- TLMZ21-12 intersected 5.80 metres averaging 47.56 g/t Au within a broader interval of 12.60 metres averaging 23.76 g/t Au

- Intersection is interpreted to be a new zone of mineralization, sub-parallel to the Main Zone

- TLMZ21-12 includes the second highest grade interval ever reported at Tartan Lake

Satori Resources Inc. (TSXV: BUD) ("Satori" or the "Company") is pleased to announce additional results from the completed Phase One drill program at the 100% owned Tartan Lake property, Flin Flon, Manitoba.

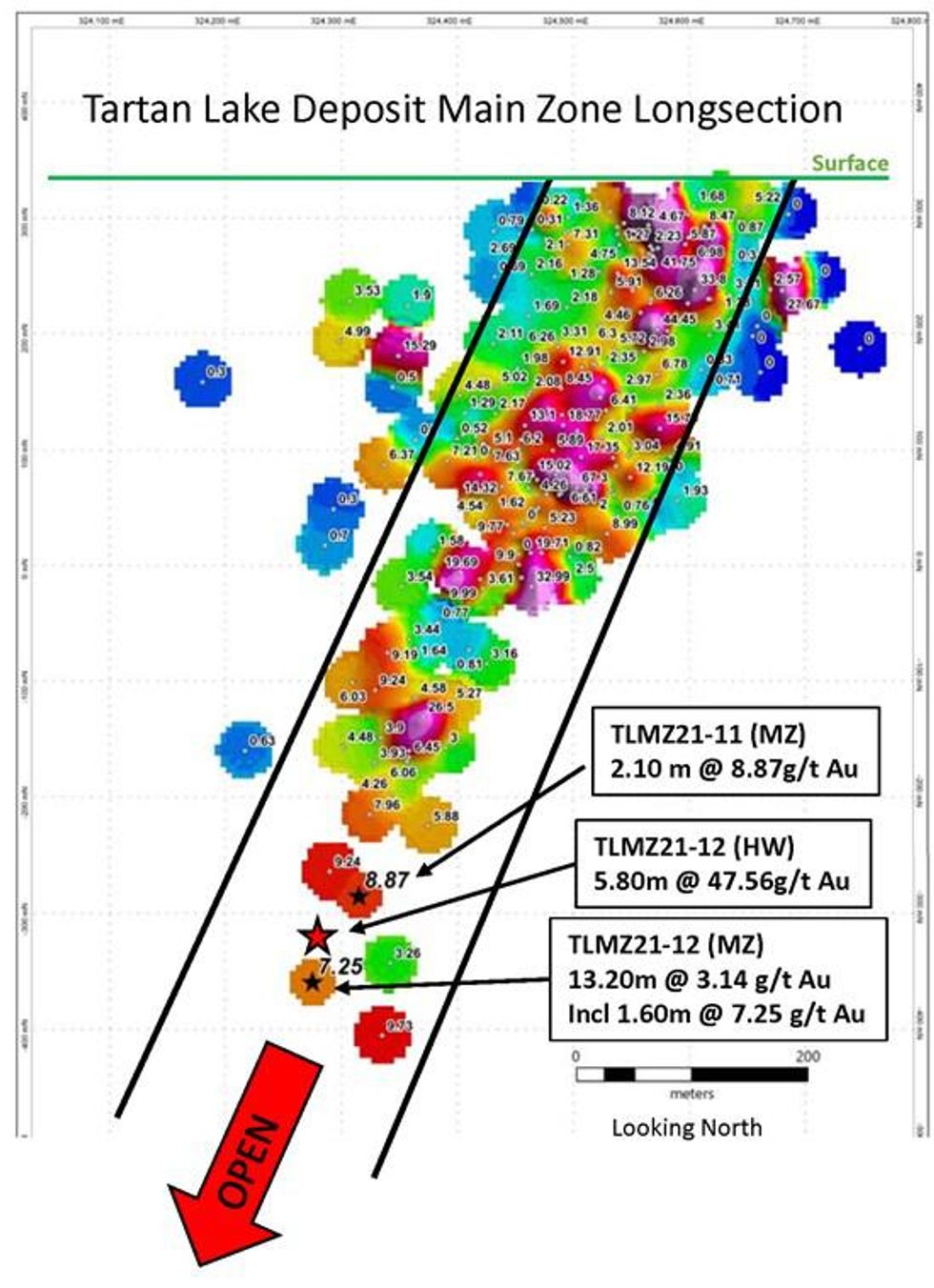

TLMZ21-11 and TLMZ21-12 both targeted the down plunge continuation of the Main Zone mineralization, approximately 100 metres to the west of TLMZ21-01 (4.15 metres averaging 9.73 g/t Au) and 75 and 150 metres below the historic holes defining the resource limits.

Both holes intersected two distinct zones of mineralization. A hanging wall ("HW") zone, not observed in the earlier holes, completed 100 metres to the east, associated with quartz-feldspar intrusives, and was intersected 20-25 metres above the quartz-carbonate-tourmaline veins defining the Main Zone.

TLMZ21-12 intersected 5.80 meters averaging 47.56 g/t Au in the HW zone followed by a Main Zone intercept of 1.60 metres averaging 7.25 g/t Au (Ref. Figure 1.0 and Table 1.0). The Company advises that results of the standard screen metallic assays for the HW zone are pending. The Company believes that it is unlikely the screen metallic results will materially affect the reported results.

TLMZ21-11 intersected 5.25 metres averaging 2.25 g/t in the HW zone followed by 2.10 metres averaging 8.87 g/t Au in the Main Zone (Ref. Figure 1.0 and Table 1.0).

Jennifer Boyle, Chief Executive Officer, states that "These latest results clearly demonstrate that additional discovery potential exists at depth along the Main Zone plunge. Over 500 drill holes have been completed at Tartan Lake. To have one hole of a small drill program intercept the second highest grade ever reported at Tartan Lake is a very encouraging result. The hanging wall mineralization intersected in hole TLMZ21-12 may represent a new zone of gold mineralization that parallels the Main Zone. The signature quartz-carbonate veining is absent in the hanging wall zone. The high-grade mineralization is associated with felsic intrusives and increased sulphide content, which is further evidence suggesting that the hanging wall mineralization could reflect a new zone of mineralization. Additional drilling to evaluate the extent of the hanging wall mineralization at depth to the west is certainly a priority for 2022. We are currently finalizing a ground based induced polarity ("IP") survey of the Main, South, McFadden and Ruby Lake targets. We believe that the IP survey will identify additional, undrilled targets within the host shear zones. Our plan is to complete the IP survey in Q1-2022 and start a follow up drill program late in Q1-2022."

Table 1.0 - Summary of Results TLMZ21-11 and 12, TLSZ21-10

| Target | Hole ID | From | To | Interval (1) | Grade | Zone |

| (metres) | (metres) | (metres) | (Au g/t) | |||

| Main Zone | TLMZ21-11 | 715.25 | 720.50 | 5.25 | 2.15 | HW |

| and | 732.15 | 738.95 | 6.80 | 5.53 | Main | |

| including | 736.85 | 738.95 | 2.10 | 8.87 | ||

| TLMZ21-12 | 769.00 | 781.60 | 12.60 | 23.76 | HW | |

| including | 770.90 | 776.70 | 5.80 | 47.56 | ||

| and | 799.80 | 813.00 | 13.20 | 3.14 | Main | |

| including | 805.40 | 807.00 | 1.60 | 7.25 | ||

| South Zone | TLSZ21-10 | No significant values | South | |||

Table 2.0 - Tartan Lake Highest Value Intercepts - Project to Date

| Rank | Hole ID | From | To | Interval (1) | Grade | Grade x Interval | Zone |

| (#) | (metres) | (metres) | (metres) | (Au g/t) | (gram meters) | ||

| 1 | NUG324 (2) | 43.69 | 46.37 | 2.68 | 151.16 | 405.11 | Main |

| 2 | TLMZ21-12 | 770.90 | 776.70 | 5.80 | 47.56 | 275.85 | HW |

| 3 | NUG222 (2) | 41.84 | 45.00 | 3.16 | 83.34 | 263.35 | Main |

| 4 | NAP43 (2) | 64.00 | 67.20 | 3.20 | 78.54 | 251.33 | Main |

| 5 | NUG136 (2) | 51.43 | 55.19 | 3.76 | 58.00 | 218.08 | Main |

| 6 | NUG221 (2) | 25.39 | 36.96 | 11.57 | 17.35 | 200.74 | Main |

| 7 | NUG189 (2) | 90.58 | 99.12 | 8.54 | 23.25 | 198.56 | Main |

| 8 | NAP86 (2) | 221.59 | 231.83 | 10.24 | 18.77 | 192.20 | Main |

| 9 | NAP112W4 (2) | 187.19 | 193.33 | 6.14 | 29.89 | 183.52 | Main |

| 10 | NUG255 (2) | 17.39 | 20.08 | 2.69 | 67.31 | 181.06 | Main |

(1) Interval is measured down hole. There is insufficient information to estimate true width at this time.

(2) Historical interval.

Figure 1 Longitudinal Section - Main Zone

To view an enhanced version of Figure 1, please visit:

https://orders.newsfilecorp.com/files/3276/106810_24abe33704360bfd_002full.jpg

Wes Hanson P.Geo., Director of Satori, is the qualified person who has reviewed and approved the contents of this press release.

ABOUT Satori Resources Inc. (TSXV: BUD)

Satori is a Toronto-based mineral exploration and development company whose primary property is expanding the resource at the past producing Tartan Lake Gold Mine Project, located in the prolific Flin Flon Greenstone Belt, Manitoba.

The Tartan Lake Project (2,670 Ha.) is located approximately 12 kilometres northeast of Flin Flon, Manitoba, and includes the Tartan Lake Mine (1986-1989) which produced 36,000 ounces of gold before the mine was shut down due to, in part, the price of gold falling below USD$390. Remaining infrastructure includes: an indicated resource estimate of 240,000 ounces averaging 6.32 g/t Au (see news release February 23, 2017), an all-season access road, grid connected power supply, mill, mechanical, warehouse and office buildings, tailing impoundment and a 2,100 metre decline and developed underground mining galleries to a depth of 300 metres from surface. Gold mineralization is associated with anastomosing quartz-carbonate veins hosted in east-west striking, steeply dipping shear zones up to 30 metres in width. The veins vary from several centimetres to several metres in width and gold grades vary from 1.0 to +100 g/t. Satori believes the mineral resources of the project are currently limited by drill coverage.

FOR FURTHER INFORMATION, PLEASE CONTACT:

Jennifer Boyle, B.A., LL.B.

President and Chief Executive Officer

Satori Resources Inc.

(416) 904-2714

jennifer@capexgroupinc.com

Mr. Pete Shippen

Chair, Satori Resources Inc.

(416) 930-7711

pjs@extramedium.ca

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

CAUTION REGARDING FORWARD-LOOKING INFORMATION

This news release of Satori contains statements that constitute "forward-looking statements." Such forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause Satori's actual results, performance or achievements, or developments in the industry to differ materially from the anticipated results, performance or achievements expressed or implied by such forward-looking statements.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/106810