August 12, 2024

Far Northern Resources (ASX:FNR) FNR is very encouraged by the success of the recent drilling program in Far Northern Queensland. The IP targets will be reassessed for further directional drilling on the Mining Lease.

HIGHLIGHTS

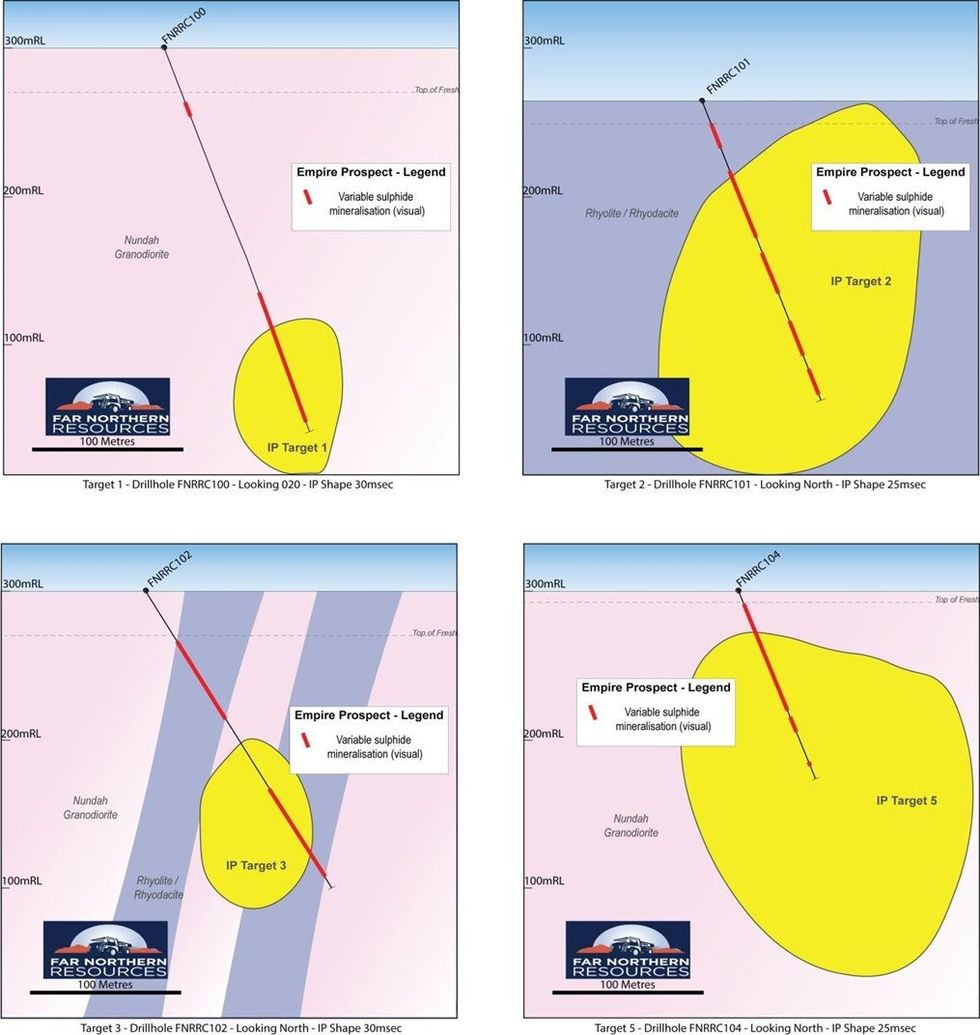

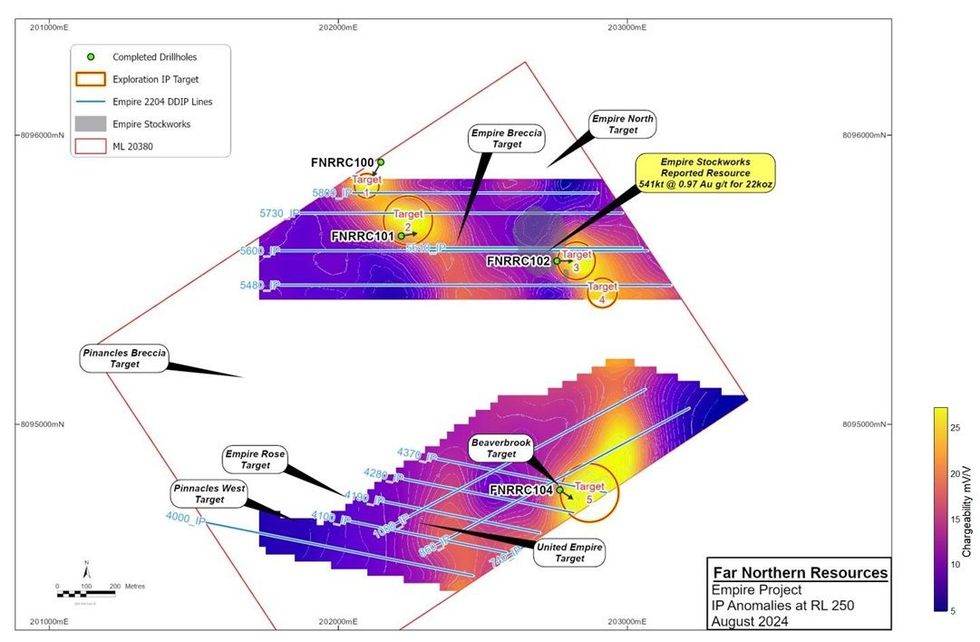

All targets were intersected in line with the IP anomalies identified in June - See ASX announcement of 12 June 2024 (see Fig 2)

- Target 1 – 83 meters of disseminated arsenopyrite and pyrite and quartz veins from 45 meters (see Fig 1). Consisting of 7 m* from 45 m, and 76 m* from 186 m.

- Target 2 – 125 meters of mineralization of disseminated arsenopyrite and pyrite and sulphides from 12 meters. (see Fig 1), consisting of 16 m* from 12 m, 50 m* from 54 m, 19 m* from 119 m, 12 m* from 174 m and 28 m* from 192m.

- Target 3 – 144 meters containing quartz veins up to 90% with arsenopyrite, pyrite and sulphides from 31 meters. (see Fig 1), consisting of 71 m* from 31 m and 73 m* from 160 m.

- Target 5 – 92 meters mineralization of disseminated arsenopyrite from 10 meters. (see Fig 1), consisting of 77 m* from 10 m, 12 m* from 93 m and 3 m* from 131m.

The Board of Far Northern Resources Limited, said:

The fact that sulphides are present in all four anomalies and were encountered in the very first drilling program, is very encouraging. We will now reassess all IP targets for further directional drilling in the near future.

FNR would like to thank Fender Geophysics, Mitre Geophysics and Bullion Drilling, for their work.

All samples have now been submitted to Intertek Minerals in Townsville for testing. FNR looks forward to receiving the assay results and getting back on the ground at the Empire Mining Lease to follow up on recent exploration program.

Click here for the full ASX Release

This article includes content from Far Northern Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

FNR:AU

The Conversation (0)

23 June 2025

Bridge Creek Phase 1 Assays

Far Northern Resources (FNR:AU) has announced Bridge Creek Phase 1 AssaysDownload the PDF here. Keep Reading...

21 May 2025

Bridge Creek Phase 1 Assay Composites Received

Far Northern Resources (FNR:AU) has announced Bridge Creek Phase 1 Assay Composites ReceivedDownload the PDF here. Keep Reading...

29 April 2025

Quarterly Activities/Appendix 5B Cash Flow Report

Far Northern Resources (FNR:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

08 April 2025

Drilling to Commence on Bridge Creek Mining Lease

Far Northern Resources (FNR:AU) has announced Drilling to Commence on Bridge Creek Mining LeaseDownload the PDF here. Keep Reading...

17 February 2025

Amended Appendix 5B

Far Northern Resources (FNR:AU) has announced Amended Appendix 5BDownload the PDF here. Keep Reading...

6h

How to Invest in Gold Royalty and Streaming Stocks

Gold royalty companies offer investors exposure to gold and silver with the benefits of diversification, lower risk and a steady income stream. Royalty companies operating in the resource sector will typically agree to provide funding for the exploration or development of a resource in exchange... Keep Reading...

7h

How Would a New BRICS Currency Affect the US Dollar?

The BRICS nations, originally composed of Brazil, Russia, India, China and South Africa, have had many discussions about establishing a new reserve currency backed by a basket of their respective currencies. The creation of a potentially gold-backed currency, known as the "Unit," as a US dollar... Keep Reading...

10h

Toronto to Host Global Mineral Sector for PDAC 2026, March 1 – 4

The Prospectors & Developers Association of Canada (PDAC) will bring together the mineral exploration and mining community in Toronto for its 94th annual Convention, taking place March 1 – 4, 2026, at the Metro Toronto Convention Centre (MTCC).As the World’s Premier Mineral Exploration & Mining... Keep Reading...

13h

THE SIGNAL ARCHITECTURE: 5 Stocks Calibrating the 2026 Infrastructure Cycle

USANewsGroup.com Market Intelligence Brief — WHAT'S HAPPENING: The infrastructure holding the global economy together is being stress-tested in real time: Gold at $5,552 per ounce as central banks loaded another 755 tonnes into reserves [1]The G7 issued formal guidance treating the quantum... Keep Reading...

23 February

Mining’s New Reality: Strategic Nationalism, Gold Records and a Fractured Cost Curve

The era of “smooth globalization” is over, and mining is entering a more fragmented, politically charged phase defined by strategic nationalism, according to speakers at S&P Global’s latest webinar.Jason Holden, who opened the “State of the Market: Mining Q4 2025” session with a macro overview,... Keep Reading...

23 February

Brazilian State Firm Seeks Injunction to Block Equinox Gold-CMOC Asset Sale

A Brazilian state-run mining company is seeking an emergency court injunction to block the sale of one of Equinox Gold's (TSX:EQX,NYSEAMERICAN:EQX) Brazilian assets. Bloomberg reported that Companhia Baiana de Produção Mineral (CBPM) has asked the Bahia State Court of Justice to immediately... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00