April 14, 2025

Ni-Co Energy is a Canadian mineral exploration company advancing the discovery and development of critical metals—particularly nickel, copper, and cobalt. Headquartered in Gatineau, Quebec, the company is focused on the underexplored yet highly prospective Grenville geological province, known for its potential to host mineral-rich systems.

Through its 100 percent-owned project in Quebec, Ni-Co Energy offers investors direct exposure to high-demand critical minerals. The project benefits from strong early-stage drill results, excellent infrastructure access, and a clear path to discovery in a geopolitically stable, mining-friendly jurisdiction.

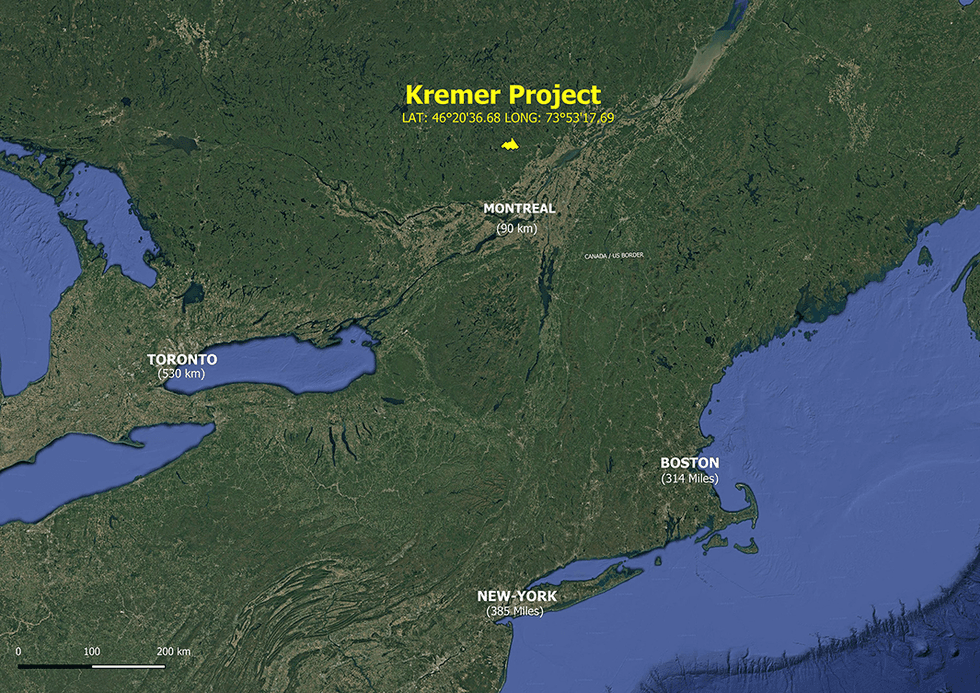

The 100 percent-owned Kremer Project is Ni-Co Energy’s flagship exploration asset and a clear reflection of the company’s strategy to unlock critical mineral resources in geologically prospective yet underexplored regions. Located just 90 kilometers from downtown Montreal and 15 kilometers northwest of Saint-Côme, the Kremer property benefits from exceptional accessibility and established infrastructure—key advantages that enhance its potential as a high-impact, early-stage exploration project.

Company Highlights

- Ni-Co Energy targets high-demand metals essential to the energy transition: nickel, copper and cobalt, with applications in EV batteries, energy storage and electrification infrastructure.

- The flagship Kremer project is a 100 owned, 15,375-hectare property located 90 km to the north from downtown Montreal (but 15 km away from the nearest town) in the highly prospective Grenville Geological Province in Quebec.

- Early-stage Discovery Potential: Multiple massive and semi-massive sulfide intercepts confirmed in 2023 drilling campaign with grades up to 1.73 percent nickel and 0.85 percent copper over 2.95 meters. This campaign consisted of 22 holes and 4,200 meters; ~41 percent of the drilled holes intersected sulfides.

- Airborne and ground EM surveys revealed an 8-kilometer-long EM conductor corridor, with overlapping gravity and MAG anomalies, and multiple surface showings.

- The project is road-accessible year-round via Route 347 and forestry roads, with power lines nearby and proximity to regional mining services.

- A two-phase, C$2 million exploration program planned for 2025, including an 8000-meter drilling campaign along with borehole TDEM focused on high-priority geophysical and geochemical targets.

This Ni-Co Energy profile is part of a paid investor education campaign.*

Click here to connect with Ni-Co Energy to receive an Investor Presentation

Sign up to get your FREE

Harvest Gold Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

11h

Harvest Gold

Advancing the large-scale Mousseau Gold Project in Quebec’s World-class Abitibi Region

Advancing the large-scale Mousseau Gold Project in Quebec’s World-class Abitibi Region Keep Reading...

7h

Top 5 Canadian Mining Stocks This Week: Homeland Nickel Gains 132 Percent

Welcome to the Investing News Network's weekly look at the best-performing Canadian mining stocks on the TSX, TSXV and CSE, starting with a round-up of Canadian and US news impacting the resource sector.The Government of Ontario, Canada, announced on Tuesday (January 13) that it was accelerating... Keep Reading...

15h

Ontario Accelerates C$5 Billion Crawford Nickel Project Under New One-Process Framework

Ontario moved this week to fast track Canada Nickel Company's (TSXV:CNC,OTCQX:CNIKF) Crawford nickel project, positioning what's being billed as the western world’s largest nickel development as a cornerstone of the province’s push to secure domestic critical minerals supply chains.Crawford is... Keep Reading...

15 January

Top Australian Mining Stocks This Week: NiCo Resources Jumps on Surging Nickel Price

Welcome to the Investing News Network's weekly round-up of the top-performing mining stocks listed on the ASX, starting with news in Australia's resource sector.Companies focused on a variety of critical minerals makes up this week’s list, including ones targetting nickel, vanadium, potash and... Keep Reading...

08 January

Global Nickel Market Recalibrates After Explosive Trading Week

Nickel prices stabilized on Thursday (January 8) after a turbulent week that saw the market swing sharply higher before retreating as traders reassessed the balance between existing supply risks and a growing overhang of inventory.Three-month nickel on the London Metal Exchange (LME) hovered... Keep Reading...

05 January

Nusa Nickel Corp. Provides 2025 Year-End Corporate Update and 2026 Outlook

Nusa Nickel Corp. is pleased to provide a year-end update highlighting key achievements in 2025 and outlining strategic priorities for 2026 as the Company continues to build a vertically integrated nickel business in Indonesia.2025 Year-End Highlights-Successfully advanced into production during... Keep Reading...

29 December 2025

Top 5 Canadian Nickel Stocks

Nickel prices have experienced volatility in the past few years due to supply and demand uncertainty. While demand has been consistent, prices have been mainly influenced by structural oversupply stemming from high output from Indonesia, which rapidly increased output in recent years to become... Keep Reading...

Latest News

Sign up to get your FREE

Harvest Gold Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00