval deeper in the hole yielded 105.6 g/t Ag equivalent over 0.3 meters (20 g/t Ag, 0.22% Pb, 1.79% Zn)

- A third interval contained 382.2 g/t Ag equivalent over 0.45 meters (144 g/t Ag, 0.45% Pb, 5.12% Zn) within a 0.75-meter interval of 253.4 g/t Ag equivalent (95 g/t Ag, 0.31% Pb, 3.39% Zn)

Figure 4. Geologic and drill hole map of the Palos Verdes and adjacent concessions with silver assays from the recent sampling and showing surface projection of the mineralized shoots and the high-level alteration assemblage discussed in the text. Planned deep drill holes from Vizsla Silver ground shown in purple and red color. Broad hachured swath is the northwest-trending structure interpreted to have offset the eastern extension of the vein.

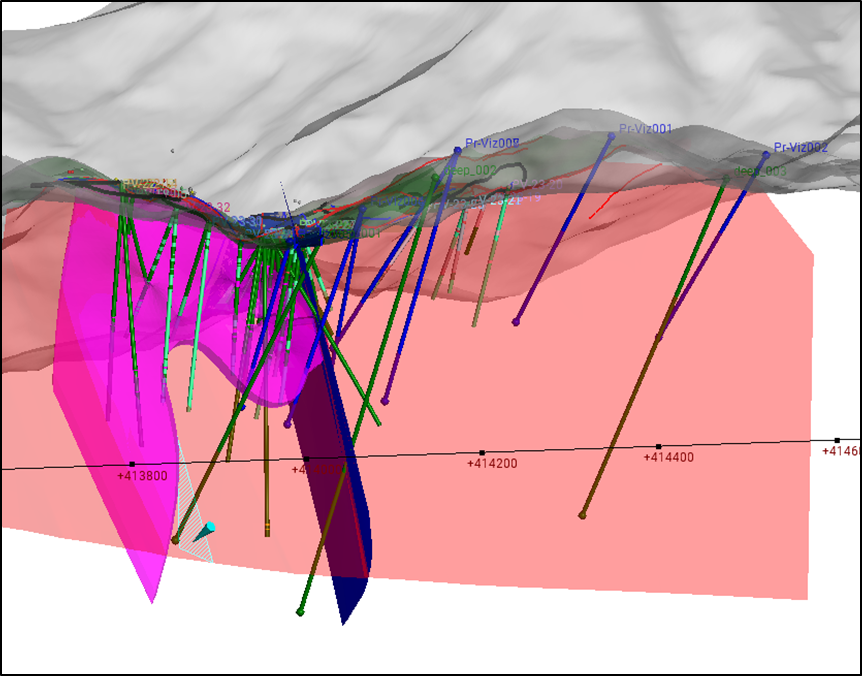

Figure 5. View of subsurface at Palos Verdes, looking northerly, with the Palos Verdes vein projection in red and the high-grade mineralized shoot in magenta, apparently truncated by the NW fault, blue.

Table of drill highlights for the previously unreported holes at the Palos Verdes Project:

Hole | From | To | Width | Est True width (m) | Au | Ag (g/t) | Cu | Pb | Zn | *Ag eq (g/t) |

PV-27 | 0.90 | 1.30 | 0.40 | 0.10 | 0.216 | 107 | - | 0.02 | 0.02 | 126.2 |

PV-32 | 109.40 | 111.60 | 2.20 | 1.41 | 0.16 | 17.5 | 0.27 | 0.92 | 1.30 | 115.4 |

111.30 | 111.60 | 0.30 | 0.19 | 0.83 | 45.0 | 0.68 | 4.32 | 4.67 | 333.9 | |

150.10 | 155.65 | 5.55 | 3.57 | 0.20 | 20.7 | 0.16 | 0.61 | 1.09 | 103.8 | |

155.25 | 155.65 | 0.40 | 0.26 | 0.04 | 17 | 0.21 | 3.56 | 6.03 | 391.5 | |

PV-33 | 225.65 | 226.40 | 0.75 | 0.26 | 0.03 | 94.8 | 2.28 | 0.31 | 3.39 | 253.4 |

225.95 | 226.40 | 0.45 | 0.14 | 0.04 | 144 | 3.65 | 0.45 | 5.12 | 382.2 |

*Silver equivalent values are calculated using the following metals prices: Au, US$1,750/oz, Ag, $21.24/oz, Pb, $0.97/lb and Zn, $1.34/lb. Cu was not used in the calculation, and metallurgical recoveries were not considered as there is no data available for the Palos Verdes vein. True width estimated from hole inclination and estimated vein dip, where known.

Table of drill hole data for holes not previously released:

Hole | Target | Easting | Northing | Elev | Azim | Incl | Depth (m) | |

PV-23-26 | NW fault | 413,807 | 2,593,082 | 1,236 | 10 | -45 | 327.00 | |

PV-23-27 | PV vein | 413,814 | 2,593,082 | 1,226 | 320 | -75 | 234.00 | |

PV-23-28 | NW fault | 413,801 | 2,593,136 | 1,244 | 35 | -60 | 117.00 | |

PV-23-29 | SW PV gap | 413,735 | 2,593,073 | 1,216 | 330 | -75 | 183.00 | |

PV-23-30 | SW PV gap | 413,707 | 2,592,990 | 1,202 | 330 | -50 | 180.00 | |

PV-23-31 | SW PV gap | 413,709 | 2,592,990 | 1,200 | 330 | -75 | 246.00 | |

PV-23-32 | SW PV gap | 413,677 | 2,592,942 | 1,211 | 315 | -50 | 199.50 | |

PV-23-33 | SW PV gap | 413,678 | 2,592,938 | 1,216 | 330 | -75 | 250.50 | |

Coordinates in UTM WGS84 using handheld Garmin GPS.

Additional Information About the Private Placement

The Private Placement will be made available to subscribers pursuant to the accredited investor and friends, family and business associate exemptions provided under sections 2.3(1) and 2.5 of National Instrument 45-106 Prospectus Exemptions.

The Private Placement will also be made available to existing shareholders of the Company who, as of the close of business on April 3, 2024, held Shares (and who continue to hold such Shares as of the closing date of the Private Placement), pursuant to the existing securityholder exemption set out in BC Instrument 45-534 Exemption From Prospectus Requirement for Certain Trades to Existing Security Holders (the "Existing Securityholder Exemption"). The Existing Securityholder Exemption limits a shareholder to a maximum investment of CAD$15,000 in a 12-month period unless the shareholder has obtained advice regarding the suitability of the investment and, if the shareholder is resident in a jurisdiction of Canada, that advice has been obtained from a person that is registered as an investment dealer in the jurisdiction. If the Company receives subscriptions from investors relying on the Existing Securityholder Exemption exceeding the maximum amount of the Private Placement, the Company intends to adjust the subscriptions received on a pro-rata basis.

The Company intends to use the proceeds from the Private Placement to fund drilling at its Palos Verdes project, and for general working capital purposes. There may be circumstances, however, where, for sound business reasons, a reallocation of funds may be necessary.

The Company may pay finder's fees to eligible finders in connection with the Private Placement, subject to compliance with applicable securities laws and Canadian Securities Exchange policies.

All securities issued in connection with the Private Placement will be subject to a four-month hold period from the closing date under applicable Canadian securities laws, in addition to such other restrictions as may apply under applicable securities laws of jurisdictions outside Canada.

The securities being offered have not been and will not be registered under the U.S. Securities Act and may not be offered or sold in the United States, or to, or for the account or benefit of, U.S. persons or persons in the United States, absent registration or an applicable exemption from the registration requirements. This press release shall not constitute an offer to sell or the solicitation of an offer to buy nor shall there be any sale of the securities in any State in which such offer, solicitation or sale would be unlawful.

Debt Settlements

The Company also announces that it has entered into debt settlement agreements with certain creditors of the Company (the "Creditors") pursuant to which the Company has agreed to issue to the Creditors, and the Creditors have agreed to accept, an aggregate of 646,391 Units (the "Settlement Units"), in full and final settlement of accrued and outstanding indebtedness in the aggregate amount of $109,886.

Each Settlement Unit consists of one Share and one-half of one Warrant. Each such warrant shall entitle the holder to purchase one common share in the capital of the Company for a period of twenty-four (24) months from the date of issue at an exercise price of $0.25.

The Settlement Units will be subject to a statutory hold period of four months from the date of issuance under applicable Canadian securities laws, in addition to such other restrictions as may apply under applicable securities laws of jurisdictions outside Canada.

Updated Disclosure Regarding Closing of Prior Debt Settlement Transaction

The Company also wishes to clarify its previously disseminated press release dated April 5, 2024, announcing the closing of the Company's previously announced debt settlement transactions with certain creditors of the Company (the "Prior Debt Settlement"). The press release inadvertently disclosed in one instance that the Company issued a total of 788,235 Shares to ProDeMin, a company controlled by then President and CEO (now Chief Exploration Officer) of Prismo, Dr. Craig Gibson, in the Prior Debt Settlement. The actual number of Shares issued to ProDeMin was 588,235 as elsewhere stated in the news release.

QA/QC

Samples taken by Prismo are analyzed by multielement ICP-AES and MS methods internationally recognized analytical service providers. Certified Reference Materials including standard pulps and coarse blank material are inserted in the sample stream at regular intervals. Dr. Craig Gibson, PhD., CPG., a "Qualified Person" as defined by National Instrument 43-101 and Chief Exploration Officer and a director of the Company, has reviewed and approved the technical disclosure in this news release.

Not for distribution to U.S. news wire services or dissemination in the United States.

About Prismo Metals Inc.

Prismo (CSE: PRIZ) is mining exploration company focused on two precious metal projects in Mexico (Palos Verdes and Los Pavitos) and a copper project in Arizona (Hot Breccia).

Please follow @PrismoMetals on Twitter, Facebook, LinkedIn, Instagram, and YouTube

Prismo Metals Inc.

1100 - 1111 Melville St., Vancouver, British Columbia V6E 3V6

Contact:

Alain Lambert, Chief Executive Officer alambert@cpvcgroup.ca

Steve Robertson, President steve.robertson@prismometals.com

Jason Frame, Manager of Communications jason.frame@prismometals.com

Neither the Canadian Securities Exchange nor its Market Regulator (as that term is defined in the policies of the Canadian Securities Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Note Regarding Forward-Looking Information

This release includes certain statements and information that may constitute forward-looking information within the meaning of applicable Canadian securities laws. Forward-looking statements relate to future events or future performance and reflect the expectations or beliefs of management of the Company regarding future events. Generally, forward-looking statements and information can be identified by the use of forward-looking terminology such as "intends" or "anticipates", or variations of such words and phrases or statements that certain actions, events or results "may", "could", "should", "would" or "occur". This information and these statements, referred to herein as "forward‐looking statements", are not historical facts, are made as of the date of this news release and include without limitation, statements regarding discussions of future plans, estimates and forecasts and statements as to management's expectations and intentions with respect to, among other things: the expected closing date of the Private Placement; the anticipated proceeds to be raised under the Private Placement; the intended use of any proceeds raised under the Private Placement; the payment of any finder's fees in connection with the Private Placement; the issuance of the Settlement Units; the Company's plans to commence drilling at the Hot Breccia and Palos Verdes projects and the expected depth thereof; and the anticipated receipt of the final BLM permit and the timing thereof.

These forward‐looking statements involve numerous risks and uncertainties and actual results might differ materially from results suggested in any forward-looking statements. These risks and uncertainties include, among other things: delays in obtaining or failure to obtain required regulatory approvals for the Private Placement and the Debt Settlement; market uncertainty; the inability of the Company to raise the anticipated proceeds under the Private Placement; the inability of the Company to utilize the anticipated proceeds of the Private Placement as anticipated; delays or changes in plans with respect to exploration projects or capital expenditures, including in respect of the Company's proposed drill programs; delays in the receipt of the final BLM permit; the uncertainty of mineral resource exploration cost estimates; health, safety and environmental risks; worldwide demand for metals; metals prices and other commodity price and exchange rate fluctuations; environmental risks; competition; ability to access sufficient capital from internal and external sources; and changes in legislation, including but not limited to tax laws, royalties and environmental regulations.

In making the forward looking statements in this news release, the Company has applied several material assumptions, including without limitation: the Company will obtain the required regulatory approvals for the Private Placement; the Company will be able to raise the anticipated proceeds under the Private Placement and on the timetable anticipated; the Company will use the proceeds of the Private Placement as currently anticipated; the Company will issue the Settlement Units as anticipated; the Company will commence drilling at the Hot Breccia and Palos Verdes projects at the expected depth and on the timetable anticipated; and the final BLM permit will be received and on the timetable anticipated.

Although management of the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements or forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements and forward-looking information. Readers are cautioned that reliance on such information may not be appropriate for other purposes. The Company does not undertake to update any forward-looking statement, forward-looking information or financial out-look that are incorporated by reference herein, except in accordance with applicable securities laws. We seek safe harbor.

SOURCE: Prismo Metals Inc.

View the original press release on accesswire.com