TDG Gold Corp (TSXV:TDG) (the "Company" or "TDG") is pleased to announce the opening of its Baker Mine Camp located within the road connected "Toodoggone Production Corridor" of north-central British Columbia. With the assistance of Chu Cho Industries and in cooperation with TDG's neighbour Benchmark Metals Inc., the final stretch of the Finlay-Nation forest service road which runs from Highway 97 was cleared up to the Baker Camp during the final week of May. TDG's camp management team has mobilized and the 20-person camp at Baker Mine is scheduled to be fully operational by June 28, 2021. TDG's geological team led by VP Exploration, Andy Randell, P.Geo., is expected to arrive in camp by the June 24, 2021

SHASTA EXPLORATION PROGRAM

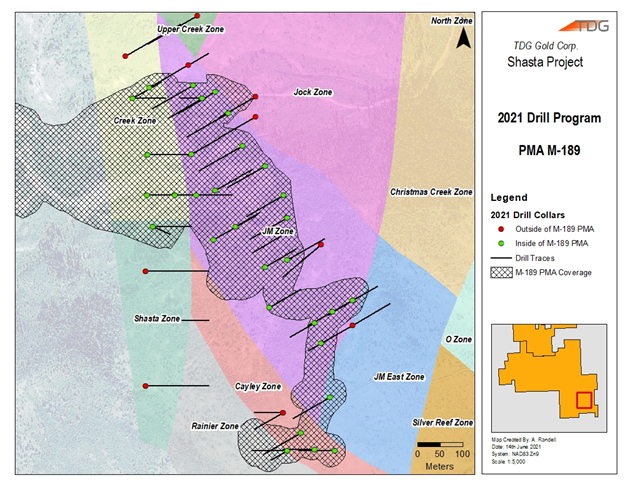

The primary focus of TDG's 2021 exploration is a diamond drill program at its former producing high-grade gold-silver Shasta mine. Figure 1 below shows a map of the proposed drill locations for 2021.

Figure 1 showing the Permitted Mine Area and proposed drill hole locations for Phase 1 (green) of the Shasta 2021 drill program.

Of TDG's proposed 68 drill holes in the 2021 Shasta drill program, 29 (3,855m total) are included in the Phase 1 drill program, all of which are within the existing Permitted Mine Area ("PMA"). Phase 2 drill holes are also largely within the PMA and are dependent on results of Phase 1 activities.

In TDG's news release of March 03, 2021, TDG published an exploration target range for Shasta of 0.90 - 1.47 million ounces of gold-equivalent based on recompilation of historical drilling information. The purpose of the proposed drilling is threefold: (1) to confirm the validity of historical drill assays; (2) to drill test known extensions to the existing mineralization around the historical mine workings; and, (3) to drill test for continuity of mineralization between historically identified zones. Drilling is expected to commence around mid-July after mapping and surface studies are complete along with relogging of the historical core which is stacked at Shasta.

Less than 50% of the historical drill core at Shasta was assayed. TDG will attempt to reassay sections of the historical core wherever possible. Historical drilling at Shasta was BQ diameter, whereas TDG intends to drill NQ2 and HQ diameter core with the aim of providing larger and more representative sampling of quartz carbonate stockwork and brecciation that exists as a mineralized halo surrounding the fault controlled, higher grade hanging wall that was the target of the historical mine operations.

TDG aims to publish an inaugural resource estimate for Shasta in H1 2022. All drill locations have been selected in collaboration with Moose Mountain Technical Services in order to facilitate the calculation of a NI 43-101 compliant resource estimate for Shasta.

BAKER EXPLORATION PROGRAM

The exploration plan for Baker will initially focus on detailed mapping, sampling and trenching within the Baker footprint and the satellite zones, with the Baker "B Vein" being prioritized. The B Vein is situated 300 metres northeast of the historical workings and appears to have high-grade ore material remaining in situ according to records and observations made during a site visit in October 2020. A hand sample collected at the B Vein site was recently assayed and returned grades of 135 grams per tonne ("g/t") gold ("Au") and 5.36 percent copper. Although this is a single sample and cannot be taken as representative of the entire B Vein, it is an encouraging result given that the sample was collected from outcrop.

The first stage of work at Baker will be led by Dr Thomas Bissig, former senior Research Associate with the Mineral Deposit Research Unit ("MDRU"). Thomas is a co-author of a MDRU 2019 report for Geoscience BC which considers an exploration framework for porphyry to epithermal transitions in the Toodoggone Mineral District. Information gathered from the initial work will be used to define a drilling campaign later in the season should it be warranted. The Permitted Mine Area includes the historical Baker Pit, and any work outside of this will be completed under new exploration permits for the Baker-Shasta and Oxide Peak properties.

METS EXPLORATION PROGRAM

Exploration at the Mets mining lease will focus on confirmation of grades and extent of development that has occurred historically on site. Core from previous drill campaigns is stored at the Baker mill and will be relogged and assayed where appropriate. New maps and surface / trench samples will be collected on site to augment the historical data, and a new environmental baseline testing project will start in June 2021.

The Mets mining lease covers 200 hectares and is road accessible from the Baker Mine. Between 1980 and 1992, 8,784m of diamond drilling, 2,622m of trenching and 350m of underground development were completed at Mets. Historical drill highlights include 9.52 g/t Au and 1.9 g/t Ag over 25.90 m and 3.57 g/t Au and 2.36 g/t Ag over 46.40 m, including 13.93 g/t Au and 2.00 g/t Ag over 11.80 m (see TDG news release of May 19, 2021).

Qualified Person

The technical content of this news release has been reviewed and approved by Andy Randell, PGeo., a qualified person as defined by National Instrument 43-101.

About TDG Gold Corp.

TDG is a major mineral claim holder in the historical Toodoggone Production Corridor of north-central British Columbia, Canada, with over 23,000 hectares of brownfield and greenfield exploration opportunities under direct ownership or earn-in agreement. TDG's flagship projects are the former producing, high-grade gold-silver Shasta, Baker and Mets mines which are all road accessible, produced intermittently between 1981-2012, and have over 65,000 metres of historical drilling. In 2021, TDG proposes to advance the projects through compilation of historical data, new geological mapping, geochemical and geophysical surveys, and drill testing of the known mineralization occurrences and their extensions. TDG currently has 64,423,459 common shares issued and outstanding.

ON BEHALF OFTHE BOARD

Fletcher Morgan

Chief Executive Officer

For further information:

TDG Gold Corp.,

Telephone:+1.604.536.2711

Email: info@tdggold.com

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release may contain certain "forward looking statements". Forward-looking statements involve known and unknown risks, uncertainties, assumptions and other factors that may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Any forward-looking statement speaks only as of the date of this news release and, except as may be required by applicable securities laws, the Company disclaims any intent or obligation to update any forward-looking statement, whether as a result of new information, future events or results or otherwise.

SOURCE: TDG Gold Corp.

View source version on accesswire.com:

https://www.accesswire.com/651735/TDG-Gold-Corp-Announces-Opening-of-Baker-Mine-Camp-and-Outlines-Phase-One-Drill-Program-for-Shasta-Project-Toodoggone-District-British-Columbia