Canex Metals Inc. ("CANEX" or the "Company") is pleased to announce assay results have been received for 7 additional drill holes from the Company's 2021 reverse circulation drilling program at the Gold Range Project, Arizona

Highlights

- Hole GR21-37 from the historic Excelsior Mine returned 1.6 g/t gold over 35.1 metres starting from surface, including 2.2 g/t gold over 24.4 metres . This is the best hole drilled on the property to date and is considered high grade for a bulk tonnage target.

- Hole GR21-37 returned high grade intercepts of 4.4 g/t gold over 10.7 metres , including 8.2 g/t gold over 4.6 metres .

- Hole GR21-36 returned 1.1 g/t gold over 19.8 metres, including 6.9 g/t gold over 1.5 metres.

- Hole GR21-38 returned 1.2 g/t gold over 18.3 metres within a larger interval grading 0.8 g/t gold over 27.4 metres.

- The mineralization intersected at Excelsior is 1 kilometre from the historic Malco Mine and 2.7 kilometres from the initially drill tested Eldorado, with all three areas occurring along a district scale mineralized structure that remains open for expansion .

Dr. Shane Ebert, President of the Company stated, "We are delighted to see the initial drill results from the Excelsior zone return very strong gold grades with the zone remaining open in all directions. These grades and widths highlight the potential of the Gold Range property and the success our team is having targeting and defining zones of near surface, oxidized, bulk tonnage style gold mineralization. Drilling to date has confirmed a 3 kilometre long mineralized target zone extending from the Eldorado to the Excelsior areas, and this target is gold bearing in every place we have drill tested it so far, suggesting sizable gold resource potential. We are currently planning additional surface exploration work on the recently acquired Excelsior Mine Property to further refine drill targets along the mineralized trend with a goal of resuming drill testing as soon as a drill is available".

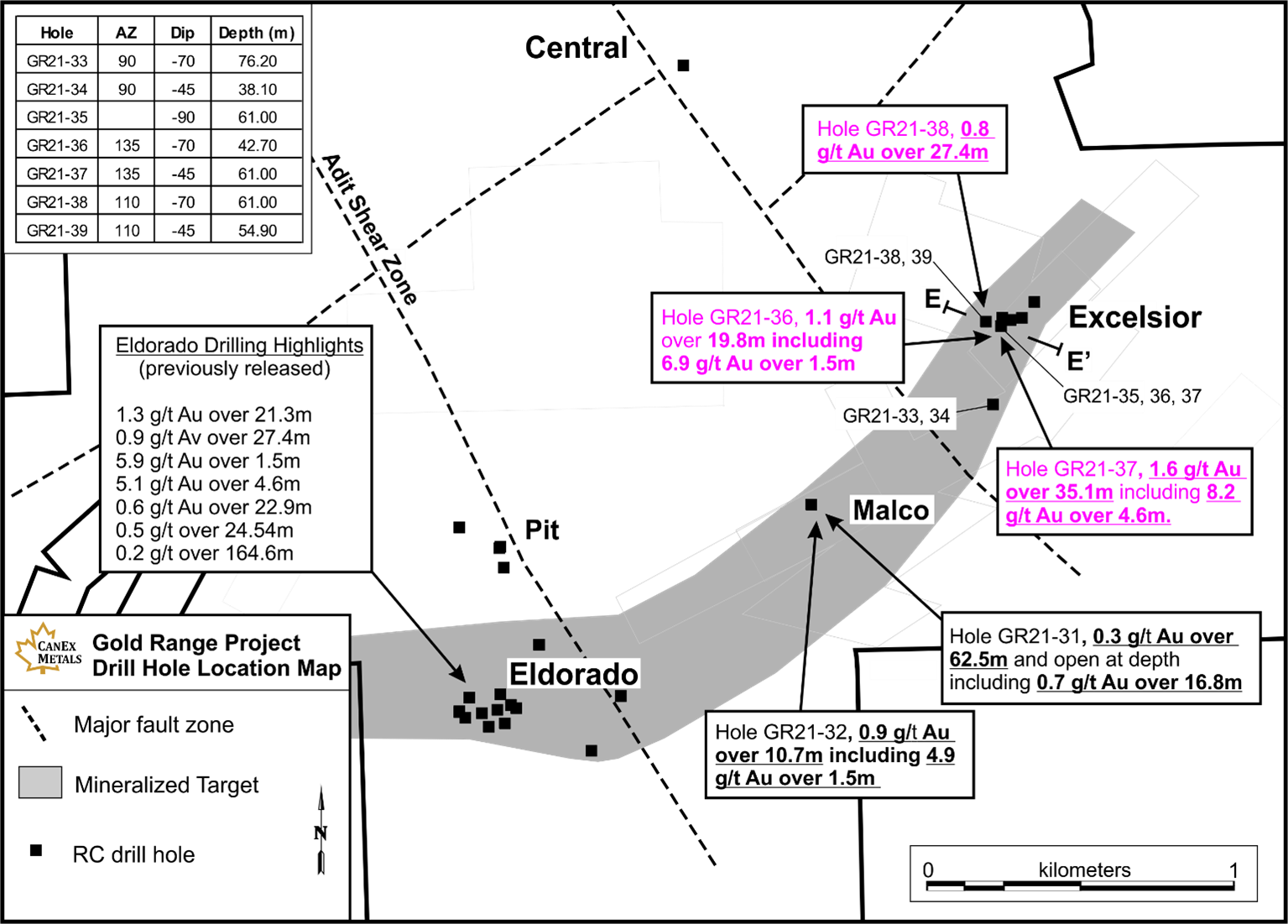

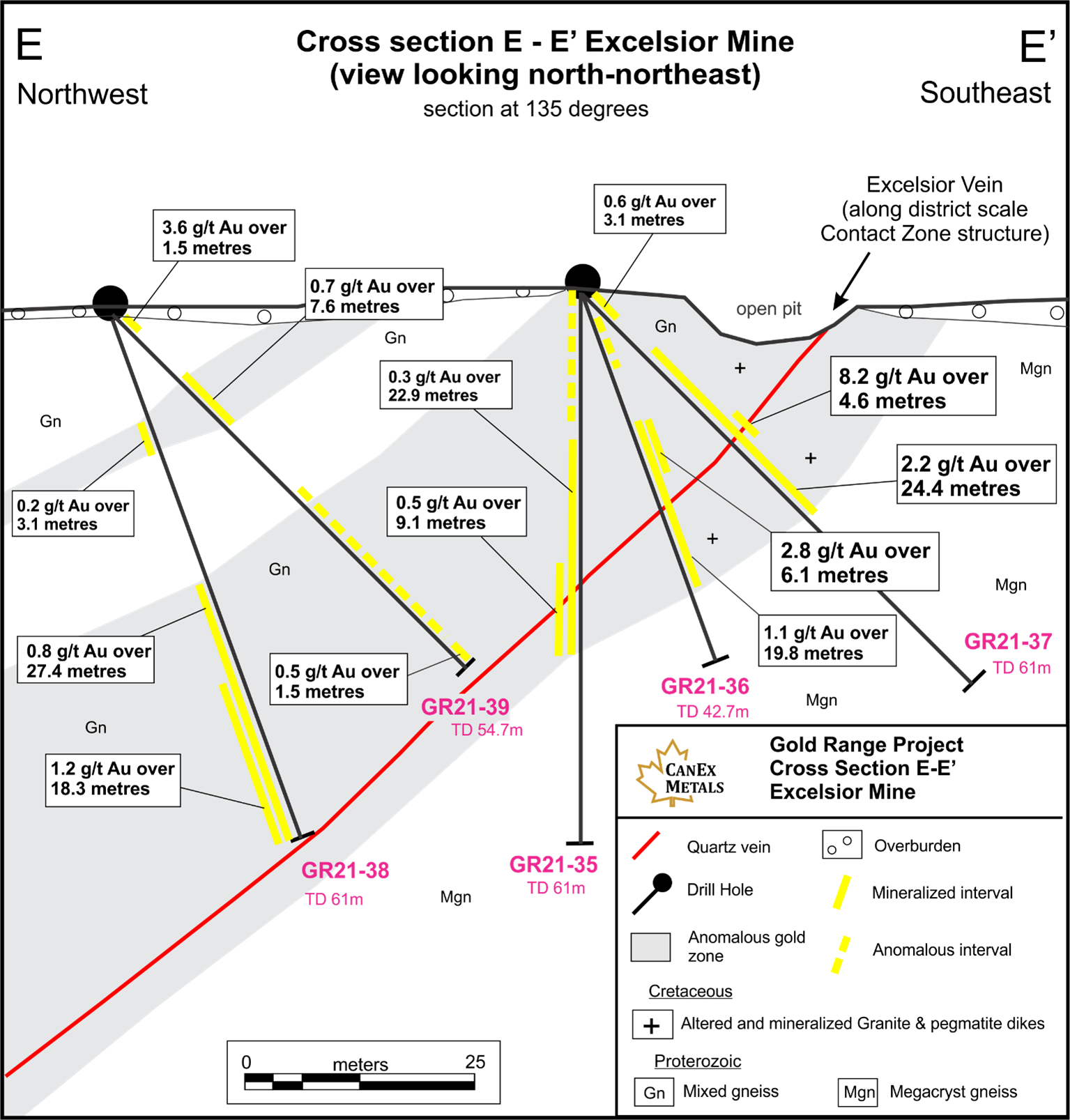

Results for reverse circulation drill holes GR21-33 to 39 from the Company's 2021 drilling program at the Gold Range project have been received and are presented here. A map showing drill hole locations is shown on Figure 1. Holes GR21-33 and 34 were drilled 250 metres south of the Excelsior zone, and holes GR21-35 to 39 tested the Excelsior area along a single cross section as shown on Figure 2.

Hole GR21-37 returned mineralization from surface to 35.06 metres depth averaging 1.6 g/t gold over 35.1 metres including a higher-grade zone containing 8.2 g/t gold over 4.6 metres . This mineralized zone is consistent with observations and sampling conducted within a small open pit above hole GR21-37, where stockwork quartz and quartz-carbonate veining occurs along with high grade veins and mineralized intrusive dikes. Holes GR21-35 and 36 were drilled from the same pad as GR21-37 and also intersected significant mineralized intervals, including 0.5 g/t gold over 9.1 metres in hole GR21-35, and 1.1 g/t gold over 19.8 metres in hole GR21-35.

Holes GR21-38 and 39 were both drilled from the same pad located 50 metres back from holes GR21-35, 36, and 37. Both holes ended in mineralization and stopped short of the main Excelsior Vein. These holes will be deepened or re-drilled in future programs. Holes GR21-38 and 39 intersected large zones of anomalous gold with hole GR21-28 returning 1.2 g/t gold over 18.3 metres.

These first holes into the Excelsior zone demonstrate good continuity of mineralization and show strong grades within a 30 to 40 metre wide mineralized zone that has a moderate dipping geometry favorable for an open pit target. Hole GR21-37 demonstrates a considerable high grade component to the system, and supports systematic drill testing of the target down dip and along strike.

Holes GR21-33 and 34 tested a blind target in a covered area coinciding with the Contact Zone structure and the occurrence of quartz boulders at surface. Hole GR21-33 intersected 0.3 g/t gold over 7.6 meters starting at 3.1 metres depth and 0.4 g/t gold over 4.6 metres starting at 15.2 metres depth before encountering the Contact Zone structure and hitting mostly barren rocks in the footwall. Hole GR21-33 continues to confirm the association of the Contact Zone structure with district scale gold mineralization, and future tests in this area will step back to the west and test a larger area in the hanging wall of the fault.

Highlights from reverse circulation drill holes GR21-33 to 39

| Drill Hole | From (m) | To (m) | Width (m)* | Au g/t |

| GR21-33 | 3.05 | 10.67 | 7.6 | 0.3 |

| GR21-33 | 15.24 | 19.81 | 4.6 | 0.4 |

| GR21-34 | 6.10 | 7.62 | 1.5 | 0.8 |

| GR21-35 | 16.76 | 39.62 | 22.9 | 0.3 |

| including | 30.48 | 39.62 | 9.1 | 0.5 |

| GR21-36 | 15.24 | 35.05 | 19.8 | 1.1 |

| including | 15.24 | 21.34 | 6.1 | 2.8 |

| including | 15.24 | 16.76 | 1.5 | 6.9 |

| GR21-37 | 0.00 | 35.06 | 35.1 | 1.6 |

| GR21-37 | 10.67 | 35.06 | 24.4 | 2.2 |

| including | 19.81 | 30.48 | 10.7 | 4.4 |

| including | 19.81 | 24.38 | 4.6 | 8.2 |

| including | 21.34 | 22.86 | 1.5 | 14.1 |

| GR21-38 | 33.53 | 60.96 EOH | 27.4 | 0.8 |

| including | 42.67 | 60.96 | 18.3 | 1.2 |

| GR21-39 | 0.00 | 1.52 | 1.5 | 3.6 |

| GR21-39 | 10.67 | 18.29 | 7.6 | 0.7 |

| GR21-39 | 53.34 | 54.86 | 1.5 | 0.5 |

*Drill hole intercepts, true widths have not been determined for most holes. Grades have not been capped in the averaging.

Figure 1. Gold Range Property showing drill holes in this release and the location of cross section E - E' at the historic Excelsior Mine.

Figure 2. Cross section E - E' through the Excelsior Mine.

January-February Gold Range Drill Program

In early 2021 the Company successfully completed 34 reverse circulation drill holes across 2.5 kilometres of strike length along the southern portion of the Gold Range Property. In total 2357.6 metres were drilled in holes ranging from 38 to 137 metres deep. Fifteen holes were drilled at the Eldorado Zone to test and expand the Company's previously announced bulk tonnage oxide discovery, 5 holes tested various targets across the southern part of the property and 14 holes tested the Excelsior Mine area.

To date 25 holes from the 2021 drill program have been received and released and results for an additional 9 drill holes are pending and will be released as they are received, compiled, and interpreted.

Quality Control

Reverse circulation drill cuttings were collected in numbered cloth sample bags from 5 foot (1.52m) intervals during drilling and were picked up from site and analyzed by Skyline Assayers and Laboratories in Tucson, Arizona (which is ISO/IEC 17025 accredited). A 1000g pulp was prepared and gold was assayed using a 50g fire assay with an atomic absorption finish (method FA-01-50g). Gold samples greater than 5 g/t are redone using a 50g fire assay method with a gravimetric finish (method FA-02 50g). Twenty-four additional elements were analyzed using a multi acid digestion and inductively coupled plasma (method TE-4). The Company included certified reference standards, blanks, and duplicates in every sample batch and then checked to ensure proper quality assurance and quality control.

About Canex Metals

Canex Metals (TSX.V:CANX) is a Canadian junior exploration company focused on advancing its Gold Range Project in Northern Arizona. Led by an experienced management team, which has made three notable porphyry and bulk tonnage discoveries in North America, CANEX has identified and tested several targets which host the potential for bulk tonnage oxide gold mineralization at its Gold Range Project. Recent drilling has identified near surface bulk tonnage gold potential at the Eldorado Zone with Hole GR21-25 returning 1.3 g/t gold over 21.3 metres including 5.1 g/t gold over 4.5 metres . The new discovery correlates with a strong gold in soil anomaly and sheeted quartz veinlets and stockworks within metamorphic rocks. The recent addition of the Excelsior Mine Property has added an additional 2 kilometres of strike along a 3 kilometre long highly prospective mineralized trend that extends from the Company's Eldorado discovery to the historic Excelsior Mine. The Excelsior Mine has seen historic underground and open pit mining along a zone 200 metres long and open along strike. Gold mineralization is centered along the shallow dipping high grade Excelsior Vein which is surrounded by a halo of sheeted quartz and quartz carbonate veins 20 to 50 metres wide.

The Company remains focused on testing and advancing key exploration targets on the Gold Range Property through continued exploration and drilling.

Dr. Shane Ebert P.Geo., is the Qualified Person for Canex Metals and has approved the technical disclosure contained in this news release.

"Shane Ebert",

Shane Ebert

President/Director

For Further Information Contact:

Shane Ebert at 1.250.964.2699 or

Jean Pierre Jutras at 1.403.233.2636

Web: https://www.canexmetals.ca

Neither the TSX Venture Exchange nor its regulation services provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Except for the historical and present factual information contained herein, the matters set forth in this news release, including words such as "expects", "projects", "plans", "anticipates" and similar expressions, are forward-looking information that represents management of Canex Metals Inc. internal projections, expectations or beliefs concerning, among other things, future operating results and various components thereof or the economic performance of CANEX. The projections, estimates and beliefs contained in such forward-looking statements necessarily involve known and unknown risks and uncertainties, which may cause CANEX's actual performance and financial results in future periods to differ materially from any projections of future performance or results expressed or implied by such forward-looking statements. These risks and uncertainties include, among other things, those described in CANEX's filings with the Canadian securities authorities. Accordingly, holders of CANEX shares and potential investors are cautioned that events or circumstances could cause results to differ materially from those predicted. CANEX disclaims any responsibility to update these forward-looking statements.

SOURCE: Canex Metals Inc.

View source version on accesswire.com:

https://www.accesswire.com/651553/Canex-Intersects-16-gt-Gold-Over-351-Metres-Including-82-gtT-Gold-Over-46-Metres-at-the-Excelsior-Mine-Gold-Range-Project-Arizona