August 02, 2023

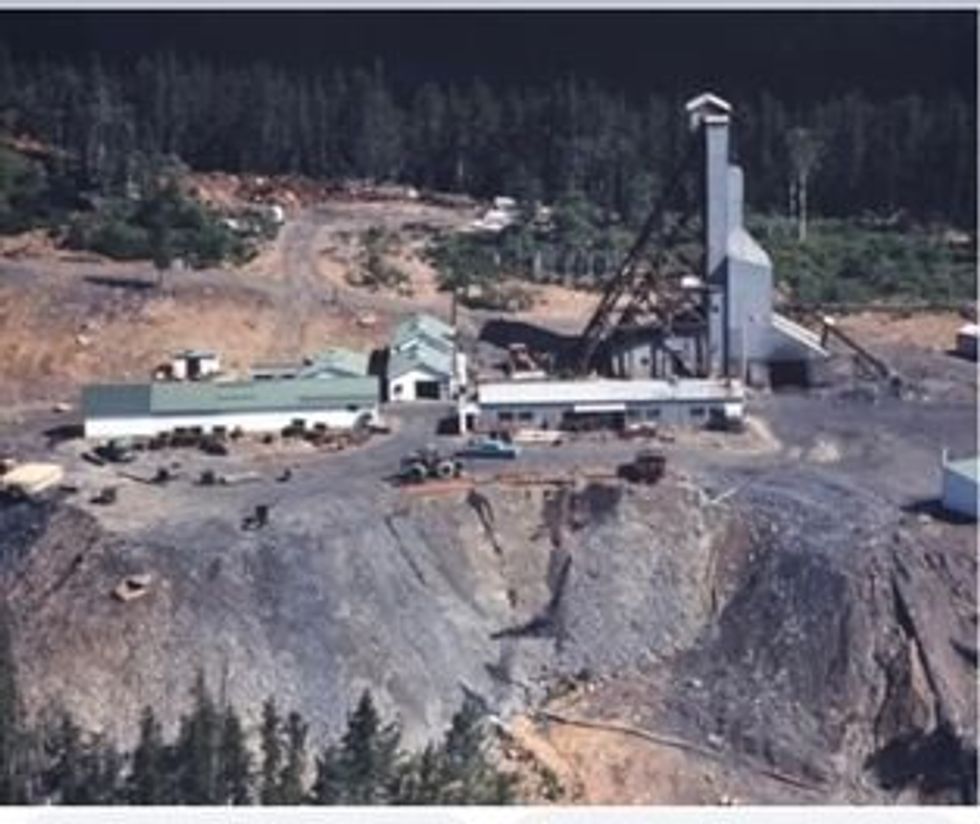

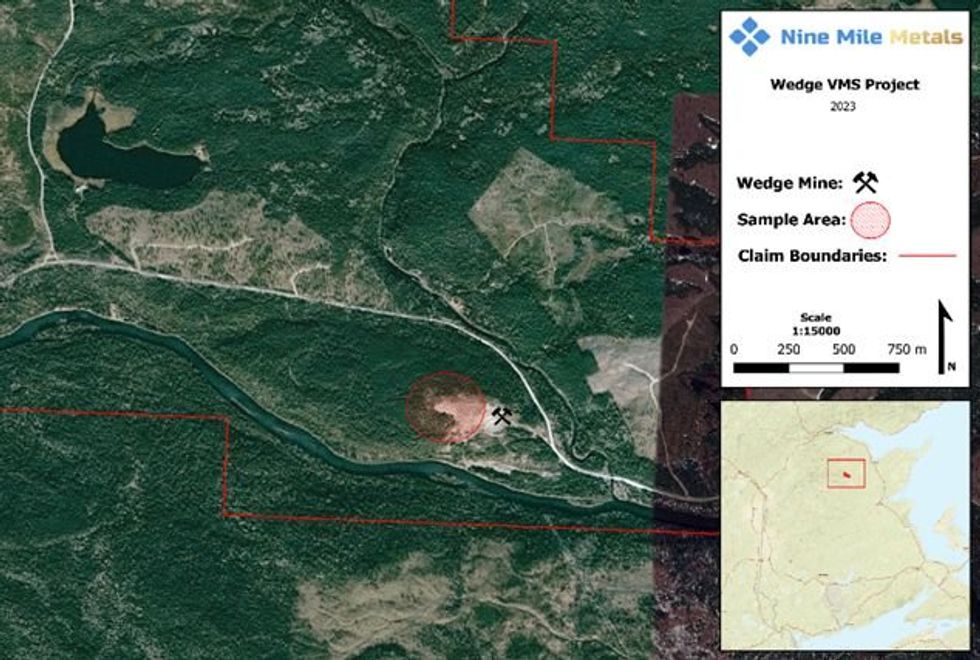

Nine Mile Metals Ltd. (CSE: NINE, OTCQB: VMSXF, FSE: KQ9) (the “Company” or “Nine Mile”) is pleased to announce the certified results for VMS mineralization collected from the Wedge mine site in the world-famous Bathurst Mining Camp, New Brunswick, Canada. Discovered in 1956, Cominco operated the mine between 1962 to 1968 producing 1.5 million tonnes of predominantly copper ore. Despite a long exploration and operating history, technical data regarding the mine was not required to be reported to the New Brunswick Department of Energy and Mines, including drill logs, assay certificates, production figures and underground mine plans.

Highlights:

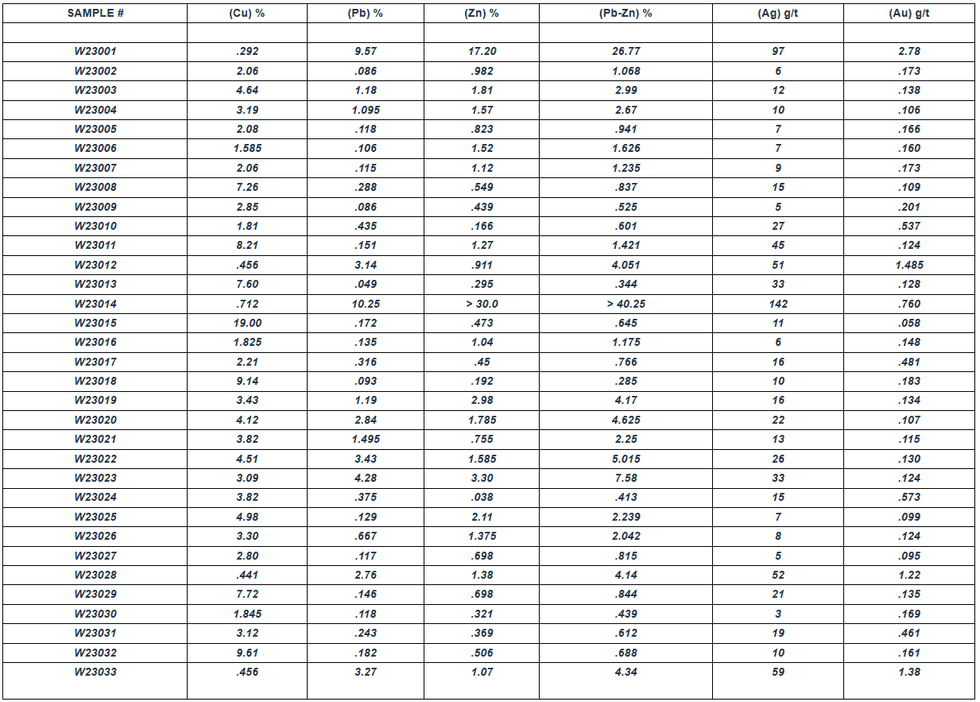

- High Grade Results: 19% Cu, 10.25% Pb, 30%+ Zn, 97 g/t Ag, and 2.78 g/t Au.

- Samples were fine-grained massive VMS (Cu-Pb-Zn) mineralization collected at the Wedge mine site.

- The samples were either Cu rich with minor (Pb/Zn) or (Pb/Zn) rich with minor Cu.

- Most samples consisted of 90% and sulphides and minor quartz / accessory minerals.

- Assay results also indicate credits for both Au and Ag.

- Property re-processed geophysics and AI stage 1 analysis completed.

- Upcoming drill program designs permitted and completed.

** ALS Global Labs Certified Assay Results

Patrick J. Cruickshank, MBA, CEO & Director stated, “These certified results clearly demonstrate the high-grade Cu potential at the historic Wedge Mine. Locally enriched zones of Pb /Zn were also present as seen with sample W23014 where the Zn assay exceeded the upper analytical range. We look forward to testing the mine at depth and along trend with our new re-processed AI targets on the property. Now that the phase 2 drill program has commenced at Nine Mile Brook again, we will drill the Wedge property and then California Lake after our Nine Mile Brook program concludes. The strength and quality of our portfolio will provide exploration opportunities for increasing shareholder value. We look forward to an extremely busy fall drill season on the (3) priority projects and announcing future drill results.”

Sample W23001

Sample W23014

“The sample results show a wide range of copper mineralization, in addition to local enrichment of lead, zinc, silver, and gold. The team looks forward to continued exploration at the Wedge and surrounding targets along trend,” stated Gary Lohman, B.Sc., P. Geo., VP Exploration and Director.

Sample W23015

Historic Wedge Mine in Production 1960’s

Sample Ore Collection Zone (Wedge Project) BMC

The disclosure of technical information in this news release has been prepared in accordance with Canadian regulatory requirements as set out in National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) and reviewed and approved by Gary Lohman, B.Sc., P. Geo., Director who acts as the Company’s Qualified Person, and is not independent of the Company.

About Nine Mile Metals Ltd.:

Nine Mile Metals Ltd. is a Canadian public mineral exploration company focused on Critical Minerals Exploration (CME) VMS (Cu, Pb, Zn, Ag and Au) exploration in the world-famous Bathurst Mining Camp, New Brunswick, Canada. The Company’s primary business objective is to explore its four VMS Projects: Nine Mile Brook VMS; California Lake VMS; Canoe Landing Lake (East–West) VMS and the new Wedge VMS Projects. The Company is focused on Critical Minerals Exploration (CME), positioning for the boom in EV and green technologies requiring Copper, Silver, Lead and Zinc with a hedge with Gold.

ON BEHALF OF NINE MILE METALS LTD.

“Patrick J. Cruickshank, MBA”

CEO and Director

T: 506-804-6117

E: patrick@ninemilemetals.com

Forward-Looking Information:

This press release may include forward-looking information within the meaning of Canadian securities legislation, concerning the business of Nine Mile. Forward-looking information is based on certain key expectations and assumptions made by the management of Nine Mile. In some cases, you can identify forward-looking statements by the use of words such as “will,” “may,” “would,” “expect,” “intend,” “plan,” “seek,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” “continue,” “likely,” “could” and variations of these terms and similar expressions, or the negative of these terms or similar expressions. . Forward-looking statements in this press release include that (a) Nine will drill the Wedge property and then California Lake after it Nine Mile Brook program concludes, (b) the strength and quality of Nine’s portfolio will provide exploration opportunities for increasing shareholder value, (c) the certified results clearly demonstrate the high-grade Cu potential at the historic Wedge Mine, and (d) Nine looks forward to continued exploration at the Wedge and surrounding targets along trend. Although Nine Mile believes that the expectations and assumptions on which such forward-looking information is based are reasonable, undue reliance should not be placed on the forward-looking information because Nine Mile can give no assurance that they will prove to be correct.

The Canadian Securities Exchange (CSE) has not reviewed and does not accept responsibility for the adequacy or the accuracy of the contents of this release.

NINE:CC

Sign up to get your FREE

Nine Mile Metals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

03 February

Nine Mile Metals

Advancing copper-rich critical mineral projects in Canada’s world-class Bathurst Mining Camp

Advancing copper-rich critical mineral projects in Canada’s world-class Bathurst Mining Camp Keep Reading...

06 March

Peter Krauth: Silver Cycle Still Early, Big Money Ready to Buy

Peter Krauth, editor of Silver Stock Investor and Silver Advisor, shares his thoughts on silver price activity and where the white metal is in the cycle. He believes the awareness phase is just beginning, with mania still relatively far in the future. Don't forget to follow us @INN_Resource for... Keep Reading...

05 March

Chen Lin: Key Silver Date to Watch, My Favorite 2026 Commodities

Chen Lin of Lin Asset Management weighs in on silver and gold, as well as the critical minerals market, which is his favorite sector for 2026. He also discusses how conflict in the Middle East could impact the resource sector. Don't forget to follow us @INN_Resource for real-time... Keep Reading...

05 March

Prince Silver: Fully Funded and Targeting 100 Million Ounces Silver Equivalent in Nevada

Ranking first in the world in the Fraser Institute’s 2025 Annual Survey of Mining Companies, Nevada remains a top choice for companies. Prince Silver’s (CSE:PRNC,OTCQB:PRNCF) flagship Prince silver project stands to benefit from its outstanding permitting process and geology.Prince Silver CEO... Keep Reading...

04 March

What's Next for the Silver Price After $100 Per Ounce?

First Majestic Silver (TSX:AG,NYSE:AG) CEO Keith Neumeyer’s silver price prediction of over US$100 per ounce came true in 2026. When will silver prices make a more lasting hold in triple digit territory?The silver price was up over 189 percent year-on-year as of March 2, 2026, on the back of... Keep Reading...

27 February

Obonga Project: Wishbone VMS Update

Panther Metals Plc (LSE: PALM), the exploration company focused on mineral projects in Canada, is pleased to provide an update for the Obonga Project's Wishbone Prospect which is an emerging and highly prospective base metal volcanogenic massive sulphide ("VMS") system in Ontario,... Keep Reading...

26 February

Agadir Melloul Mining Licence

Critical Mineral Resources is pleased to announce that a Mining Licence has been awarded for Agadir Melloul, marking an important step forward as the Company accelerates development towards production.The Mining License is 14.6km 2 and covers Zone 1 North and Zone 2, which remain the focus of... Keep Reading...

Latest News

Sign up to get your FREE

Nine Mile Metals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00