(TheNewswire)

Vancouver, Canada - TheNewswire June 25, 2021 - Nexus Gold Corp. (" Nexus " or the " Company ") (TSXV:NXS ) ( OTC:NXXGF ) ( FSE:N6E) is pleased to report that it has completed its ground reconnaissance program over its 100% owned, 190.53 sq-km (19,053-hectare), Manzour-Dayere gold exploration permit located on the Boromo Greenstone belt, 325 km southwest of the capital city of Ouagadougou, Burkina Faso, West Africa.

Members of the Company's geological team conducted a series of geological mapping and prospecting exercises over various areas of the concession. The property is underlain by a wedge of volcano-sedimentary rocks which hosts numerous artisanal workings. Local artisanal miners are extracting material from quartz veins occurring in the volcano sedimentary package. The wedge is completely surrounded by felsic intrusive rocks.

A large alluvial mining camp is located near the northeast corner of the property. Nexus geologists viewed several areas in these workings where coarse free gold was being extracted. The alluvial workings are 500 meters downstream from the Manzour-Dayere property suggesting that the property may have contributed to gold deposition there. In total the geological team traversed over 250 kilometers of roads and trails, collecting multiple samples from several areas of interest. Sample results will be released once received, reviewed, and verified.

Previous operators on the property identified nine structures through an airborne magnetics survey. These structures received little to no follow up work. Data accumulated by the team from this program is currently being reviewed and once completed the scope and nature of follow up exploration plans will be determined.

Follow up programs will look to expand the gold mineralization that has already been identified in the Northeast corner of the property and returned results of 9.60 grams-per-tonne ("g/t") gold ("Au"), 7.07 g/t Au, 5.73 g/t Au, 3.84 g/t Au and 2.84 g/t Au (see Company news release dated February 27, 2020).

Recent historical exploration on the property conducted between 2011 and 2014 returned reported high-grade values of 132 g/t Au, 85.40 g/t Au, 61.20 g/t Au, and 27.9 g/t Au, from select grab samples of quartz veining at the main orpaillage in the extreme northeast corner of the property, while select grab samples of the sedimentary host rock returned values of 103 g/t Au and 21.40 g/t Au, respectively. The workings on the main orpaillage are extensive and extend to depths of 60 to 80 meters below surface.*

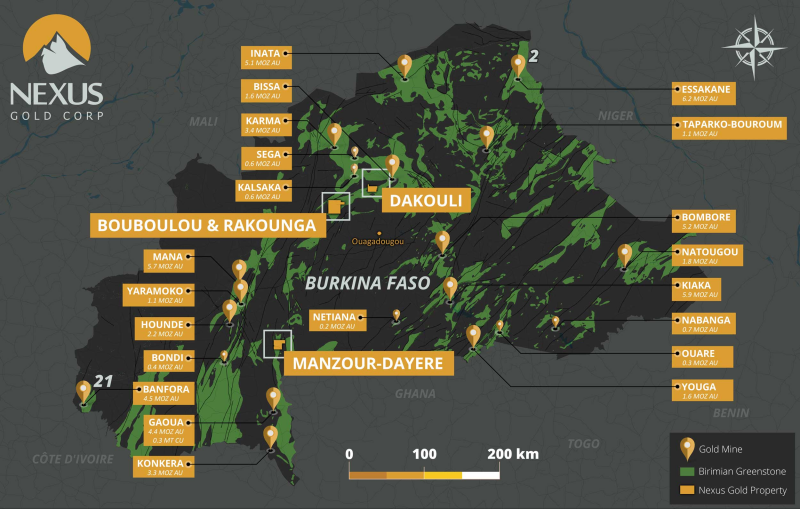

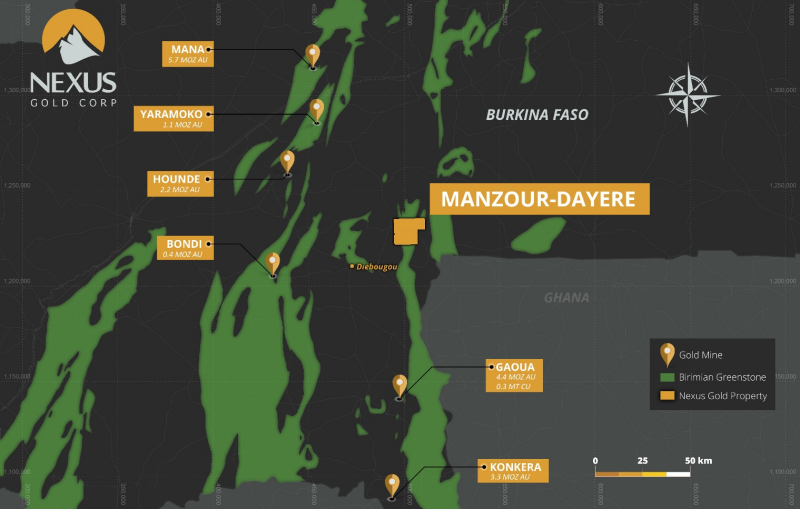

The Manzour-Dayere Concession is located along the Boromo Greenstone belt, an early Proterozoic Birimian sequence of the West African Craton, that is home to several significant gold deposits. Situated in southwestern Burkina Faso, near the border with Ghana, the area is home to several producing mines, including Yaramoko (Roxgold), Hounde (Endeavour), Poura (Newmont), Bondi (Sarama).

Image 1: Nexus Gold projects and significant deposits/mines, Burkina Faso, West Africa

Image 2: Manzour-Dayere location, with and nearby deposits/mines, southern Burkina Faso, West Africa

Non-Brokered Private Placement

The Company also announces that it has completed the offering of 16,109,450 units (each, a " Unit "). The Units were offered by way of non-brokered private placement, at a price of $0.05 per Unit, for gross proceeds of $805,472.50. Each Unit consists of one common share and one common share purchase warrant (each, a " Warrant ") exercisable to acquire an additional common share at a price of $0.07 until June 28, 2024. The gross proceeds from the offering will be used for further project development work and for general working capital purposes.

In connection with completion of the offering, the Company paid finders' fees of $13,500 and issued 270,000 Warrants to certain arm's-length parties that introduced subscribers to the offering. All securities issued in connection with completion of the offering are subject to a four-month-and-one-day statutory hold period, in accordance with applicable securities laws, until October 29, 2021.

* Please note that while the Company considers sampling results from the Manzour-Dayere concession to be accurate, readers are cautioned that a Qualified Person has been unable to verify the laboratory involved in the analysis of these samples, and no documentation was available regarding quality control procedures utilized in the analysis.

Grab samples are selective by nature and may not represent the true grade or style of mineralization across the property .

Warren Robb P.Geo., Vice President, Exploration, is the designated Qualified Person as defined by National Instrument 43-101 and is responsible for the technical information contained in this release.

About the Company

Nexus Gold is a Canadian-based gold exploration and development company with an extensive portfolio of projects in Canada and West Africa. The Company's primary focus is on its 100%-owned, 98-sq km Dakouli 2 Gold Concession in Burkina Faso, West Africa, and the approximately 1400-ha McKenzie Gold Project, located in Red Lake, Ontario. The Company is concentrating on the development of its core assets while seeking joint-venture, earn-in, and strategic partnerships for other projects in its portfolio.

For more information, please visit nxs.gold

On behalf of the Board of Directors of

Nexus Gold CORP.

Alex Klenman

President & CEO

604-558-1920

info@nexusgoldcorp.com

www.nexusgoldcorp.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. This news release may contain forward-looking statements. These statements are based on current expectations and assumptions that are subject to risks and uncertainties. Actual results could differ materially because of factors discussed in the management discussion and analysis section of our interim and most recent annual financial statement or other reports and filings with the TSX Venture Exchange and applicable Canadian securities regulations. We do not assume any obligation to update any forward-looking statements, except as required by applicable laws.

Copyright (c) 2021 TheNewswire - All rights reserved.