June 04, 2023

Blackstone Minerals Limited (ASX:BSX) (“Blackstone” or the “Company”) is pleased to formally announce the inclusion of Metso as the technology supplier for the precursor cathode active material (“pCAM”) into the Ta Khoa Refinery DFS delivery team. Metso is currently designing the pCAM plant with Wood, providing invaluable experience and engineering technical support. Metso will also conduct independent pCAM test work to ‘validate’ the nickel and cobalt sulphates generated during the ALS Pilot Program (refer to ASX announcement 20 December 2022) to be suitable for pCAM generation.

Metso is a known industry leader in sustainable technologies, end-to-end solutions and services for the aggregates, minerals processing and metals refining industries, and has supported Blackstone during the Ta Khoa Project prefeasibility study with testwork, pilot work at site and technology selections. Metso provides sustainable technology and equipment for the entire lithium, nickel, and cobalt production chain from the mine to battery materials and black mass recycling with project scope ranging from equipment packages to plant deliveries. For active cathode precursors manufacturing, Metso's technology offering starts from optimised raw materials selection down to precipitated metal hydroxide precursor materials. Metso’s battery material and pCAM team was established in 2019 with industry experts, researchers, and specialised engineers to develop solutions for the growing battery industry. The team is supported by its own pCAM testing facilities. More information can be found on Metso’s website at Battery minerals - Metso.

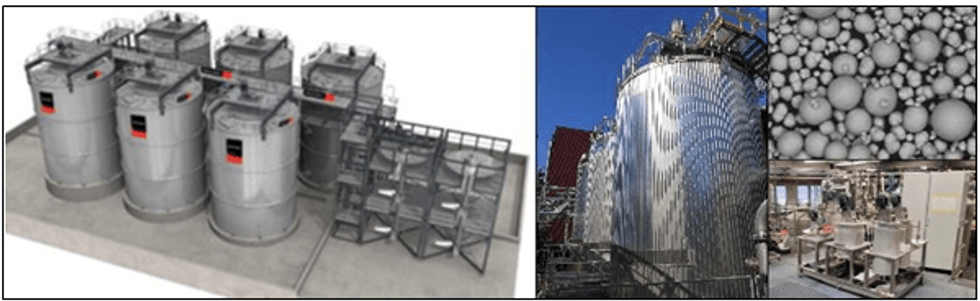

In addition to technical support, Metso brings a suite of bespoke and high value technology to the pCAM facility design, such as the modular OKTOP® reactors (with industrial references for scaling-up pCAM precipitation processes), Larox® filtration technologies and Courier® HX continuous product quality analyser equipment to enable precision control and real time optimisation. Metso has shown that precursors precipitated with OKTOP® reactor technology are proven to meet the required chemical and physical properties for high performance cathode active material.

Blackstone Minerals’ Managing Director, Scott Williamson, commented:

Metso bring a legacy of innovation and success from the mineral processing industry to the battery industry, joining them on this journey is certainly exciting. Blackstone intends to leverage off Metso ’s engineering services and know-how into the pCAM facility design, thus de-risking the Project and confirming Blackstone’s intent to be a real player in the pCAM space. Securing another world leader to the Ta Khoa Project is yet another jigsaw piece in the battery value chain puzzle. Blackstone continues to look forward to project success as it marches towards developing the greenest and most resilient nickel business in the world.

Click here for the full ASX Release

This article includes content from Blackstone Minerals Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

BSX:AU

Sign up to get your FREE

Blackstone Minerals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

8h

Blackstone Minerals

Advancing the Mankayan copper-gold project, a world-class copper-gold project in the Philippines

Advancing the Mankayan copper-gold project, a world-class copper-gold project in the Philippines Keep Reading...

27 January

Quarterly Activities/Appendix 5B Cash Flow Report

Blackstone Minerals (BSX:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

28 December 2025

Managing Director Resignation and Board Changes

Blackstone Minerals (BSX:AU) has announced Managing Director Resignation and Board ChangesDownload the PDF here. Keep Reading...

24 October 2025

Quarterly Activities/Appendix 5B Cash Flow Report

Blackstone Minerals (BSX:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

27 August 2025

BSX Secures JV Partner & Funding for Ta Khoa Nickel Project

Blackstone Minerals (BSX:AU) has announced BSX Secures JV Partner & Funding for Ta Khoa Nickel ProjectDownload the PDF here. Keep Reading...

25 August 2025

Trading Halt

Blackstone Minerals (BSX:AU) has announced Trading HaltDownload the PDF here. Keep Reading...

16h

Fathom Announces Completion of Gochager Lake Winter Trail and Expected Start of Winter Drill Program

Fathom Nickel Inc. (CSE: FNI) (FSE: 6Q5) (OTCQB: FNICF) ('Fathom", or the "Company") is pleased to announce the completion of the winter trail, and mobilization of drilling and ancillary equipment to the Gochager Lake project. Drilling of the 3,000-to-4,000-meter program is expected to begin... Keep Reading...

23h

Fathom Announces Completion of Gochager Lake Winter Trail and Expected Start of Winter Drill Program

Fathom Nickel Inc. (CSE: FNI,OTC:FNICF) (FSE: 6Q5) (OTCQB: FNICF) ('Fathom", or the "Company") is pleased to announce the completion of the winter trail, and mobilization of drilling and ancillary equipment to the Gochager Lake project. Drilling of the 3,000-to-4,000-meter program is expected to... Keep Reading...

23 February

Ni-Co Energy Inc. Files Preliminary Prospectus for Proposed Initial Public Offering

Ni-Co Energy Inc. (“Ni-Co Energy” or the “Company”) is pleased to announce that it has filed a preliminary prospectus (the “Preliminary Prospectus”) with the securities regulatory authorities in the provinces of Québec, Ontario, Alberta, and British Columbia in connection with its proposed... Keep Reading...

12 February

Bahia Metals Corp. Completes Initial Public Offering of $5,750,000, with Full Exercise of Over-Allotment Option

Bahia Metals Corp. (CSE: BMT) ("Bahia" or the "Company") is pleased to announce that it has successfully completed its initial public offering (the "IPO") of 11,500,000 units of the Company (the "Units") at a price of $0.50 per Unit, inclusive of the full exercise of the 15% over-allotment... Keep Reading...

04 February

FPX Nickel Reports Confirmatory Results from Geotechnical Drilling at the Baptiste Nickel Project

FPX Nickel Corp. (TSX-V: FPX, OTCQX: FPOCF) ("FPX" or the "Company") is pleased to report assay results from select drill holes completed during its 2025 engineering field investigation program at the Baptiste Nickel Project ("Baptiste" or the "Project") in central British Columbia.As previously... Keep Reading...

Latest News

Sign up to get your FREE

Blackstone Minerals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00