TDG Gold Corp (TSXV:TDG) (the "Company" or "TDG") is pleased to announce the extension of its Baker and Shasta mining leases until Sep 10, 2051 and June 13, 2050 respectively. TDG completed its acquisition of the Toodoggone District assets of Talisker Resources Ltd. ("Talisker") in December 11, 2020 which included the Baker and Shasta mining leases and surrounding mineral claims, and the Mets mining lease - all located within the historical Toodoggone Production Corridor

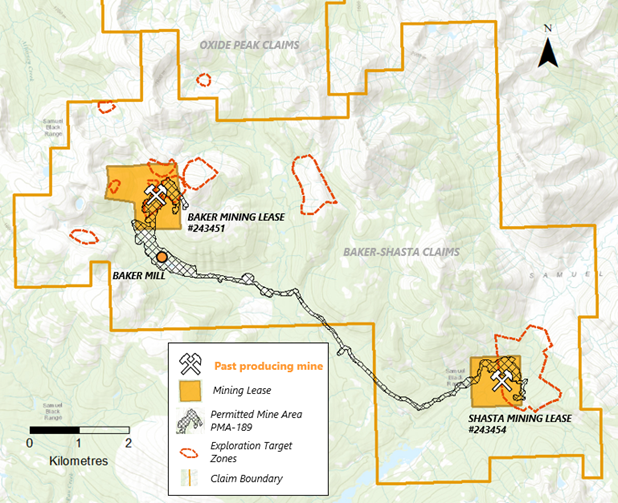

The extension of the Baker and Shasta mining leases also triggers the transfer of the existing Mines Act Permit to TDG, which defines a Permitted Mine Area ("PMA") covering just over 175 hectares (see Figure 1 below) and enables the undertaking of certain activities within its boundary including exploration. Over 90% of TDG's proposed drillholes for the imminent 2021 field season at Shasta fall within the PMA. The Shasta 2021 drill program of 4,000-6,000 metres is designed to test historical drilling results as well as extensions to the known mineralization at Shasta. Drilling is expected to commence in early August 2021 after further surface sampling and mapping work at Shasta has been completed.

Figure 1: Map showing location of Baker and Shasta mining leases and Permitted Mine Area.

TDG would like to thank First Nations for their consultation and support during the applications for the extension of the Baker and Shasta mining leases, and also the teams at Talisker, Falkik Environmental Consultants and the BC Ministry of Energy, Mining and Low Carbon Innovation ("EMLI") for their input and management of the application process.

As part of the 30-year extensions to the Baker and Shasta mining leases and transfer of the Mines Act Permit, TDG has agreed to provide reclamation and security bonding for the PMA which includes the roads, Baker mill, Baker and Shasta mines and tailings storage facilities; and, TDG has agreed to maintain the PMA in compliance with the requirements of the Mines Act permit including a comprehensive environmental monitoring program which will be undertaken in 2021 by Chu Cho Environmental LLP ("Chu Cho") and Sasuchan Environmental LP ("Sasuchan") in partnership with other sector experts. Both Chu Cho and Sasuchan are wholly owned and operated by Tsay Keh Dene and Takla First Nations respectively.

Qualified Person

The technical content of this news release has been reviewed and approved by Andy Randell, PGeo., a qualified person as defined by National Instrument 43-101.

About TDG Gold Corp.

TDG is a major holder of mineral claims and mining leases in the historical Toodoggone Production Corridor of north-central British Columbia, Canada, with over 23,000 hectares of brownfield and greenfield exploration opportunities under direct ownership or earn-in agreement. TDG's flagship projects are the former producing, high-grade gold-silver Shasta, Baker and Mets mines which are all road accessible, produced intermittently between 1981-2012, and have over 65,000 metres of historical drilling. In 2021, TDG proposes to advance the projects through compilation of historical data, new geological mapping, geochemical and geophysical surveys, and drill testing of the known mineralization occurrences and their extensions. TDG currently has 64,423,459 common shares issued and outstanding.

ON BEHALF OF THE BOARD

Fletcher Morgan

Chief Executive Officer

For further information:

TDG Gold Corp.,

Telephone: +1.604.536.2711

Email: info@tdggold.com

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release may contain certain "forward looking statements". Forward-looking statements involve known and unknown risks, uncertainties, assumptions and other factors that may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Any forward-looking statement speaks only as of the date of this news release and, except as may be required by applicable securities laws, the Company disclaims any intent or obligation to update any forward-looking statement, whether as a result of new information, future events or results or otherwise.

SOURCE: TDG Gold Corp.

View source version on accesswire.com:

https://www.accesswire.com/649831/TDG-Gold-Corp-Announces-30-Year-Extensions-to-Baker-and-Shasta-Mining-Leases-Toodoggone-Production-Corridor-British-Columbia