NOT FOR DISTRIBUTION TO U.S NEWSWIRE SERVICES OR FOR DISSEMINATION IN THE UNITED STATES

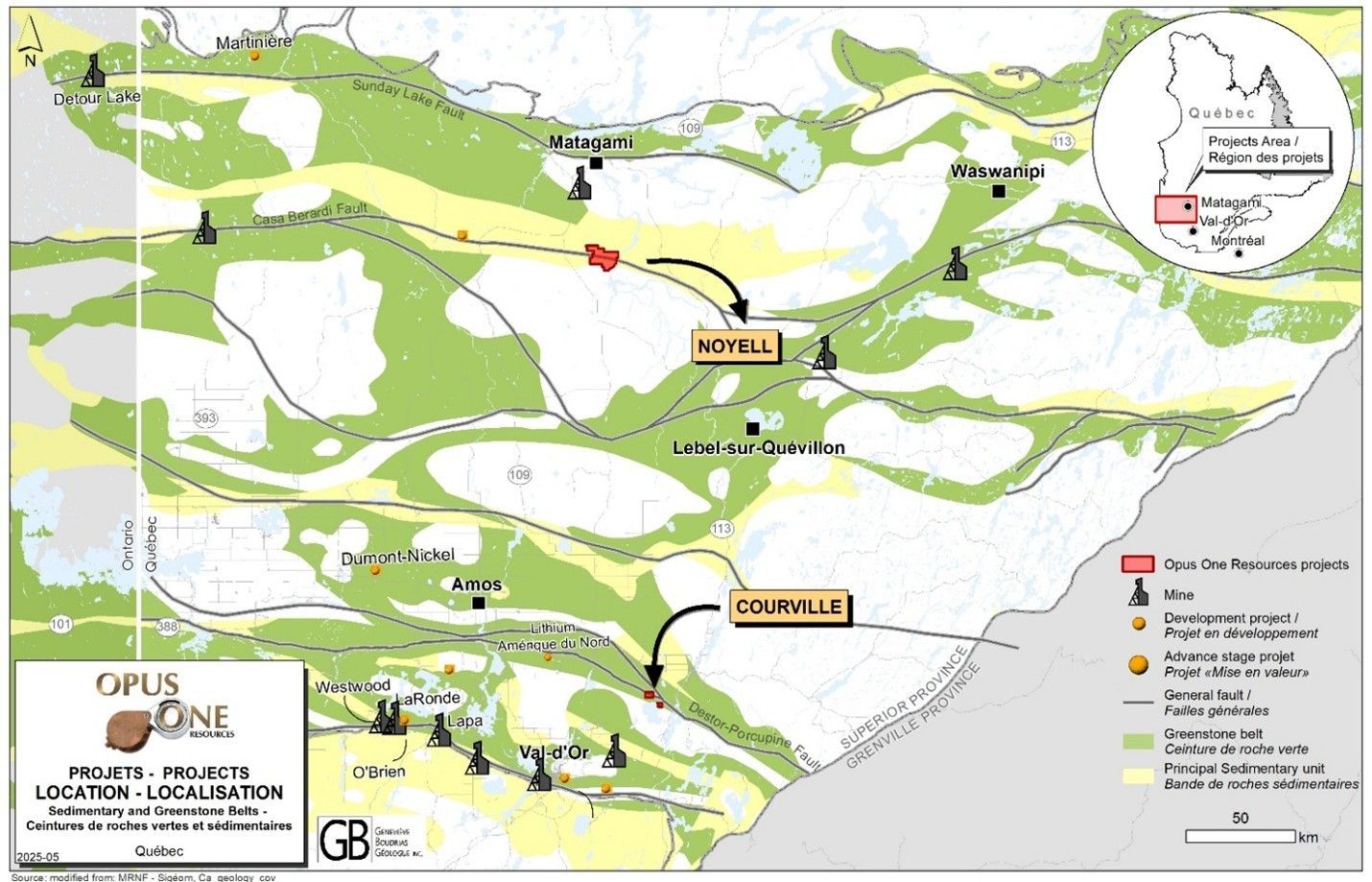

Opus One Gold Corp (TSX-V: OOR) (the " Company " or " Opus One ") is pleased to present a technical update after a successful drilling program carried out at the beginning of winter 2025 on its 100% owned Noyell gold project, south of Matagami in Abitibi, Quebec.

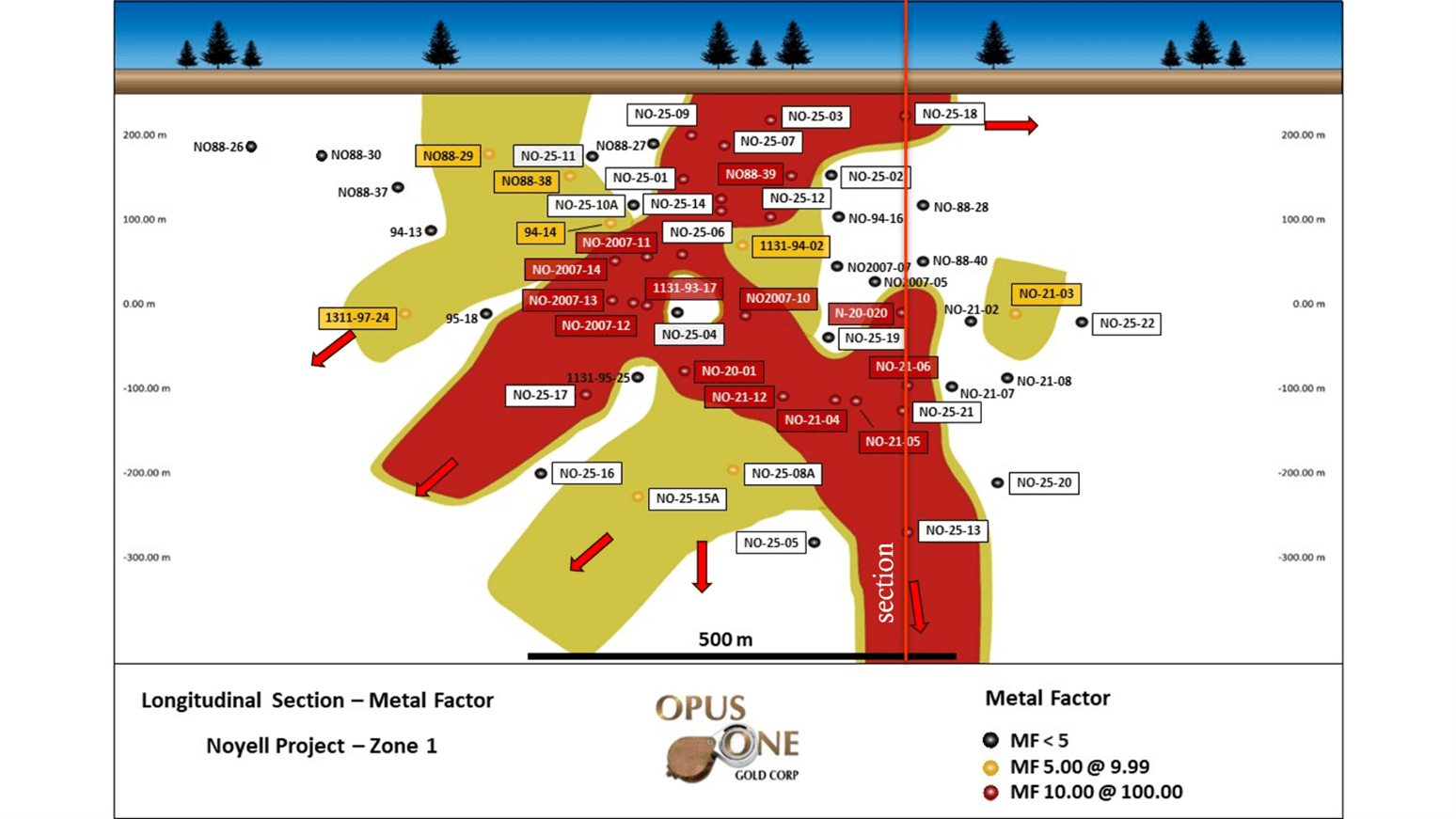

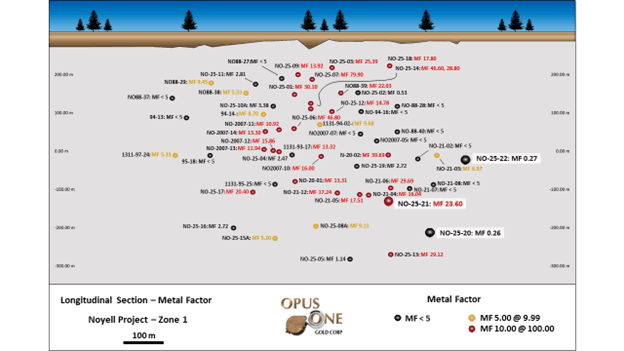

All assay results have been received, compiled and published in previous press releases. Opus One wishes now to present its new interpretation for the gold mineralization on its Zone 1 Discovery (see attached longitudinal section). The longitudinal section is looking north. It strikes at N110° and it dips steeply to the south (66°S). At the 300 m level, Zone 1 extends for approximately 600 m in the east-west direction. Zone 1 appears to reach surface, under the overburden, and it has been followed down to the 500 m level where it remains open (see attached cross section). True thickness of Zone 1 is variable, but it reaches 15m in its upper portion (NO-25-07). Hole NO-25-13, the deepest high-grade interval of Zone 1 exhibits a true thickness of over 5m which represents the approximate average width of the zone.

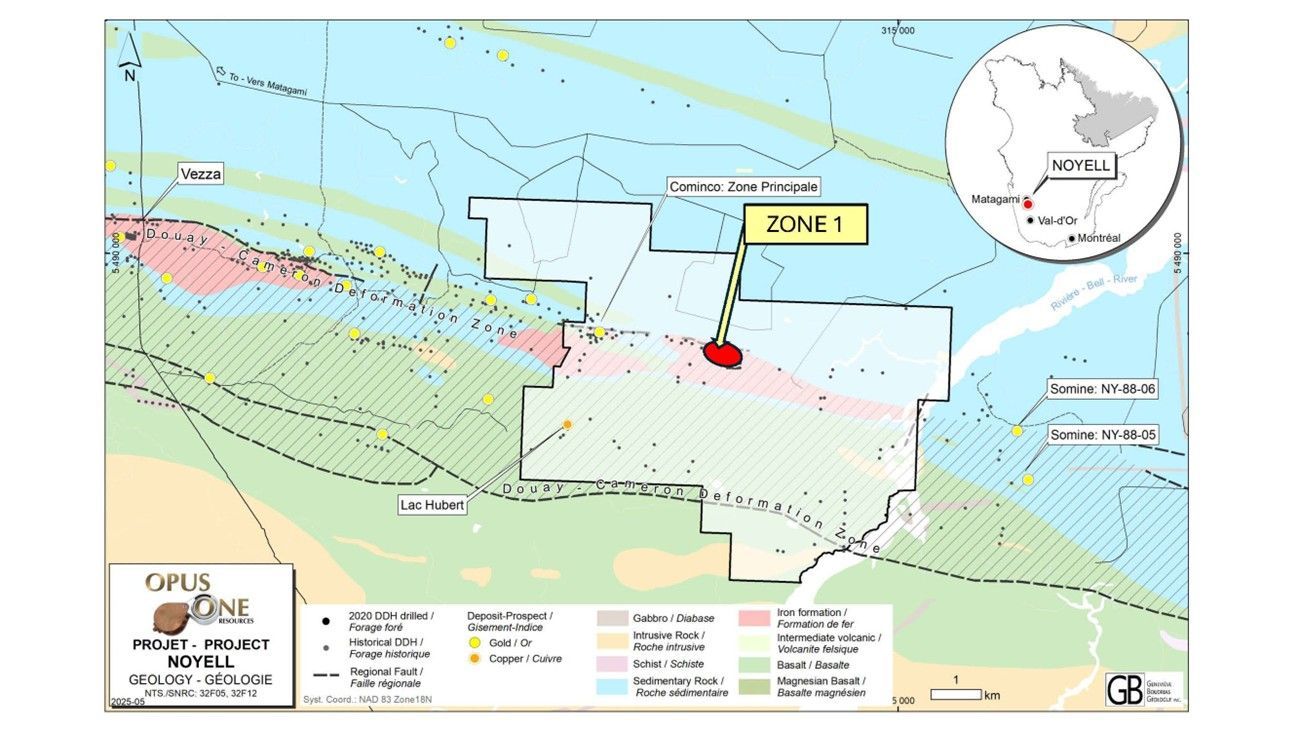

The mineralization within Zone 1 consists of a stockwork of quartz, iron carbonates and semi-massive sulphides (mostly pyrrhotite, with minor pyrite and arsenopyrite) hosted by fine sediments of the Taïbi Formation along the Casa-Berardi-Douay-Cameron deformation corridor (CBDC). Zone 1 is often, but not always, spatially associated with a narrow band of oxide Iron formation (BIF).

A preliminary geological interpretation indicates that Zone 1 might represent a sulphidization of the BIF in a zone of tension along the deformation corridor. The CBDC deformation corridor, which strikes nearly east-west to the west of Zone1, appears to bend slightly to the south near Zone 1 creating a zone of tension which was filled by the stockwork. The gold bearing fluids introduced a lot of quartz, theoretically transformed the magnetite (BIF) into iron sulphides and created a strong and pervasive alteration halo consisting mostly of chamosite, sericite and iron carbonates. Highest gold grades coincide with the highest sulphide content. Some visible gold was observed within the quartz also. No shearing is associated with Zone 1.

Latest drilling by Opus One (9,000 m during the winter months of 2025) indicates that the gold mineralization within the Zone 1 Discovery is open to the east, at least near surface (DDH NO-25-18), it is open at depth along a high grade steeply dipping shoot in its eastern portion (DDH NO-25-13), it appears to be open at depth in the center of the zone along a lower grade shoot (NO-25-15a) and it appears open along three vectors toward the west, at depth (NO-25-15a, NO-25-17 and Soquem's historical hole 1311-97-24).

Opus One is currently carrying digitization and spectrometric studies on core samples from the latest drilling program to better characterize the gold mineralization of Zone 1. Our goal is to identify with certainty where the gold occurs within the stockwork and what are its main mineralogical associations. This work should provide vital information on the potential for gold recovery for this type of mineralization.

Opus One is currently finalizing the compilation of data from its 2025 bio-chemical survey carried out directly to the west and south-west of Zone 1. Results should be made available soon.

Opus One is already gearing up for the upcoming drilling season. Numerous drilling targets have been identified to infill and to extend Zone 1 in all directions and to test new areas in the western portion of the property where significant gold was reported in drill records in the 80's and 90's by previous operators. The permitting process has been initiated, and three drill rigs have been secured for the winter months, early in 2026.

ZONE 1 DISCOVERY – LONGITUDINAL SECTION

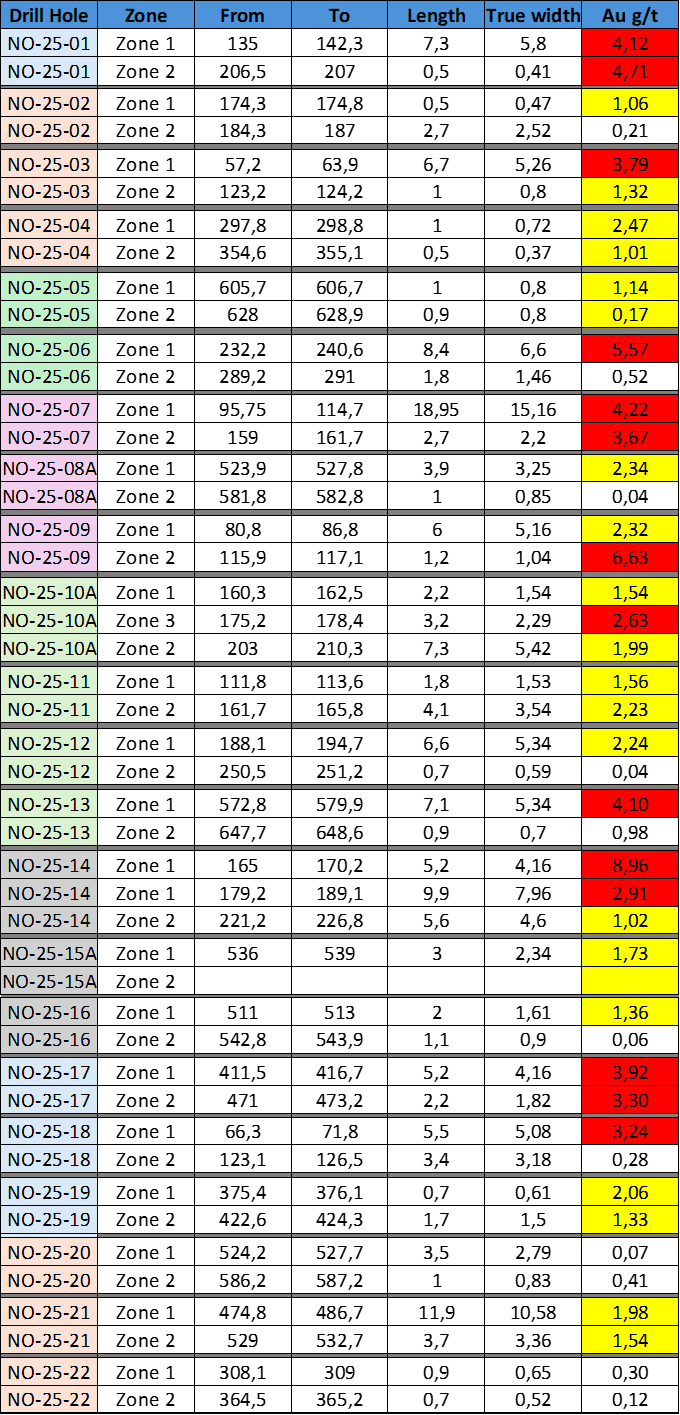

2025 WINTER FINAL DRILLING RESULTS

Louis Morin, Opus One CEO commented: The 2025 drilling program on its Noyell project has been a real success for Opus One. The gold mineralization of Zone 1 has significantly increased and remains potentially open in many directions and along several vectors. We are very optimistic about the forthcoming drilling program on Zone 1 and on the western portion of the property where Opus One never ventured before. With the mobilization of three drill rigs in January 2026, definition drilling of Zone 1 should accelerate significantly. We will go wider, and we will go deeper than ever. The excitement continues.

Sample preparation, analysis and QAQC program

All core recovered is NQ size. All samples are described, labelled, cut (diamond saw) and bagged at Technominex' facilities in Rouyn-Noranda. Samples are then shipped to AGAT certified Laboratory in Val D'or for preparation. Sample pulps are then shipped to various AGAT laboratories in Canada for analysis. Samples are assayed for gold using by Fire Assay (50g), with ICP-OES Finish. All samples equal or above 10 g/t Au are submitted to ore grade gravimetric finish.

Opus One's QAQC program consists of one control sample inserted, at Technominex' facility, after 9 regular samples. Control samples consist of a certified blank and various gold grades certified material.

OPUS ONE Gold Corp.

Opus One Gold Corp. is a mining exploration company focused on discovering high quality gold and base metals deposits within strategically located properties in proven mining camps, close to existing mines in the Abitibi Greenstone Belt, north-western Quebec and north-eastern Ontario - one of the most prolific gold mining areas in the world. Opus One holds assets in the Val-d'Or and Matagami mineral districts.

An independent qualified person, Pierre O'Dowd P.Geo, has verified and approved the data disclosed, including sampling, analytical, and test data underlying the information or opinions contained in the written disclosure as required by section 3.1 and 3.2 of NI43-101.

Forward-Looking Statements

This news release contains statements that may constitute "forward-looking information" within the meaning of applicable Canadian securities legislation. Forward-looking information may include, among others, statements regarding the future plans, costs, objectives or performance of Opus One, or the assumptions underlying any of the foregoing. In this news release, words such as "may", "would", "could", "will", "likely", "believe", "expect", "anticipate", "intend", "plan", "estimate" and similar words and the negative form thereof are used to identify forward-looking statements. Forward-looking statements should not be read as guarantees of future performance or results, and will not necessarily be accurate indications of whether, or the times at or by which, such future performance will be achieved. No assurance can be given that any events anticipated by the forward-looking information will transpire or occur, including the anticipated exploration program on the project, the results of such exploration program, the development of the project and what benefits Opus One will derive from the project, the expected demand for lithium. Forward-looking information is based on information available at the time and/or management's good-faith belief with respect to future events and are subject to known or unknown risks, uncertainties, assumptions, and other unpredictable factors, many of which are beyond Opus One' control.

These risks, uncertainties and assumptions include, but are not limited to, those described under "Financial Instruments" and "Risk and Uncertainties in Opus One' Annual Report for the fiscal year ended August 31 st , 2024, a copy of which is available on SEDAR at www.sedar.com and could cause actual events or results to differ materially from those projected in any forward-looking statements. Opus One does not intend, nor does Opus One undertake any obligation, to update or revise any forward-looking information contained in this news release to reflect subsequent information, events or circumstances or otherwise, except if required by applicable laws.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of the release.

For more information, please contact:

Louis Morin

Chief Executive Officer & Director

Tel.: (514) 591-3988

Michael W. Kinley, CPA, CA

President, Chief Financial Officer & Director

Tel: (902) 826-1579

Visit Opus One's website: www.OpusOneGold.com

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/659e0dca-d039-45d8-8c14-dd1fb668c4a3

https://www.globenewswire.com/NewsRoom/AttachmentNg/a0afc2d9-c741-4b7c-9491-bffb3f269694

https://www.globenewswire.com/NewsRoom/AttachmentNg/a712815e-e16e-4770-a5dd-25d303769c7b

https://www.globenewswire.com/NewsRoom/AttachmentNg/f39966b8-adb5-4f29-ace5-8178d8d5f1f7

https://www.globenewswire.com/NewsRoom/AttachmentNg/b4c511a1-33b1-4319-8b95-a4677550b79f