October 30, 2024

Octava Minerals Limited (ASX:OCT) (“Octava” or the “Company”), a Western Australia focused explorer of the new energy metals REE’s, antimony, gold & nickel, is pleased to provide an exploration update on its Western Australian exploration projects.

Highlights

- Mobilisation of crews for detailed geophysical survey over the identified 10km antimony corridor at Yallalong.

- Heritage clearance confirmed over two priority antimony drill targets, Discovery and Central, in preparation for drilling to commence.

- Drilling to focus on extending the existing high-grade antimony mineralisation along strike and at depth over the Discovery target.

- Heritage surveys over next 2 priority antimony targets planned for early December.

- Drill site preparation underway at the large Byro REE & Li project in readiness for metallurgical core drilling to commence mid-November.

Yallalong Antimony

The Yallalong project is located ~ 220km to the northeast of the port town of Geraldton in Western Australia and comprises two granted Exploration Licences, E70/5051 (100% owned) with an exploration area of 63.4km2 and E09/2823 (100% owned) with an exploration area of 94km2.

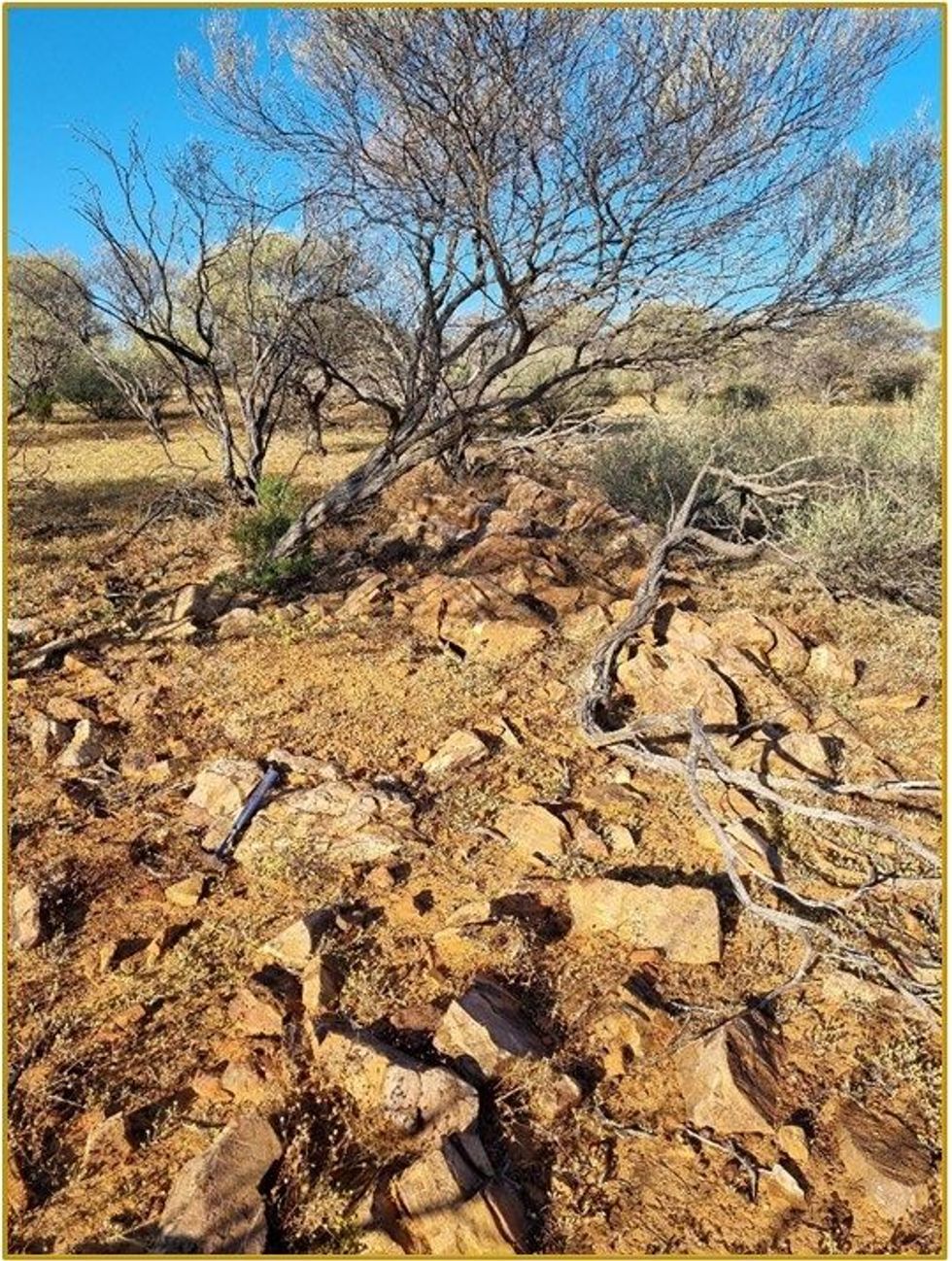

The antimony (Sb) mineralisation identified at Yallalong appears to occur within a 10km north- south striking mineralised corridor that is interpreted to be related to a structural corridor between the Darling and Woodrarung faults. (Refer ASX announcement 17 September 2024)

Octava will begin detailed gravity and seismic surveys over the identified antimony corridor at Yallalong. Teams will mobilise on ground in the coming days. The geophysical surveys will provide details on the key structures such as shears & faults which act as conduits to mineralising fluids. It will also provide better understanding of the key lithological boundaries.

POW applications covering the 4 priority antimony targets have been approved. These approvals cover the exploration and planned drilling of the antimony targets at the Yallalong Project.

The two priority targets, Discovery and Central, have confirmed heritage clearance, clearing the path for drilling to commence. Heritage surveys covering the No.4 and North targets are expected to be completed by early December in preparation for drilling early in the new year.

The drilling at the Discovery target will focus on extending the previously intersected high-grade antimony mineralisation, both along strike and at depth, with the aim of outlining an antimony resource. Drilling at the Central target will test anomalous antimony at surface, as no drilling has been carried out previously.

Byro

The Byro Project is located on the Byro Plains of the Gascoyne Region, Western Australia, 220 km south-east of Carnarvon and 650 km north of Perth. The Byro project is prospective for rare earths (REE’s), lithium and base metals. (Refer ASX announcement 24 January 2024)

Previous GSWA regional soil sampling and RC drilling has recorded wide areas and large intercepts of anomalous REE, Li & other elements including V and Zn. Previous work identifies an area of mineralisation occurring over more than 30km in strike length and 15km in width. See Figure 2.

Click here for the full ASX Release

This article includes content from Octava Minerals Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

19 February

Top Australian Mining Stocks This Week: Lithium Valley Results Boost Gold Mountain

Welcome to the Investing News Network's weekly round-up of the top-performing mining stocks listed on the ASX, starting with news in Australia's resource sector.Mining giant BHP (ASX:BHP,NYSE:BHP,LSE:BHP) reported strong half-year copper results, saying that its copper operations accounted for... Keep Reading...

17 February

Howard Klein Doubles Down on Strategic Lithium Reserve as Project Vault Takes Shape

Before the Trump administration revealed plans for Project Vault, Howard Klein, co-founder and partner at RK Equity, proposed the idea of a strategic lithium reserve. “The goal of a strategic lithium reserve is to stabilize prices and allow the industry to develop,” he told the Investing News... Keep Reading...

17 February

Sigma Lithium Makes New Lithium Fines Sale, Unlocks US$96 Million Credit Facility

Sigma Lithium (TSXV:SGML,NASDAQ:SGML) has secured another large-scale sale of high-purity lithium fines and activated a production-backed revolving credit facility as it ramps up operations in Brazil.The lithium producer announced it has agreed to sell 150,000 metric tons (MT) of high-purity... Keep Reading...

12 February

Albemarle Lifts Lithium Demand Forecast as Energy Storage Surges

Albemarle (NYSE:ALB) is raising its long-term lithium demand outlook after a breakout year for stationary energy storage, underscoring a shift in the battery materials market that is no longer driven solely by electric vehicles.The US-based lithium major reported fourth quarter 2025 net sales of... Keep Reading...

21 January

Official signing of the Portuguese State Grant

Savannah joins other grant recipient companies at official signing ceremony

Savannah Resources Plc, the developer of the Barroso Lithium Project in Portugal, a 'Strategic Project' under the European Critical Raw Materials Act and Europe's largest spodumene lithium deposit (the 'Project'), was delighted to join with other recipients of State grants yesterday at the... Keep Reading...

21 January

Excellent Results from 2025 Core Drilling Program at McDermitt

Jindalee Lithium Limited (Jindalee, or the Company; ASX: JLL, OTCQX: JNDAF) is pleased to report assay results from the drilling program at the McDermitt Lithium Project completed late 2025. All holes returned strong lithium and magnesium intercepts from shallow depths, including:R92: 36.5m @... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00