TSXV:OGN)(OTCQX:OGNRF) Orogen Royalties Inc. ("Orogen" or the "Company") is pleased to announce it has signed an option agreement (the "Agreement") with Badger Minerals LLC ("Badger"), a private mineral exploration company, for the Kalium Canyon gold project in Nevada, USA

To earn a 100% interest in the Kalium Canyon project, Badger will make cash payments of US$1.75 million and exploration expenditures of US$5.0 million over a five-year period. Orogen will retain a 2% net smelter return ("NSR") royalty of which 0.5% can be purchased for US$2.0 million.

"Orogen's property portfolio is suitably positioned for partnerships with good quality producing and exploration companies," commented Orogen CEO Paddy Nicol. "These partnerships are structured on the foundation of royalty creation or equity interests, cash payments, and exploration work in a short time frame, and accomplishes Orogen's strategy of cost-effective organic royalty creation. Our eleven joint ventures in British Columbia, Nevada, and Mexico have active exploration and drilling programs and provide an excellent opportunity to increase our royalty portfolio."

About the Kalium Canyon Project

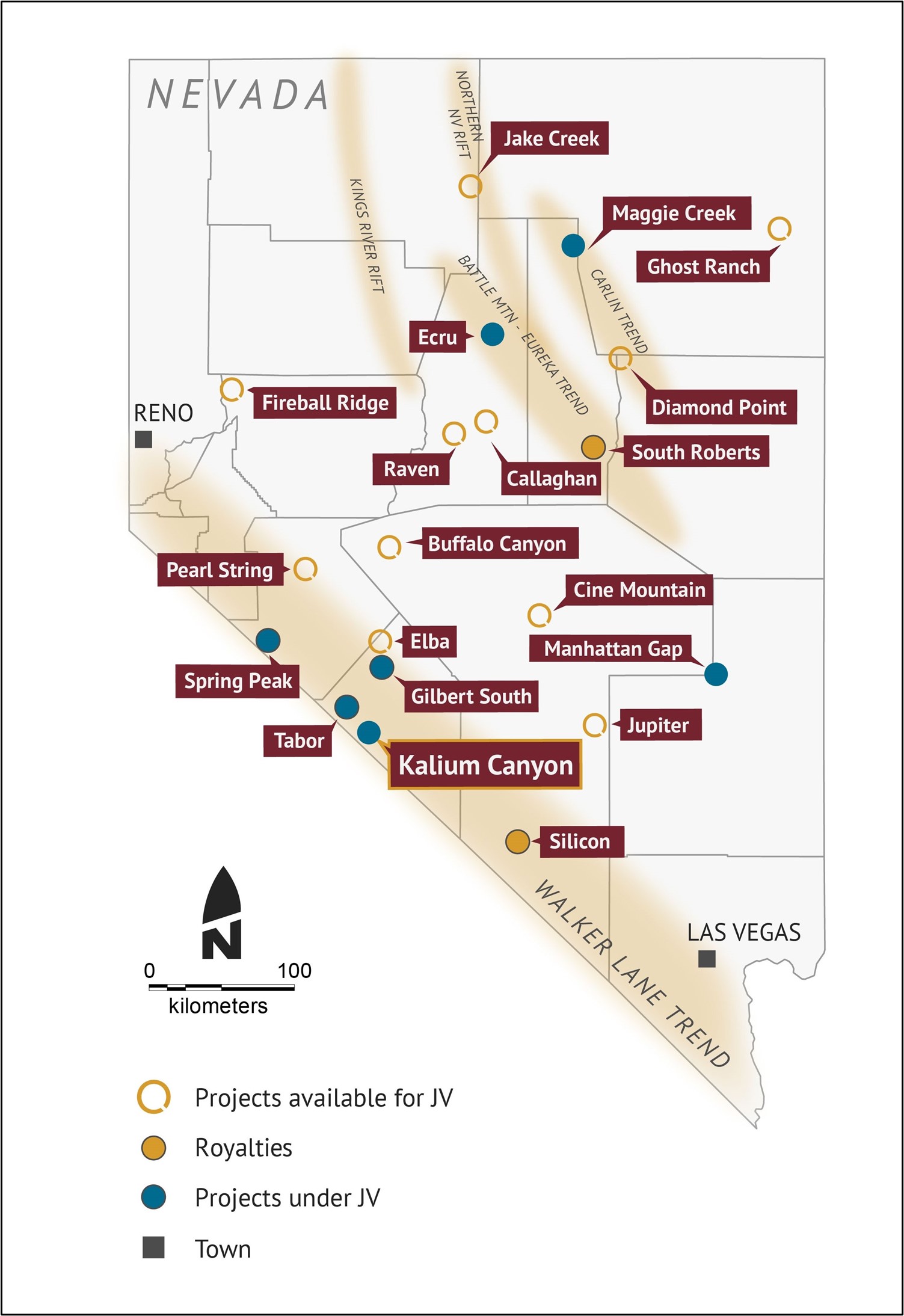

Kalium Canyon covers 101 claims in the Walker Lane trend (Figure 1) where many low sulfidation epithermal gold discoveries in Nevada have been found, including North Bullfrog, C-Horst/Lynnda Strip, Silicon, and Eastside. Locally, the project lies within the Red Mountain district where approximately 10 million ounces of silver was produced.

Kalium Canyon contains the Kalium and Argenta zones, northeast trending mineralized structures that run parallel to the historic 16-1, Nivloc, and Mohawk mines where production came from large continuous veins underground. (Figure 2).

Figure 1: Location of Orogen's interests in Nevada

Figure 2: Mineralized structures near Kalium Canyon. Geology from Stewart et al (1974)

The Kalium structure is an undrilled, one- to two-kilometre-long corridor overlain by a steam heated cell of alunite-kaolinite alteration. The Argenta structure to the southeast is approximately four to five kilometres long and hosts a known gold-rich stockwork vein system with historic chip channel samples from 1947 of 15 metres grading 3.74 grams per tonne ("g/t") gold and later reverse circulation drilling returning up to 46 metres grading 1.2 g/t gold. The mineralization is hosted by high-angle breccias which are open to depth. Siliceous sinters exposed at the surface attest to the shallow level of exposure of this structural zone, similar to the shallow style of alteration exhibited by the Kalium structure.

Both structural zones have potential for hosting precious metal mineralization beneath shallow caps, and past drilling has been limited to small portions of these systems.

Terms of the Kalium Canyon Option

Under the terms of the Agreement, Badger can earn a 100% interest in Kalium Canyon by making cash payments of US$1.75 million and US$5.0 million in exploration expenditures subject the following schedule:

- $25,000 cash on the date of signing the Agreement;

- $50,000 cash and $250,000 in exploration on or before the first anniversary;

- $100,000 cash and $500,000 in exploration on or before the second anniversary;

- $100,000 cash and $1,000,000 in exploration on or before the third anniversary;

- $250,000 cash and $1,500,000 in exploration on or before the fourth anniversary; and

- $1,225,000 cash and $1,750,000 in exploration on or before the fifth anniversary of the Effective Date.

Upon exercising the option, Badger will grant to Orogen a 2% NSR of which 0.5% can be purchased for U$2.0 million. Upon commencement of commercial production, Badger will also make a one-time payment of US$5.00 per ounce gold equivalent contained on an NI 43-101 reserves and resources estimate on a Feasibility Study to a maximum of US$10.0 million.

The Kalium Canyon project also includes the "Marty" claims, that the Company recently acquired from Bridgeport Gold Inc. ("Bridgeport"), a wholly owned subsidiary of Sandstorm Gold Royalties (TSX:SSL). The Company paid Bridgeport a total consideration of 100,000 Orogen shares. The Company received conditional acceptance from TSX Venture Exchange on June 17, 2021.

Qualified Person Statement

All technical data, as disclosed in this press release, has been verified by Laurence Pryer, Ph.D., P.Geo., Exploration Manager for Orogen. Dr. Pryer is a qualified person as defined under the terms of National Instrument 43-101.

About Orogen Royalties Inc.

Orogen Royalties Inc. is focused on organic royalty creation and royalty acquisitions on precious and base metal discoveries in western North America. Orogen's royalty portfolio includes the Ermitaño West gold deposit in Sonora, Mexico (2% NSR royalty) being developed by First Majestic Silver Corp. and the Silicon gold project (1% NSR royalty) in Nevada, USA, being advanced by AngloGold Ashanti N.A. The Company is well financed with several projects actively being developed by joint venture partners.

On Behalf of the Board

OROGEN ROYALTIES INC.

Paddy Nicol

President & CEO

To find out more about Orogen, please contact Paddy Nicol, President & CEO at 604-248-8648, and Liliana Wong, Manager of Marketing and Investor Relations at 604-248-8648. Visit our website at www.orogenroyalties.com.

Orogen Royalties Inc.

1201 - 510 West Hastings Street

Vancouver, BC

Canada V6B 1L8

info@orogenroyalties.com

Forward Looking Information

This news release includes certain statements that may be deemed "forward looking statements". All statements in this presentation, other than statements of historical facts, that address events or developments that Orogen Royalties Inc. (the "Company") expect to occur, are forward looking statements. Forward looking statements are statements that are not historical facts and are generally, but not always, identified by the words "expects", "plans", "anticipates", "believes", "intends", "estimates", "projects", "potential" and similar expressions, or that events or conditions "will", "would", "may", "could" or "should" occur.

Forward looking information relates to statements concerning the Company's future outlook and anticipated events or results, as well as the Company's management expectations with respect to the proposed business combination (the "Transaction"). This document also contains forward-looking statements regarding the anticipated completion of the Transaction and timing thereof. Forward-looking statements in this document are based on certain key expectations and assumptions made by the Company, including expectations and assumptions concerning the receipt, in a timely manner, of regulatory and stock exchange approvals in respect of the Transaction.

Although the Company believe the expectations expressed in such forward looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results may differ materially from those in the forward looking statements. Factors that could cause the actual results to differ materially from those in forward looking statements include market prices, exploitation and exploration successes, and continued availability of capital and financing, and general economic, market or business conditions. Furthermore, the extent to which COVID-19 may impact the Company's business will depend on future developments such as the geographic spread of the disease, the duration of the outbreak, travel restrictions, physical distancing, business closures or business disruptions, and the effectiveness of actions taken in Canada and other countries to contain and treat the disease. Although it is not possible to reliably estimate the length or severity of these developments and their financial impact as of the date of approval of these condensed interim consolidated financial statements, continuation of the prevailing conditions could have a significant adverse impact on the Company's financial position and results of operations for future periods.

Investors are cautioned that any such statements are not guarantees of future performance and actual results or developments may differ materially from those projected in the forward looking statements. Forward looking statements are based on the beliefs, estimates and opinions of the Company's management on the date the statements are made. Except as required by securities laws, the Company undertakes no obligation to update these forward looking statements in the event that management's beliefs, estimates or opinions, or other factors, should change.

SOURCE: Orogen Royalties Inc.

View source version on accesswire.com:

https://www.accesswire.com/655553/Orogen-Options-the-Kalium-Canyon-Project-to-Badger-Minerals