(TheNewswire)

August 11, 2021 TheNewswire - Rouyn Noranda, Quebec - Granada Gold Mine Inc. (TSXV:GGM) (OTC:GBBFF)) (Frankfurt:B6D) (the "Company" or "Granada") is pleased to announce additional drill results from its on-going drill program at its Granada Gold Mine Project near Rouyn-Noranda along the prolific Cadillac Break in northwestern Quebec's Abitibi region.

Drilling Highlights:

GR-16-14W1 intersected 2.82 g/t over 1.0 m at 852.65m

GR-16-14W2 intersected 4.26 g/t over 1.0m at 907.85m

GR-16-14W3 intersected 7.63 g/t over 5.0 m at 886.0 m

GR-21-01 intersected 7.55 g/t over 1.0 m at 314.75 m

GR-21-02 intersected 7.91 g/t over 1.0 m at 363.85 m

GR-21-12 intersected 4.68 g/t over 1.25 m at 457.45 m

"The objective was to drill under the pit-constrained resource and at depth – in order to increase the quantity and quality of the mineral resources. These latest drill results – from new holes and wedges off existing holes – show intersections of gold of economic grade near the surface, under the pit-constrained resource and at depth. This supports the view that a significant increase in our next resource update is possible," said Frank J. Basa, P.Eng., President and CEO.

This news release presents available partial results of diamond drill wedge holes off GR-16-14 as well as infill holes between GR-11-362 and GR-11-393. The mineralized structures were intersected at various depth in each wedge showing the continuity of the structures with gold grade variability, confirming the continuation of mineralized veins.

Holes GR-21-01 and GR-21-02 were drilled to bridge a 100m gap between GR-11-362 and GR-11-393 under the pit-constrained resource. Partial results are disclosed. GR-21-12 was drilled to identify continuity of gold zones on the eastern edge of the orphan tailings.

Table 1: Structures intersected assay results

| Hole ID | From (m) | To (m) | Length (m) | Gold (g/t) | Objective |

| GR-16-14W1 | 667.55 | 668.05 | 0.50 | 2.76 | Extends under Pit-Constrained Resource |

| AND | 852.65 | 853.65 | 1.00 | 2.82 | idem |

| GR-16-14W2 | 665.30 | 666.42 | 1.12 | 0.42 | idem |

| AND | 690.00 | 694.00 | 4.00 | 1.38 | idem |

| AND | 808.50 | 811.20 | 2.70 | 1.25 | idem |

| AND | 864.00 | 865.00 | 1.00 | 3.85 | idem |

| AND | 907.85 | 908.85 | 1.00 | 4.26 | idem |

| GR-16-14W3 | 712.60 | 714.00 | 1.40 | 7.84 | idem |

| AND | 826.50 | 827.50 | 1.00 | 1.14 | idem |

| AND | 849.00 | 850.45 | 1.45 | 1.22 | idem |

| AND | 886.00 | 891.00 | 5.00 | 7.63 | idem |

| Including | 888.00 | 888.65 | 0.65 | 53.50 | idem |

| GR-21-01 | 191.25 | 195.40 | 4.15 | 1.62 | Infill between GR-11-362 & GR-11-393 |

| Including | 193.40 | 194.40 | 1.00 | 3.82 | Idem |

| AND | 223.90 | 227.05 | 3.15 | 0.81 | Idem |

| AND | 236.00 | 240.10 | 4.10 | 1.54 | Idem |

| Including | 236.00 | 237.00 | 1.00 | 4.69 | Idem |

| AND | 252.10 | 253.10 | 1.00 | 2.20 | Idem |

| AND | 314.75 | 318.22 | 3.47 | 2.32 | Idem |

| Including | 314.75 | 315.75 | 1.00 | 7.55 | Idem |

| AND | 341.40 | 342.50 | 1.10 | 4.53 | Idem |

| GR-21-02 | 361.10 | 364.85 | 3.75 | 2.61 | Idem |

| Including | 363.85 | 364.85 | 1.00 | 7.91 | Idem |

| GR-21-12 | 331.10 | 334.50 | 3.40 | 1.05 | East of Orphan Tailings |

| AND | 367.35 | 369.00 | 1.65 | 1.11 | Idem |

| AND | 379.65 | 382.95 | 3.30 | 1.52 | Idem |

| AND | 456.00 | 459.85 | 3.85 | 1.77 | Idem |

| Including | 457.45 | 458.70 | 1.25 | 4.68 | Idem |

Lengths are core length, no capping applied. Au is Gold by Fire assay, or by gravimetric finish or screen metallic method.

Table 2: DRILL HOLE LOCATION DATA – Wedges inserted at 424m depth and above

| Hole | UTME | UTMN | Elevation | Azimuth | Dip | Length (m) |

| GR-16-14W1 | 647516.8 | 5338875.7 | 298.96 | 191.5 | -65.5 | 906 |

| GR-21-01 | 646996.6 | 5338305.4 | 309.47 | 186.0 | -80.0 | 447 |

| GR-21-02 | 646996.6 | 5338305.4 | 309.47 | 196.0 | --65.0 | 429 |

| GR-21-12 | 646743.0 | 5338364.0 | 315.0 | 203 | -85.0 | 474 |

The 2021 Exploration program

The 2021 drill program is aiming to fill the gaps allowing additional mineral resources to be developed while simultaneously testing the continuity of the structures with the 200-series holes.

In addition, holes are being drilled to verify the extension of structure and gold mineralization under the orphan tailings area.

The drill program has completed 30,000 meters to date and will be paused to give the technical team the time to evaluate and assimilate all existing data as well as to incorporate the laboratory results which are lagging due to ongoing delays in turnaround times across the industry.

Qualified person

The technical information in this news release has been reviewed by Claude Duplessis, P.Eng., GoldMinds Geoservices Inc. m ember of Québec Order of Engineers and a qualified person in accordance with National Instrument 43- 101 standards.

Quality Control and Reporting Protocols

All NQ core assays reported for Wedges of 2020 holes were obtained by either 1-kilogram screen fire assay or standard 50-gram fire-assaying-AA (Atomic Absorption) finish or gravimetric finish at SGS Laboratory in Vancouver where sample preparation is done in Val d'Or, Québec. The 2021 assay results are from ALS laboratory in Val d'Or. The screen assay method is selected by the geologist or geological engineer when samples contain visible gold. The drill program, Quality Assurance/Quality Control ("QA/QC") and interpretation of results is performed by qualified persons employing a QA/QC program consistent with NI 43-101 and industry best practices. Standards and blanks are included with every 20 samples for QA/QC purposes for this program in addition to the lab QA/QC.

About Granada Gold Mine Inc.

Granada Gold Mine Inc. continues to develop the Granada Gold Property near Rouyn-Noranda, Quebec. Approximately 150,000 meters of drilling has been completed to date on the property, focused mainly on the extended LONG Bars zone which trends 2 kilometers east-west over a potential 5.5 kilometers of mineralized structure. The highly prolific Cadillac Break, the source of more than 75 million plus ounces of gold production in the past century, cuts through the north part of the Granada property. But is not necessarily indicative of mineralization hosted on the company's property.

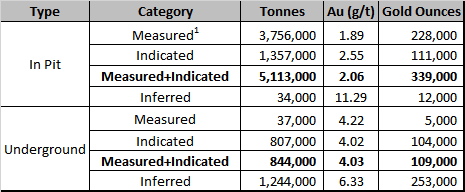

Updated Mineral Resource

The updated resource at the Company's Granada Gold project in Rouyn-Noranda, Quebec was estimated by SGS Canada and outlined in a January 29, 2021 news release. The final report was filed March 15, 2021 with an Effective date of December 15, 2020. The 43-101 Technical Report is titled: Granada Gold Project Mineral Resource Estimate Update, Rouyn-Noranda, Quebec, Canada authored by Yann Camus, P.Eng. and Maxime Dupéré, B.Sc, géo. Both of SGS Canada Inc.

Updated Mineral Resource Estimate Base Case with Details for both the Open Pit Portion and the Underground Portion

-

1. Cut-off grades are based on a gold price of US$1,600 per ounce, a foreign exchange rate of US$0.76 for CA$1, a gold recovery of 93%

-

2. Pit constrained mineral resources are reported at a cut-off grade of 0.9 g/t Au within a conceptual pit shell

-

3. Underground mineral resources are reported at a cut-off grade of 3.0 g/t Au within reasonably mineable volumes

"Frank J. Basa"

Frank J. Basa P. Eng.

President and Chief Executive Officer

For further information, please contact:

Frank J. Basa, P. Eng., President and CEO at 1-819-797-4144 or

Wayne Cheveldayoff, Corporate Communications, at 416-710-2410 or waynecheveldayoff@gmail.com

Neither the TSX Venture Exchange nor its Regulation Service Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. This news release may contain forward-looking statements including but not limited to comments regarding the timing and content of upcoming work programs, geological interpretations, receipt of property titles, potential mineral recovery processes, etc. Forward-looking statements address future events and conditions and therefore, involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated in such statements.

Copyright (c) 2021 TheNewswire - All rights reserved.