- WORLD EDITIONAustraliaNorth AmericaWorld

April 01, 2024

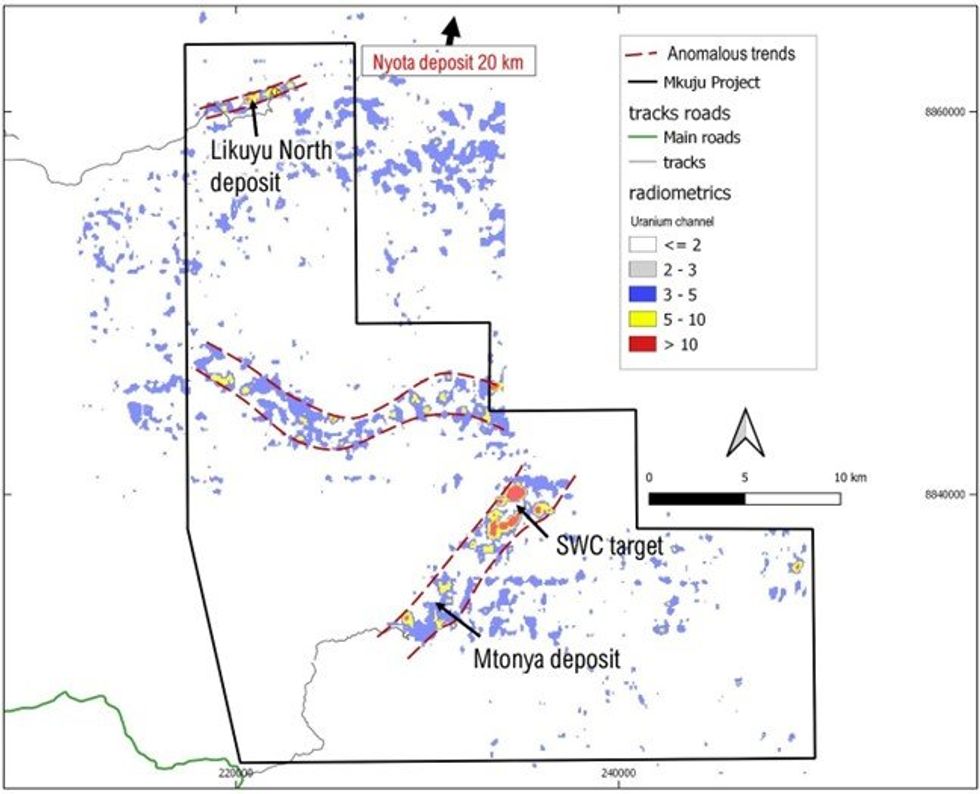

Gladiator Resources Ltd (ASX: GLA) (Gladiator or the Company) is pleased to announce it is on track for commencement of drilling at its key uranium targets at the Mkuju Project during May. The program will include the first core drilling at the SWC target where 2023 trenches intersected up to 7139ppm U3O8. At Mtonya and Likuyu North the Company’s drilling will test potential extensions and new zones to the existing uranium deposits. The geological team has been established, key equipment orders made, and the drilling contractor selection process is proceeding well.

- Preparations are progressing well; drilling expected to commence in May to test the Southwest Corner target and test potential extensions to the Mtonya and Likuyu North deposits:

- At Southwest Corner, the drilling to test the potential for down-dip extension of the recently trenched high-grade surface uranium.

- At Mtonya holes will follow up on excellent uranium intersections not followed up by previous explorers in 2012.

- At Likuyu North drilling testing for potential new zones that if present would add to the existing 4.6 Mlb U3O8 (JORC) Resource.

- At Southwest Corner, the drilling to test the potential for down-dip extension of the recently trenched high-grade surface uranium.

- In line with Tanzanian procurement regulations drilling contractor tender evaluation and award will take place during April.

- Major items purchased including downhole gamma-ray logging equipment. Camp provider has been identified.

- Seasoned and Africa-experienced Exploration Manager Fabien Linares begins full-time on 1 April and will be responsible for implementation of the program.

- All drilling to be by diamond coring to maximise on geological observation and data quality.

The SWC target – summary and Gladiators planned drilling

The target is an intense 3.5 km x 1.8 km oval shaped airborne radiometric anomaly northeast of the Mtonya deposit. Despite being the most intense radiometric anomaly in the area no drilling other than 2008 shallow auger holes (max depth 12 m) and a single core hole have been carried out here, by Mantra Resources. The auger holes gave excellent uranium intersections1. Reportedly, Mantra Resources did not follow-up the excellent auger-hole results, prioritising exploration at their flagship “Nyota” Uranium deposit 50 km to the north. In 2023 Gladiator carried out trenching to confirm and understand the uranium mineralization and encountered high grade uranium in 4 of the 5 trenches. Vertical channel samples across the gently dipping layer/s included 2.55m with an average grade of 2017ppm U3O8 and 1.40m with an average grade of 4442ppm U3O82. Gladiators drilling will test the potential down-dip extension of this mineralization which appears to be hosted within gently dipping layers, as exposed in the trenches and described in detail in the announcement dated 26 December 2023. This is illustrated in figure 2.

The Mtonya deposit – summary and Gladiators planned drilling

The previous drilling program was carried out by Uranium Resources Plc (URA) in 2011 and 2012 and used to support a mineral resource estimate, considered as a ‘foreign estimate’ and reported by Gladiator (refer GLA announcement dated 14 July 2022). A review of the data by the MSA Group revealed that some of the best zones of uranium mineralisation were left ‘open’ and that further drilling is required to test potential continuation of the uranium mineralisation. An example of this is provided in Figure 3. 2011/12 drillholes URAMT105 and 106 contain excellent mineralization which may extend to the northwest and will be tested with 1-2 holes in this direction. Gladiator will drill a number of holes to test this and other areas of the deposit that may contain significant extensions to the known mineralization.

This article includes content from Gladiator Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

GLA:AU

The Conversation (0)

29 May 2024

Gladiator Resources

Capitalizing on the uranium momentum with prolific assets in Tanzania

Capitalizing on the uranium momentum with prolific assets in Tanzania Keep Reading...

4h

Basin Energy Hits 1,112 ppm TREO, Fast Tracks 2026 Uranium and REE Strategy at Sybella-Barkly

Basin Energy (ASX:BSN) is moving to accelerate its 2026 exploration efforts following "exciting" results from its maiden drilling program at the Sybella-Barkly project in Queensland. In a recent interview, Managing Director Pete Moorhouse revealed that the company has confirmed a significant... Keep Reading...

19 February

Drilling Confirms Potential REE System at Sybella Barkly

Basin Energy (BSN:AU) has announced Drilling Confirms Potential REE System at Sybella BarklyDownload the PDF here. Keep Reading...

18 February

Niger’s Seized Uranium Remains in Geopolitical Limbo

A stockpile of 1,000 metric tons of uranium seized from a French-operated mine in Niger is now sitting at a military airbase in Niamey that was recently attacked by Islamic State militants, raising fresh concerns over security and the material’s uncertain future.The uranium, which is processed... Keep Reading...

12 February

Deep Space Energy Secures US$1.1 Million to Advance Lunar Power and Satellite Resilience Goals

Latvian startup Deep Space Energy announced it has raised approximately US$1.1 million in a combination of private investment and public funding to advance a radioisotope-based power generator designed to operate on the Moon.The company closed a US$416,500 pre-seed round led by Outlast Fund and... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00