Data and insights on each step of an ecommerce order, from checkout to returns

Pitney Bowes Inc. (NYSE: PBI), a global shipping and mailing company that provides technology, logistics, and financial services, has released its comprehensive 2022 Order Experience Index , a compilation of data and insights on each step in the customer journey of an ecommerce order, from checkout to returns. The Index is a guide for direct-to-consumer (DTC) retailers as they adapt to volatile macroeconomic factors and post-pandemic shifts in consumer preferences.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20230321005701/en/

"While the word ‘unprecedented' was appropriate for the market changes we saw over the last couple of years, it would be a mistake to label the year ahead as a ‘return' to pre-pandemic behaviors," said Vijay Ramachandran, Vice President, Enablement and Experience at Pitney Bowes Global Ecommerce . "Ecommerce brands are coming to terms with a new market landscape where delivery speed and free returns aren't the same drivers they once were. As we explore in our latest Order Experience Index—a benchmark sample of insights we share with our clients everyday—consumers have new expectations that may upend many of the pandemic-fueled investments retailers made over the last few years."

The Index contains takeaways from BOXpoll market surveys and BOXscore shopping benchmarks to analyze the current state of ecommerce and offer actionable insights for direct-to-consumer retailers to use to develop new strategies for the evolving landscape ahead. Key findings and trends include:

Consumers' definition of convenience is shifting, driving new considerations for retailers as they rethink checkout and delivery experiences.

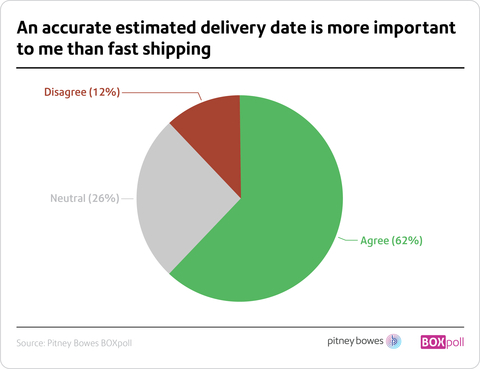

- Shipping doesn't necessarily need to be "fast," but rather, predictable. The average consumer defines "fast" shipping as more than three days—a number that has grown as the market has recovered from pandemic restrictions.

- 62% of consumers say an accurate estimated delivery date is more important than fast shipping.

- "Convenience" is the number one reason consumers cite for picking online shopping over in-store, with 49% selecting convenience over better prices, broader selection and getting their items delivered faster.

Retailers must strike a balance between a memorable and sustainable unboxing experience.

- More than 1 in 3 consumers (38%) are sustainability shoppers (those who seek or buy products based on environmentally friendly features). Nearly half (47-48%) of younger, more affluent consumers, as well as parents and urbanites, fall into this category.

- Consumers (54%) deem easy-to-reuse packaging the most helpful way for retailers to make order packaging more sustainable.

Retailers must rethink returns strategies, considering a convenient returns experience while keeping costs low.

- Retailers report that returns cost an average of 21% of order value.

- Meanwhile, 70% are actively working on lowering returns transportation and processing costs.

Though international inflation and a strong US dollar have dampened demand for US exports, retailers have several opportunities to win back cross-border customers with a positive order experience.

- Cross-border cart abandonment rose year-over-year.

- Common reasons for cross-border cart abandonment in 2022 included not wanting to risk paying import duties at package pick-up and taxes as well as a lack of localization.

The 2022 Order Experience Index can be downloaded here . Learning from both consumer behaviors and larger shipping trends, retailers can also anticipate the release of Pitney Bowes' forthcoming 2022 Shipping Index, releasing on March 28, which takes a close look at the state of the shipping industry in the US with a detailed analysis of the vertical, including details of parcel volume, carrier revenue, and market share.

Methodology

BOXpoll by Pitney Bowes, part of the BOXtools insights platform, is a weekly survey on current events, culture and ecommerce logistics. Morning Consult conducts weekly consumer polls on behalf of Pitney Bowes among a national sample of more than 2,000 online shoppers. Visit www.pitneybowes.com/boxpoll for the latest BOXpoll findings.

BOXscore , a customer experience benchmarking platform by Pitney Bowes, uses crowdsourced mystery shopping data to provide retailers with insights into their ecommerce logistics.

About Pitney Bowes

Pitney Bowes (NYSE:PBI) is a global shipping and mailing company that provides technology, logistics, and financial services to more than 90 percent of the Fortune 500. Small business, retail, enterprise, and government clients around the world rely on Pitney Bowes to remove the complexity of sending mail and parcels. For the latest news, corporate announcements and financial results visit https://www.pitneybowes.com/us/newsroom.html . For additional information visit Pitney Bowes at www.pitneybowes.com .

View source version on businesswire.com: https://www.businesswire.com/news/home/20230321005701/en/

Brett Cody, Pitney Bowes

T: 203-218-1187

E: Brett.Cody@pb.com