September 05, 2023

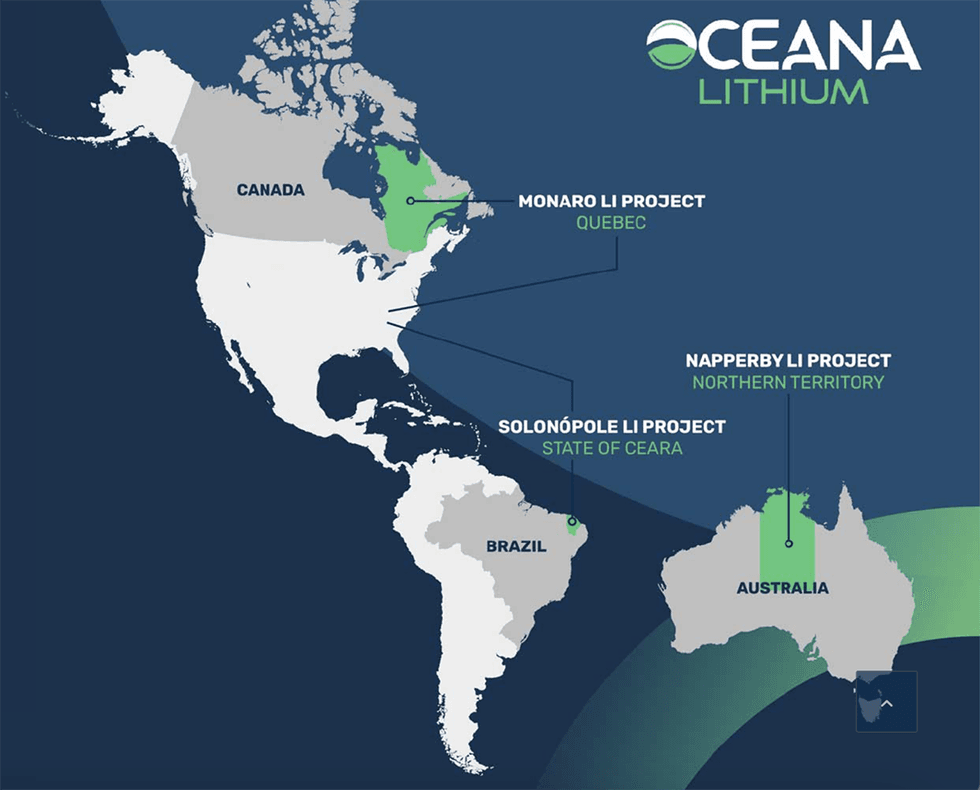

Oceana Lithium (ASX:OCN) is well-positioned to explore three strategic and highly prospective lithium projects in Australia, Canada and Brazil — all tier-one mining jurisdictions. Oceana Lithium is an early-stage exploration company with flagship Solonópole project displaying considerable promise.

The company's well-informed exploration strategy stems from veteran geologists and mining professionals with decades of experience between them. It's already identified multiple exploration targets across all three projects, all of which are highly prospective and known to contain lithium.

Oceana's Solonópole project consists of eight permits covering 114 square kilometers of highly prospective ground. Detailed field mapping by Oceana's Brazilian subsidiary Ceara Litio has identified a significant mineralized pegmatite corridor within the company's claim. The permits also cover several historic artisanal mining sites previously tapped for lithium, tantalum, niobium and tin.

Company Highlights

- Oceana Lithium is an early-stage exploration company with significant discovery opportunities.

- The company maintains three strategic and highly prospective lithium projects in Australia, Canada and Brazil — all tier-one mining jurisdictions.

- Brazil in particular is an emerging international destination for lithium, with multiple promising discoveries in recent years.

- Recent investments in battery manufacturing within the country also present a huge opportunity for lithium exploration.

- Oceana's well-informed exploration strategy is helmed by geologists with considerable experience, including James Abson, Uwe Naeher, and Renato Braz Sue.

- The company has committed to embracing Indigenous peoples and values within its project areas with the goal of sustainable critical minerals development that honours the lives, memories, sacred sites, traditions and hopes of landowners.

- The company is well-funded to advance exploration on all its projects, with $6 million in cash following a well-supported private placement in July 2023.

- Investors can expect strong newsflow over the coming months, as drilling is underway in Brazil and on-ground exploration has commenced in Canada.

This Oceana Lithium profile is part of a paid investor education campaign.*

Click here to connect with Oceana Lithium (ASX:OCN) to receive an Investor Presentation

OCN:AU

The Conversation (0)

12 March 2024

Oceana Lithium

Large-scale, highly prospective, pre-discovery projects in Brazil and Australia

Large-scale, highly prospective, pre-discovery projects in Brazil and Australia Keep Reading...

21 January

Official signing of the Portuguese State Grant

Savannah joins other grant recipient companies at official signing ceremony

Savannah Resources Plc, the developer of the Barroso Lithium Project in Portugal, a 'Strategic Project' under the European Critical Raw Materials Act and Europe's largest spodumene lithium deposit (the 'Project'), was delighted to join with other recipients of State grants yesterday at the... Keep Reading...

21 January

Excellent Results from 2025 Core Drilling Program at McDermitt

Jindalee Lithium Limited (Jindalee, or the Company; ASX: JLL, OTCQX: JNDAF) is pleased to report assay results from the drilling program at the McDermitt Lithium Project completed late 2025. All holes returned strong lithium and magnesium intercepts from shallow depths, including:R92: 36.5m @... Keep Reading...

08 January

Top 5 US Lithium Stocks (Updated January 2026)

The global lithium market enters 2026 after a punishing 2025 marked by oversupply, weaker-than-expected EV demand and sustained price pressure, although things began turning around for lithium stocks in Q4. Lithium carbonate prices in North Asia fell to four-year lows early in the year,... Keep Reading...

07 January

5 Best-performing ASX Lithium Stocks (Updated January 2026)

Global demand for lithium presents a significant opportunity for Australia and Australian lithium companies.Australia remains the world’s largest lithium miner, supplying nearly 30 percent of global output in 2024, though its dominance is easing as other lithium-producing countries such as... Keep Reading...

05 January

CEOL Application for Laguna Verde Submitted

CleanTech Lithium PLC ("CleanTech Lithium" or "CleanTech" or the "Company") (AIM: CTL, Frankfurt:T2N), an exploration and development company advancing sustainable lithium projects in Chile, is pleased to announce it has submitted its application (the "Application") for a Special Lithium... Keep Reading...

29 December 2025

SQM, Codelco Seal Landmark Lithium Joint Venture in Salar de Atacama

Sociedad Quimica y Minera (SQM) (NYSE:SQM) and Codelco have finalized their long-awaited partnership, forming a new joint venture that will oversee lithium production in Chile’s Salar de Atacama through 2060.SQM announced on Saturday (December 27) that it has completed its strategic partnership... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Trading Halt

11h

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00