February 25, 2025

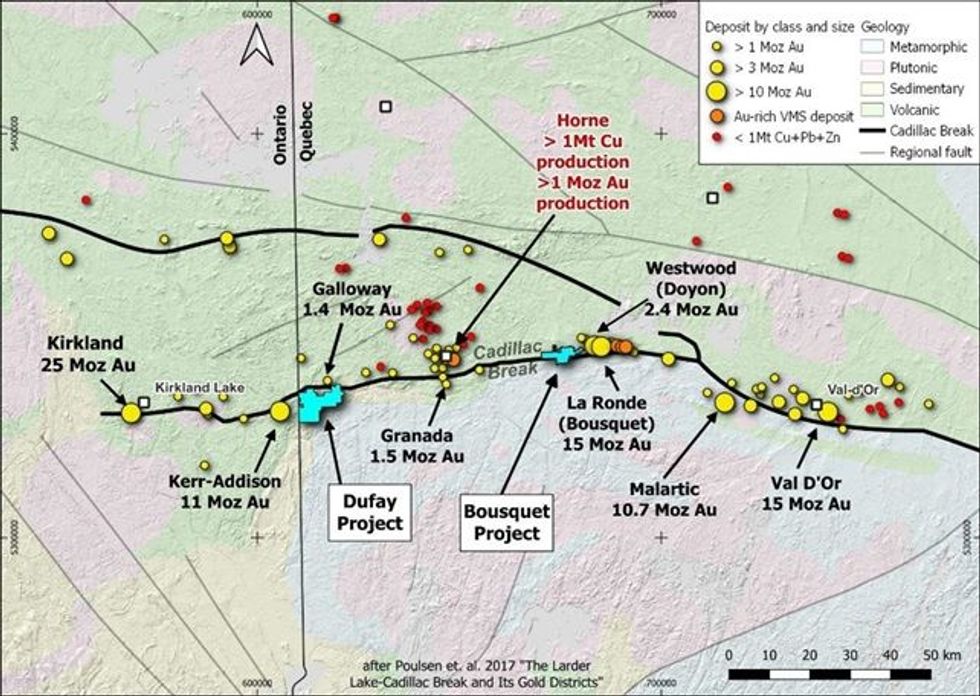

Olympio Metals Limited (ASX:OLY) (Olympio or the Company) is pleased to announce that it has signed a binding Letter of Intent with Bullion Gold Resources Corporation (TSX-V:BGD) to enter into an option to acquire up to 80% of the Bousquet Gold Project (Bousquet Option), an advanced high- grade gold project on the Cadillac-Lake Larder Fault Zone, known as the ‘Cadillac Break’ in Quebec, Canada. This terrane bounding structure is associated with world class orogenic gold and copper mineralisation1. The Bousquet Project is located 30km east of the Rouyn-Noranda Au-Cu mining centre (Horne and Granada mines) and 15km west of the Bousquet Mining Camp, which includes the>15Moz Au La Ronde2 and 2.4 Moz Au Westwood3 working mines (Figure 1).

Highlights

- Option to acquire up to 80% of the Bousquet Gold Project from Bullion Gold

- Located on the Cadillac Break, a regional structure associated with world class gold and copper mineralisation (>110 Moz Au1)

- Numerous high-grade prospects including Paquin East with historical intercept of 9m @ 16.96g/t Au6

- Within 15km of multi-million ounce working gold mines (Agnico Eagle’s La Ronde - 15.8Moz Au2 and Iamgold’s Westwood - 2.4Moz Au3)

- High-grade, quartz hosted vein systems with common visible gold, similar to nearby O’Brien Project 15km to the east (1.0Moz Au4, Radisson)

- 24km2 of contiguous tenure, covering a 10km strike of the Cadillac Break

- Complements the Company’s Dufay Au-Cu Project 60km to the west, and provides a combined 20km strike exposure to highly prospective segments of the Cadillac Break

- Excellent road, rail and hydroelectric infrastructure runs through the project, with year- round access

- Underexplored property with the majority of drillholes completed pre-1947

- The Option provides further exposure to a strong gold price with flexible structure terms

Olympio’s Managing Director, Sean Delaney, commented:

“Acquiring the advanced Bousquet Gold Project presents a significant opportunity for Olympio to expand our exposure to one of the world’s premier gold-bearing structures—the renowned Cadillac Break. The project is strategically positioned between substantial gold deposits to the east and west, with numerous high-grade gold prospects featuring gold both at surface and in drilling. This makes Bousquet an exceptional exploration target. The geological setting and mineralisation style closely resemble the nearby million-ounce O’Brien Project, where high-grade gold zones are often associated with visible gold in quartz veining.

“The Project is next to working gold mines with under-utilised mills (<20km by road), with a major highway, railway and hydroelectric power all traversing the centre of the project.

Bullion are divesting Bousquet to focus on their large Bodo polymetallic project which provides Olympio with this great opportunity to explore in one of the world’s best gold regions.”

The Bousquet Gold Project is a strategic land acquisition which complements the Dufay Gold-Copper Project 60km to the west along the renowned Cadillac Break. The southern half of the project covers a well-defined, regionally mineralised zone to the south of the Cadillac Break, which hosts numerous gold prospects within Timiskaming Group sediments that are exclusively correlated with the development of the Cadillac Break.

The Bousquet Project includes several advanced gold prospects and numerous structural and geophysical targets that remain untested by drilling or modern exploration. The majority of drilling on the project is pre-1947, and all prospects remain under-explored.

HIGH GRADE QUARTZ VEINS IN FAVOURABLE GEOLOGICAL CONTEXT

Gold mineralisation at Bousquet is structurally controlled, quartz vein-hosted, high-grade gold associated with second and third order structures peripheral to the Cadillac Break, which is typical of the majority of mineralisation on the Cadillac Break1.

Click here for the full ASX Release

This article includes content from Olympio Metals Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

3h

Peruvian Metals Closes Private Placement

Peruvian Metals Corp (TSXV: PER,OTC:DUVNF) ("Peruvian Metals" or the "Company") is pleased to announce the closing of its non-brokered private placement (the "Offering") previously announced on January 29, 2026. Pursuant to the Offering, the Company issued an aggregate of 10,000,000 units... Keep Reading...

5h

Blackrock Silver Commences 17,000 Metre Two-Phased Expansion Drill Programs at Tonopah West Project

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") announces the mobilization of drill rigs for two major resource expansion drill campaigns at the Tonopah West project ("Tonopah West") located along the Walker Lane Trend in Nye and Esmeralda... Keep Reading...

16h

How to Invest in Gold Royalty and Streaming Stocks

Gold royalty companies offer investors exposure to gold and silver with the benefits of diversification, lower risk and a steady income stream. Royalty companies operating in the resource sector will typically agree to provide funding for the exploration or development of a resource in exchange... Keep Reading...

16h

How Would a New BRICS Currency Affect the US Dollar?

The BRICS nations, originally composed of Brazil, Russia, India, China and South Africa, have had many discussions about establishing a new reserve currency backed by a basket of their respective currencies. The creation of a potentially gold-backed currency, known as the "Unit," as a US dollar... Keep Reading...

19h

Toronto to Host Global Mineral Sector for PDAC 2026, March 1 – 4

The Prospectors & Developers Association of Canada (PDAC) will bring together the mineral exploration and mining community in Toronto for its 94th annual Convention, taking place March 1 – 4, 2026, at the Metro Toronto Convention Centre (MTCC).As the World’s Premier Mineral Exploration & Mining... Keep Reading...

23h

THE SIGNAL ARCHITECTURE: 5 Stocks Calibrating the 2026 Infrastructure Cycle

USANewsGroup.com Market Intelligence Brief — WHAT'S HAPPENING: The infrastructure holding the global economy together is being stress-tested in real time: Gold at $5,552 per ounce as central banks loaded another 755 tonnes into reserves [1]The G7 issued formal guidance treating the quantum... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00