- WORLD EDITIONAustraliaNorth AmericaWorld

September 17, 2023

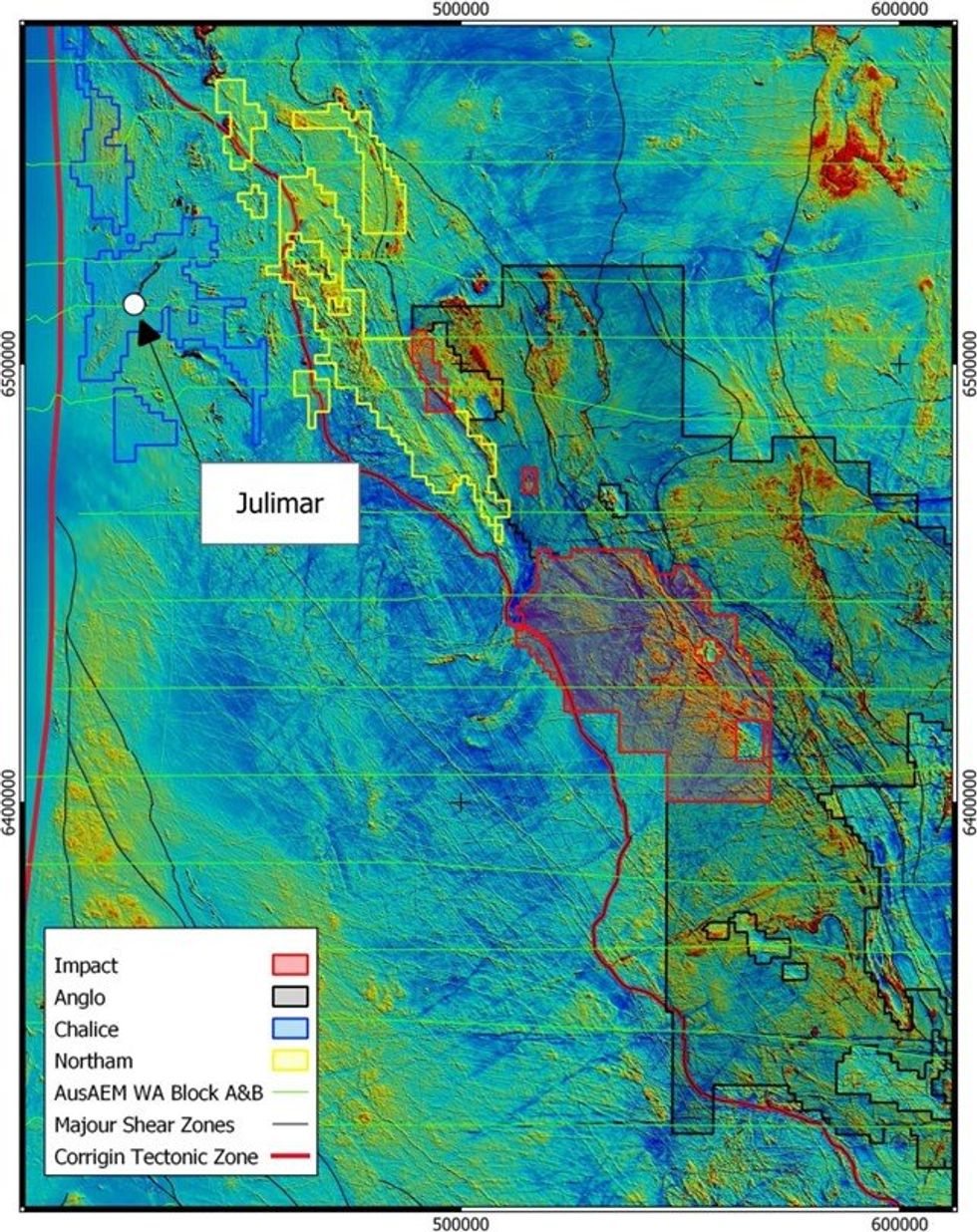

Impact Minerals Limited (ASX:IPT) is pleased to announce that it has identified 20 moderate to strong conductors in airborne electromagnetic (AEM) data flown over parts of its 100% owned Arkun Project in the emerging mineral province of southwest Western Australia, a Tier One jurisdiction (Figure 1).

- Twenty moderate to strong electromagnetic (EM) conductors identified at the Arkun Battery Metals project in 400 m line-spaced airborne electromagnetic (“AEM”) survey data collected by the XCalibur HELITEM time-domain system.

- Several priority anomalies coincide with magnetic and gravity anomalies and Ni Cu PGM-in-soil anomalies.

- Many other anomalies have yet to be soil sampled, and this work is a priority for the next Quarter with a view to a maiden drill programme in Q1 2024.

- Broken Hill update: Xplor programme completed. IGO withdraws from joint venture over the alkaline intrusions. Data synthesis and interpretation in progress of all data collected during Xplor and by IGO. Both BHP and IGO remain interested in the broader Broken Hill project.

Impact Minerals’ Managing Director, Dr. Mike Jones, said, “These new conductors at Arkun look very promising and significantly increase the potential for the discovery of massive nickel-copper-PGM sulphides. What’s particularly exciting is that some conductors have coincident soil geochemistry anomalies. However, with many of them still yet to be soil sampled, we are confident of generating more targets for follow-up work, which will include drilling. With the recent REE soil anomalies identified throughout the project area, including the standout Horseshoe prospect, Arkun continues to emerge as a major project for a wide range of essential battery and strategic minerals.”

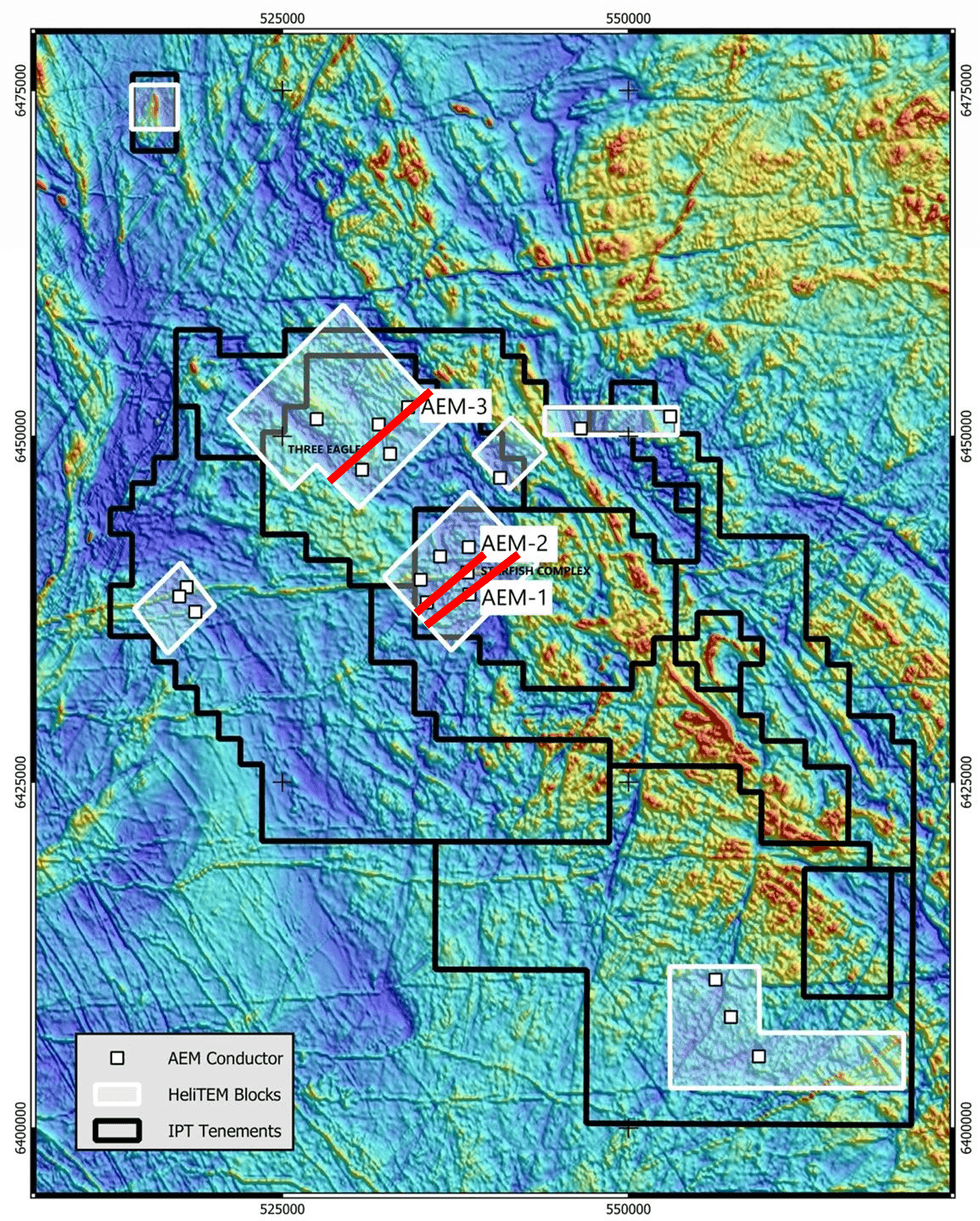

The airborne EM survey was completed over seven priority areas, covering only about 15% of the Arkun project, by XCalibur Multiphysics using the HELITEM system at a line spacing of 400 metres (Figure 2).

The 20 conductors were identified using a combination of interpretation of individual lines of EM data by consultants Resource Potentials and by reprocessing of the survey data by Intrepid Geophysics using their proprietary 2.5D AEM inversion algorithm. The 2.5D inversion process provides conductivity models and can image steeply dipping, deep, and near-surface targets.

Also shown is ground held by private company Northam Mining Ltd, in which Chalice Mining is now earning an interest via a joint venture, and ground held by Anglo American Corporation, which surrounds the Arkun Project on three sides. The green lines are publicly available regional AEM flight lines flown in 2020, including one line over the Gonneville deposit (Figure 7).

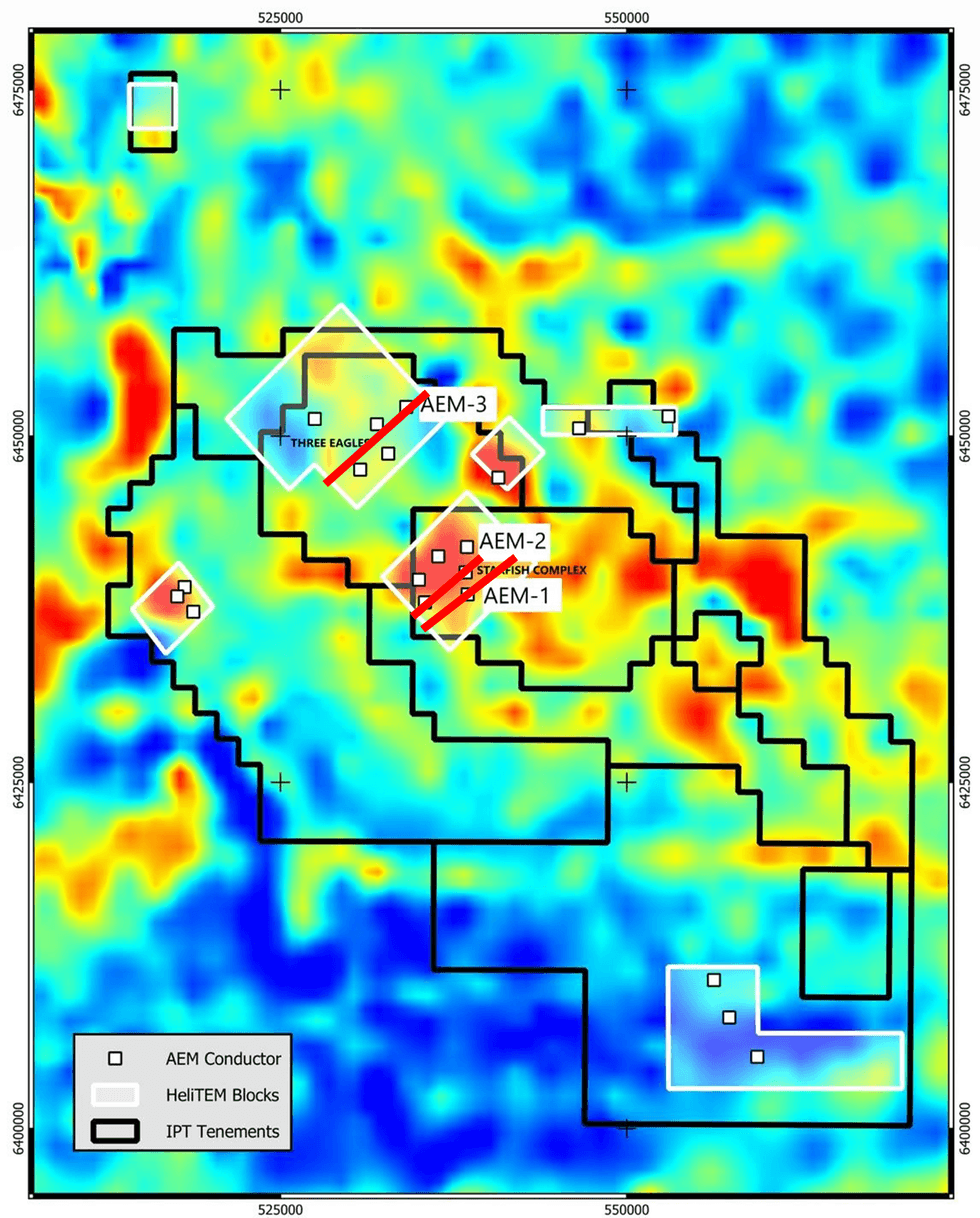

Two of the survey areas contain numerous EM conductors that have broadly coincident strong nickel- copper-PGM soil geochemistry anomalies: these include 5 AEM anomalies at the Three Eagles prospect and 6 AEM anomalies at the Starfish complex (Figures 2 and 3; and ASX Release 9 August 2023).

In addition, the EM conductors are commonly coincident either with magnetically quiet areas and/or gravity- highs in regional geophysical data, which together may represent mafic and ultramafic intrusions that are potential hosts for nickel-copper-PGM mineralisation (Figures 2 and 3).

THREE PRIORITY CONDUCTORS

Three prominent conductors that are priority areas for follow-up work have been identified in the 2.5D inversions and are shown here as examples.

Click here for the full ASX Release

This article includes content from Impact Minerals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

IPT:AU

The Conversation (0)

22 October 2024

Impact Minerals Limited

Developing the lowest-cost HPA project in Australia

Developing the lowest-cost HPA project in Australia Keep Reading...

27 March 2025

Successful Completion of the Renounceable Rights Issue

Impact Minerals Limited (IPT:AU) has announced Successful Completion of the Renounceable Rights IssueDownload the PDF here. Keep Reading...

19 March 2025

Renounceable Rights Issue Closing Date

Impact Minerals Limited (IPT:AU) has announced Renounceable Rights Issue Closing DateDownload the PDF here. Keep Reading...

13 March 2025

Major drill targets identified at the Caligula Prospect

Impact Minerals Limited (IPT:AU) has announced Major drill targets identified at the Caligula ProspectDownload the PDF here. Keep Reading...

09 March 2025

NFM: Sale of Broken Hill East Project to Impact Minerals

Impact Minerals Limited (IPT:AU) has announced NFM: Sale of Broken Hill East Project to Impact MineralsDownload the PDF here. Keep Reading...

04 March 2025

Update on the Renounceable Rights Issue to raise $5.2M

Impact Minerals Limited (IPT:AU) has announced Update on the Renounceable Rights Issue to raise $5.2MDownload the PDF here. Keep Reading...

06 March

Adrian Day: Gold Dips Bought Quickly, Price Run Not Over Yet

Adrian Day, president of Adrian Day Asset Management, shares his latest thoughts on what's moving the gold price, emphasizing that its bull run isn't over yet. "It's monetary factors that are driving gold — that's what's fundamentally driving gold," he said. "Monetary factors, lack of trust in... Keep Reading...

06 March

Brien Lundin: Gold, Silver Stock Run Just Starting, Get in Now

Brien Lundin, editor of Gold Newsletter and New Orleans Investment Conference host, shares his stock-picking strategy at a time when high metals prices are beginning to lift all boats. In his view, gold and silver equities may still only be in the second inning. Don't forget to follow us... Keep Reading...

06 March

Venezuela Gold Set for US Market in Brokered Deal

A new US-Venezuela gold deal could soon channel hundreds of kilograms of bullion from the South American nation into American refineries.Venezuela’s state-owned mining company, Minerven, has agreed to sell between 650 and 1,000 kilograms of gold dore bars to commodities trading house Trafigura... Keep Reading...

05 March

Rick Rule: Gold Price During War, Silver Strategy, Oil Stock Game Plan

Rick Rule, proprietor at Rule Investment Media, shares updates on his current strategy in the resource space, mentioning gold, silver, oil and agriculture. He also reminds investors to pay more attention to gold's underlying drivers than to current events.Click here to register for the Rule... Keep Reading...

05 March

Lobo Tiggre: Gold, Oil in Times of War, Plus My Shopping List Now

Lobo Tiggre of IndependentSpeculator.com shares his thoughts on how gold, silver and oil could be impacted by the developing situation in the Middle East. He cautioned investors not to chase these commodities if prices run. Don't forget to follow us @INN_Resource for real-time updates!Securities... Keep Reading...

05 March

TomaGold: New High-grade Deep Discovery at Berrigan Mine

TomaGold (TSXV:LOT) President, CEO and Director David Grondin said the company is focusing on its flagship Berrigan mine in Chibougamau, Québec, following a large, significant discovery at depth.Berrigan is 4 kilometers northwest of the city of Chibougamau and has existed for about 50 years.... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00