Tarku Resources Ltd (TSXV:TKU)(FRA:7TK)(OTCQB:TRKUF) (the 'Company' or 'Tarku') is pleased to announce the successful completion of its 2021 drill program on the high-grade Silver Strike Project in the Tombstone District of Arizona (the 'Project'). Tarku's drill program confirmed the presence of several high-grade silver veins and structures along with copper lead and zinc. The results additionally demonstrated the presence of a possible Carbonate Replacement Deposit ('CRD') System, similar to the nearby Hermosa project in Arizona

Julien Davy, President, and CEO of Tarku, stated: 'We are extremely pleased with the results of this first drill program on the Silver Strike project. There is a 4 km distance between Lucky Cuss and East Side historical mines and the Ground Hog Area. We have received high-grade silver results at both points close to the surface and around 100m depth. Our interpretations do date let us strongly speculate that both areas are geologically related, opening the potential for a large Carbonate Replacement system feeding all various spikes similar to the world-class Hermosa Mine, located within a comparable geological environment 80km from our project.'

Highlights from Tarku's 2021 Phase 1 exploration and drill program:

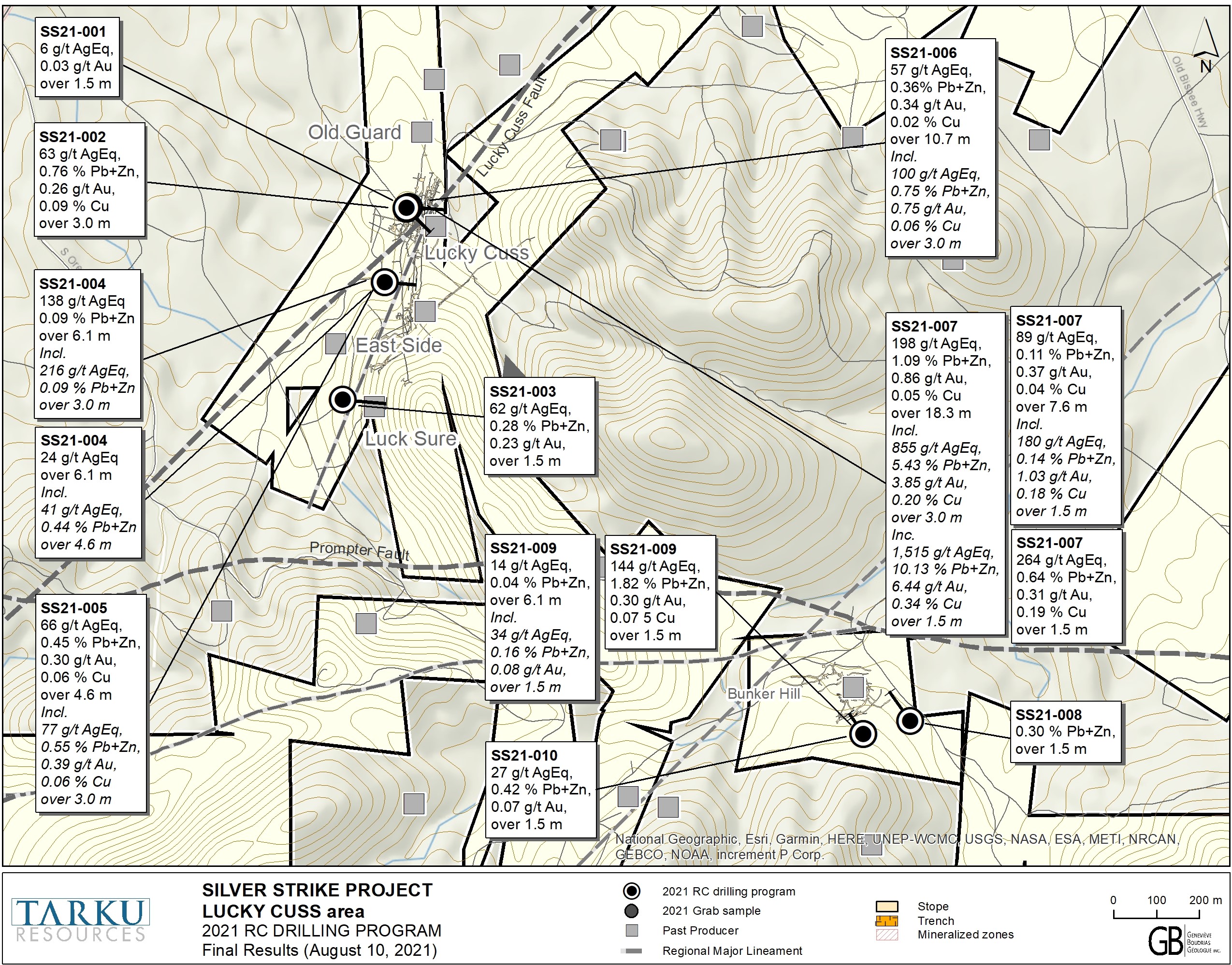

- Drill program successfully demonstrates high-grade mineralization with results as (see figure 1 & 2) :

- 720 g/t silver, 6.44 g/t gold, 0.64% copper and 10.13% lead-zinc combined or 1,515 g/t silver equivalent (AgEq) over 1.5 m at 7,6 meters in hole SS21-007 (Lucky Cuss),

- 203 g/t silver, 0.31 g/t gold, 0.19% copper and 0.64% lead-zinc combined or 264 g/t silver equivalent (AgEq) over 1.5 m at 74.7 meters in hole SS21-007 (Lucky Cuss),

- 214 g/t Silver at 70.1 meters in hole SS21-004 (East Side),

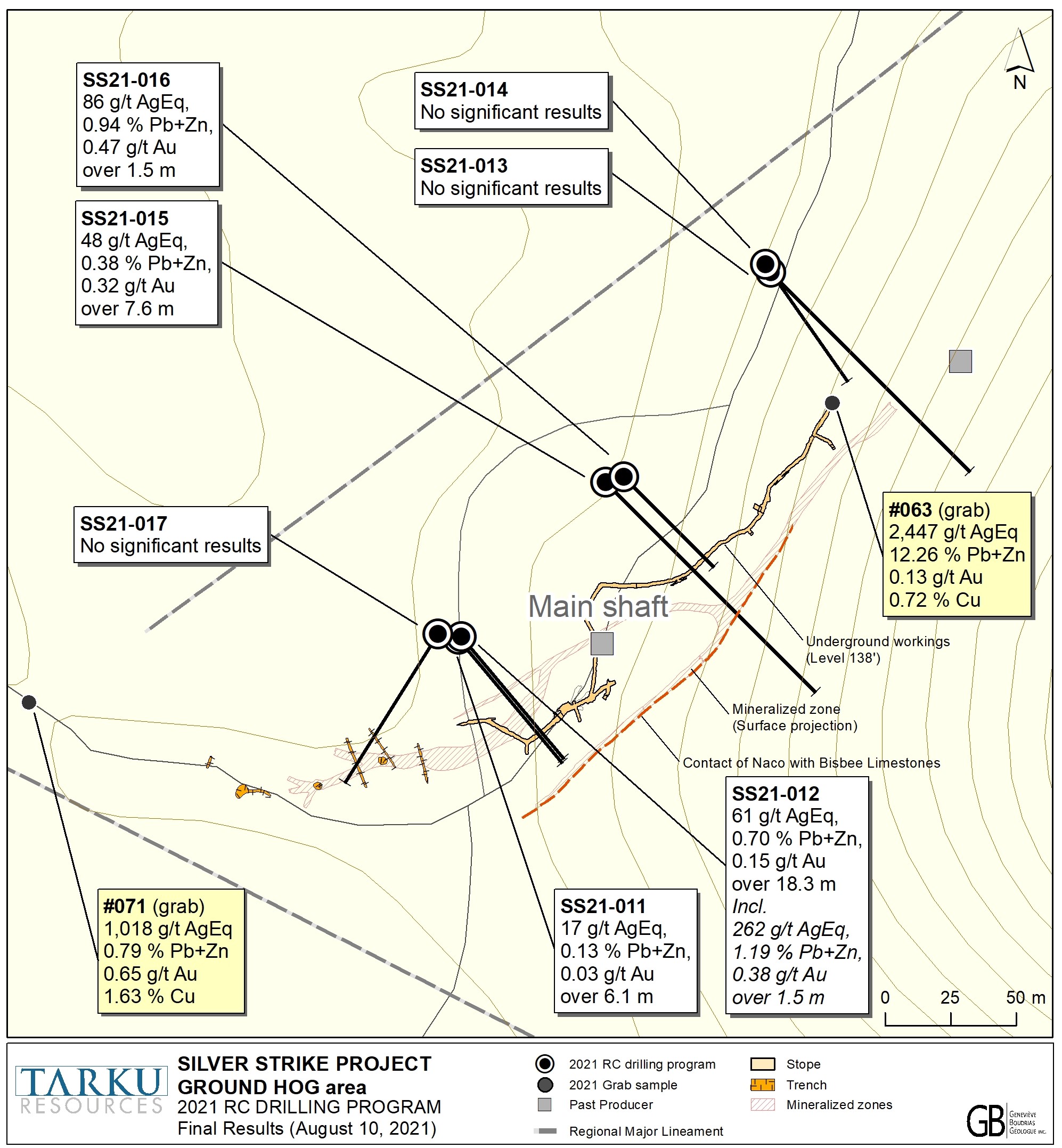

- 204 g/t silver, 0.38 g/t gold and 1.19% lead-zinc combined or 262 g/t silver equivalent (AgEq) over 1.5 m at 74.7 meters in hole SS21-012 (Ground Hog),

- Surface exploration demonstrates high-grade mineralization at Ground Hog, 4km away from Lucky Cuss (see figure 1 & 2) :

- 2,030 g/t silver, 0.13 g/t gold, 0.72% copper and 12.26% lead-zinc combined or 2,447 g/t silver equivalent (AgEq) at surface in a grab sample at Ground Hog,

- 778 g/t silver, 0.65 g/t gold, 1.63% copper and 0.79% lead-zinc combined or 1,018 g/t silver equivalent (AgEq) at surface in a grab sample at Ground Hog,

- Drill program results have allowed Tarku to further its understanding of regional geology and to refine its exploration approach for next phases at Silver Strike:

- The new data seem to better fit a CRD type model similar to the nearby Hermosa Project in Arizona,

- Fines samples returned assay results up to 1,000% higher than Regular Samples suggests underestimated assay results through the RC drill program,

- Next Steps (phase 2) will encompass Geophysical and Geochemical regional surveys to prepare for an expanded core drilling program on priority targets (Phase 3).

2021 Drilling program on Silver Strike

This latest drill program completed by Tarku on the Silver Strike project is the first comprehensive drill program ever completed in this area. During the 38 years from 1877 to 1915, the area is known to have produced approximately 32 million ounces of silver at an average grade of almost 26 oz/t as well as 260,000 ounces of gold at 6.5g/t and in lesser amounts other base metals such as lead, zinc, copper, and manganese. These historical results were then known to be exclusively carried in high-grade silver veins of 1 or 2 feet wide.

As mentioned in the previous June 3 rd press release, Tarku's initial drilling program was designed to validate these historical high-grade values by testing both the near vicinity of past mines as well as the extension potential until 4km to the South-West. A total of 23 Reverse Circulation ('RC') drill holes totaling 8,921 feet (2,719.1 meters) have been completed. The best results are listed in table 1 below. The management considers this program as a technical accomplishment by succeeding the replication of high-grade results close to past mines, by demonstrating the strong regional potential with economic Silver results at Ground Hog, 4km away from historical area, and by refining his understanding of regional geology and the mineralizing system, no longer consider as a epithermal system with silver vein, but as a carbonate replacement system (CRD), similar to the Hermosa project, Arizona.

Underestimated Samples illustrated by the Fines

Sampling methodology included the taking of 5 ft long samples and all results are reported as an average grade over 5 ft. Each sample was collected at the drill rig using a binary splitter that directs half the sample into a sample bag which is sent for analysis, while the other half is bagged and kept in storage as a field duplicate. Fines samples from the vacuum were previously not considered in this drill program, but 7 Fines samples were taken for test purposes returning results up to 1,000% higher as illustrated in figure 4 below. Tarku cautions that 7 samples over the whole drill program are not sufficient to complete a comprehensive reconciliation procedure but it illustrates a known sampling discrepancy between Fines and Regular Samples using standard RC sampling methodology. It is accepted that Fines could easily average 20% of overall Sample Mass with RC drilling and depending on the mineralization environment, the inclusion of Fines could significantly increase the mineralization results (see figure 4). Full drilling sample methodology and Quality Assurance / Quality Control were described in the press release dated May 6 th , 2021.

Julien Davy, President, and CEO of Tarku stated: 'These results will assist us in refining the overall exploration model and facilitate the interpretation of several anomalous silver structures. Results are very encouraging as several holes returned economical values for silver, gold, and other base metals. The detection of the fact that the results in the Fines could be up to 1,000% higher than the regular samples is major and will be considered in the upcoming exploration Phase 2 and 3. It suggests that most of our medium grade results could be high-grade results and therefore add to the attractiveness of the Silver Strike project' .

The Carbonate Replacement Deposit model suggested

The variety of mineralization within the sediments at Lucky Cuss and Ground Hog, suggest that the Carbonate Replacement Deposit (CRD) model could be more extensively spread over the Silver Strike property than originally expected and that the limits have not yet been found. CRD is typically a high-temperature carbonate-hosting Ag-Pb-Zn deposit formed by the replacement of sedimentary, usually carbonate rock, by metal-bearing solutions in the vicinity of igneous intrusions that play the role of heat source. With some local variations, ore body geometries could vary from chimneys to veins to the blanketlike body along the bedding plane of the rock, it is then commonly called a manto . Those Polymetallic replacements/mantos are often stratiform wall-rock replacement orebodies distal to porphyry deposits (copper or molybdenum). The presence of abundant manganese on the Silver Strike Project is typical in that environment and reinforces the potential CRD deposit.

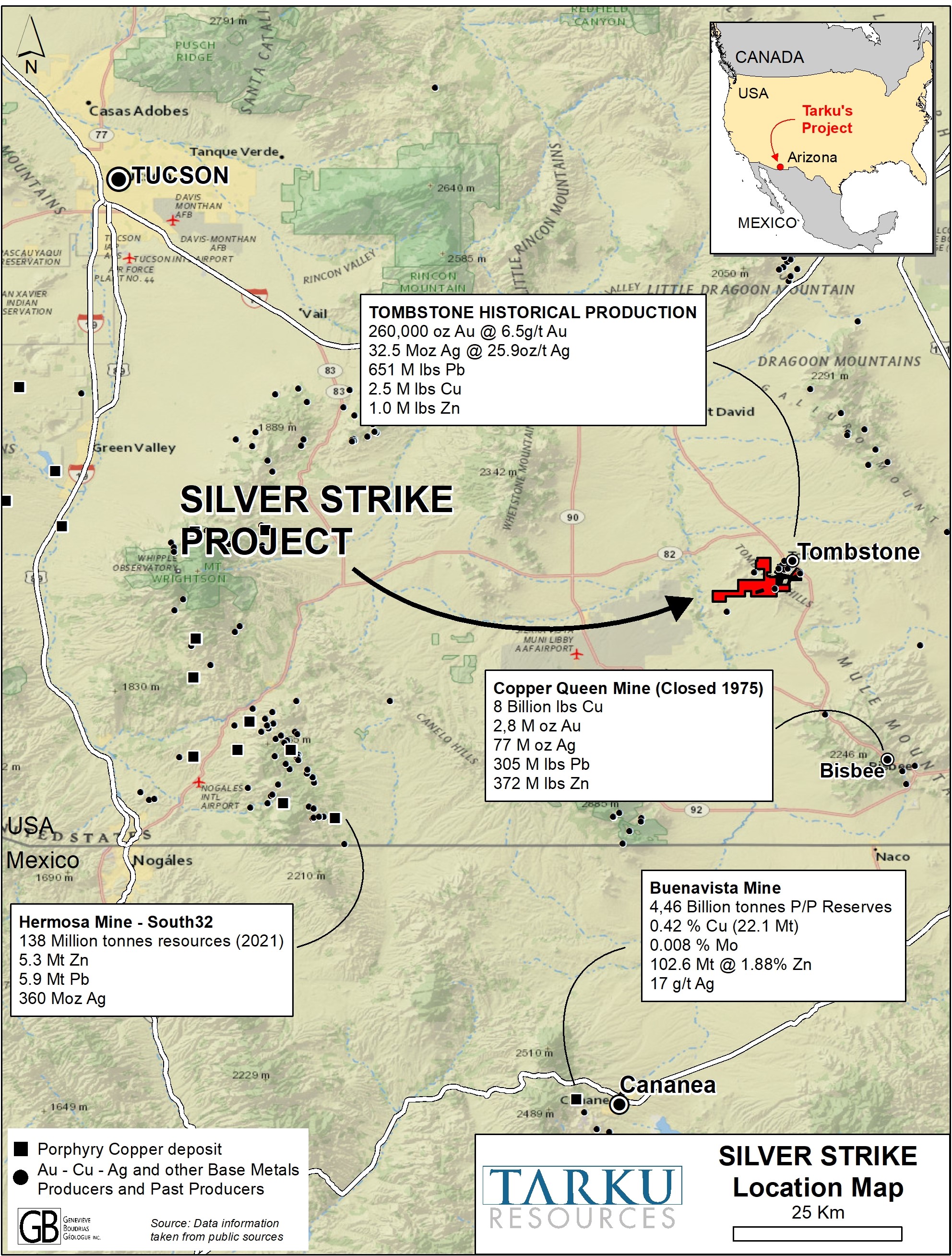

This model is similar to what is found at the Hermosa Project, located 80km west in Santa Cruz County, Arizona which South32 acquired for USD 1.8 billion in 2018. The Hermosa project See figure 1, which hosts the Taylor Deposit, is hosted in the related age and comparable sediment types and is classified as a CRD style zinc-lead-silver massive sulphide deposit. The updated Mineral Resource reported under the JORC Code (2012) at 138 million tonnes, averaging 3.82% zinc, 4.25% lead, and 81 g/t silver with a contained 5.3 million tonnes of zinc, 5.9 million tonnes of lead and 360 million ounces of silver.

Table 1 below lists the best assay results received and utilizes samples with over 5 g/t silver and over 0.05 g/t gold. Due to the presence of some significant gold and base metals results, a silver equivalent index (AgEq) was calculated using the criteria described below, Table 1.

Tarku is now in an excellent position to plan future exploration programs that will encompass soil geochemistry, geophysics surveys, and more significant and targeted diamond drill programs.

Figure 1 : Location Map positioning the Silver Strike projects and other major mining project as the Hermosa projects in South Arizona - News Release August 10 th , 2021 (see full size figure on web site).

Figure 2 : Lucky Cuss and Bunker Hill area - News Release August 10 th , 2021 (see full size figure on web site)

Figure 3 : Ground Hog area - News Release August 10 th , 2021 (see full size figure on web site)

Figure 4 : Variation between 4 Fines assay results and their regular sample results during Silver Strike RC drill program suggesting an up to over 1,000% higher mineralization content in the Fines - News Release August 10 th , 2021.

Table 1 : Drill Hole Best Assay Results updated as of this date - News Release August 10 th , 2021.

Hole # | Target | From | To | Width (2) | Ag | Au | Cu | Pb | Zn | Ag Eq (1) | Pb+Zn Comb. | Mn | |

SS21-001 | Lucky Cuss | 3,0 | 18,3 | 15,2 | 4 | 0,03 | 6 | 0,27 | |||||

SS21-002 | Lucky Cuss | 0,0 | 3,0 | 3,0 | 12 | 0,26 | 0,09 | 0,27 | 0,49 | 63 | 0,76 | 0,26 | |

SS21-003 | Luck Sure | 47,2 | 48,8 | 1,5 | 38 | 0,23 | 0,19 | 0,09 | 62 | 0,28 | 1,02 | ||

SS21-004 | East Side | 67,1 | 73,2 | 6,1 | 136 | 0,09 | 138 | 0,09 | 2,68 | ||||

incl, | 70,1 | 73,2 | 3,0 | 214 | 0,09 | 216 | 0,09 | 3,87 | |||||

SS21-004 | East Side | 80,8 | 86,9 | 6,1 | 24 | 24 | 0,79 | ||||||

incl, | 82,3 | 86,9 | 4,6 | 28 | 0,19 | 0,25 | 41 | 0,44 | 0,83 | ||||

SS21-005 | East Side | 123,44 | 128,02 | 4,6 | 24 | 0,30 | 0,06 | 0,20 | 0,25 | 66 | 0,45 | 0,33 | |

incl, | 123,4 | 126,5 | 3,0 | 22 | 0,39 | 0,10 | 0,22 | 0,33 | 77 | 0,55 | 0,44 | ||

SS21-006 | Lucky Cuss | 56,4 | 67,1 | 10,7 | 20 | 0,34 | 0,02 | 0,20 | 0,16 | 57 | 0,36 | 0,46 | |

incl, | 56,4 | 59,4 | 3,0 | 17 | 0,75 | 0,06 | 0,39 | 0,36 | 100 | 0,75 | 0,36 | ||

SS21-007 | Lucky Cuss | 4,6 | 22,9 | 18,3 | 99 | 0,86 | 0,05 | 0,61 | 0,47 | 198 | 1,09 | 0,55 | |

SS21-007 | incl, | 6,1 | 9,1 | 3,0 | 397 | 3,85 | 0,20 | 2,73 | 2,70 | 855 | 5,43 | 0,84 | |

incl, | 7,6 | 9,1 | 1,5 | 720 | 6,44 | 0,34 | 5,08 | 5,05 | 1 515 | 10,13 | 1,11 | ||

SS21-007 | Lucky Cuss | 15,2 | 22,9 | 7,6 | 55 | 0,37 | 0,04 | 0,08 | 0,03 | 89 | 0,11 | 0,33 | |

incl, | 15,2 | 16,8 | 1,5 | 80 | 1,03 | 0,18 | 0,07 | 0,06 | 180 | 0,14 | 0,50 | ||

SS21-007 | Lucky Cuss | 74,7 | 76,2 | 1,5 | 203 | 0,31 | 0,19 | 0,26 | 0,38 | 264 | 0,64 | 4,79 | |

SS21-008 | Bunker Hill | 51,8 | 53,3 | 1,5 | 0,20 | 0,10 | 0,30 | 0,45 | |||||

SS21-009 | Bunker Hill | 10,7 | 16,8 | 6,1 | 13 | 0,03 | 0,01 | 14 | 0,04 | 0,12 | |||

incl, | 13,7 | 15,2 | 1,5 | 24 | 0,08 | 0,11 | 0,05 | 34 | 0,16 | 0,25 | |||

SS21-009 | Bunker Hill | 74,7 | 76,2 | 1,5 | 67 | 0,30 | 0,07 | 1,28 | 0,55 | 144 | 1,82 | 2,61 | |

SS21-010 | Bunker Hill | 96,0 | 97,5 | 1,5 | 11 | 0,07 | 0,29 | 0,14 | 27 | 0,42 | 0,85 | ||

SS21-011 | Ground Hog | 64,0 | 70,1 | 6,1 | 11 | 0,03 | 0,00 | 0,10 | 0,03 | 17 | 0,13 | 0,16 | |

SS21-012 | Ground Hog | 71,6 | 89,9 | 18,3 | 31 | 0,15 | 0,00 | 0,51 | 0,19 | 61 | 0,70 | 1,60 | |

incl. | 73,2 | 74,7 | 1,5 | 204 | 0,38 | 0,00 | 0,90 | 0,28 | 262 | 1,19 | 0,35 | ||

SS21-013 | Ground Hog | No significant results | |||||||||||

SS21-014 | Ground Hog | No significant results | |||||||||||

SS21-015 | Ground Hog | 134,1 | 141,7 | 7,6 | 13 | 0,32 | 0,00 | 0,13 | 0,26 | 48 | 0,38 | 2,08 | |

SS21-016 | Ground Hog | 76,2 | 77,7 | 1,5 | 26 | 0,47 | 0,00 | 0,59 | 0,36 | 86 | 0,94 | 5,13 | |

SS21-017 | Ground Hog | No significant results | |||||||||||

SS21-018 | West Rattlesnake | Abandoned hole | |||||||||||

SS21-019 | West Rattlesnake | No significant results | |||||||||||

SS21-020 | Ace in the Hole | 95,0 | 120,0 | 25,0 | 9 | 0,09 | 0,00 | 0,10 | 0,31 | 28 | 0,41 | 0,65 | |

SS21-021 | Ace in the Hole | 44,2 | 47,2 | 3,0 | 11 | 0,00 | 0,00 | 0,05 | 0,47 | 27 | 0,53 | 0,63 | |

SS21-022 | Solstice | 22,9 | 29,0 | 6,1 | 45 | 0,05 | 0,00 | 0,10 | 0,21 | 58 | 0,31 | 1,30 | |

SS21-022 | Solstice | 103,6 | 105,2 | 1,5 | 96 | 0,41 | 0,00 | 0,13 | 0,49 | 145 | 0,62 | 5,66 | |

SS21-023 | Solstice | 24,4 | 25,9 | 1,5 | 40 | 0,10 | 0,00 | 0,22 | 0,19 | 59 | 0,42 | 2,19 | |

- Ag Equivalent (AgEq): Only samples with over 5g/t Ag and over 0.05g/t Au were used - Prices of $24/oz silver, $1,800/oz gold (ratio Au:Ag = 65:1), $4.00/lb copper (ratio Cu:Ag = 0.01:1), $0.90/lb lead (ratio Pb:Ag = 0.002:1) and $1.20/lb zinc (ratio Zn:Ag = 0.003:1) were used for equivalent calculations. 100% recoveries have been considered as no metallurgical study has been made yet.

- Intervals shown are drill intercept, true thickness cannot be calculated yet.

Qualified persons

Julien Davy, P.Geo., M.Sc, MBA, President and Chief Executive Officer of Tarku, the qualified person under National Instrument 43-101 Standards of Disclosure for Mineral Projects, prepared, supervised and approved the technical information in this news release.

About Tarku Resources Ltd. (TSX.V: TKU - FRA: 7TK - OTCBQ: TRKUF)

Tarku is an exploration company focused on new discoveries in favourable mining jurisdictions such as Quebec and Arizona. In Quebec, Tarku owns 100% of the ' Three A 's' exploration projects, (Apollo, Admiral and Atlas Projects), in the Matagami Greenstone belt, which has been interpreted by management as the eastern extension of the Detour Belt, and which has seen recent exploration successes by Midland Exploration Inc., Wallbridge Mining Company Ltd., Probe Metals Inc. In Arizona, in the Tombstone district, Tarku owns the option to acquire 75% on 20km2 in the Silver Strike Project.

Tarku Contact Information :

Email: investors@tarkuresources.com

Website: www.tarkuresources.com

Please follow @TarkuResources on LinkedIn, Facebook, Twitter and Instagram.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This press release may contain forward-looking statements that are subject to known and unknown risks and uncertainties that could cause actual results and activities to vary materially from targeted results and planning. Such risks and uncertainties include those described in Tarku's periodic reports including the annual report or in the filings made by Tarku from time to time with securities regulatory authorities.

SOURCE: Tarku Resources Ltd.

View source version on accesswire.com:

https://www.accesswire.com/659115/Tarku-Announces-Completion-of-Initial-Drilling-Program-at-Silver-Strike-with-Confirmation-of-a-Significant-Silver-Copper-Lead-Zinc-Rich-CRD-System