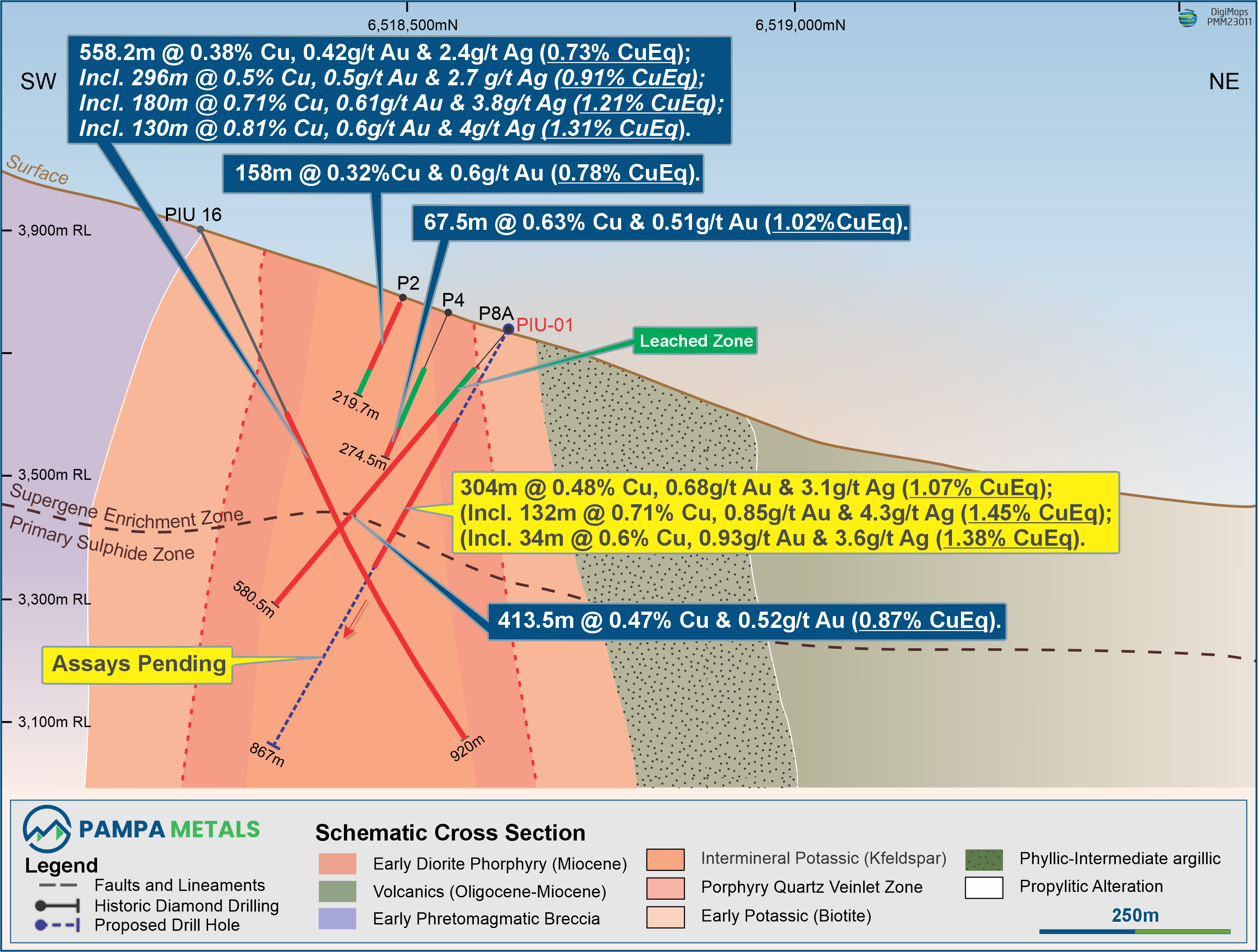

Pampa Metals Corp. ("Pampa Metals" or the "Company") (CSE:PM)(FSE:FIR)(OTCQB:PMMCF) is pleased to report assay results for the upper 502 meters of diamond drillhole PIU-01 (refer figure 1) which was recently completed to a depth of 867m at the Company's Piuquenes Central porphyry target located in San Juan Province, Argentina. Assay results for the upper 502m section of hole PIU-01 include

- 304m @ 0.48% Cu, 0.68 g/t Au, 3.1 g/t Ag (1.07% CuEq)* (from 198 m);

- including 132 m @ 0.71% Cu, 0.85 g/ Au, 4.3 g/t Ag (1.45% CuEq)* (from 220m); and

- including 34 m @ 0.60% Cu, 0.93 g/t Au, 3.6 g/t Ag (1.38% CuEq)* (from 468m).

Assays results from 502m to 867m (End Of Hole) are expected shortly.

As previously reported, hole PIU-01 was designed to extend Cu-Au mineralization to depth on the southwestern margin of the Piuquenes Central porphyry. Drilling intersected the mineralized intrusion at a downhole depth of 198m as predicted. Supergene copper enrichment was observed from 220m to 380m downhole, coincident, and overlapping with primary mineralization from 350 meters. Strong primary mineralization associated with intense porphyry A type quartz stockwork veining is evident from 350m to approximately 650m. From 650m to the end of hole at 867m quartz veining and mineralization continues, becoming progressively less intense with depth. From 830m disseminated hematite/specularite-pyrite-chalcopyrite mineralization is hosted in volcanic host rocks outside the porphyry intrusive and remains open at depth.

Joseph van den Elsen, Pampa Metals President and CEO commented: "We are very pleased to report exceptional intervals of both supergene enriched and primary copper mineralization in the first hole of our maiden drill campaign at the Piuquenes Project. Excellent progress is being on the second hole which has been designed to further test the depth and lateral extensions of the previously reported mineralization at Piuquenes Central. Subsequent drill programs will also test the undrilled Piuquenes East porphyry target and other nearby targets identified on the property."

A Company Presentation is available at: www.pampametals.com/investor/presentations

Figure 1: Piuquenes Central Schematic Cross Section

Geology and Mineralization - Diamond Drillhole PIU-01

From surface to 198 m, PIU-01 intersected a fine-grained quartz diorite porphyry with evidence of Intermediate argillic alteration and secondary biotite. Sporadic quartz stockwork veining with disseminated oxidized sulfides are observed from 80 m, becoming more frequent from 150 m deep, coincident with intermineral potassic alteration and anomalous gold values.

Moderate porphyry A-type quartz stockwork veining is present from approximately 150m downhole, increasing in intensity from 220m depth. Supergene copper enrichment is evident from 220m to 380m depth, partially coincident (from 288 m depth) with increasing intensity of porphyry A-type quartz vein stockworks and evidence of intermineral potassic alteration. A narrow zone of copper oxides is observed from 220 - 229m downhole.

Dense porphyry A-type quartz vein stockwork with chalcopyrite and traces of disseminated bornite mineralization hosted in potassic altered diorite porphyry was intersected from 350m to approximately 650 m downhole. From 650m to approximately 740m a zone of moderate intensity quartz veining was intersected, prior to a zone of sporadic quartz veining which remains open at 867m (EOH). From 730m intermediate argillic alteration is present, as is molybdenite, sphalerite and hematite/specularite associated with grey sericite-chlorite veining and fine-grained disseminated chalcopyrite-bornite. From 830m the host-rock is volcanic, superimposed by sericite-chlorite alteration and disseminated hematite/specularite-pyrite-chalcopyrite mineralization, veining and breccias.

Images 1 & 2: Porphyry qtz stockwork veining with oxide copper mineralization (Top) and supergene enrichment (Bottom)

Image 3. Intense Porphyry A type quartz stockwork veining w/primary chalcopyrite mineralization (393-401m)

ON BEHALF OF THE BOARD

Joseph van den Elsen | President & CEO

INVESTOR CONTACT

Joseph van den Elsen | Joseph@pampametals.com

ABOUT Pampa Metals

Pampa Metals is a copper-gold exploration company listed on the Canadian Stock Exchange (CSE:PM), Frankfurt (FSE: FIR), and OTC (OTCQB: PMMCF) exchanges.

In November 2023, the Company announced it had entered into an Option and Joint Venture Agreement for the acquisition of an 80% interest in the Piuquenes Copper-Gold Porphyry Project in San Juan Province, Argentina. Previous intervals of significant copper and gold mineralization at Piuquenes Central ( refer 5 December 2023 News Release) include:

- 413.5 m@ 0.47% Cu, 0.52 g/t Au (0.87% CuEq)* (167-580.5 m); and

- 558.2 m @ 0.38% Cu, 0.42 g/t Au, 2.4 g/t Ag ( 0.73% CuEq )* (362-920.2 m EOH);

- including 130 m @ 0.81% Cu, 0.6 g/t Au, 4 g/t Ag ( 1.31 % CuEq )* (362-492 m)

Qualified Person

Technical information in this news release has been approved by Mario Orrego G. Mr. Orrego G. is a Geologist, a Registered Member of the Chilean Mining Commission and a Qualified Person as defined by National Instrument 43-101. Mr. Orrego G. is a consultant to the Company.

* %CuEq values are calculated based on copper and gold metal prices: Cu = US$3.20/lb, Au = US$1,700/oz and Ag = US$ 20/oz. The formula utilized to calculate %CuEq is: Cu Eq Grade (%) = Cu Head Grade (%) +