NV Gold Corporation ( TSXV:NVX)(OTCQB:NVGLF) (" NV Gold " or the " Company ") is pleased to announce that the Company has initiated its planned IP Survey at its 100%-owned Sandy Gold Project (" Sandy "), located within the Walker Lane, Lyon County, Nevada, USA. Combined with the Leapfrog modelling and detailed mapping earlier in the 3 rd Quarter, the outcome of the IP Survey will be used for better target definition to guide a 2 nd Phase drilling program projected for the 1 st Quarter of 2022 or earlier depending on equipment availability

Recap of previously announced 2021 Sandy Project Highlights

- The Company completed its expanded program of 17 RC (Reverse Circulation) drill holes totaling 3,811 m (12,505 ft) in 1 st Quarter of 2021.

- The "maiden" RC drilling has encountered a large epithermal gold system. The alteration footprint at the surface has a strike length of 2.4 kilometers and a width of half a kilometer. Most of the property remains undrilled, and the system remains open at depth and under late volcanic cover.

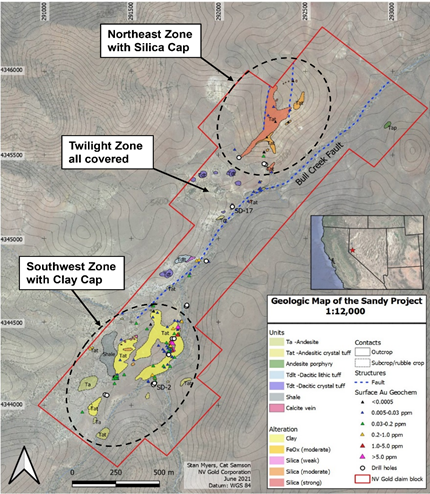

- A surface rock chip sampling program completed yielded positive gold values from anomalous to high grade. Of note, five samples yielded 11.3 g/t Au and 11.6 g/t Ag, 11.5 g/t Au and 14.1 g/t Ag, and 18.1 g/t Au and 43.2 g/t Ag (refer to Figure 1).

- All seventeen of the 2021 RC holes intercepted anomalous gold and strong trace element geochemistry. Twelve holes were above a threshold of >3 meters @ >0.1 g/t Au. The strongest intercept was 22.9 meters @ 0.65 g/t Au from 29 meters to 51.9 meters (including 6.1 meters of 1.58 g/t Au at 38.1 meters) in SD-2 (refer to Figure 1).

Mapping Conclusions

Hydrothermal alteration at Sandy is predominantly clay to silica-clay alteration (of the tuffaceous rocks) in the Southwest Zone, mostly seen as float around epithermal quartz vein pieces, while stronger (massive and "near-massive") silicification forms ridgelines and broader structural zones in the upper Northeast Zone (refer to Figures 1 & 3). Very white clay, possibly illite, is interpreted in the strongest silica-clay altered zones, both in the Southwest and Northeast Zones. The alteration is consistent with low sulfidation vein alteration and looks to be clay alteration developed on the margins or above epithermal veins. Based on the size, elevation range, zonation (silica above, clay below) and apparent geometry of the alteration, the Northeast Zone could be an altered cap overlying a preserved epithermal vein system.

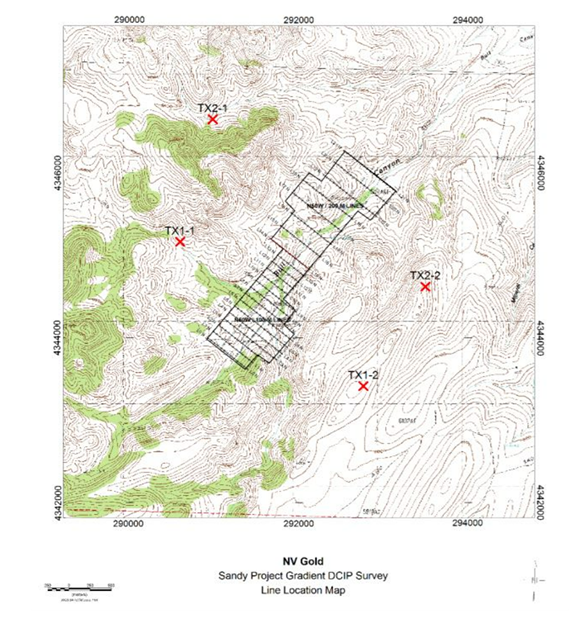

The upcoming IP (refer to Figure 2) survey should be especially useful to interpret the 3D geometry of the alteration at the Northeast zone. Even if high resistivity is relatively shallow (shallow silicification) and any subsurface veins are too narrow to detect, the widespread clay alteration should produce moderate resistivity/conductivity anomalies in 3D and any roots or zones of greater resistivity or conductivity (near vein halo alteration) may be considered as vein drill targets. Deeper zones of greater chargeability may indicate broader sulfide rich zones around deeper veins and would also be potential drill targets. Once the IP surveying is completed, deeper drill targeting should be straightforward.

"The strike-length and amount of alteration and the presence of high-grade Au of up to 18.1 g/t Au from rock chips remain encouraging for an economic gold system at Sandy. I was pleased to have Mr. Myers and Ms. Teal (previously known as Pinto) involved in the program, which will provide an immediate upgrade in data quality. I have worked with Stan and Rita for many years together at Yanacocha, Peru, where we were engaged in numerous discoveries, including the Kupfertal Porphyry. Several Au and trace element geochem anomalies remain untested at Sandy, and the Leapfrog modelling suggests there may be open gold mineralization in the Southwest Zone. In addition, mapping has identified a highly silicified and altered cap, possibly overlying a preserved epithermal vein system at the Northeast Zone that is very encouraging. I am excited and looking forward to see the IP results soon to be included and guiding our 2 nd Phase drilling campaign in 1 st Q of 2022", stated Thomas Klein, VP Exploration, NV Gold.

On behalf of the Board of Directors,

John E. Watson

President & CEO

For further information, visit the Company's website at www.nvgoldcorp.com or contact:

John E. Watson, President & CEO

Phone: 1-888-363-9883

Neither the TSX Venture Exchange nor its Regulation Service Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward Looking Statements

This news release includes certain forward-looking statements or information. All statements other than statements of historical fact included in this release, including, without limitation, statements regarding the Company's planned exploration activities, the possible interpretations of the results of the IP survey, the geological interpretation of clay composition, of a cap overlying an epithermal system or of possible gold mineralization are forward-looking statements that involve various risks and uncertainties. There can be no assurance that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Important factors that could cause actual results to differ materially from the Company's plans or expectations include regulatory issues, market prices, availability of capital and financing, general economic, market or business conditions, timeliness of government or regulatory approvals, the lack of continuity of mineralization, the extent to which mineralized structures extend on to the Company's Projects and other risks detailed herein and from time to time in the filings made by the Company with securities regulators. The Company disclaims any intention or obligation to update or revise any forward-looking statements whether because of new information, future events or otherwise, except as otherwise required by applicable securities legislation.

Figure 1: Mapping-Sandy Project

Figure 2: Location of proposed IP lines at the Sandy Project

Figure 3: Silicified hydrothermal breccia ribs on the hilltop of the Northeast Zone, looking northeast.

SOURCE: NV Gold Corp.

View source version on accesswire.com:

https://www.accesswire.com/661435/NV-Gold-Commenced-IP-Survey-at-its-Sandy-Gold-Project-in-Nevada