January 23, 2024

Octava Minerals Limited (ASX:OCT) (“Octava” or the “Company”), a Western Australia focused explorer of the new energy metals Lithium, Nickel, PGM’s and gold, is pleased to report that it has signed a binding but conditional agreement to purchase 100% of the shares in Byro Mining Pty Ltd (“Byro”), the owner of the Byro REE & Lithium Project in the Gascoyne region of Western Australia, from the shareholders of Byro.

Highlights

- Octava has signed a binding conditional agreement for the acquisition of 100% of the issued capital of Byro Mining Pty Ltd, which holds the Byro sedimentary REE and Li project.

- Low-cost entry into potential new source of critical minerals.

- Previous exploration suggests a possible large-scale REE / Li deposit with potential for additional critical minerals.

- GSWA soil sampling identified widespread anomalous halo of REO (Ce, La, Sc & Y only) & Li2O over 40km of strike length.

- Historic drilling over 25km of strike show thick intersections (>90m) of anomalous REE and lithium in black shale.

- Octava will commence material characterisation and extraction studies of critical minerals on existing samples.

Octava’s Managing Director Bevan Wakelam stated,” We are pleased to have secured an agreement to acquire this project. Previous work has identified the Permian black shales of the Byro sub basin to be metalliferous, with anomalous REE & lithium that is laterally extensive and over large thicknesses in historic drilling.

With a low-cost entry point into this highly prospective project, Octava will investigate the potential for Australia’s first, large scale sedimentary deposit of REE & lithium. Metal extraction from black shales is a proven, low-cost technology and we will immediately get to work on material characterisation and initial mineral extraction testwork and further drilling.”

About the Byro Project

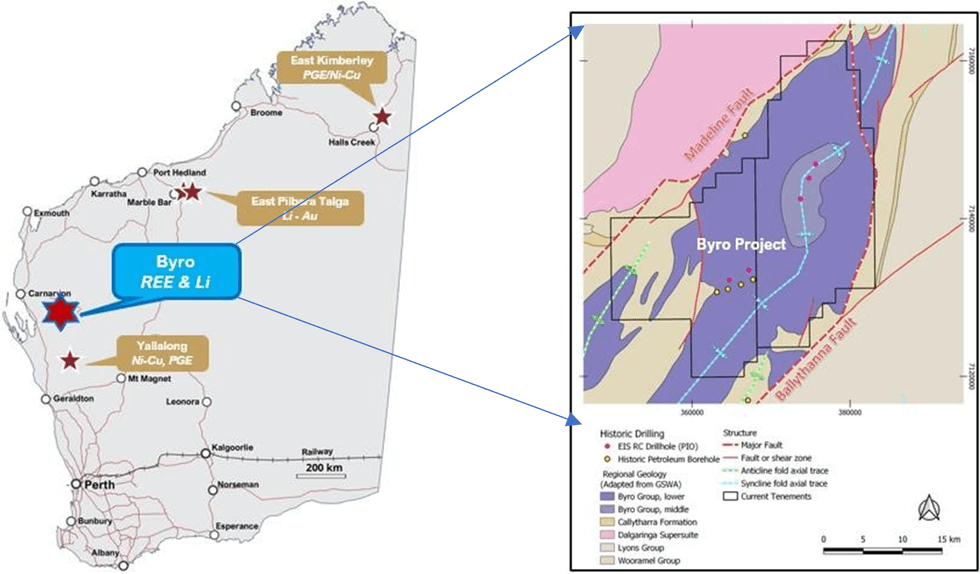

The Byro Project is located on the Byro Plains of the Gascoyne Region, Western Australia, 220km south-east of Carnarvon and 650 km north of Perth. It consists of two granted Exploration Licences – E 09/2673 and E 09/2674 – totalling 798 km2. The Byro Project also has Native Title agreements in place. Nearby infrastructure includes accessibility to a commercial port (Geraldton) and power from the NW gas pipeline and future potential access to Western Australian government proposed green energy sites.

The Byro project lies at the centre of the Byro Sub-basin of the Carnarvon Basin. The sub-basin is Permo-Carboniferous and is approximately 100km by 150km in size and up to 3km in depth. The basin is bound to the east by the Precambrian Yilgarn Craton margin, and to the west by extensions of the Darling Fault. The Permian period is well known for the development of extensive hydrothermal activity, with SEDEX / sediment-hosted polymetallic deposits best known in Europe (Kupfershiefer, Poland and Germany).

GSWA regional soil sampling (4km by 4km sample spacing) identified large anomalous halos of REO up to 540ppm & Li2O up to 180ppm over 40km in strike length and 20km wide. (see Figure 2 below). The tenement area also contains five wide-spaced historic RC drillholes over a ~ 25km strike length and four ~ 1.5km spaced, historic petroleum boreholes (see Figure 1 above).

The historic assay results from the 5 RC drillholes have shown anomalous lithium (200 - 430 ppm Li2O) over large thickness (30 to 90m thick; see table 1A in JORC table in Appendix 2) and are from near surface. Selected drill cutting samples from the petroleum wells North Ballythana Core holes 1 to 4 (stored in the GSWA core Library in Perth) have also been geochemically analysed, returning similar anomalous lithium grades. The sampling has also identified anomalous REE, with samples > 500 ppm TREO and > 600 ppm V205 (see table 2A and 2B in and JORC table in Appendix 2).

Click here for the full ASX Release

This article includes content from Octava Minerals Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

21 January

Official signing of the Portuguese State Grant

Savannah joins other grant recipient companies at official signing ceremony

Savannah Resources Plc, the developer of the Barroso Lithium Project in Portugal, a 'Strategic Project' under the European Critical Raw Materials Act and Europe's largest spodumene lithium deposit (the 'Project'), was delighted to join with other recipients of State grants yesterday at the... Keep Reading...

21 January

Excellent Results from 2025 Core Drilling Program at McDermitt

Jindalee Lithium Limited (Jindalee, or the Company; ASX: JLL, OTCQX: JNDAF) is pleased to report assay results from the drilling program at the McDermitt Lithium Project completed late 2025. All holes returned strong lithium and magnesium intercepts from shallow depths, including:R92: 36.5m @... Keep Reading...

08 January

Top 5 US Lithium Stocks (Updated January 2026)

The global lithium market enters 2026 after a punishing 2025 marked by oversupply, weaker-than-expected EV demand and sustained price pressure, although things began turning around for lithium stocks in Q4. Lithium carbonate prices in North Asia fell to four-year lows early in the year,... Keep Reading...

07 January

5 Best-performing ASX Lithium Stocks (Updated January 2026)

Global demand for lithium presents a significant opportunity for Australia and Australian lithium companies.Australia remains the world’s largest lithium miner, supplying nearly 30 percent of global output in 2024, though its dominance is easing as other lithium-producing countries such as... Keep Reading...

05 January

CEOL Application for Laguna Verde Submitted

CleanTech Lithium PLC ("CleanTech Lithium" or "CleanTech" or the "Company") (AIM: CTL, Frankfurt:T2N), an exploration and development company advancing sustainable lithium projects in Chile, is pleased to announce it has submitted its application (the "Application") for a Special Lithium... Keep Reading...

29 December 2025

SQM, Codelco Seal Landmark Lithium Joint Venture in Salar de Atacama

Sociedad Quimica y Minera (SQM) (NYSE:SQM) and Codelco have finalized their long-awaited partnership, forming a new joint venture that will oversee lithium production in Chile’s Salar de Atacama through 2060.SQM announced on Saturday (December 27) that it has completed its strategic partnership... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00