February 26, 2025

NioBay Metals Inc. (“NioBay” or the “Company”) (TSX-V: NBY) (OTCQB: NBYCF) is proud to announce that it has intercepted titanium in several of the surface drill holes carried out in Zone 1, on the Foothills Property, located on the lands of the Séminaire de Québec.

The Company had filed an application for authorization for impact projects with the Ministry of Natural Resources with the aim of carrying out a drilling campaign as soon as authorization is received. Below, the Company provides the results of the TiO2 mineralized zones of interest, from the fall 2024 exploration campaign.

The Foothills project is located north of Saint-Urbain, 100 km north of Québec City and 90 km south of Saguenay (La Baie region), Québec. The project covers an approximate area of 285 km2 and includes five separate claim blocks. It covers most of the contact of the intrusive zone known as the Saint-Urbain anorthosite.

It should be noted that the drilling work generated 32.14 tonnes of CO2 equivalents. A donation was granted to Carbone Boreal (Université du Québec à Chicoutimi) as compensation.

Table of Results

Intersections calculated for a cut-off grade of 8% Ti, a minimum length of 1 m and a maximum internal dilution of 1 m.

| Drill Hole | From (m) | To (m) | Length (m) | Dilution (m) | TiO2 (%) |

| 1625-24-002 | 89.75 | 153.00 | 63.25 | 1.00 | 10.57 |

| 1625-24-002 | 185.00 | 186.80 | 1.80 | 0.00 | 17.09 |

| 1625-24-002 | 220.80 | 226.55 | 5.75 | 0.00 | 22.36 |

| 1625-24-003 | 135.25 | 149.00 | 13.75 | 0.00 | 12.62 |

| 1625-24-003 | 151.00 | 156.00 | 5.00 | 0.50 | 19.13 |

| 1625-24-003 | 172.30 | 180.00 | 7.70 | 0.00 | 14.44 |

| 1625-24-004 | 154.10 | 158.40 | 4.30 | 0.00 | 14.73 |

| 1625-24-006 | 16.50 | 18.80 | 2.30 | 0.00 | 9.22 |

| 1625-24-006 | 25.00 | 30.45 | 5.45 | 0.70 | 11.76 |

| 1625-24-006 | 37.00 | 38.00 | 1.00 | 0.00 | 8.01 |

| 1625-24-006 | 48.00 | 49.00 | 1.00 | 0.00 | 14.60 |

| 1625-24-007 | 44.20 | 47.00 | 2.80 | 0.00 | 11.14 |

| 1625-24-007 | 49.00 | 62.65 | 13.65 | 0.00 | 10.56 |

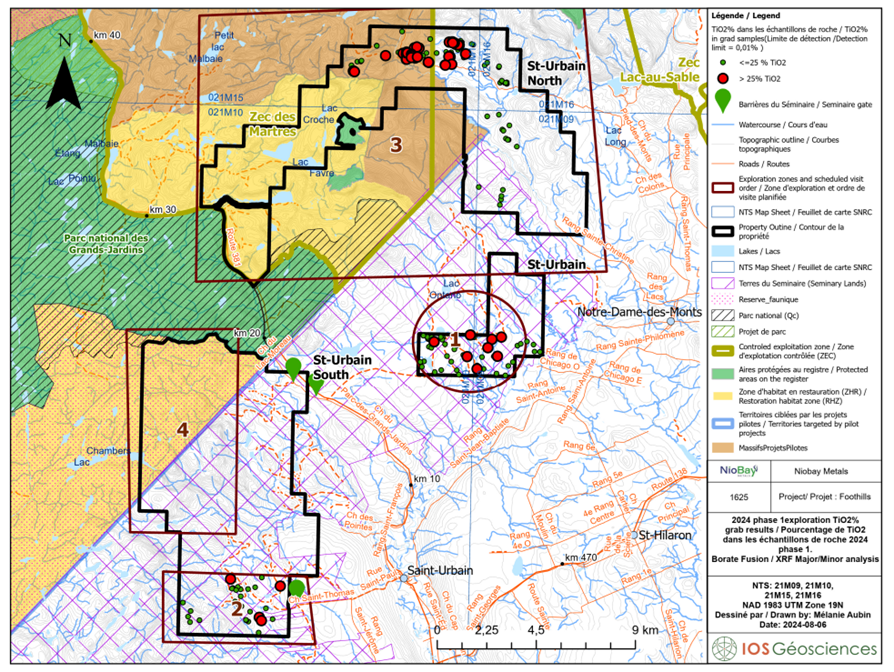

June 2024 prospecting area and sample locations

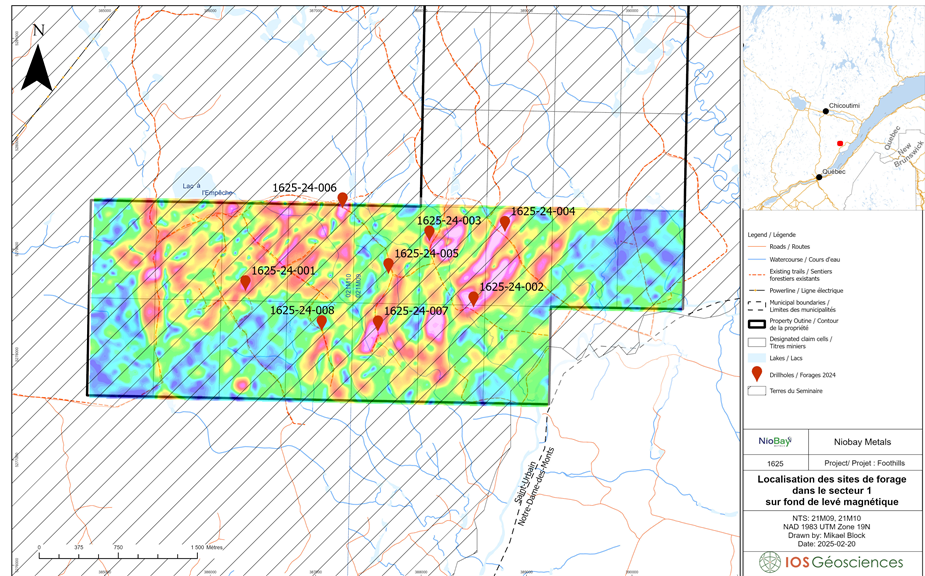

Map 2: Location of Drill Sites

Message from the President

“We are finally able to present our results from Zone 1. We were pleasantly surprised by the grade in certain holes. The next step will be to drill on a section of Zone 3. The application for authorization for this zone have been filed. Remember that sector 3 has demonstrated very good surface values in titanium (Press release of August 7, 2024)”, concluded Mr. David.

PDAC 2025

NioBay will be at PDAC again this year from March 2nd to the 5th inclusively, at the Toronto Convention Centre. Come meet us at booth 3015.

Qualified Persons

This press release has been reviewed and approved by Mr. Mikael Block, P.Geo., a Qualified Person under National Instrument 43-101. Mr. Block is a Project Manager employed by IOS Services Géoscientifiques.

About NioBay Metals Inc.

NioBay aims to become a leader in the development of mine(s) with low carbon consumption and responsible water and wildlife management practices while prioritizing the environment, social responsibility, good governance, and the inclusion of all stakeholders. Our top priority, which is critical to our success, is the consent and full participation of the Indigenous communities in whose territories and/or on ancestral lands we operate.

In addition to others properties, NioBay holds a 100% interest in the James Bay Niobium Project located 45 km south of Moosonee, in the Moose Cree Traditional Territory of the James Bay Lowlands in Ontario. NioBay also holds a 72.5% interest in the Crevier Niobium and Tantalum project located in Québec and on the Nitassinan territory of the Pekuakamiulnuatsh First Nation. The Company has also the option to acquire an 80% interest in the Foothills project, a titanium-phosphate project located near the former St-Urbain mine site in Quebec.

About Titanium

Titanium (Ti) is as strong as steel, but much less dense. It is therefore important as an alloying agent with many metals, including aluminum, molybdenum and iron. These alloys are mainly used in aircraft and spacecraft because of their low density and ability to withstand extreme temperatures. They are also used in sports equipment, laptops, bicycles and medical prostheses. Recently, this metal has been used in some battery components.

Cautionary Statement

Certain statements contained in this press release constitute forward-looking information under the provisions of Canadian securities laws including statements about the Company's plans. Such statements are necessarily based upon a number of beliefs, assumptions, and opinions of management on the date the statements are made and are subject to numerous risks and uncertainties that could cause actual results and future events to differ materially from those anticipated or projected. The Company undertakes no obligation to update these forward-looking statements in the event that management's beliefs, estimates or opinions, or other factors should change, except as required by law.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accept responsibility for the adequacy or accuracy of this release.

FOR MORE INFORMATION, CONTACT:

NioBay Metals Inc.

Jean-Sébastien David, P.Geo., MPM

President & CEO

jsdavid@niobaymetals.com

www.niobaymetals.com

Kimberly Darlington

Investor Relations

kimberly@refinedsubstance.com

Tel: 514-771-3398

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/29b6747d-ce60-40ad-b263-edd85dcc6921

https://www.globenewswire.com/NewsRoom/AttachmentNg/79550acc-c4ce-4e20-ae0d-13463ccafa16

NBY:CA

The Conversation (0)

04 February

Australia Set to Join Global Critical Minerals Alliance Meeting

Australia is taking part in a ministerial meeting aimed at exploring a strategic critical minerals alliance alongside the US, Europe, the UK, Japan and New Zealand.According to media reports, the talks were convened by US Secretary of State Marco Rubio and are scheduled for February 4. The... Keep Reading...

27 January

Quarterly Activities/Appendix 5B Cash Flow Report

American Rare Earths Limited (ARR:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

21 January

Forge Encounters Coal Seam amid Rising Coal Prices and Completes Resin Injections at La Estrella, Colombia

Forge Resources Corp. (CSE: FRG) (OTCQB: FRGGF) (FSE: 5YZ) ("Forge" or the "Company") is pleased to provide an operational update from its fully permitted flagship La Estrella coal project, located in Santander, Colombia. Underground development activities continue to advance steadily, supported... Keep Reading...

23 December 2025

ERG's Gallium Deal Puts Kazakhstan on Track to Become World's Top 2 Producer

Kazakhstan could be set to emerge as a key player in critical minerals and low-carbon metals as Eurasian Resources Group (ERG) moves ahead with gallium and iron projects in the country. During President Kassym-Jomart Tokayev’s state visit to Japan, ERG signed a long-term agreement to supply... Keep Reading...

19 December 2025

Australia Joins Global Pact to Secure Critical Minerals Supply Chains

Australia signed a critical minerals declaration at the Pax Silica Summit, alongside six other countries.Present at the December 12 summit were Australia, the US, Korea, Japan, the UK, Singapore and Israel.“The Pax Silica Summit is a United States-led initiative on securing technology supply... Keep Reading...

16 December 2025

Rare Earths Oxide Produced from Halleck Creek Ore-Major Technical Breakthrough

American Rare Earths (ASX: ARR | OTCQX: ARRNF | ADR: AMRRY) (“ARR” or the “Company”) has successfully completed another critical stage in its mineral processing program by producing a mixed rare earths oxide (“MREO”) using the updated preliminary PFS mineral processing flowsheet. HighlightsRare... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00