August 27, 2024

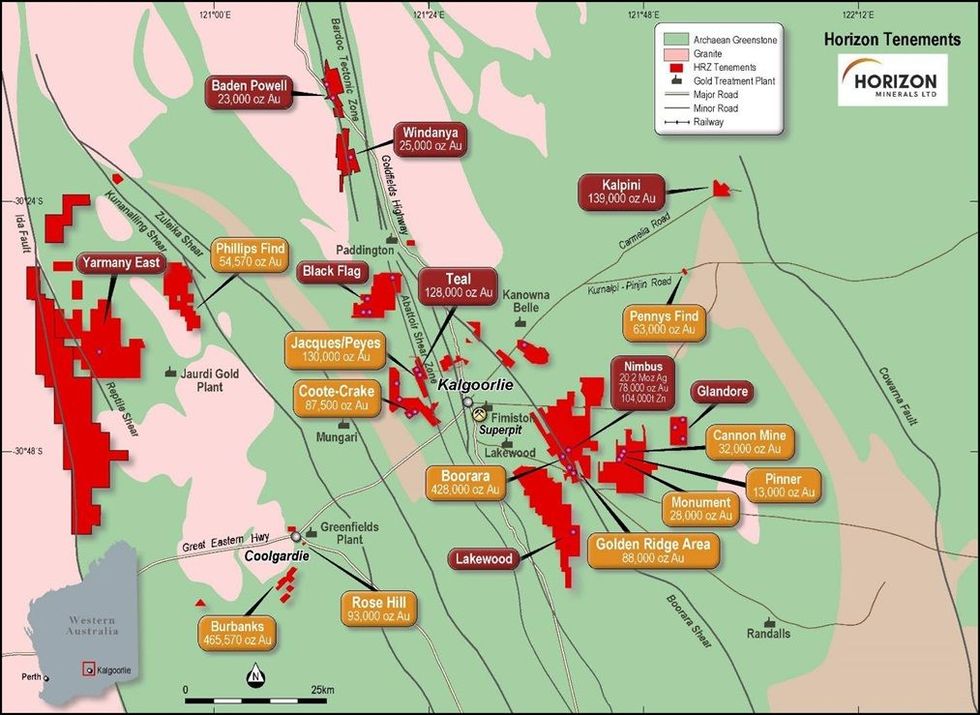

Horizon Minerals Limited (ASX: HRZ) (“Horizon” or the “Company”) is pleased to provide an update on the Nimbus silver-zinc project, adjacent to the Boorara gold mine, 17km east-southeast of Kalgoorlie-Boulder in the goldfields of Western Australia (Figure 1).

HIGHLIGHTS

- The current global Mineral Resource estimate for Nimbus stands at:

- 12.1Mt grading 52g/t Ag for 20.24Moz of silver and 0.9% Zn for 106kt zinc 1

- A high-grade subset exists within this global resource immediately below the historical pits and has a Mineral Resource estimate of:

- 260kt grading 774g/t Ag for 6.4Moz silver and 12.8% Zn for 33kt zinc 1

- Concept study has confirmed the optimal economic development pathway through mining of the higher-grade lodes and generation of a silver / zinc concentrate with more drilling required to increase overall tonnage and mine life 2

- Silver currently trading at A$42/oz and zinc at A$4,000/t

- A Programme of Work (POW) has been approved by DEMIRS and drilling expected to be undertaken in the first half of 2025 to drill test the exploration target 3

- Exploration Target defined below Nimbus to be tested.

Commenting on the Nimbus silver-zinc project, Horizon Managing Director and CEO Mr Grant Haywood said:

“We see the potential to grow the higher-grade core within the Nimbus resource at depth down plunge and along strike. Whilst we are firmly focussed on delivering on gold production at Boorara and Phillips Find, the Company will continue working to develop a longer-term production profile at Nimbus. We look forward to undertaking drilling in 2025 with the aim of increasing the resource prior to re-instigating a feasibility study for the project”.

Cautionary Statement – Exploration Target

The potential quantity and grade of the Exploration Target is conceptual in nature. There has been insufficient exploration to estimate a Mineral Resource and there is no certainty that further exploration work will result in the determination of mineral resources. See the basis of exploration target on pages 6 and 15-17, also Tables on pages 21-24, Competent Persons Statement on Pages 18.

The Nimbus Project is sits 2km east of the Company’s cornerstone Boorara project and 6.5km north- northwest of Golden Ridge. Both Boorara and Golden Ridge are historic gold mining centres, with Boorara recommencing production activities.1 The Nimbus mine site on granted mining leases M26/490 and M26/598 and easily accessed from the Kalgoorlie-Bulong Road via an unsealed haul road. The tenements are located within the Hampton Hill Pastoral Station (Figure 2).

The Nimbus Project was mined by Polymetals in two stages. Phase 1 (Jan 2004 – April 2005) concentrated on mining extremely weathered oxide material in the Discovery and East Pits. Phase 2 (Nov 2005 – May 2006) concentrated on mining remnant oxide and supergene material from the Discovery Pit. Ore treatment was undertaken at an onsite mill utilising a Merrill-Crowe circuit.

The Nimbus Silver-Zinc Project was placed on care and maintenance in 2007 after producing 3.6 Moz of silver from 318 kt of ore processed at a grade of 353 g/t Ag.

Click here for the full ASX Release

This article includes content from Horizon Minerals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

HRZ:AU

Sign up to get your FREE

Horizon Minerals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

21 August 2025

Horizon Minerals

Emerging stand-alone gold producer in Western Australia

Emerging stand-alone gold producer in Western Australia Keep Reading...

18 February

Successful A$175M Capital Raising

Horizon Minerals (HRZ:AU) has announced Successful A$175M Capital RaisingDownload the PDF here. Keep Reading...

17 February

Studies Support Standalone Gold Development in WA Goldfields

Horizon Minerals (HRZ:AU) has announced Studies Support Standalone Gold Development in WA GoldfieldsDownload the PDF here. Keep Reading...

17 February

Gold Ore Reserve Update

Horizon Minerals (HRZ:AU) has announced Gold Ore Reserve UpdateDownload the PDF here. Keep Reading...

16 February

Trading Halt

Horizon Minerals (HRZ:AU) has announced Trading HaltDownload the PDF here. Keep Reading...

12 February

Gold Mineral Resources Update

Horizon Minerals (HRZ:AU) has announced Gold Mineral Resources UpdateDownload the PDF here. Keep Reading...

11h

Mining’s New Reality: Strategic Nationalism, Gold Records and a Fractured Cost Curve

The era of “smooth globalization” is over, and mining is entering a more fragmented, politically charged phase defined by strategic nationalism, according to speakers at S&P Global’s latest webinar.Jason Holden, who opened the “State of the Market: Mining Q4 2025” session with a macro overview,... Keep Reading...

16h

Brazilian State Firm Seeks Injunction to Block Equinox Gold-CMOC Asset Sale

A Brazilian state-run mining company is seeking an emergency court injunction to block the sale of one of Equinox Gold's (TSX:EQX,NYSEAMERICAN:EQX) Brazilian assets. Bloomberg reported that Companhia Baiana de Produção Mineral (CBPM) has asked the Bahia State Court of Justice to immediately... Keep Reading...

18h

Silver Hammer Closes CDN$3,913,617 Non-Brokered Private Placement Pursuant to Listed Issuer Exemption

Silver Hammer Mining Corp. (CSE: HAMR,OTC:HAMRF) (the "Company" or "Silver Hammer") is pleased to announce that further to its news release dated February 2, 2026, it has closed its previously announced non-brokered private placement pursuant to the Listed Issuer Exemption ("LIFE") (the... Keep Reading...

22 February

High-Grade Near-Surface Graphite Intersected at Millennium

Metal Bank (MBK:AU) has announced High-Grade Near-Surface Graphite Intersected at MillenniumDownload the PDF here. Keep Reading...

22 February

Boundiali Resource Grows to 3Moz - Indicated Up 49%

Aurum Resources (AUE:AU) has announced Boundiali Resource Grows to 3Moz - Indicated Up 49%Download the PDF here. Keep Reading...

22 February

High-grade Assays incl 4m @ 26.7g/t Au in Sandstone Drilling

Brightstar Resources (BTR:AU) has announced High-grade assays incl 4m @ 26.7g/t Au in Sandstone drillingDownload the PDF here. Keep Reading...

Latest News

Sign up to get your FREE

Horizon Minerals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00