March 31, 2022

Noram Lithium Corp. ("Noram" or the "Company") (TSXV:NRM | OTCQB:NRVTF | Frankfurt:N7R) is pleased to report that the Company has completed hole CVZ-70 on its Zeus lithium clay deposit in Nevada to a total depth of 463 ft (141.1m). When logging and visual inspection of the core was completed, it was noted that mineralization appeared immediately near surface and extended down to approximately 387.0 ft (138m) for a total intersection of 380ft (116m).

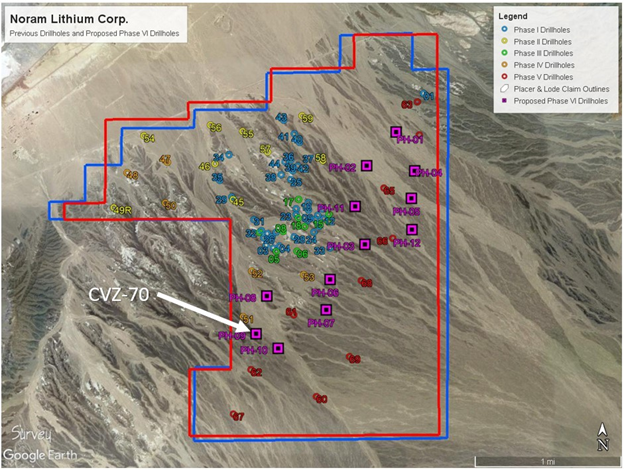

Figure 1 shows the Zeus project drilling to date with the various drilling phases color coded. The arrow points to the recently completed CVZ-70 hole. Other planned Phase VI holes are indicated in purple.

Figure 1 - Location of all past drill holes (Phase I to Phase V) previously completed in addition to the 12 proposed holes for Phase V1 currently underway. CVZ-70 and other planned Phase VI holes are indicated in purple.

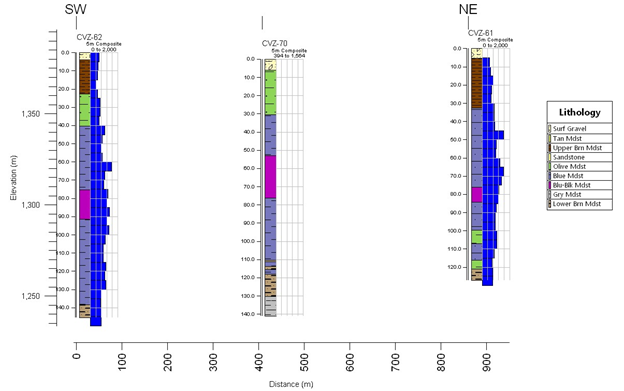

"Drill hole CVZ-70 is an incredibly encouraging hole for Noram. Figure 2 below shows a cross section with CVZ-70 and two adjacent, previously drilled, holes. The blue, green, black and magenta layers in the figure indicate claystone layers that have been shown to host the higher lithium assays from past drilling. The 380-foot (116-meter) intersection in CVZ-62 was one of the thickest claystone intersections by far. CVZ-70 appears to likely rival this and prior holes from prior programs. Thicker intersections such as this one will have profound implications on future resource tonnage calculations" commented Brad Peek M.Sc. CPG., VP of Exploration and Qualified Person for this and all 5 of the previous drilling phases of Noram's Zeus lithium property.

Figure 2. Comparative stratigraphy for drill holes CVZ-70 as compared to CVZ-61 and CVZ-62, which were drilled as part of the Phase V program. CVZ-61 and CVZ-62 were two of the longest intercepts drilled on the property to date. All of the claystone units except the brown silty claystone have relatively high lithium concentrations in previous drill holes on the property. The histogram on the sides of CVZ-61 and CVZ-62 are the composited lithium grades in ppm Li.

CVZ-70 is the first of the 12-hole Phase VI drilling program which is expected to upgrade approximately 175 million tonnes of the current 827 million tonne Inferred Resource to the Indicated category. Core samples from CVZ-70 have been shipped to ALS Laboratory in Reno, Nevada for assay processing on a "rush" basis. Assay results are pending.

The technical information contained in this news release has been reviewed and approved by Brad Peek., M.Sc., CPG, who is a Qualified Person with respect to Noram's Clayton Valley Lithium Project as defined under National Instrument 43-101.

About Noram Lithium Corp.

Noram Lithium Corp. (TSXV: NRM | OTCQB: NRVTF | Frankfurt: N7R) is a well-financed Canadian based advanced Lithium development stage company with less than 90 million shares issued and treasury exceeding US$18 million. Noram is aggressively advancing its Zeus Lithium Project in Nevada from the development-stage level through the completion of a Pre-Feasibility Study in 2022.

The Company's flagship asset is the Zeus Lithium Project ("Zeus"), located in Clayton Valley, Nevada. The Zeus Project contains a current 43-101 measured and indicated resource estimate* of 363 million tonnes grading 923 ppm lithium, and an inferred resource of 827 million tonnes grading 884 ppm lithium utilizing a 400 ppm Li cut-off. In December 2021, a robust PEA** indicated an After-Tax NPV(8) of US$1.3 Billion and IRR of 31% using US$9,500/tonne Lithium Carbonate Equivalent (LCE). Using the LCE long term forecast of US$14,000/tonne, the PEA indicates an NPV (8%) of approximately US$2.6 Billion and an IRR of 52% at US$14,250/tonne LCE.

Please visit our web site for further information: www.noramlithiumcorp.com.

ON BEHALF OF THE BOARD OF DIRECTORS

Sandy MacDougall

Chief Executive Officer and Director

C: 778.999.2159

For additional information please contact:

Peter A. Ball

President and Chief Operating Officer

peter@noramlithiumcorp.com

C: 778.344.4653

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. This news release may contain forward-looking information which is not comprised of historical facts. Forward-looking information involves risks, uncertainties and other factors that could cause actual events, results, performance, prospects and opportunities to differ materially from those expressed or implied by such forward-looking information. Forward-looking information in this news release includes statements regarding, among other things, the completion transactions completed in the Agreement. Factors that could cause actual results to differ materially from such forward-looking information include, but are not limited to, regulatory approval processes. Although Noram believes that the assumptions used in preparing the forward-looking information in this news release are reasonable, including that all necessary regulatory approvals will be obtained in a timely manner, undue reliance should not be placed on such information, which only applies as of the date of this news release, and no assurance can be given that such events will occur in the disclosed time frames or at all. Noram disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by applicable securities laws. *Updated Lithium Mineral Resource Estimate, Zeus Project, Clayton Valley, Esmeralda County, Nevada, USA (August 2021) **Preliminary Economic Assessment Zeus Project, ABH Engineering (December 2021).

Click here to connect with Noram Lithium Corp. (TSXV:NRM) to receive an Investor Presentation.

NRM:CA

The Conversation (0)

21 January

Official signing of the Portuguese State Grant

Savannah joins other grant recipient companies at official signing ceremony

Savannah Resources Plc, the developer of the Barroso Lithium Project in Portugal, a 'Strategic Project' under the European Critical Raw Materials Act and Europe's largest spodumene lithium deposit (the 'Project'), was delighted to join with other recipients of State grants yesterday at the... Keep Reading...

21 January

Excellent Results from 2025 Core Drilling Program at McDermitt

Jindalee Lithium Limited (Jindalee, or the Company; ASX: JLL, OTCQX: JNDAF) is pleased to report assay results from the drilling program at the McDermitt Lithium Project completed late 2025. All holes returned strong lithium and magnesium intercepts from shallow depths, including:R92: 36.5m @... Keep Reading...

08 January

Top 5 US Lithium Stocks (Updated January 2026)

The global lithium market enters 2026 after a punishing 2025 marked by oversupply, weaker-than-expected EV demand and sustained price pressure, although things began turning around for lithium stocks in Q4. Lithium carbonate prices in North Asia fell to four-year lows early in the year,... Keep Reading...

07 January

5 Best-performing ASX Lithium Stocks (Updated January 2026)

Global demand for lithium presents a significant opportunity for Australia and Australian lithium companies.Australia remains the world’s largest lithium miner, supplying nearly 30 percent of global output in 2024, though its dominance is easing as other lithium-producing countries such as... Keep Reading...

05 January

CEOL Application for Laguna Verde Submitted

CleanTech Lithium PLC ("CleanTech Lithium" or "CleanTech" or the "Company") (AIM: CTL, Frankfurt:T2N), an exploration and development company advancing sustainable lithium projects in Chile, is pleased to announce it has submitted its application (the "Application") for a Special Lithium... Keep Reading...

29 December 2025

SQM, Codelco Seal Landmark Lithium Joint Venture in Salar de Atacama

Sociedad Quimica y Minera (SQM) (NYSE:SQM) and Codelco have finalized their long-awaited partnership, forming a new joint venture that will oversee lithium production in Chile’s Salar de Atacama through 2060.SQM announced on Saturday (December 27) that it has completed its strategic partnership... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00