August 17, 2022

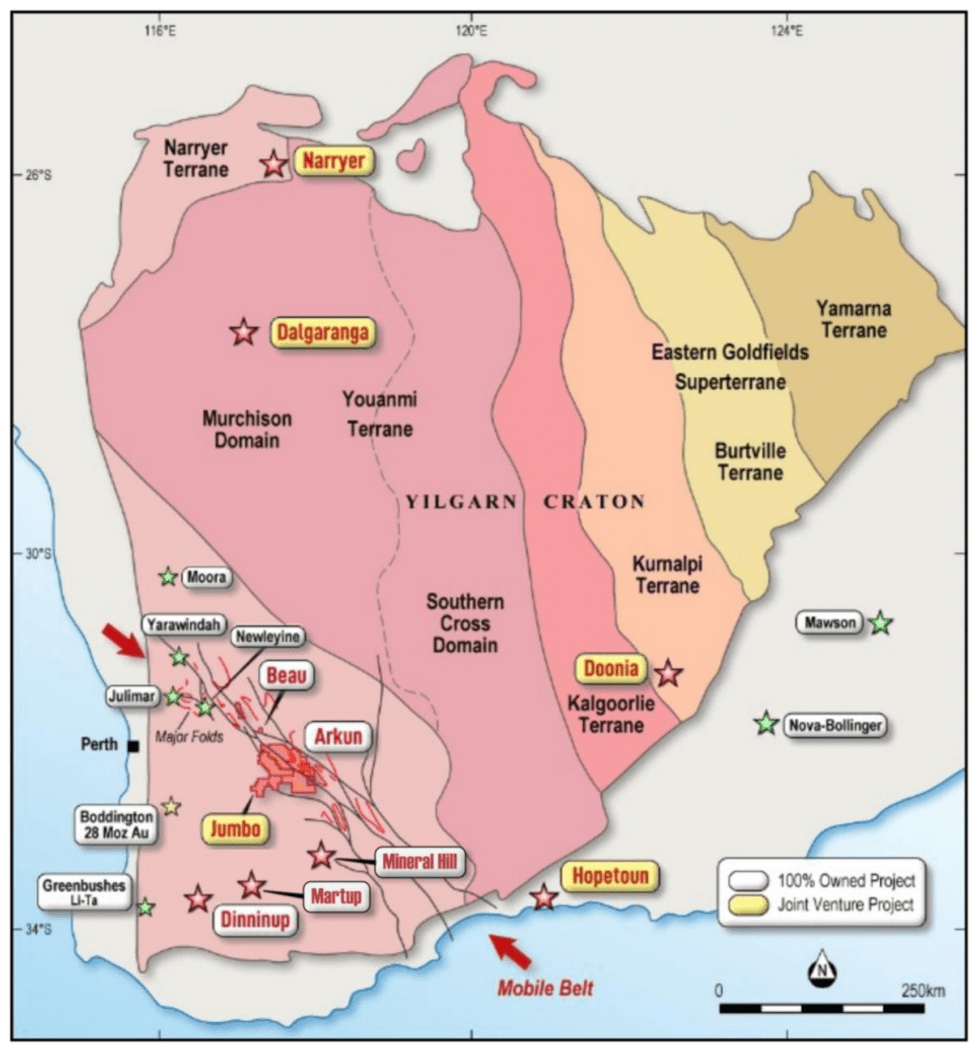

Three large and significant soil geochemistry anomalies for a range of battery metals and precious metals have been identified at Impact Minerals Limited's (ASX:IPT) 100% owned Beau Project, part of the greater Arkun- Beau-Jumbo project area in the emerging mineral province of southwest Western Australia (Figure 1).

Highlights:

- Four large and significant soil geochemistry anomalies identified, including:

- a large copper-nickel-PGM-silver-cobalt anomaly up to 2.5 km by 1 km in size and associated with previously unrecognised layered mafic gabbros

- a gold-palladium anomaly about 500 metres in diameter

- two lithium-caesium-tantalum anomalies each about 1 km in dimension that may be part of a large zoned intrusive pegmatite system

- Field checking and relevant follow-up sampling of all areas will commence by the end of August to identify reconnaissance drill targets as quickly as practicable

- A reconnaissance drill programme will be organised as soon as practicable and subject to access and the harvest period

- There has been no previous exploration at Beau prior to Impact’s work

Impact Minerals’ Managing Director Dr Mike Jones said “These are the first detailed soil geochemistry results we have had from the hitherto poorly explored greater Arkun project area and confirm our belief that the area is very prospective for a range of battery, strategic and precious metals. In addition, it is a validation of our targeting methodology which we have applied across our extensive project portfolio in Western Australia and put together over the past 18 months”.

“A large nickel-copper-PGM anomaly overlies previously unidentified layered mafic intrusive rocks; these are known hosts to significant massive sulphide deposits around the globe. In addition, we have identified a gold anomaly that is associated with rare earth responses and which may be part of a large intrusion-related system. To cap it all off, we also have identified two areas with significant responses for a range of metals associated with a zoned lithium pegmatite system. Follow-up field checking will commence later this month in order to define targets for first-pass drilling as soon as practicable and to identify the bedrock which is mostly obscured by laterite. We also look forward to getting the results from a further 600 soil samples that are still to come from the northern part of the Arkun project”.

Previous work by Impact across the Arkun and Beau project areas using a proprietary geophysical-geochemical technology owned by Southern Sky Energy Pty Ltd, identified 17 broad areas of interest, principally for Ni-Cu- PGM mineralisation, for follow-up work (ASX Release 10th June 2021).

Reconnaissance soil geochemistry traverses along gazetted roads and tracks over 15 of these targets identified a total of 22 more specific targets for both Ni-Cu-PGM mineralisation and, for the first time in the area, lithium- caesium-tantalum pegmatites and Rare Earth Elements (REE). A number of the original targets returned anomalous soil results for more than one style of mineralisation. Targets for both Ni-Cu-PGM and lithium were identified at Beau.

Click here for the full ASX Release

This article includes content from Impact Minerals Limited , licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

IPT:AU

The Conversation (0)

22 October 2024

Impact Minerals Limited

Developing the lowest-cost HPA project in Australia

Developing the lowest-cost HPA project in Australia Keep Reading...

27 March 2025

Successful Completion of the Renounceable Rights Issue

Impact Minerals Limited (IPT:AU) has announced Successful Completion of the Renounceable Rights IssueDownload the PDF here. Keep Reading...

19 March 2025

Renounceable Rights Issue Closing Date

Impact Minerals Limited (IPT:AU) has announced Renounceable Rights Issue Closing DateDownload the PDF here. Keep Reading...

13 March 2025

Major drill targets identified at the Caligula Prospect

Impact Minerals Limited (IPT:AU) has announced Major drill targets identified at the Caligula ProspectDownload the PDF here. Keep Reading...

09 March 2025

NFM: Sale of Broken Hill East Project to Impact Minerals

Impact Minerals Limited (IPT:AU) has announced NFM: Sale of Broken Hill East Project to Impact MineralsDownload the PDF here. Keep Reading...

04 March 2025

Update on the Renounceable Rights Issue to raise $5.2M

Impact Minerals Limited (IPT:AU) has announced Update on the Renounceable Rights Issue to raise $5.2MDownload the PDF here. Keep Reading...

1h

Venezuela Gold Set for US Market in Brokered Deal

A new US-Venezuela gold deal could soon channel hundreds of kilograms of bullion from the South American nation into American refineries.Venezuela’s state-owned mining company, Minerven, has agreed to sell between 650 and 1,000 kilograms of gold dore bars to commodities trading house Trafigura... Keep Reading...

22h

Rick Rule: Gold Price During War, Silver Strategy, Oil Stock Game Plan

Rick Rule, proprietor at Rule Investment Media, shares updates on his current strategy in the resource space, mentioning gold, silver, oil and agriculture. He also reminds investors to pay more attention to gold's underlying drivers than to current events.Click here to register for the Rule... Keep Reading...

22h

Lobo Tiggre: Gold, Oil in Times of War, Plus My Shopping List Now

Lobo Tiggre of IndependentSpeculator.com shares his thoughts on how gold, silver and oil could be impacted by the developing situation in the Middle East. He cautioned investors not to chase these commodities if prices run. Don't forget to follow us @INN_Resource for real-time updates!Securities... Keep Reading...

23h

TomaGold: New High-grade Deep Discovery at Berrigan Mine

TomaGold (TSXV:LOT) President, CEO and Director David Grondin said the company is focusing on its flagship Berrigan mine in Chibougamau, Québec, following a large, significant discovery at depth.Berrigan is 4 kilometers northwest of the city of Chibougamau and has existed for about 50 years.... Keep Reading...

23h

Oreterra Metals Fully Financed for Maiden Discovery Drilling at Trek South

Oreterra Metals (TSXV:OTMC) is set to launch its first-ever discovery drill program at the Trek South porphyry copper-gold prospect in BC, Canada, a pivotal moment following a corporate restructuring that culminated in the company emerging under its new name on February 2.Speaking at the... Keep Reading...

05 March

Oreterra Metals

Get access to more exclusive Gold Investing Stock profiles here Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00