- Drilling to commence at Jupiter zone, a 3-km-long regional-scale structure

- Targeting source of kilometre-long boulder train grading to 25.2 g/t Au

- 3,000 metres-plus diamond drilling across Eianarson and Rogue projects in 2021

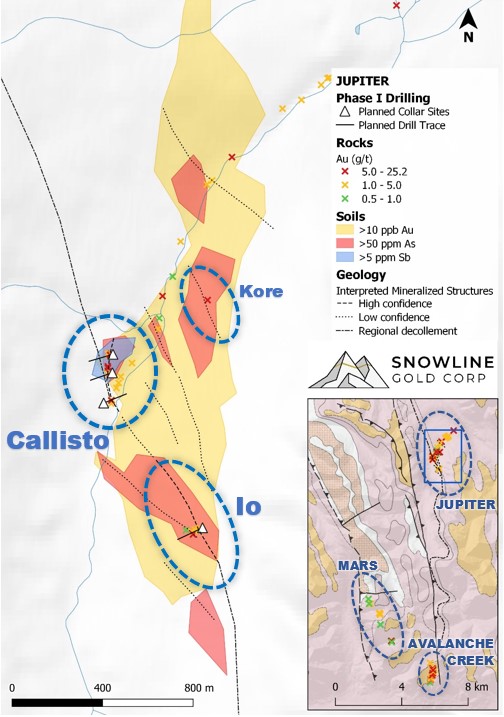

Snowline Gold Corp. (CSE:SGD)(OTC PINK:SNWGF) (the "Company" or "Snowline") is pleased to announce that it has commenced drill mobilization to the Company's 61,000 hectare Einarson gold project in the Yukon Territory, Canada. Initial drilling will test the newly defined Jupiter zone (formerly "Mars NE"), a 3-kilometre long by up to 500-metre-wide area of anomalous gold-in-soil values accompanied by a prominent float train of mineralized quartz boulders. These boulders commonly assay between 1 and 7 gt Au, to a maximum of 25.2 gt Au

"We are very excited to begin drilling at Jupiter," said Scott Berdahl, COO and Director of Snowline. "Our first-ever drill programme will build on several campaigns of mineral discovery and target-defining exploration. The broad areal extent, high grade surface samples, and geological similarities to large epizonal gold deposits make Jupiter a very prospective target."

The geological setting and style of mineralization at Jupiter suggest the presence of a shallow orogenic gold system, with possible similarities to Newfound Gold's Queensway project or Kirkland Lake's Fosterville Mine. Geochemical similarities between mineralization at Jupiter and nearby Carlin-style gold deposits suggest mineralization may be genetically related.

2021 Drill Campaign

Early-season technical work by Snowline Gold's team suggests that the gold occurrences at Jupiter are associated with an extensive regional structure. Mineralization has been identified over more than a kilometer, with a mineralized float train stretching 3 km (see Figure 1). A 1,500 metre Phase I diamond drilling program is designed to intersect the mineralization with a series of shallow, 200-300 metre deep holes.

Phase II drilling will build upon the surface exploration and drill results from Jupiter. An additional 1,500 metres is budgeted to test other targets across the Einarson property and on Snowline's nearby Rogue property.

Figure 1 - Planned Phase I drill sites atop exploration geochemistry at Jupiter. At least three source areas have been identified for the mineralization in the float train, and Phase I drilling will test two of these zones. Jupiter is part of a larger structural zone that includes the Mars and Avalanche Creek prospects in the southern part of the Einarson property.

Surface Exploration Strategy

Prospecting at Einarson in late 2020 discovered a mineralized float train similar to Jupiter along a major structural corridor ~12 kilometres to the south, with grab samples up to 34.2 g/t Au. This new zone, Avalanche Creek, demonstrates the regional scope of the occurrence of this style of mineralization. Extensive prospecting is planned along favourable structures at Einarson. A concurrent a program of trenching, mapping, drone surveying and geochemical sampling is underway at Jupiter to provide additional context for Phase I drill results and to aid in targeting the Phase II drilling.

At Rogue, prospecting in the Valley zone this season has already encountered abundant sulphide veining across a 250-metre traverse, about 600 metres from where similar gold-bearing sulphide veins with historic grab sample assays of up to 152.0 g/t Au occur with visible gold. Assays for these new samples are pending. Extensive mapping, geochemical sampling, prospecting and a drone-based aerial magnetic survey will be conducted at Rogue to solidify targets for a first-ever diamond drill program in the Valley and/or Gracie zones.

Figure 2 - Quartz textures at Jupiter indicate gold deposition at a shallow crustal level, with multiple pulses of mineralizing fluid flow. A) Overgrown blading texture in quartz, possibly after calcite, which would indicate fluid boiling. Float sample ER1916 - 6.78 g/t Au. B) Banded, fine-grained arsenopyrite gives an almost colloform appearance. Float sample ER1942 - 3.1 g/t Au. C) Ankeritic brecciation of milky quartz with chalcedonic veinlets. Float sample ER1922 - 0.8 g/t Au. Similar texture with more sulphides (float sample ER1923) returned 7.38 g/t Au D) Bladed siderite and euhedral quartz filling an open space in a high-level vein. Subcrop sample ER1950 - Au below detection.

Qualified Person

Information in this release has been reviewed and approved by Scott Berdahl, P. Geo., Chief Operating Officer of Snowline and a Qualified Person for the purposes of National Instrument 43-101. The Einarson property is an early-stage exploration property that does not presently contain any mineral resources as defined by National Instrument 43-101.

ABOUT Snowline Gold Corp.

Snowline Gold Corp. is a Yukon Territory focused gold exploration company with a 7-project portfolio covering over 90,000 ha. The Company is exploring its flagship 72,000 ha Einarson and Rogue gold projects in the prospective yet underexplored Selwyn Basin, with drilling expected to commence in June 2021. Snowline's projects all lie in the prolific Tintina Gold Province that hosts multiple million-ounce-plus gold mines and deposits, from Kinross' Fort Knox mine to Newmont's Coffee deposit. Snowline's first mover claim position represents a unique opportunity to explore and expand a new greenfield, district-scale gold system.

ON BEHALF OF THE BOARD

Nikolas Matysek, B.Sc. (Geol)

CEO & Director

For further information, please contact:

Snowline Gold Corp.

+1 (778) 228-3020

info@snowlinegold.com

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This news release contains certain forward-looking statements, including statements about the Company reviewing its newly acquired project portfolio to maximize value, reviewing options for its non-core assets, including targeted exploration and joint venture arrangements, conducting follow-up prospecting and mapping this summer and plans for exploring and expanding a new greenfield, district-scale gold system. Wherever possible, words such as "may", "will", "should", "could", "expect", "plan", "intend", "anticipate", "believe", "estimate", "predict" or "potential" or the negative or other variations of these words, or similar words or phrases, have been used to identify these forward-looking statements. These statements reflect management's current beliefs and are based on information currently available to management as at the date hereof.

Forward-looking statements involve significant risk, uncertainties and assumptions. Many factors could cause actual results, performance or achievements to differ materially from the results discussed or implied in the forward-looking statements. Such factors include, among other things: risks related to uncertainties inherent in drill results and the estimation of mineral resources; and risks associated with executing the Company's plans and intentions. These factors should be considered carefully and readers should not place undue reliance on the forward-looking statements. Although the forward-looking statements contained in this news release are based upon what management believes to be reasonable assumptions, the Company cannot assure readers that actual results will be consistent with these forward-looking statements. These forward-looking statements are made as of the date of this news release, and the Company assumes no obligation to update or revise them to reflect new events or circumstances, except as required by law.

SOURCE: Snowline Gold Corp.

View source version on accesswire.com:

https://www.accesswire.com/651887/Snowline-Gold-Mobilizes-Drill-to-Einarson-Gold-Project-Yukon-Territory