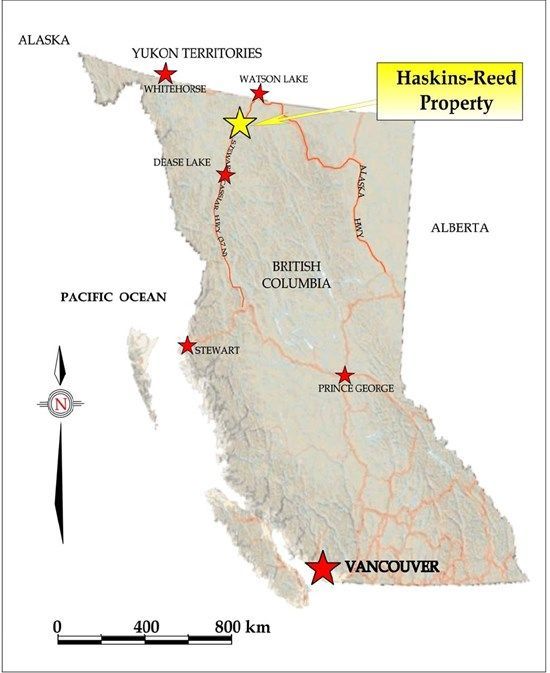

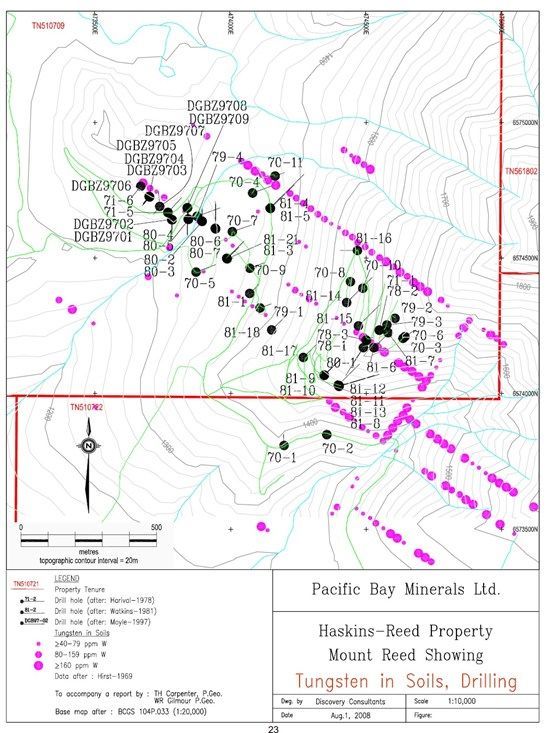

David H. Brett, Chairman of Pacific Bay Minerals Ltd. (TSXV: PBM,OTC:PBMFF) ("Pacific Bay" or the "Company") reports that a crew has mobilized to the Company's 100% owned Haskins-Reed Critical Minerals Property in the Cassiar District of north-central BC, accessible by Highway 37. The program will follow up on high-grade Tungsten skarns at the Mount Reed prospect, where historical drilling returned values of 2.01% WO3 over 3.3 metres, 0.37% WO3 over 5.18 metres and 0.17% WO3 over 54.8 metres. The Haskins-Reed project hosts multiple critical mineral prospects, including historic estimates of 1,739,000 tonnes grading 56.9 gt silver, 0.53% copper, 2.77% zinc, 0.47% lead and 0.24% bismuth in the Della B Zone, the site of significant drilling and underground workings (see clarifying note on this historical estimate below). Drill results quoted are core lengths only and not true widths as the geometry of the mineralized zone has not yet been determined.

"The Company is encouraged by the government of Canada's recently announced support for critical minerals in north-western BC, including the possible extension of the Highway 37 hydro electric transmission line to the Cassiar area and beyond," said Pacific Bay Chairman David H. Brett. "Aside from copper, tungsten and zinc, Canada's critical minerals list includes Bismuth, an uncommon specialty metal that has been identified at Haskins-Reed."

"As the Company works toward establishing a foothold in Brazil through the acquisition of the Pereira Velho Gold Property, we are excited about our renewed focus on the Haskins-Reed property," said Pacific Bay CEO Reagan Glazier. "We also believe critical metals like tungsten, copper, zinc and bismuth will continue to see bullish market sentiment attract investment to the space, particularly in BC."

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3362/267517_36b9d03db4731a3b_002full.jpg

Cautionary note: Management believes the estimates of tonnage and grade for the Della B Zone are based on sound geological work carried out in the late 1960s and 1970s backed up by significant exploration including drilling and metallurgical studies by reputable companies, and as such are useful for investors as an indication of the project's mineral potential. However, the estimates are of a historical nature and do not conform to current NI 43-101 regulations relevant to the disclosure mining and mineral exploration information and therefor do not constitute mineral resources. Significant additional drilling and other exploration work is required to define a mineral resource in keeping with current applicable regulation. A qualified person has not done sufficient work to classify the historical estimate as a current mineral resource. Therefore the Company does not consider the historical estimate as a current mineral resource.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3362/267517_36b9d03db4731a3b_003full.jpg

The scientific and technical information contained in this news release has been reviewed and approved by Mr. David Bridge, P.Geo., a consultant of the Company, who is a "Qualified Person" as defined in NI 43-101.

Pacific Bay Minerals Ltd. Per/

David Brett, MBA

Chairman

Contact: David Brett, 604-682-2421, dbrett@pacificbayminerals.com

This news release contains "forward‐looking statements" within the meaning of Canadian securities legislation. Forward‐looking statements include, but are not limited to, statements with respect to Haskins-Reed property. the magnitude and quality of the Property and spending commitments. Such statements and information are based on numerous assumptions regarding present and future business strategies and the environment in which Pacific Bay will operate in the future. Certain important factors that could cause actual results, performances or achievements to differ materially from those in the forward‐looking statements include, amongst others, the global economic climate, dilution, share price volatility and competition, results of exploration activities, and the ability of the Company to raise equity financing. Although Pacific Bay has attempted to identify important factors that could cause actual results to differ materially from those contained in forward‐looking statements, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward‐looking statements. Pacific Bay does not undertake to update any forward‐looking statements, except in accordance with applicable securities laws.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/267517