TDG Gold Corp (TSXV:TDG) (the "Company" or "TDG") is pleased to provide an update on the ongoing resource drilling underway at its Shasta gold-silver project, located in the 'Toodoggone Production Corridor' of north-central British Columbia

The drill program at Shasta has intersected thicknesses of up to 70 metres ("m") of quartz breccia and stockwork veining that is texturally and mineralogically comparable to material historically mined from Shasta, which operated as a producing gold and silver mine until 2012. The location and thicknesses of mineralization and alteration encountered generally conforms with the geologic model prepared by Moose Mountain Technical Services ("Moose Mountain") and appears to have extended the mineralization to depth. Assay results are pending, with the first assay data expected by the end of 2021 and final assays in the first quarter of 2022.

2021 Program

The ongoing 2021 exploration program ("2021 Program") is generating geological, geophysical and geochemical data to support and enhance the understanding of mineralization at Shasta for the development of an economic resource model. TDG has added a third diamond drill rig to facilitate the completion of an approximately 10,000 m of HQ core diameter drilling program, which is expected to be completed by end of October, 2021. TDG is drilling oriented core, which also provides supplemental information on the orientation of mineralization and veining encountered, as well as geotechnical information that can be used in pit designs and optimization. This additional information will be very beneficial to the resource modelling and future drill targeting.

The 2021 Program has been designed, in consultation with Moose Mountain, to infill historical drill holes giving tighter and more regular coverage across the deposit thereby increasing the confidence in the continuity of the grade of gold and silver mineralization. This increased confidence should support improved classification in a mineral resource estimate planned for completion following receipt of all assay results. The 2021 drilling will also twin select historical drill holes to confirm the grade of known mineralization, provide infill geological data and to better understand the vein orientations of the known system.

2021 Drilling

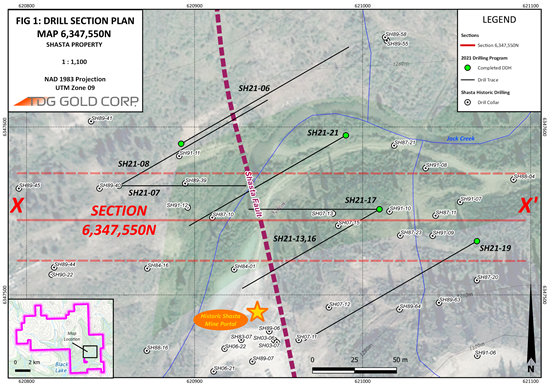

Diamond drill hole ("DDH") SH21-007 and DDH SH21-008 (Figure 1; the latter partially off cross-section and shown on Figure 2) were drilled to infill between historical holes SH89-040* and SH89-045* located in the Creek Zone at Shasta.

DDH SH21-007

DDH SH21-007 intersected the Shasta fault at the model-predicted depth of 65 m, and past the fault encountered a broad zone of silicified volcaniclastics with stockwork quartz veining, strong pervasive potassic alteration with a sulphide assemblage comprised of pyrite, chalcopyrite and acanthite (Figure 3), a package of host rocks, mineralization and alteration typical of the Shasta mineralization seen in historical holes SH89-040* and SH89-045*. Assays are pending and DDH SH21-021 continues the test of mineralization continuity in proximity to DDH SH21-007 (Figures 4 and 5).

Figure 1. Drill section plan map of historical portal area ("JM", "Creek" and "Jock" Zone locality).

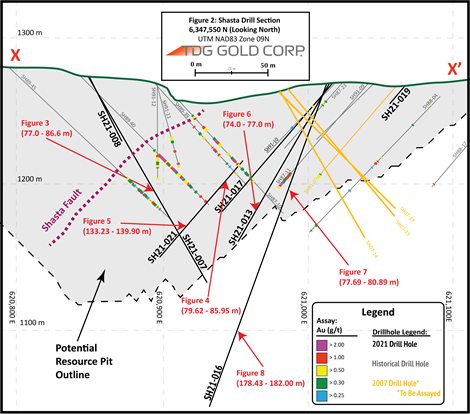

Figure 2. Showing Shasta cross-section at 6,347,550N with 2021 diamond drill holes crossing historical holes.

Figure 3. Core photo showing silicified potassic-altered volcaniclastics with quartz vein stockwork (intersected between 80.32 -86.06 m in hole SH21-007).

Figure 4. Core photo showing silicified potassic-altered volcaniclastics with quartz vein stockwork (intersected between 79.62 - 85.95 m in hole SH21-021).

Figure 5. Core photo showing silicified potassic-altered volcaniclastics with quartz vein stockwork / breccia (intersected between 133.23 - 139.90 m in hole SH21-021).

Historical hole DDH SH89-040* intersected mineralization over a 37 m interval* (from 71 m to 108 m) grading 1.84 grams per tonne ("g/t") gold ("Au") and 105.6 g/t silver ("Ag"). This included intervals* of 9.4 m (from 72.4 m to 83.6 m) grading 3.97 g/t Au and 226.6 g/t Ag; and 4.7 m (from 87.8 m to 92.5 m) grading 2.87 g/t Au and 177.9 g/t Ag. Historical hole DDH SH89-045* intersected mineralization over a 29.1 m interval* (from 109.6 m to 138.7 m) grading 0.77 g/t Au and 37.3 g/t Ag.

DDH SH21-013

DDH SH21-013 was drilled to infill historical holes and confirm 2007 drilling results. All core from 2007 was processed, but assays were never compiled. As such, TDG is working to locate, recover and sample the 2007 core in the extensive core farm on site and, if successful, will send in the samples for assay. The results of the 2007 drilling were not used in defining TDG's initial exploration target range (see TDG news release of March 03, 2021) and the additional data could enhance the results of future mineral resource estimates.

SH21-013 encountered similar potassic-quartz stockwork veined volcaniclastic rocks with visible sulphides (Figure 6) thought to represent grades of an adjacent hole (SH87-011). DDH SH87-011* intersected mineralization over a 26.2 m interval* (from 61.4 m to 87.6 m) grading 2.09 g/t Au and 120.3 g/t Ag.

Figure 6. Core photo showing silicified potassic volcaniclastics with quartz vein stockwork (intersected between 74.00 -77.08 m in hole SH21-013).

DDH SH21-016

SH21-016 was targeted infill drilling and originally proposed for an end of hole ("EOH") depth of ~ 150 m, testing the continuity of the mineralization, seen in SH87-011* (see Figure 2 above; Figure 7). The hole continued to a total depth ("TD") of 224 m, well past the planned depth as potassic alteration, silicification and quartz-carbonate veining with sulphides persisted. SH21-016 represents a test of the potential for deeper mineralization, below the current proposed resource pit (see Figure 2 above; Figure 8).

Next Steps

TDG expects its proposed Drill Program at Shasta to be completed by around the end of October 2021, with initial assay results expected in late 2021. Winterization of the Baker camp is well underway and expected to be completed in early October. The aim is to enable TDG to continue exploration at its Toodoggone projects later into 2021 and to recommence exploration activities earlier in 2022 than would otherwise been possible.

* Note 1: drill holes and/or composite intervals with an asterisk denote that assay results are recorded from written reports and government filed assessment reports. Laboratory certificates in these examples have not been found in historical data search. Some records also show that samples were assayed at the Baker Mine Site Laboratory, where no individual assay certificates are recorded.

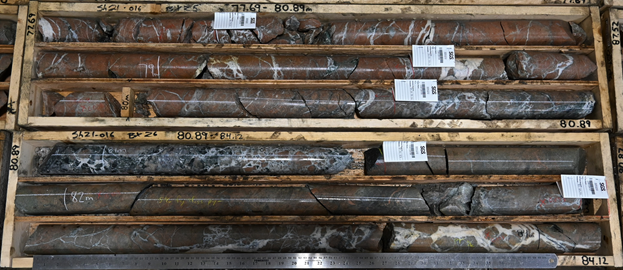

Figure 7. Core photo showing potassic alteration, stockwork quartz veins with vein-breccia (intersected between 77.69-84.12 m in hole SH21-016).

Figure 8. Core photo showing core intersected below the planned resource pit. Stockwork quartz veins and potassic alteration encountered (between 178.43-185.17 m in hole SH21-016).

Personnel

TDG also announces that Andy Randell has stepped down as TDG's interim Vice President, Exploration. Management of TDG's BC exploration program has been assumed by TDG's Senior Project Geologist, Steven Kramar, MSc., P.Geo.

Cautionary Statements

The economic significance of interpreted mineralization must be treated with caution as assay results are still pending. In some intersections, the mineralization appears to extend below the currently contemplated mineral resource pit. While deeper mineralization is geologically significant, there is no guarantee that it may be included in the pit-constrained NI 43-101 mineral resource estimate (being prepared for TDG by Moose Mountain; targeted for publication in the first half of 2022).

Qualified Person

The technical content of this news release has been reviewed and approved by Steven Kramar, MSc., P.Geo., a qualified person as defined by National Instrument 43-101.

This news release includes historical drilling information that has been reviewed by the Company's geological team. The Company's review of the historical records and information reasonably substantiate the validity of the information presented in this news release; however, the Company cannot directly verify the accuracy of the historical data, including the procedures used for sample collection and analysis. Therefore, the Company encourages investors to exercise appropriate caution when evaluating these results. Further data review is underway, in order to verify the validity of the data for the anticipated NI 43-101 compliant mineral resource estimate.

About TDG Gold Corp.

TDG is a major mineral claim holder in the historical Toodoggone Production Corridor of north-central British Columbia, Canada, with over 23,000 hectares of brownfield and greenfield exploration opportunities under direct ownership or earn-in agreement. TDG's flagship projects are the former producing, high-grade gold-silver Shasta, Baker and Mets mines, which are all road accessible, produced intermittently between 1981-2012, and have over 65,000m of historical drilling. In 2021, TDG proposes to advance the projects through compilation of historical data, new geological mapping, geochemical and geophysical surveys, and drill testing of the known mineralization occurrences and their extensions. On June 29, 2021, TDG announced that it had entered into a non-binding letter of intent to acquire the Nueva Esperanza silver-gold advanced exploration and development project located in the Maricunga Belt of northern Chile. TDG currently has 70,867,903 common shares issued and outstanding.

ON BEHALF OF THE BOARD

Fletcher Morgan

Chief Executive Officer

For further information, contact TDG Gold Corp. at:

Telephone:+1.604.536.2711

Email: info@tdggold.com

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release may contain certain "forward looking statements". Forward-looking statements involve known and unknown risks, uncertainties, assumptions and other factors that may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Any forward-looking statement speaks only as of the date of this news release and, except as may be required by applicable securities laws, the Company disclaims any intent or obligation to update any forward-looking statement, whether as a result of new information, future events or results or otherwise.

SOURCE: TDG Gold Corp.

View source version on accesswire.com:

https://www.accesswire.com/665845/TDG-Gold-Corp-Intersects-Significant-Widths-of-Mineralization-and-Adds-Third-Drill-at-Its-Shasta-Gold-Silver-Project-Toodoggone-District-British-Columbia