Northern Lights Resources Corp. (CSE:NLR)("Northern Lights" or "NLR") is pleased to announce that it has executed a Property Option and Joint Venture Agreement (the "Agreement") with Reyna Silver Corp. (TSXV:RSLV) ("Reyna Silver") on the Medicine Springs Project in Elko County, Nevada, U.S.A. (the "Transaction

The Medicine Springs Project comprises 149 unpatented Federal mineral claims covering 1,189 Ha located in the Ruby Mountains Valley just off the famous Carlin Trend. The Medicine Springs Project has the potential to host silver-zinc-lead Carbonate Replacement Deposit ("CRD") mineralization. Northern Lights is currently earning a 100% interest in the Medicine Springs Project under the terms of an option agreement with the underlying claim owners executed August 20, 2017 (the "NLR 2017 Option").

Under the terms of the Agreement, Reyna can earn up to 80% equity in the Medicine Springs Project by completing minimum exploration expenditures of US$2.4 million plus other commitments and paying a cash payment of US$1 million to Northern Lights by no later than December 31, 2023. (See "Key Terms of the Property Option and Joint Venture Agreement" for details). Upon completion, Northern Lights and Reyna Silver will jointly own 100% of the Medicine Springs Project and will establish a Joint Venture.

Northern Lights has a free carried interest (with no future repayment) on all exploration expenditures on the Medicine Springs Project until Reyna Silver has spent a minimum of US$4 million. After the free carry period is complete, Northern Lights will contribute to joint venture expenditures on an equity basis.

The Transaction is legally binding with completion only subject to the finalization of Reyna Silver's legal due diligence on the Medicine Springs Project mineral claims that is to be finished by the end of October 2020.

Northern Lights CEO, Jason Bahnsen commented "We are delighted to have Reyna Silver as a joint venture partner on the Medicine Springs Project. Medicine Springs is a CRD system with high-grade silver potential similar to Reyna Silver's flagship Guigui Project in Mexico. This joint venture leverages the exploration work that Northern Lights has completed on the project together with the proven CRD expertise of Dr. Peter Megaw and the team at Reyna Silver. We look forward to working together with Reyna Silver to accelerate unlocking the potential of Medicine Springs."

For enhanced image, click here

The Medicine Springs Project

Dr. Peter Megaw, Technical Advisor to Reyna Silver commented "Medicine Springs ticks the most important boxes we look for in CRD exploration including location on a large regional structure that hosts significant CRDs, situated at the top or a thick section of potentially favorable carbonate host rocks and evidence of high silver grades. Some of the dump and rock chip samples run well over our 400 g/t (12 oz/t) silver threshold and it is quite likely that similar grades were diluted by the Reverse Circulation drilling used historically in the district. We will be drilling core to get a true picture of the clearly structurally-controlled mineralization as we trace it towards its source."

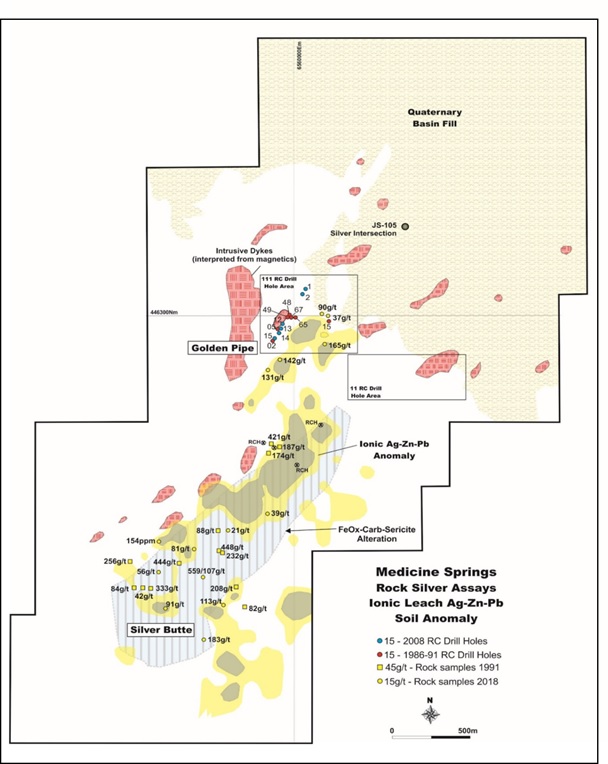

Since acquiring the Medicine Springs Project in 2017, Northern Lights has completed exploration work including detailed geological mapping, rock sampling, analysis of historic geophysical survey data (CSAMT and IP), review of historic exploration drilling, an aeromagnetic survey and an Ionic Leach soil geochemistry survey (see Figure 3).

The historic 125 shallow Reverse Circulation drill holes on the Medicine Springs Project encountered partially oxidized silver-zinc-lead mineralization at depths of up to 180 meters intersecting silver grades of up to 225 g/t. An extensive rock sampling program was completed in 2018 with a total of 66 samples collected in conjunction with surface mapping. Of the 66 samples collected, 27 samples assayed greater than 20 g/t silver and there were 17 samples with silver assays exceeding 100 g/t and a maximum value of 559 g/t. The Ionic Leach soil geochemistry survey completed in 2019 defined a strong coherent NE trending silver-zinc-lead anomaly which measures more than 2,000 meters in length and ranges up to 500 meters in width.

The results of the exploration work completed by Northern Lights at the Medicine Springs Project highlight the potential for significant silver-zinc-lead mineralization including the potential for high-grade CRD style mineralization.

Figure 3: Medicine Springs Project - Rock Assays / Ionic Leach Ag-Zn-Pb Soil Anomaly

For enhanced image, click here

Northern Lights has an initial approved exploration drill program of approximately 4,900 meters in place for the Medicine Springs Project. Reyna Silver intends to start work on the property immediately with a focus on evaluation and the start of exploration core drilling.

Key Terms of the Property Option and Joint Venture Agreement

- Reyna Silver has the option to earn an initial 75% ownership in the Medicine Springs Project with NLR retaining 25%.

- Reyna Silver has the option to acquire an additional 5% of the Medicine Springs Project by paying NLR US$1,000,000.

- Reyna Silver is appointed the operator and manager of the Medicine Springs Project with a joint operating committee to be established with representatives from both parties.

- Reyna Silver must complete expenditure commitments of approximately US$2,400,000 on the Medicine Springs Project by December 31, 2023, including a minimum of US$700,000 to be spent before December 31, 2021.

- Except for US$50,000 that will be paid by NLR, Reyna Silver will be responsible for making all remaining cash consideration payments (US$875,000) to the underlying claim owners under the NLR 2017 Option.

- NLR to make all remaining equity consideration payments (US$200,000) to the underlying claim owners under the NLR 2017 Option.

- NLR's equity interest in the Medicine Springs Project is free carried, with no future repayment of Joint Venture expenditures until Reyna Silver has spent a total of US$4,000,000. NLR will then contribute to Joint Venture expenditures on an equity basis.

- Any mineral claims acquired by either party within five miles of the outer boundaries of the current Medicine Springs Project will form part of the Joint Venture.

- Reyna Silver to assume all other rights and obligations of the underlying NLR 2017 Option.

The scientific and technical data contained in this news release was reviewed and approved by Gary Artmont (Fellow Member AUSIMM #312718), Head of Geology and qualified person to Northern Lights Resources, who is responsible for ensuring that the geologic information provided in this news release is accurate and who acts as a "qualified person" under National Instrument 43-101 Standards of Disclosure for Mineral Projects.

For further information on Medicine Springs Project and Northern Lights Resources please contact:

Albert Timcke, Executive Chairman and President

Email: rtimcke@northernlightsresources.com

Tel: +1 604 608 6163

Or

Jason Bahnsen, Chief Executive Officer

Email: Jason@northernlightsresources.com

Tel: +1 604 608 6163

About Northern Lights Resources Corp.

Northern Lights Resources Corp is a growth-oriented exploration and development company that is advancing two projects: The 100% owned, Secret Pass Gold Project located in Arizona; and the Medicine Springs silver-zinc-lead Project located in Elko County Nevada where Northern Lights is earning 100%.

Northern Lights Resources trades under the ticker of "NLR" on the CSE. This and other Northern Lights Resources news releases can be viewed at www.sedar.com and www.northernlightsresources.com.

About Reyna Silver Corp.

Reyna Silver Corp. is a silver exploration company with a robust portfolio of Mexican silver assets. The Company was built around the Guigui and Batopilas Projects, which formed part of MAG Silver's original IPO portfolio. Reyna's strategy centers around leveraging its expertise in Mexico to explore projects that have the potential for high-grade, district-scale discoveries.

Reyna Silver Corp. trades under the ticker RSLV on the TSX.V. This and other Reyna Silver Corp. can be viewed at www.sedar.com and www.reynasilver.com

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION: This news release includes certain "forward-looking statements" under applicable Canadian securities legislation. Forward-looking statements include, but are not limited to, statements concerning: the terms and conditions of the proposed private placement; use of funds; the business and operations of the Company after the proposed closing of the Offering. Forward-looking statements are necessarily based upon several estimates and assumptions that, while considered reasonable, are subject to known and unknown risks, uncertainties, and other factors which may cause the actual results and future events to differ materially from those expressed or implied by such forward-looking statements. Such factors include, but are not limited to general business, economic, competitive, political and social uncertainties; delay or failure to receive board, shareholder or regulatory approvals; and the uncertainties surrounding the mineral exploration industry. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. The Company disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

SOURCE: Northern Lights Resources Corp.

View source version on accesswire.com:

https://www.accesswire.com/609046/Northern-Lights-Executes-OptionJoint-Venture-Agreement-for-the-Medicine-Springs-Project-with-Reyna-Silver-Corp