System delivers new capabilities for life science research and biotherapeutic development through novel ion fragmentation and increased sensitivity

SCIEX , a global leader in life science analytical technologies, presents the ZenoTOF 7600 system , a new accurate mass LC-MS/MS instrument. The new system enables scientists to identify, characterize and quantify molecules better than ever before by generating data that has been previously unattainable. This breakthrough will solve real analytical challenges and help advance the development of new precision diagnostics and biotherapeutics.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20210617005207/en/

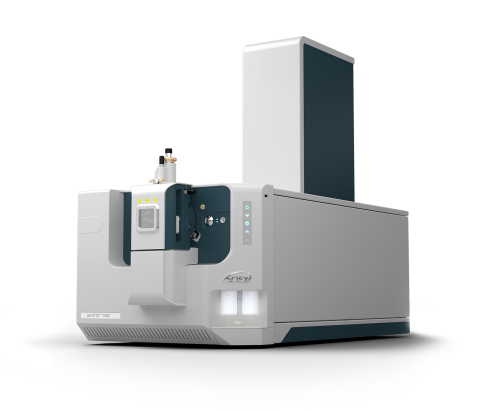

SCIEX presents new accurate mass instrument - the ZenoTOF 7600 system. This system delivers new capabilities for life science research and biotherapeutic development through novel ion fragmentation and increased sensitivity. (Photo: Business Wire)

"Only a step-change in innovation will meet the evermore ambitious goals of scientists around the world. This new platform and mindset in accurate mass has the power to change people's perspective and profoundly impact lives."

- Joe Fox, President of SCIEX.

The ZenoTOF 7600 system includes the proprietary Zeno trap and electron activated dissociation (EAD) fragmentation for the first time in a commercial instrument. Zeno trap pulsing overcomes the traditional duty cycle challenges of orthogonal TOF technology, delivering up to 20x the sensitivity and enabling the routine detection of important low-abundant molecules. In combination, tunable EAD fragmentation ensures novel structural information can be extracted and quantified from diverse compound types – a capability that is not possible by using high resolution alone.

"The fact that we can now add alternative fragmentation to our existing workflows, and with higher sensitivity at the same time is really extraordinary. It's a real change in how data are generated and the biological insight we can get."

- Matt Champion, Associate Professor, University of Notre Dame.

Extraordinary sensitivity in combination with EAD fragmentation will push new boundaries in biomarker discovery and biopharmaceutical therapies

To advance the detection and treatment of disease, it is critical to understand how thousands of proteins, lipids and metabolites in the body are regulated and modified. Biomarkers, the molecules that change when we are ill, are used by doctors as the "canary in the coal mine" warning system. So far, scientists have only scratched the surface in biomarker discovery. The ZenoTOF 7600 system will help scientists uncover more and better biomarkers, bringing us closer to true precision medicine where the right drug is given to the right patient at the right time.

Compared to previous systems, the ZenoTOF 7600 system can quantify up to 40% more proteins and analyze samples 5x faster for large biobank studies. In addition, EAD fragmentation brings new capabilities to understand how the proteins are post-translationally modified – an important but challenging area in biomarker research.

"The ability to exactly tailor kinetic energy for EAD optimizes the MS/MS spectra and maximizes quantification accuracy. The use of Zeno trap pulsing provides significant gains in sensitivity, further improving the utility of this approach for characterizing PTMs."

- Birgit Schilling, PhD, Associate Professor, Director of the Mass Spectrometry Center, The Buck Institute

The ZenoTOF 7600 system is transformational for lipidomics and can fully characterize an individual lipid from a single spectrum using EAD fragmentation. This will enable the discovery of novel lipid markers for cancer and inflammatory disease, precisely identifying and quantifying individual species that has been previously impossible.

"We were never able to characterize all the way down to the double bond position of lipid species, or identify the exact position of side chains. I see the ZenoTOF 7600 system as a really important advancement in being able to completely profile the lipidome from the top to the bottom."

- James Cox, Research Associate Professor, University of Utah.

To bring life-saving next-generation biopharmaceutical therapies to market quickly and safely , critical quality attributes must be rapidly and comprehensively analyzed. For the first time, EAD fragmentation allows biopharmaceutical scientists to precisely detect and quantify protein glycosylation patterns and differentiate isomeric amino acids. Both are critical to ensuring that therapies are safe and do not produce adverse reactions.

"As biopharma scientists seek to develop more complex and sophisticated biotherapeutics, the challenge of analytics also becomes more complex. The ability of EAD to routinely and precisely characterize these biologics will change the game and make therapies accessible to patients much faster."

- Mani Krishnan, VP GM, CE & Biopharma at SCIEX

To learn more about the ZenoTOF 7600 system, visit here .

About SCIEX

SCIEX delivers solutions for the precision detection and quantification of molecules, empowering our customers to protect and advance the wellness and safety of all. We have led the field of mass spectrometry for 50 years. From the launch of the first ever commercially successful triple quadrupole in 1981, we have developed groundbreaking technologies and solutions that influence life-changing research and outcomes.

Today, as part of the Danaher (NYSE: DHR) family of global life science and technology innovators, we continue to pioneer robust solutions in mass spectrometry and capillary electrophoresis. Our customers are able to quickly respond to environmental hazards, better understand biomarkers relevant to disease, improve patient care in the clinic, bring relevant drugs to market faster and keep food healthier and safer.

That's why thousands of life science experts around the world choose SCIEX to get the answers they can trust to better inform critical decisions that positively impact lives.

For more information, visit sciex.com .

Let's connect: Twitter , LinkedIn , Facebook , and Instagram .

Advances in human wellness depend on the power of precise science.

The SCIEX clinical diagnostic portfolio is For In Vitro Diagnostic Use. Rx Only. Product(s) not available in all countries. For information on availability, please contact your local sales representative or refer to www.sciex.com/diagnostics . All other products are For Research Use Only. Not for use in Diagnostic Procedures.

Trademarks and/or registered trademarks mentioned herein, including associated logos, are the property of AB Sciex Pte. Ltd. or their respective owners in the United States and/or certain other countries (see www.sciex.com/trademarks ).

© 2021 DH Tech. Dev. Pte. Ltd. RUO-MKT-12-13460-A.

View source version on businesswire.com: https://www.businesswire.com/news/home/20210617005207/en/

Lulu VanZandt

Manager, Brand, Public Relations and Social Media, SCIEX

lulu.vanzandt@sciex.com

+1 (508) 383-7163

M: +1 (508) 782-9484