- The first two holes ever drilled into the Valley target intersected trace amounts of visible gold across broad regions of drill core

- Prospecting at Valley encountered auriferous sheeted quartz veins over a large area with grab samples of up to 15.95 g/t Au

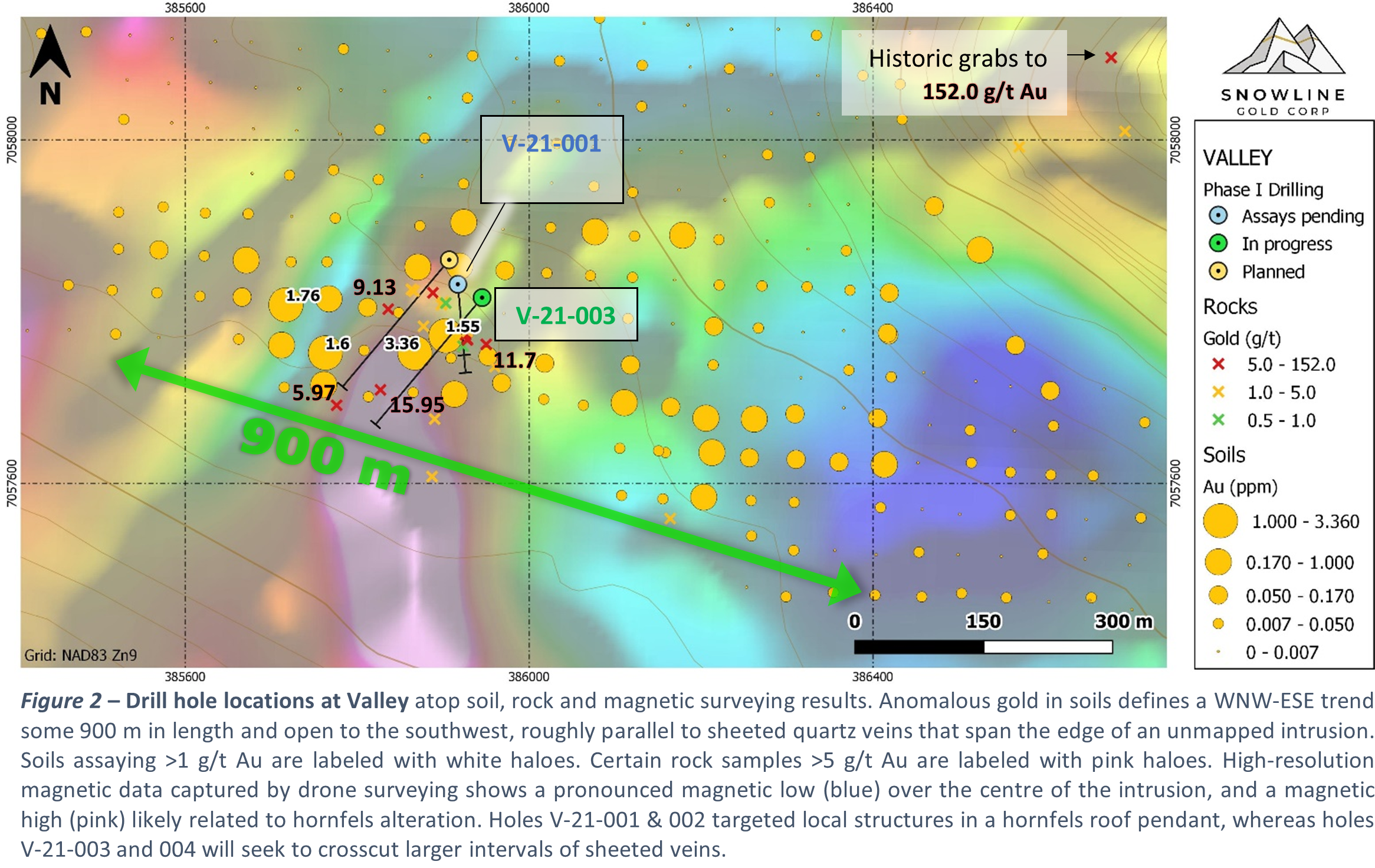

- Soil geochemistry results delineate an open 900 x 150 m soil anomaly associated with sheeted veins within and around a recently identified Tombstone series intrusion. Four soil samples returned >1 g/t Au to a maximum of 3.36 g/t Au.

Snowline Gold Corp. (CSE:SGD) (US OTC:SNWGF) (the "Company" or "Snowline") is pleased to provide an update on its exploration activities on its flagship Rogue project in the Yukon, Canada. Holes V-21-001 and V-21-002, the first two holes ever drilled into Snowline's "Valley" gold target, both intersected trace amounts of visible gold across much of their 161 m and 242 m lengths in quartz veins associated with a previously untested reduced-intrusion related gold system. Targeting efforts prior to drilling revealed an open, 900 x 150 m zone of anomalous gold-in-soils associated with a recently identified intrusion accompanied by sheeted quartz veins assaying to 15.95 gt Au

"Visible gold mineralization at Rogue marks Snowline's second drill discovery in as many drill campaigns this season. We await assay results for the full story," said Scott Berdahl, CEO and Director of Snowline Gold Corp. "Those new to Snowline may be surprised at the apparent success of our inaugural season. But while we are a newly listed company, this is not a new endeavour. We were built on over three decades of mostly private Yukon-focused exploration. Our flagship projects have taken various forms over the past 11 years, with millions spent on baseline data collection yielding promising targets and ideas. Snowline is now well-positioned to reap the benefits. We are fortunate to begin our journey at the drill discovery phase-the steepest value-add in the mining life cycle-and we are just getting started. Our recent successes further validate Snowline's driving thesis of a new gold district in the Selwyn Basin spanning multiple deposit types across our Rogue, Einarson and Ursa projects."

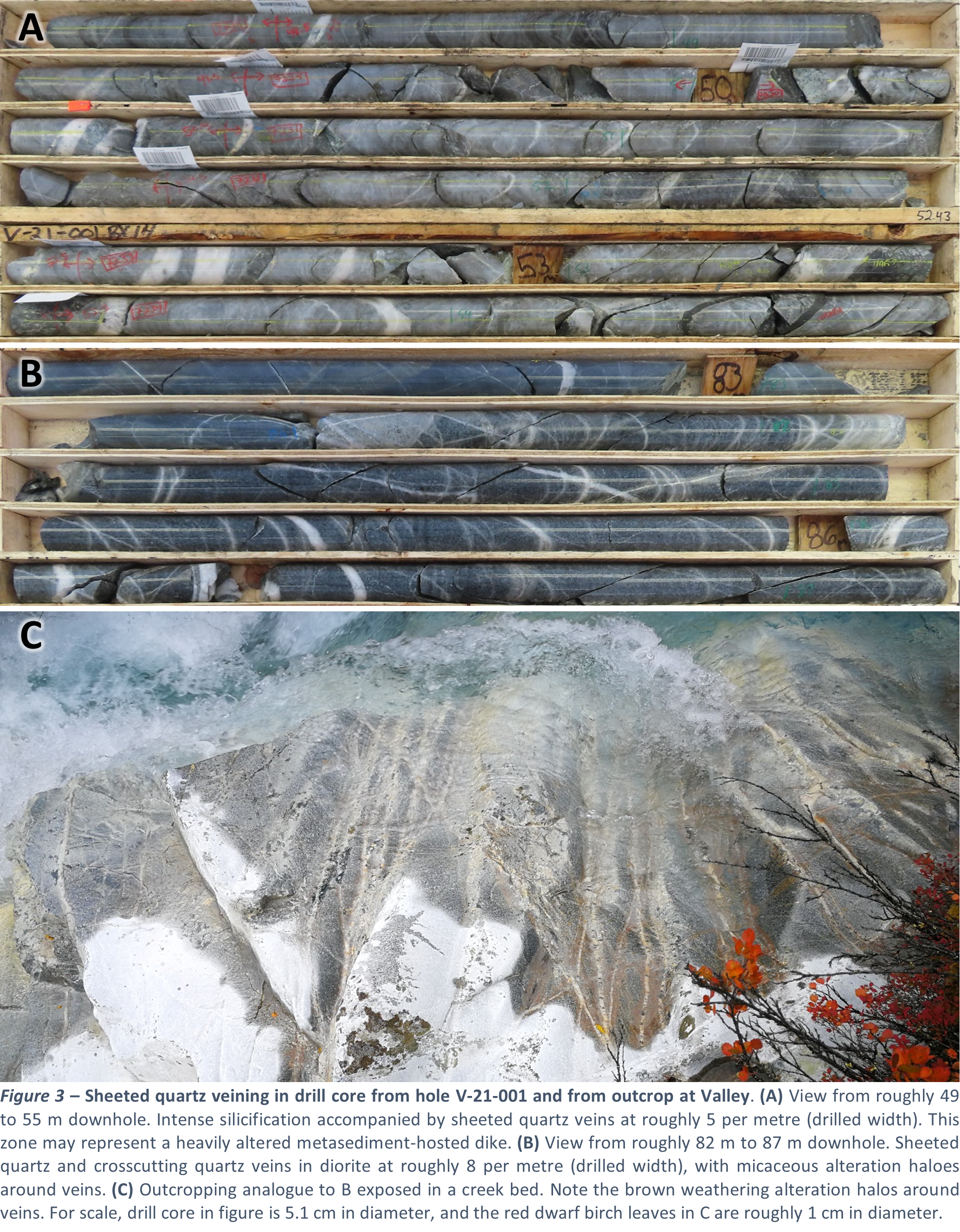

Holes V-21-001 and 002 were drilled from a single pad along an azimuth of 175°, dipping 50° and 70° (Figure 2). Visible gold encountered in drill core occurs as grains roughly 0.1-0.5mm in size within centimetre-scale, sheeted quartz veins that are present at varying densities per metre throughout both holes. In hole V-21-001, at least 28 of these small quartz veins contain visible gold, with up to five grains observed in a single vein crosscutting core. In hole V-21-002, instances of visible gold are observed through to 217.5 m depth (total hole depth 242 m). Sheeted veins are present in both hornfels sedimentary rocks and in a dominantly diorite to quartz-diorite intrusion (Figure 3). This intrusion does not appear on current geological maps, but based on nearby mapped intrusions, it is likely a member of the Mayo plutonic suite, a series of Cretaceous-aged felsic intrusions responsible for significant gold deposits including Fort Knox in Alaska and the Eagle gold mine in the Yukon Territory.

The drill discovery caps off a busy season of careful advancement and targeting by Snowline at Valley (Figure 2), comprising soil sampling, prospecting, preliminary geological mapping, and drone-supported detailed magnetic surveying and orthophotography across the target. Some 376 grid soils were collected at Valley, with partially returned assay results revealing a 900 m x 150 m zone of elevated and anomalous soils. Four soil samples received to date returned greater than 1 g/t Au, to a maximum of 3.36 g/t Au. Prospecting and preliminary geological mapping revealed a broad zone of sheeted veining striking WNW-ESE coincident with the soil anomaly. Grab samples of vein material commonly ranged from 2 g/t Au to 16 g/t Au, though readers are cautioned that overall grade in such systems commonly depends on vein densities in addition to grade. A 411-line-kilometer magnetic survey conducted by EarthEx Geophysical Solutions revealed the extent of the mostly covered intrusion and associated structures and will be useful in guiding Snowline's drill exploration efforts.

While encouraged by the discovery of visible gold in V-21-001 and 002, the company cautions that its true significance will not be known until drill hole assay results are available. Given laboratory wait times of 1-2+ months, these results are unlikely to be available in the near term. In known deposits of this type, the density of sheeted veining is as important as the grade of the veins as the host rock is commonly barren. No resources nor reserves have been calculated at Rogue, and while current results are encouraging, they do not guarantee that economically viable ore bodies will be encountered at the Valley target or elsewhere.

QUALIFIED PERSON

Information in this release has been prepared and approved by Scott Berdahl, P. Geo., Chief Executive Officer of Snowline and a Qualified Person for the purposes of National Instrument 43-101.

ABOUT Snowline Gold Corp.

Snowline Gold Corp. is a Yukon Territory focused gold exploration company with a seven-project portfolio covering >90,000 ha. The Company is exploring its flagship 72,000 ha Einarson and Rogue gold projects in the highly prospective yet underexplored Selwyn Basin. Snowline's project portfolio sits within the prolific Tintina Gold Province, host to multiple million-ounce-plus gold mines and deposits including Kinross' Fort Knox mine, Newmont's Coffee deposit, and Victoria Gold's Eagle Mine. Snowline's first-mover land position provides a unique opportunity for investors to be part of multiple discoveries and the creation of a new gold district.

ON BEHALF OF THE BOARD

Scott Berdahl, MSc, MBA, PGeo

CEO & Director

For further information, please contact:

Snowline Gold Corp.

+1-778-650-5485

info@snowlinegold.com

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This news release contains certain forward-looking statements, including statements about the Company reviewing its newly acquired project portfolio to maximize value, reviewing options for its non-core assets, including targeted exploration and joint venture arrangements, conducting follow-up prospecting and mapping this summer and plans for exploring and expanding a new greenfield, district-scale gold system. Wherever possible, words such as "may", "will", "should", "could", "expect", "plan", "intend", "anticipate", "believe", "estimate", "predict" or "potential" or the negative or other variations of these words, or similar words or phrases, have been used to identify these forward-looking statements. These statements reflect management's current beliefs and are based on information currently available to management as at the date hereof.

Forward-looking statements involve significant risk, uncertainties and assumptions. Many factors could cause actual results, performance or achievements to differ materially from the results discussed or implied in the forward-looking statements. Such factors include, among other things: risks related to uncertainties inherent in drill results and the estimation of mineral resources; and risks associated with executing the Company's plans and intentions. These factors should be considered carefully, and readers should not place undue reliance on the forward-looking statements. Although the forward-looking statements contained in this news release are based upon what management believes to be reasonable assumptions, the Company cannot assure readers that actual results will be consistent with these forward-looking statements. These forward-looking statements are made as of the date of this news release, and the Company assumes no obligation to update or revise them to reflect new events or circumstances, except as required by law.

SOURCE: Snowline Gold Corp.

View source version on accesswire.com:

https://www.accesswire.com/662959/Snowline-Gold-Intersects-Visible-Gold-in-First-Two-Drill-Holes-and-Delineates-900-X-150-Metre-Gold-in-Soil-Anomaly-at-Its-Valley-Target-Rogue-Project-Yukon