May 01, 2023

First exploration drilling program at Comet Vale in ~15 years returns strong results outside Resource; New program planned to target high-grade extensions and regional prospects

Labyrinth Resources Limited (Labyrinth or the Company) (ASX: LRL) is pleased to announce very high- grade assays from its first drilling program at its 51% owned Comet Vale gold project in WA.

Key Points

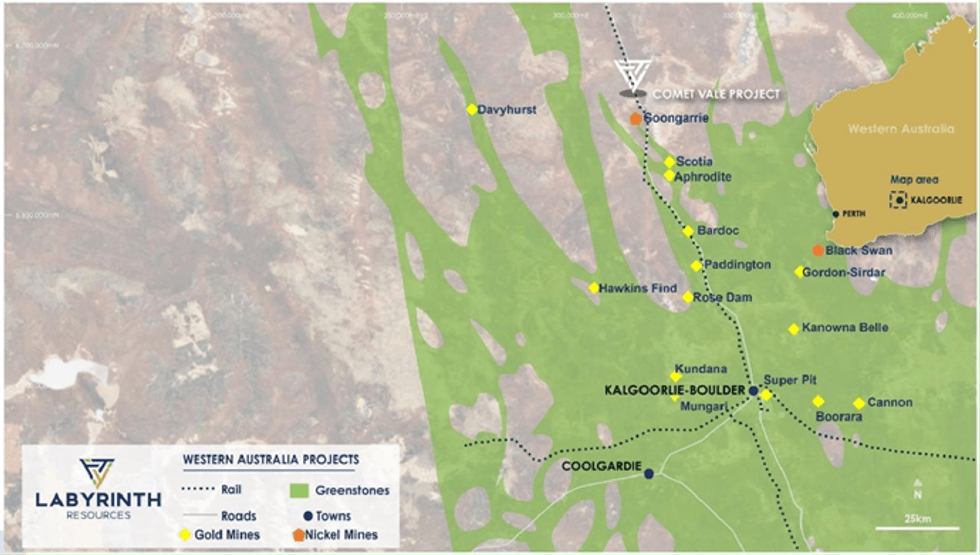

- High-grade assays received for the recently completed 1,500m, 18-hole surface exploration drill program at Comet Vale’s Sovereign Trend, just 100km from Kalgoorlie

- Significant high-grade results from this program include:

- 5m @ 15g/t Au from 46m including 2m @ 35.6g/t from 49m in hole CVRC23_008

- 3m @ 11.41g/t Au from 46m in hole CVRC23_007

- 2m @ 15.53g/t Au from 126m including 1m @ 25.56g/t from 127m in hole CVRC23_016

- Multiple high-grade results outside of recent JORC 2012 Resource, providing immediate follow up targets

- High grade results were all within 120m of surface and majority within 50m of surface, reinforcing potential for near-term open pit opportunity

- These results follow the recently released high-grade Resource of 96,000oz @ 4.8g/t1

- Resource is open in all directions, demonstrating substantial growth potential through both the near-mine and regional drilling across other known gold trends

Next Steps:

- Follow up drilling is planned to target down dip extensions

- Regional exploration drilling is planned to target additional known gold and copper/gold trends as well as other known commodities present on the property, including nickel

- Flora and fauna surveys to be conducted on the eastern tenements in preparation for regional exploration programs

The 1,500m reverse circulation surface drilling program completed in April 2023 is the first genuine surface exploration undertaken at Comet Vale for 15 years. This is despite the project hosting extensive high-grade gold and copper mineralisation across its approved mining lease tenure that straddles the Goldfields Highway just 100km north of Kalgoorlie.

The 18-hole program targeted the Sovereign Gold Trend, host to previous underground and open pit mining, and produced multiple significant high-grade results including:

- 5m @ 15g/t Au from 46m, including 2m @ 35.6g/t Au from 49m, in hole CVRC23_008 and 3m @ 11.41g/t Au from 46m in hole CVRC23_007, with both results down-dip of the existing Princess Grace open pit

- 4m @ 8.02g/t Au from 126m including 2m @ 15.53g/t (with 1m @ 25.56g/t) Au from 125m in hole CVRC23_016, located outside of the current Resource and along strike from historical Sand Queen underground workings

This first exploration drilling campaign has delivered on all fronts, demonstrating significant growth potential outside of known mineralisation, reinforcing the planning of subsequent drilling programs to expand on the initial results and confirming the high-grade nature of the recently released open pit and underground Resources of 39,477oz @ 3.3g/t Au and 56,233oz @ 7.0g/t respectively1.

Labyrinth Chief Executive Matt Nixon said: "These results are an outstanding start to our exploration campaign at Comet Vale.

“They show that there is huge potential to establish a substantial Resource with scale, grade and close proximity to surface.

“The mineralisation is open in all directions and we are very eager to test for down dip extensions in the next round of drilling.

“This area has been exposed to virtually no modern exploration and given the results achieved in just our first drilling program, we have every reason to be confident about the outlook for Comet Vale.”

EXPLORATION UPDATE

The surface RC drilling program design comprised 20 holes for a total of ~1,500m to test the Sovereign Trend, of which 18 were drilled, with holes CVRC_23_003 and 015 abandoned due to set up/rig issues. Most of the drilling focused on the shallow testing of the Sand George and Princess Grace lodes that were previously mined via small open pits but with untested down-dip continuity, with CVRC_23_016 testing for northern strike extension of the Sand Queen lodes that host the existing underground mine.

Click here for the full ASX Release

This article includes content from Labyrinth Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

LRL:AU

The Conversation (0)

31 August 2023

Labyrinth Resources

Developing underexplored gold assets in the prolific Canadian Abitibi Gold Belt and the Yilgarn Craton of Western Australia.

Developing underexplored gold assets in the prolific Canadian Abitibi Gold Belt and the Yilgarn Craton of Western Australia. Keep Reading...

7h

Armory Mining To Conduct a Series of Airborne Geophysics Surveys at the Ammo Gold-Antimony Project

(TheNewswire) Vancouver, B.C. TheNewswire - February 9, 2026 Armory Mining Corp. (CSE: ARMY) (OTC: RMRYF) (FRA: 2JS) (the "Company" or "Armory") a resource exploration company focused on the discovery and development of minerals critical to the energy, security and defense sectors, is pleased to... Keep Reading...

06 February

Editor's Picks: Is Gold and Silver's Price Correction Over?

It's been a wild couple of weeks for gold and silver. After surging to record highs at the end of January, prices for both precious metals saw significant corrections, creating turmoil for market participants.This week brought some relief, with gold bouncing back from its low point and even... Keep Reading...

06 February

Blackrock Silver to Present at the Precious Metals and Critical Minerals Virtual Investor Conference on February 10th 2026

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce that Andrew Pollard, President & Chief Executive Officer of the Company, will present live at the Precious Metals & Critical Minerals Virtual Investor Conference hosted... Keep Reading...

05 February

Experts: Gold's Fundamentals Intact, Price Could Hit US$7,000 in 2026

Gold took center stage at this year's Vancouver Resource Investment Conference (VRIC), coming to the fore in a slew of discussions as the price surged past US$5,000 per ounce. Held from January 25 to 26, the conference brought together diverse experts, with a focus point being the "Gold... Keep Reading...

05 February

Barrick Advances North American Gold Spinoff After Record 2025 Results

Toronto-based company Barrick Mining (TSX:ABX,NYSE:B) said it will move ahead with plans to spin off its North American gold assets after a strong finish to 2025.The company's board has authorized preparations for an initial public offering (IPO) of a new entity that would house its premier... Keep Reading...

05 February

Peruvian Metals Secures 6 Year Agreement with Community at Mercedes Project

Peruvian Metals Corp. (TSXV: PER,OTC:DUVNF) (OTC Pink: DUVNF) ("Peruvian Metals or the "Company") is pleased to announce that the agreement between San Maurizo Mines Ltd. ("San Maurizo"), a private Manitoba company which holds a 100% direct interest in the Mercedes Property, and Comunidades... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00