July 16, 2023

Greenstone Resources Limited (ASX:GSR) (Greenstone or the Company) is pleased to provide an update on Phase-2 exploration activities at its flagship Burbanks Gold Project following from the recently announced Burbanks Mineral Resource Estimate (MRE) which now totals 6.1Mt @ 2.4g/t gold for 465,567 ounces of contained gold1, an increase of over 68% from the previous update, reaffirming the existence of a large scale gold system with a total gold endowment now exceeding 850,000 ounces in the upper ~300 metres1.

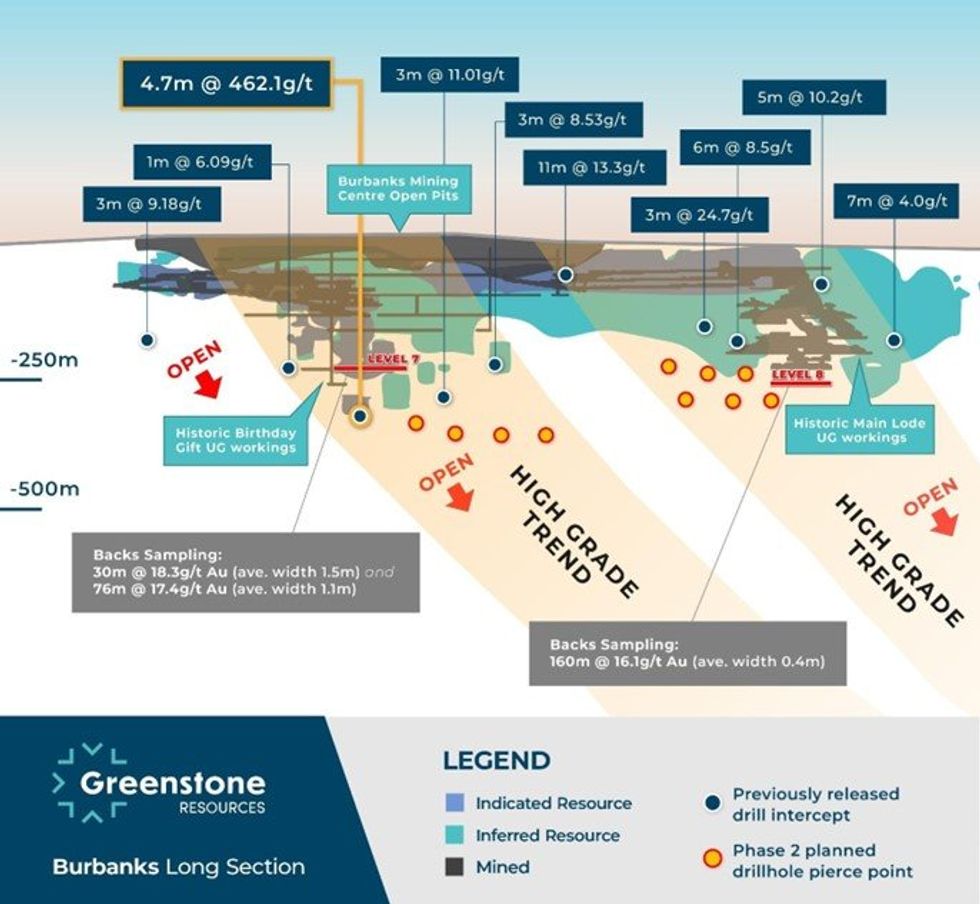

- Phase-2 drilling underway at Burbanks targeting high-grade extensions beneath historic mining centre

- Underground mining centre historically produced 324koz @ 22.7g/t Au from largely the upper 140m

- Historic production is in addition to the existing JORC (2012) resource of 6.1Mt @ 2.4g/t gold for 466koz

- Ten holes planned drilling immediately down-dip of historical high-grade intercepts, including:

- BBUD329: 4.7 metres @ 462.1g/t Au from 244.0 metres

- BBRC299: 3.0 metres @ 24.7g/t Au from 167.0 metres

- NBD001: 3.0 metres @ 11.0g/t Au from 353.0 metres

- Phillips Find drill campaign now complete, serving to confirm the prospectivity of the Truth target

The Burbanks Gold Project is located on a granted mining lease just 9.0km south of Coolgardie, Western Australia and is supported by a network of existing infrastructure including grid power, sealed roads and several neighbouring toll treatment plants, all of which will serve to expedite any future production decisions.

The Phase-2 drill campaign includes up to 15,000m of diamond and reverse circulation drilling targeting down dip and along strike extensions to known high-grade gold lodes in largely the upper 500 metres and adjacent to the existing mineral resource.

Initial Phase-2 drilling will focus on targeting extensions to known high-grade trends which remain open beneath the Burbanks Mining Centre which historically produced 324,000oz @ 22.7g/t Au from largely the upper 140 metres (Figure 1). An initial ten holes have been planned in this area, which are supported by historical underground sampling and drill intercepts, including:

- BBUD329: 4.7 metres @ 462.1g/t Au from 244.0 metres

- BBRC299: 3.0 metres @ 24.7g/t Au from 167.0 metres

- NBD001: 3.0 metres @ 11.0g/t Au from 353.0 metres

Managing Director and CEO, Chris Hansen, commented: “The recently updated resource has served to validate our longstanding conviction for the Burbanks Gold Project, with the total gold endowment now exceeding >850koz in the upper ~300m2. Importantly, with only ~30% of the mineralised horizon above 500m tested to date, there is significant potential for future growth which will be tested as part of the Phase-2 drill campaign currently underway.

The exploration strategy at Burbanks for the past 18-months has been focussed on near-surface resource additions to provide the critical mass required for the future resumption of operations. This next phase of exploration at Burbanks will be targeting the high-grade extensions beneath the historic mine workings, which remain open from shallow- depths. Despite historical underground production exceeding 324,000oz @ 22.7g/t gold from largely the upper 140 metres, this area remains underexplored with further extensions at depth supported by limited drilling and underground sampling.

The strategic significance of Burbanks cannot be understated, there are only seven ASX listed high-grade preproduction gold projects in Australia1, with Burbanks being the only project located within the epicentre of the Australian gold mining industry. The Project is surrounded by a network of existing infrastructure, including processing plants, grid power, and sealed roads, all of which will serve to expedite our path to sustainable commercial production.

Click here for the full ASX Release

This article includes content from Greenstone Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

48m

Pause in Trading

Zeus Resources Limited (ZEU:AU) has announced Pause in TradingDownload the PDF here. Keep Reading...

11h

Canadian Investment Regulatory Organization Trade Resumption - IMR

Trading resumes in: Company: iMetal Resources Inc. TSX-Venture Symbol: IMR All Issues: Yes Resumption (ET): 10:30 AM CIRO can make a decision to impose a temporary suspension (halt) of trading in a security of a publicly-listed company. Trading halts are implemented to ensure a fair and orderly... Keep Reading...

11h

iMetal Resources Intersects 16.65 Metres at 1.24 g/t Gold Within 62.25 Metres at 0.61 g/t Gold at Gowganda West

iMetal Resources Inc. (TSXV: IMR,OTC:IMRFF) (OTCQB: IMRFF) (FSE: A7VA) ("iMetal" or the "Company") has intersected 16.65 metres at 1.25 gt gold within 62.25 metres at 0.61 gt gold at its Gowganda West Gold Project, southwest of Timmins, Ontario. Drilling in the West Zone intersected broad levels... Keep Reading...

25 February

Precious Metals Price Update: Gold, Silver, PGMs Boosted by Geopolitical and Trade Tensions

Precious metals are recovering their safe-haven demand appeal this week.Gold, silver and platinum are up this week, all still down from the all-time highs recorded in January. Escalating geopolitical tensions and US trade policy shifts are once again at center stage in this sector of the... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00