Overview

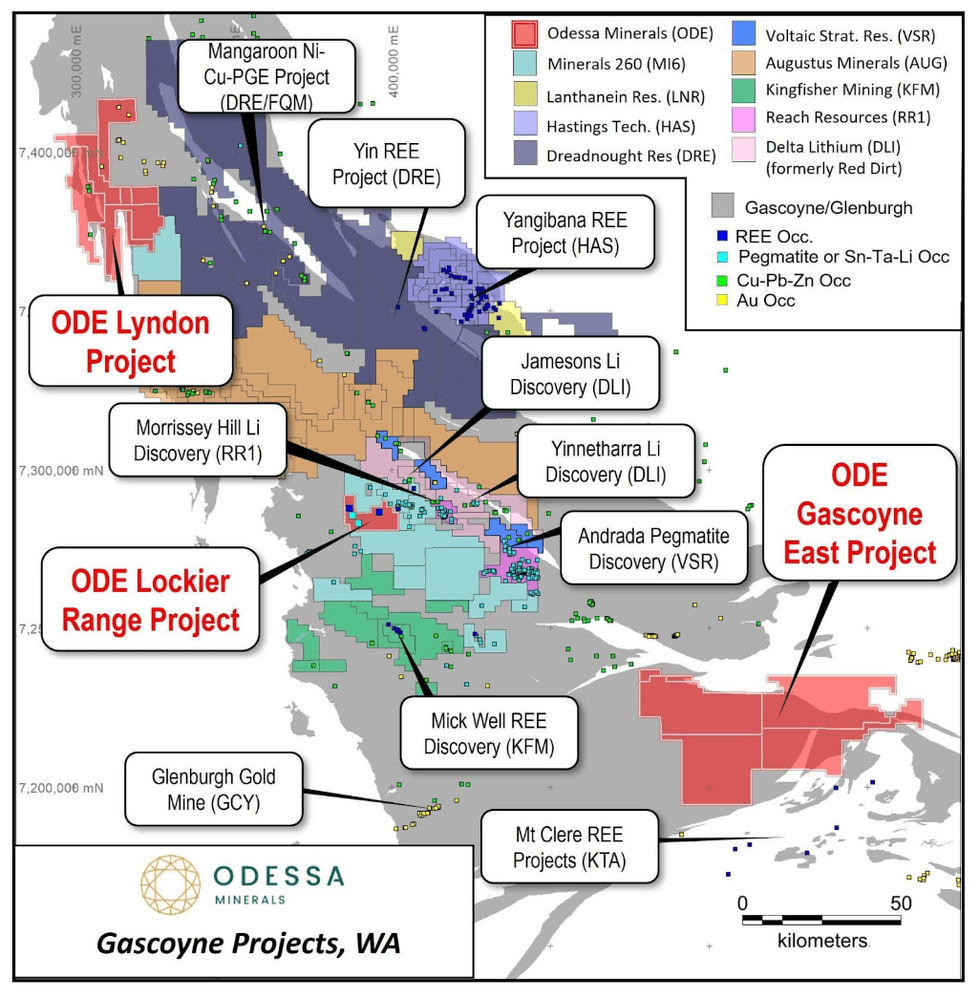

Odessa Minerals (ASX:ODE) is an ASX-listed junior mining and exploration company focusing on uranium exploration in the Gascoyne Region of Western Australia via its three projects— Lyndon Project, Relief Well and Gascoyne East.

Odessa Mineral’s pivot towards uranium and away from lithium is a smart move, especially in the current environment of high uranium prices. Uranium prices have soared to their highest point since 2008, surpassing US$100 per pound. This upward trend is expected to continue due to the ongoing supply and demand imbalance for uranium. With its portfolio of uranium projects, Odessa is strategically positioned to capitalize on these robust market fundamentals.

Odessa Minerals’ projects in the Gascoyne Region of Western Australia totalling >3,000km2

The company’s flagship Lyndon project is immediately adjacent to Paladin Energy’s 15.6 million pounds (Mlbs) U3O8 Carley Bore uranium project. The Lyndon Project has identified highly significant uranium intersections with some rock chip sample assay results showing exceptional grades up to 6,612 parts per millions (ppm) U3O8 at the Baltic Bore and Jailor Bore prospects. Odessa plans to begin drilling at the target areas in 2024.

The other two projects—Relief Well and Gascoyne East—have shown significant potential for uranium. An extensive palaeochannel stretching over 8 kilometers has been verified at Relief Well, offering the potential for uranium mineralization in a roll-front style. Odessa is planning a drilling program to test roll-front uranium mineralization at Relief Well.

The Gascoyne East project is one of the most under-explored areas in the Gascoyne Province. The company has identified multiple gold, copper and uranium targets for the project, and drilling has been planned for 2024.

The company is in the early stages of its operations, making it attractive for investors looking to get exposure to uranium assets in a tier-1 mining region like Gascoyne. The high insider holding, at nearly 28 percent, is an encouraging sign for investors as it aligns management’s interests with those of the shareholders.

Company Highlights

- Odessa Minerals is an ASX-listed, uranium exploration company with a large holding covering over 3,000 sq. km. in the Gascoyne region of Western Australia. The company has three key projects in the area – Lyndon, Relief Well, Gascoyne East.

- The company focuses on advancing uranium prospects at its flagship project, Lyndon. Lyndon is adjacent to Paladin Energy’s Carley Bore uranium project, which has a resource base of 15.6 Mlbs U3O8.

- Initial review of the Lyndon project has identified highly significant uranium intersections at the Jailor Bore, Baltic Bore and Ben Hur prospects, with some exceptional grades reaching up to 6,600 ppm U3O8.

- The Relief Well Uranium Project has revealed significant palaeochannel-hosted uranium mineralization typically amenable to low-cost recovery. The company will move forward with drill planning and seek approvals to conduct drilling at the Relief Well prospect.

- Uranium prices have surged to their highest level since 2008, exceeding US$100 per pound. This upward trend is anticipated to persist due to the tight supply and demand balance for uranium. Odessa's portfolio of uranium projects is well-positioned to benefit from strong fundamentals.

- The Gascoyne East project has extensive gold, copper and uranium targets that were identified during the recent airborne survey. The company is planning air-core and RC drilling for the project in 2024.

- The Company’s senior leadership team is well-experienced in the mining sector and has significant ownership in the company at nearly 28 percent. This is an encouraging sign for investors as it aligns the management’s interest with that of the shareholders.

Get access to more exclusive Uranium Investing Stock profiles here